can you answer for a like!

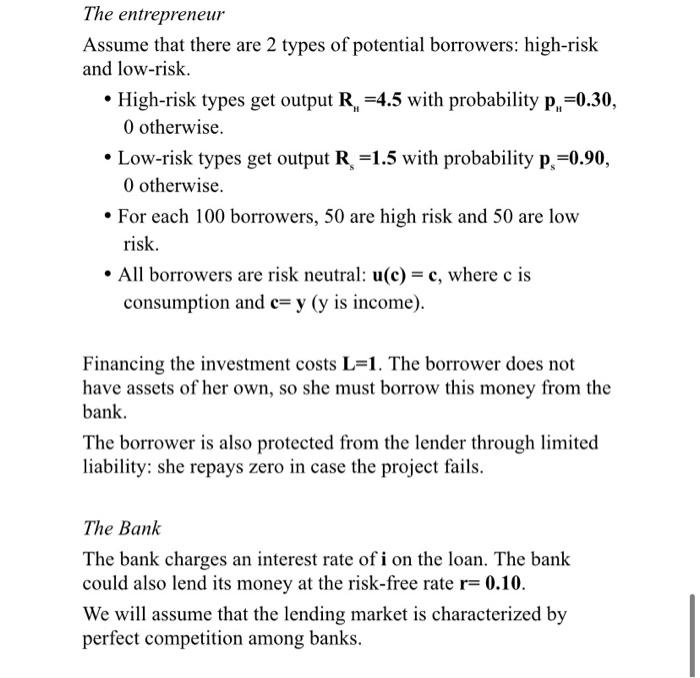

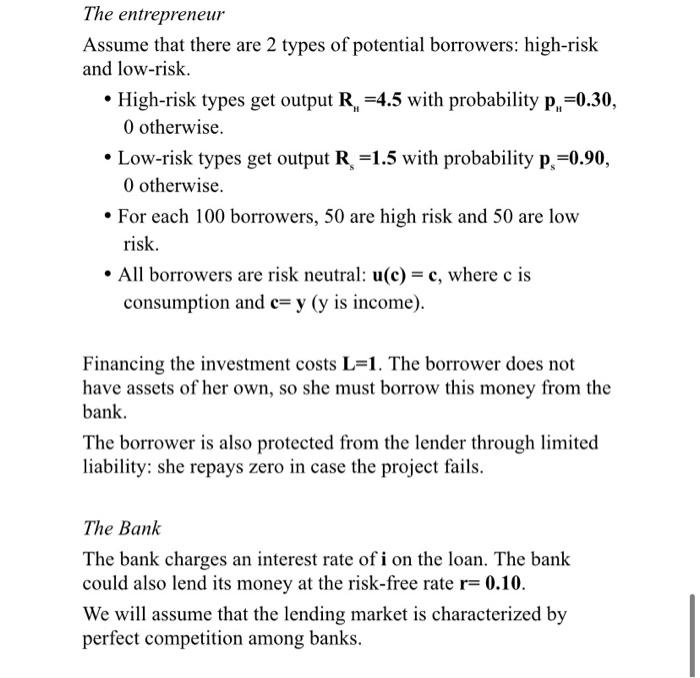

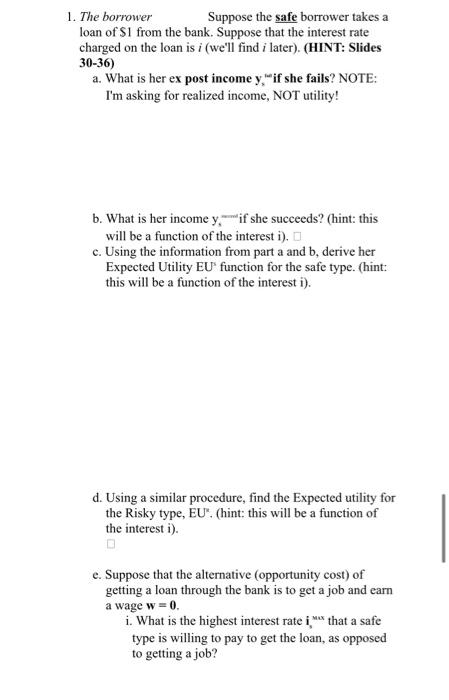

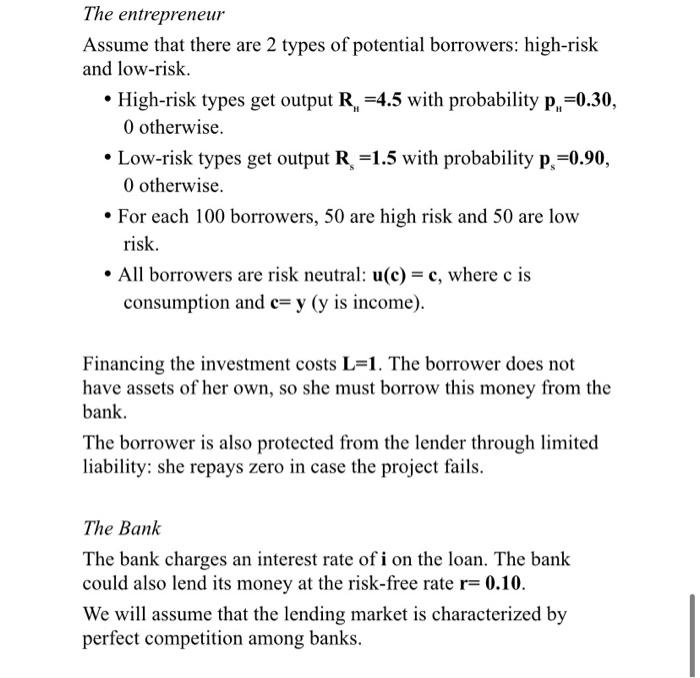

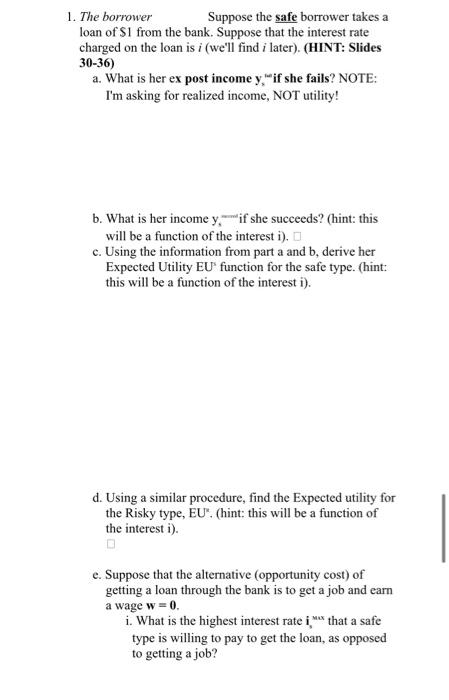

The entrepreneur Assume that there are 2 types of potential borrowers: high-risk and low-risk. - High-risk types get output Rn=4.5 with probability pn=0.30, 0 otherwise. - Low-risk types get output Rs=1.5 with probability ps=0.90, 0 otherwise. - For each 100 borrowers, 50 are high risk and 50 are low risk. - All borrowers are risk neutral: u(c)=c, where c is consumption and c=y ( y is income). Financing the investment costsL=1. The borrower does not have assets of her own, so she must borrow this money from the bank. The borrower is also protected from the lender through limited liability: she repays zero in case the project fails. The Bank The bank charges an interest rate of i on the loan. The bank could also lend its money at the risk-free rate r=0.10. We will assume that the lending market is characterized by perfect competition among banks. b. What is her income y,if she succeeds? (hint: this will be a function of the interest i). c. Using the information from part a and b, derive her Expected Utility EU3 function for the safe type. (hint: this will be a function of the interest i). d. Using a similar procedure, find the Expected utility for the Risky type, EU. (hint: this will be a function of the interest i). e. Suppose that the alternative (opportunity cost) of getting a loan through the bank is to get a job and earn a wage w=0. i. What is the highest interest rate iymax that a safe type is willing to pay to get the loan, as opposed to