Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you answer part a) in an NPV chart like it asks please Here is Exhibit 13-8 to use as a model. thank you! Cool

can you answer part a) in an NPV chart like it asks please

Here is Exhibit 13-8 to use as a model. thank you!

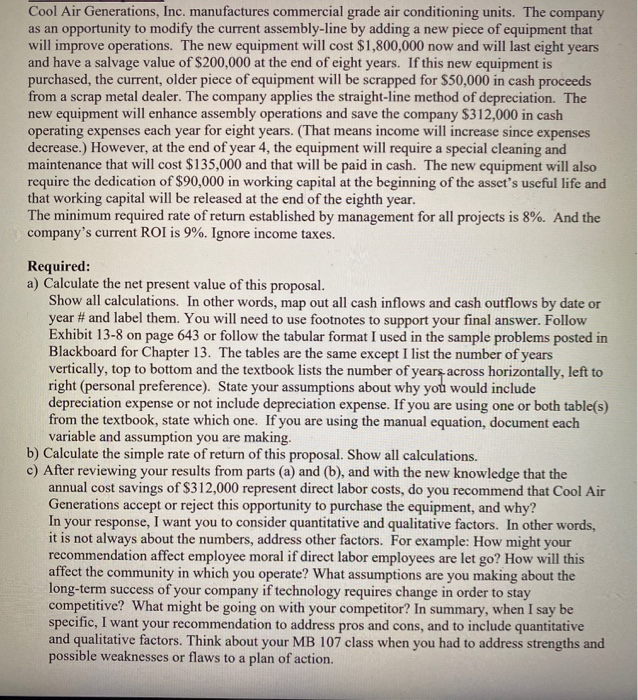

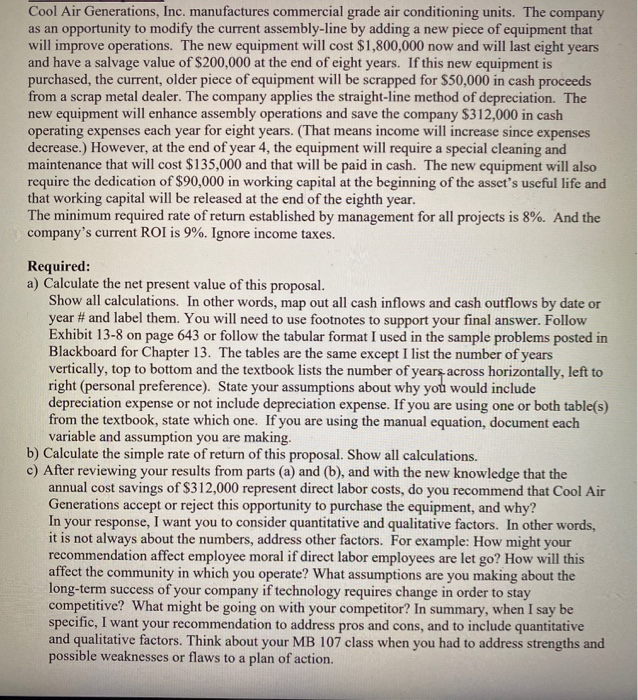

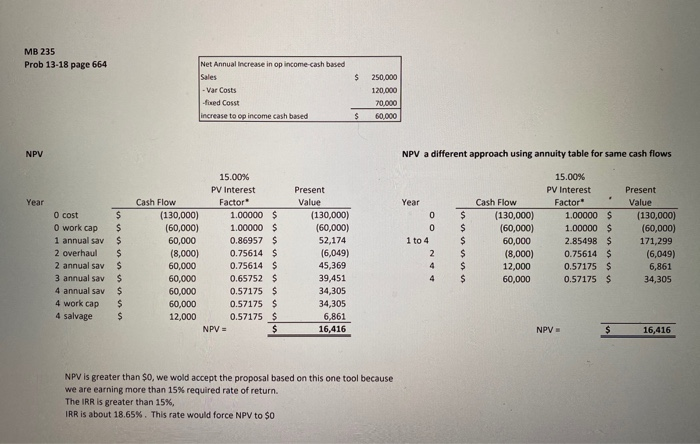

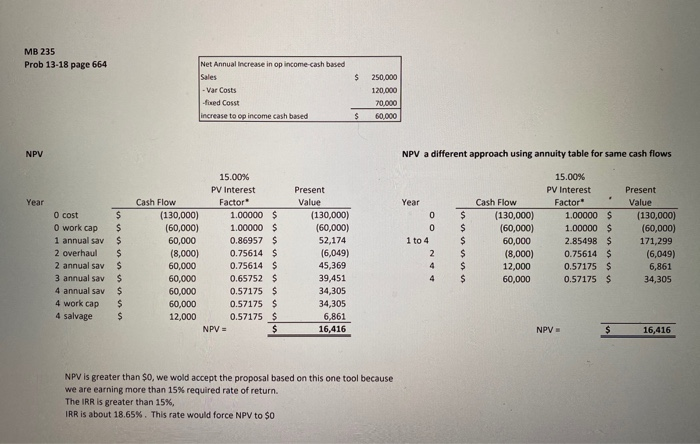

Cool Air Generations, Inc. manufactures commercial grade air conditioning units. The company as an opportunity to modify the current assembly-line by adding a new piece of equipment that will improve operations. The new equipment will cost $1,800,000 now and will last eight years and have a salvage value of $200,000 at the end of eight years. If this new equipment is purchased, the current, older piece of equipment will be scrapped for $50,000 in cash proceeds from a scrap metal dealer. The company applies the straight-line method of depreciation. The new equipment will enhance assembly operations and save the company $312,000 in cash operating expenses each year for eight years. (That means income will increase since expenses decrease.) However, at the end of year 4, the equipment will require a special cleaning and maintenance that will cost $135,000 and that will be paid in cash. The new equipment will also require the dedication of $90,000 in working capital at the beginning of the asset's useful life and that working capital will be released at the end of the eighth year. The minimum required rate of return established by management for all projects is 8%. And the company's current ROI is 9%. Ignore income taxes. Required: a) Calculate the net present value of this proposal. Show all calculations. In other words, map out all cash inflows and cash outflows by date or year # and label them. You will need to use footnotes to support your final answer. Follow Exhibit 13-8 on page 643 or follow the tabular format I used in the sample problems posted in Blackboard for Chapter 13. The tables are the same except I list the number of years vertically, top to bottom and the textbook lists the number of years across horizontally, left to right (personal preference). State your assumptions about why you would include depreciation expense or not include depreciation expense. If you are using one or both table(s) from