Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you answer for a like?! The entrepreneur Assume that there are 2 types of potential borrowers: high-risk and low-risk. - High-risk types get output

can you answer for a like?!

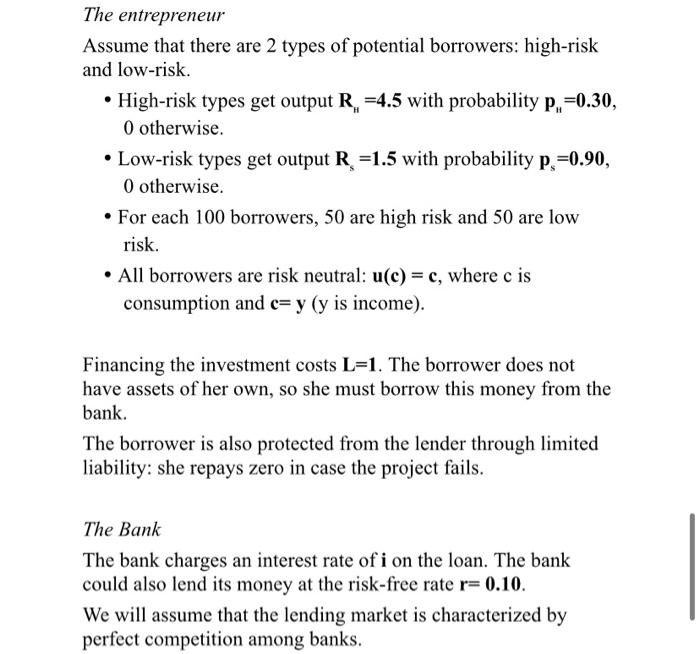

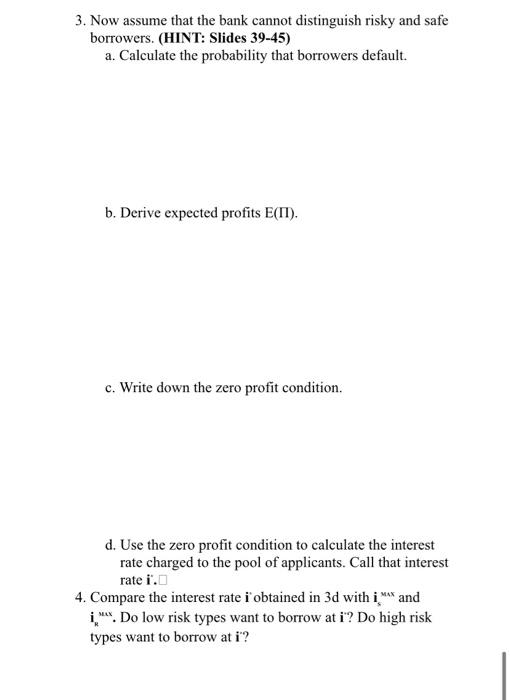

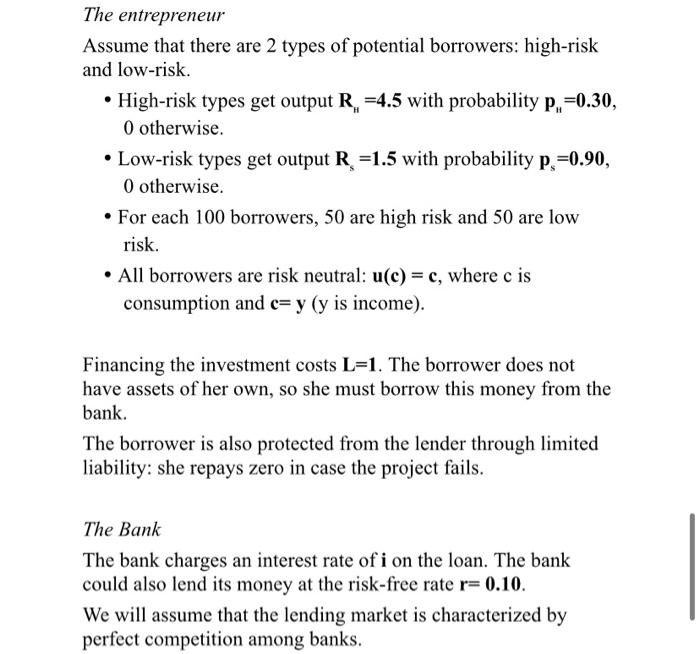

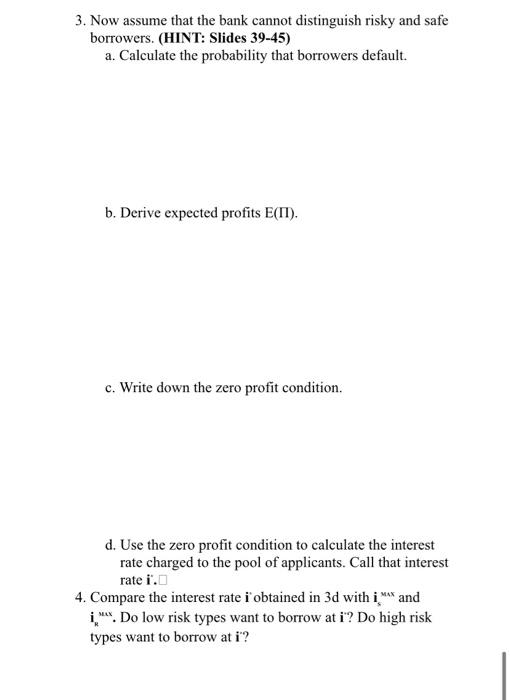

The entrepreneur Assume that there are 2 types of potential borrowers: high-risk and low-risk. - High-risk types get output Rr=4.5 with probability pu=0.30, 0 otherwise. - Low-risk types get output Rs=1.5 with probability ps=0.90, 0 otherwise. - For each 100 borrowers, 50 are high risk and 50 are low risk. - All borrowers are risk neutral: u(c)=c, where c is consumption and c=y ( y is income ). Financing the investment costs L=1. The borrower does not have assets of her own, so she must borrow this money from the bank. The borrower is also protected from the lender through limited liability: she repays zero in case the project fails. The Bank The bank charges an interest rate of i on the loan. The bank could also lend its money at the risk-free rate r=0.10. We will assume that the lending market is characterized by perfect competition among banks. 3. Now assume that the bank cannot distinguish risky and safe borrowers. (HINT: Slides 39-45) a. Calculate the probability that borrowers default. b. Derive expected profits E(). c. Write down the zero profit condition. d. Use the zero profit condition to calculate the interest rate charged to the pool of applicants. Call