getting a job? ii. What is the highest interest rate iMMx that a risky type is willing to pay, as opposed to getting a job? The entrepreneur Assume that there are 2 types of potential borrowers: high-risk and low-risk. - High-risk types get output Rn=4.5 with probability pn=0.30, 0 otherwise. - Low-risk types get output Rs=1.5 with probability ps=0.90, 0 otherwise. - For each 100 borrowers, 50 are high risk and 50 are low risk. - All borrowers are risk neutral: u(c)=c, where c is consumption and c=y ( y is income). Financing the investment costsL=1. The borrower does not have assets of her own, so she must borrow this money from the bank. The borrower is also protected from the lender through limited liability: she repays zero in case the project fails. The Bank The bank charges an interest rate of i on the loan. The bank could also lend its money at the risk-free rate r=0.10. We will assume that the lending market is characterized by perfect competition among banks. b. What is her income y,if she succeeds? (hint: this will be a function of the interest i). c. Using the information from part a and b, derive her Expected Utility EU3 function for the safe type. (hint: this will be a function of the interest i). d. Using a similar procedure, find the Expected utility for the Risky type, EU. (hint: this will be a function of the interest i). e. Suppose that the alternative (opportunity cost) of getting a loan through the bank is to get a job and earn a wage w=0. i. What is the highest interest rate iymax that a safe type is willing to pay to get the loan, as opposed to getting a job? ii. What is the highest interest rate iMMx that a risky type is willing to pay, as opposed to getting a job