the textbook, state which one. If you are using the manual equation, document each variable and assumption you are making. b) Calculate the simple rate of return of this proposal. Show all calculations. c) After reviewing your results from parts (a) and (b), and with the new knowledge that the annual cost savings of $312,000 represent direct labor costs, do you recommend that Cool Air Generations accept or reject this opportunity to purchase the equipment, and why? In your response, I want you to consider quantitative and qualitative factors. In other words, it is not always about the numbers, address other factors. For example: How might your recommendation affect employee moral if direct labor employees are let go? How will this affect the community in which you operate? What assumptions are you making about the long-term success of your company if technology requires change in order to stay competitive? What might be going on with your competitor? In summary, when I say be specific, I want your recommendation to address pros and cons, and to include quantitative and qualitative factors. Think about your MB 107 class when you had to address strengths and possible weaknesses or flaws to a plan of action. MB 235 Prob 13-18 page 664 $ Net Annual Increase in op income cash based Sales -Var Costs foxed Cosst increase to op income cash based 250,000 120,000 20.000 $ 60.000 NPV a different approach using annuity table for same cash flows Year Year O cost O work cap 1 annual sav 2 overhaul 2 annual say 3 annual sav 4 annual sav 4 work cap 4 salvage 1 to 4 $ $ $ $ $ $ $ $ 15.00% PV Interest Cash Flow Factor (130,000) 1.00000 $ (60,000) 1.00000 $ 60,000 0.86957 $ (8,000) 0.75614 $ 60,000 0.75614 $ 60,000 0.65752 $ 60,000 0.57175 $ 60,000 0.57175 $ 12,000 0.57175 $ NPV = Present Value (130,000) (60,000) 52,174 (6,049) 45,369 39,451 34,305 34,305 6,861 16,416 15.00% PV Interest Factor 1.00000 1.00000 2.85498 0.75614 0.57175 0.57175 Cash Flow (130,000) (60,000) 60,000 (8,000) 12,000 60,000 $ $ $ $ $ $ Present Value (130,000) (60,000) 171,299 (6,049) 6,861 34,305 NPV = $ 16,416 NPV is greater than $0, we wold accept the proposal based on this one tool because we are earning more than 15% required rate of return. The IRR is greater than 15%, IRR is about 18.65%. This rate would force NPV to $0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started