Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you answer the first 4 questions the basic nature or func. ansaction? Which 14. What does it mean to classify a cash flow according

can you answer the first 4 questions

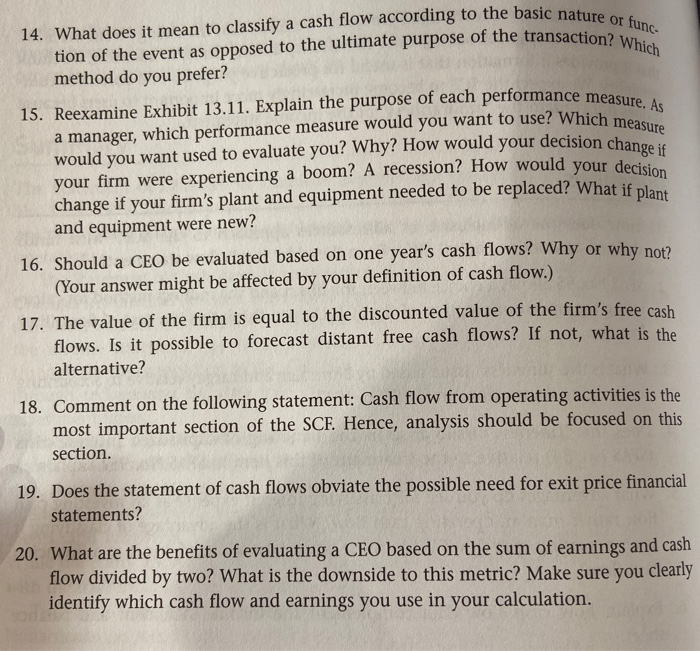

the basic nature or func. ansaction? Which 14. What does it mean to classify a cash flow according to the basic nature tion of the event as opposed to the ultimate purpose of the transaction method do you prefer? 15. Reexamine Exhibit 13.11. Explain the purpose of each performance measure a manager, which performance measure would you want to use? Which would you want used to evaluate you? Why? How would your decision chi your firm were experiencing a boom? A recession? How would your decisi change if your firm's plant and equipment needed to be replaced? What if plan and equipment were new? Which measure decision change if 16. Should a CEO be evaluated based on one year's cash flows? Why or why not? (Your answer might be affected by your definition of cash flow.) 17. The value of the firm is equal to the discounted value of the firm's free cash flows. Is it possible to forecast distant free cash flows? If not, what is the alternative? 18. Comment on the following statement: Cash flow from operating activities is the most important section of the SCF. Hence, analysis should be focused on this section. 19. Does the statement of cash flows obviate the possible need for exit price financial statements? 20. What are the benefits of evaluating a CEO based on the sum of earnings and cash flow divided by two? What is the downside to this metric? Make sure you clearly identify which cash flow and earnings you use in your calculation. the basic nature or func. ansaction? Which 14. What does it mean to classify a cash flow according to the basic nature tion of the event as opposed to the ultimate purpose of the transaction method do you prefer? 15. Reexamine Exhibit 13.11. Explain the purpose of each performance measure a manager, which performance measure would you want to use? Which would you want used to evaluate you? Why? How would your decision chi your firm were experiencing a boom? A recession? How would your decisi change if your firm's plant and equipment needed to be replaced? What if plan and equipment were new? Which measure decision change if 16. Should a CEO be evaluated based on one year's cash flows? Why or why not? (Your answer might be affected by your definition of cash flow.) 17. The value of the firm is equal to the discounted value of the firm's free cash flows. Is it possible to forecast distant free cash flows? If not, what is the alternative? 18. Comment on the following statement: Cash flow from operating activities is the most important section of the SCF. Hence, analysis should be focused on this section. 19. Does the statement of cash flows obviate the possible need for exit price financial statements? 20. What are the benefits of evaluating a CEO based on the sum of earnings and cash flow divided by two? What is the downside to this metric? Make sure you clearly identify which cash flow and earnings you use in your calculation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started