Answered step by step

Verified Expert Solution

Question

1 Approved Answer

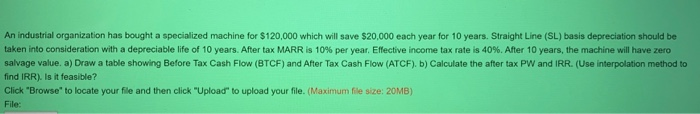

CAN YOU ANSWER IT ASAP ??? An industrial organization has bought a specialized machine for $120,000 which will save $20,000 each year for 10 years.

CAN YOU ANSWER IT ASAP ???

An industrial organization has bought a specialized machine for $120,000 which will save $20,000 each year for 10 years. Straight Line (SL) basis depreciation should be taken into consideration with a depreciable life of 10 years. After tax MARR is 10% per year. Effective income tax rate is 40%. After 10 years, the machine will have zero salvage value. a) Draw a table showing Before Tax Cash Flow (BTCF) and After Tax Cash Flow (ATCF). b) Calculate the after tax PW and IRR. (Use interpolation method to find IRR). Is it feasible? Click "Browse" to locate your file and then click "Upload" to upload your file. (Maximum file size: 20MB) File Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started