Answered step by step

Verified Expert Solution

Question

1 Approved Answer

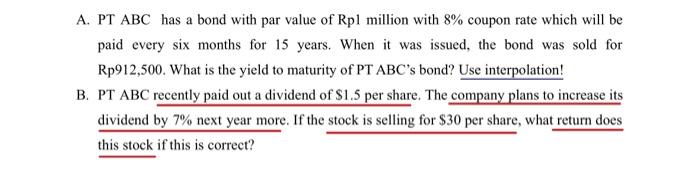

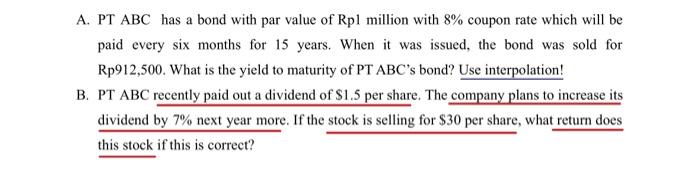

can you answer the problem b, thank you. A. PT ABC has a bond with par value of Rpl million with 8% coupon rate which

can you answer the problem b, thank you.

A. PT ABC has a bond with par value of Rpl million with 8% coupon rate which will be paid every six months for 15 years. When it was issued, the bond was sold for Rp912,500. What is the yield to maturity of PT ABC's bond? Use interpolation! B. PT ABC recently paid out a dividend of $1.5 per share. The company plans to increase its dividend by 7% next year more. If the stock is selling for $30 per share, what return does this stock if this is correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started