that interest rate i. 4. Compare the interest rate i obtained in 3d with ismax and iksux. Do low risk types want to borrow at i ? Do high risk types want to borrow at i ? The entrepreneur Assume that there are 2 types of potential borrowers: high-risk and low-risk. - High-risk types get output Rr=4.5 with probability pu=0.30, 0 otherwise. - Low-risk types get output Rs=1.5 with probability ps=0.90, 0 otherwise. - For each 100 borrowers, 50 are high risk and 50 are low risk. - All borrowers are risk neutral: u(c)=c, where c is consumption and c=y ( y is income ). Financing the investment costs L=1. The borrower does not have assets of her own, so she must borrow this money from the bank. The borrower is also protected from the lender through limited liability: she repays zero in case the project fails. The Bank The bank charges an interest rate of i on the loan. The bank could also lend its money at the risk-free rate r=0.10. We will assume that the lending market is characterized by perfect competition among banks. 3. Now assume that the bank cannot distinguish risky and safe borrowers. (HINT: Slides 39-45) a. Calculate the probability that borrowers default. b. Derive expected profits E(). c. Write down the zero profit condition. d. Use the zero profit condition to calculate the interest rate charged to the pool of applicants. Call that interest rate i. 4. Compare the interest rate i obtained in 3d with ismax and iksux. Do low risk types want to borrow at i ? Do high risk types want to borrow at

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started