Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you answer ALL thanks 1. A firm has a debt-to-value ratio of 40%, an equity beta of 1.4, and a cost of debt of

Can you answer ALL thanks

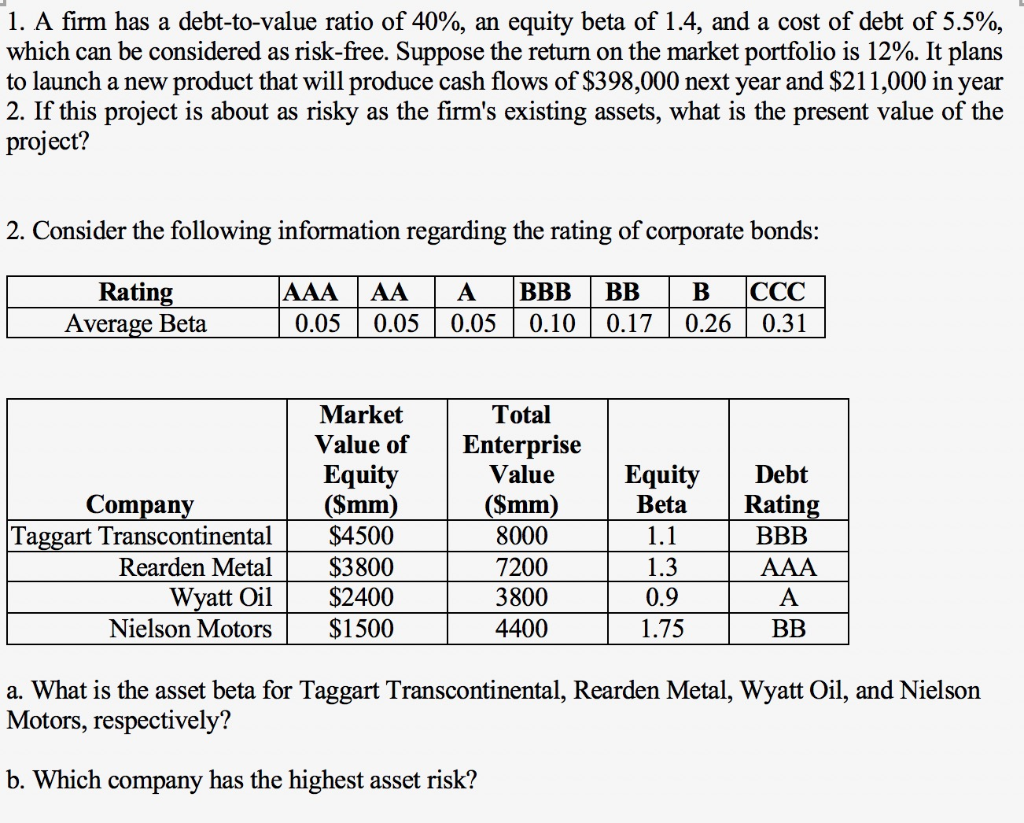

1. A firm has a debt-to-value ratio of 40%, an equity beta of 1.4, and a cost of debt of 5.5%, which can be considered as risk-free. Suppose the return on the market portfolio is 12%. It plans to launch a new product that will produce cash flows of $398,000 next year and $211,000 in year 2. If this project is about as risky as the firm's existing assets, what is the present value of the project? 2. Consider the following information regarding the rating of corporate bonds: Rating AAA AA JA BBB BB | B CCC Average Beta 0.05 0.05 0.05 0.10 0.17 0.26 0.31 Company Taggart Transcontinental Rearden Metal Wyatt Oil Nielson Motors Market Value of Equity ($mm) $4500 $3800 $2400 $1500 Total Enterprise Value ($mm) 8000 7200 3800 4400 Equity Beta 1.1 1.3 0.9 1.75 Debt Rating BBB L AAA BB a. What is the asset beta for Taggart Transcontinental, Rearden Metal, Wyatt Oil, and Nielson Motors, respectively? b. Which company has the highest asset riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started