Can you answer me that problem please

Thank you

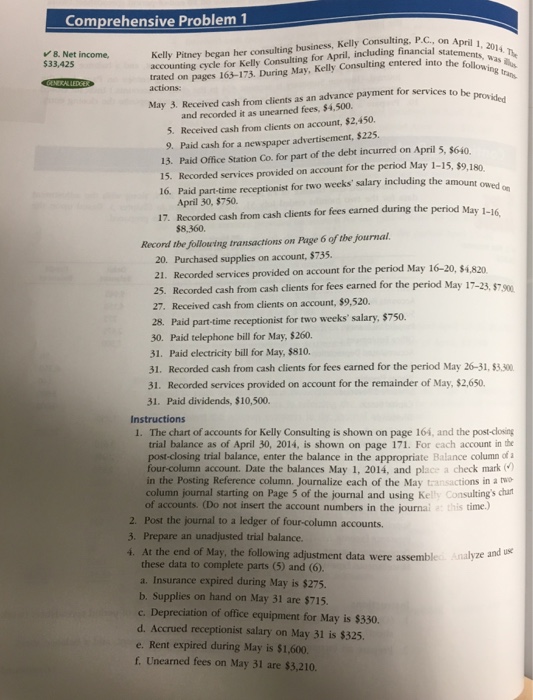

Comprehensive Problem 1 Kelly Pitney began her consulting business, Kelly Consulting, P.c., on A accounting cycle for Kelly Consulting for April, including financial statei trated on pages 163-173. During May, Kelly Consulting entered into the flts waa April 1, 2014. Th P.C., on April 1, 2014 I statements, 8. Net income was s the following trans 33,425 entered into the following t actions: provided May 3. Received cash from clients as an advance payment for services to be and recorded it as unearned fees, $4,500. 5. Received cash from clients on account, $2,450 9. Paid cash for a newspaper advertisement, $225. 13. Paid Office Station Co. for part of the debt incurred on April 5, $640 15. Recorded services provided on account for the period May 1-15, $9,180 16. including the amount owed on Paid part-time receptionist for two weeks' salary April 30, $750. period May 1-16, 17. Recorded cash from cash clients for fees earned during the period May 1- $8,360. Record the following transactions on Page 6 of the journal. 20. Purchased supplies on account, $735. 21. Recorded services provided on account for the period May 16-20, $4,820 25. Recorded cash from cash clients for fees earned for the 27. Received cash from clients on account, $9,520. 28. Paid part-time receptionist for two weeks' salary, $750 30. Paid telephone bill for May, $260. 31. Paid electricity bill for May, $810. 31, Recorded cash from cash clients for fees earned for the period May 26-31, 31. Recorded services provided on account for the remainder of May, $2,650. 31. Paid dividends, $10,500. period May 17-23 Instructions 1. The chart of accounts for Kelly Consulting is shown on page 164, and the post-losing trial balance as of April 30, 2014, is shown on page 171. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2014, and place a check mark in the Posting Reference column. Journalize each of the May t column journal starting on Page 5 of the journal and using Kelly Consulting's chu of accounts. (Do not insert the account numbers in the journal a: this time) in a two time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assemble . Analyze and u i. Analyze and us these data to complete parts (5) and (6). a. Insurance expired during May is $275 b. Supplies on hand on May 31 are $715. c. Depreciation of office equipment for May is $330. d. Accrued receptionist salary on May 31 is $325. e. Rent expired during May is $1,600. f. Unearned fees on May 31 are $3,210

Can you answer me that problem please

Can you answer me that problem please