Question

Can you answer the question without copying from the other answer. Thanks. That's all the information i have Hilary Maskona, the CEO of AllVax, met

Can you answer the question without copying from the other answer. Thanks. That's all the information i have

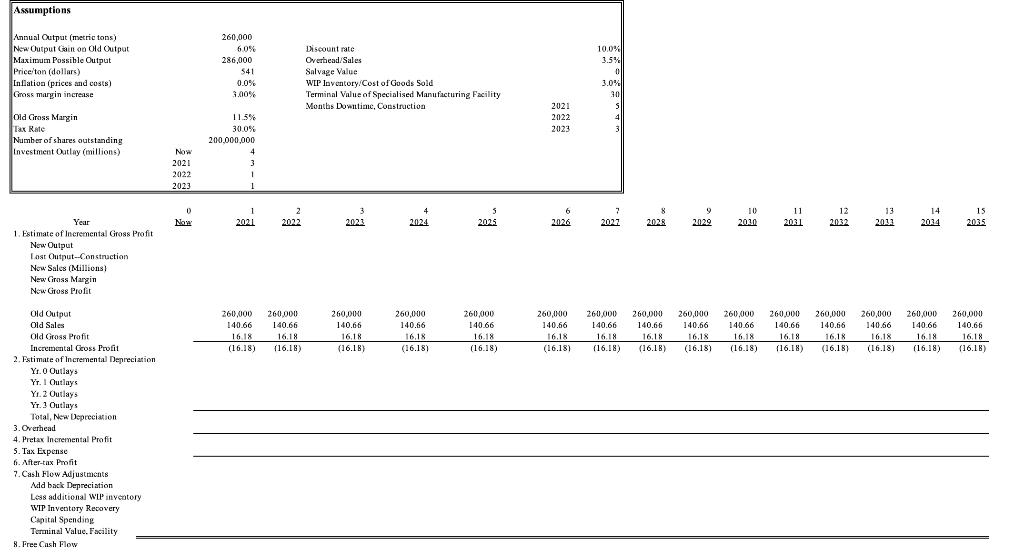

Hilary Maskona, the CEO of AllVax, met with her advisor, Vincent Purell, to review a capital-expenditure proposal on a production plant to produce COVID-19 vaccines using mRNA technology. The proposal, named AntiCov Flow project, calls for an expenditure of $9 million spread over three years to convert an existing production plant from batch to continuous-flow technology and to install sophisticated state-of-the-art process controls throughout the plant. This project is only feasible with a continuous source of cationic lipids from a chemical synthesis process conducted in a specialised manufacturing facility. The proposal suggests AllVax to purchase this type of manufacturing facility from a supplier (rather than sourcing the cationic lipids from two separate suppliers). AllVax has an option to exclusively purchase the cationic lipids facility from a supplier for $4 million (included in the proposed $9 million expenditure). The option was purchased several years earlier. Vincent advises the CEO that a comparable cationic lipids manufacturing facility can be sold today for $7 million in an auction. Vincent also forecasts that at the end of the project, the value of the cationic lipids manufacturing facility will be $30 million. This option will expire in 5 months.

The proposal will require the plant to be shut down for 5 months in the 1st year, 4 months in the 2nd year, and 3 months in the 3rd year. Vincent believes the loss will not be permanent. The benefits include an increase of 6% in new output gain on old output [new output = old output x (1+6%)] and an increase of 3% in gross margin on old gross margin of 11.5% (new gross margin = old gross margin + gross margin increase). The increased outputs will necessitate additional work-in-process inventory in value to 3% of the increased cost of goods. Vincent suggests that new assets will be fully depreciated on a straightline basis over the life of the project. It is AllVaxs policy to record depreciation expenses in the same year as expenditures. Vincent also estimates that overhead costs are at 3.5% of the increased sales. Inflation is set at 0%.

It is AllVaxs policy to evaluate projects based on four criteria: (1) net present value, (2) internal rate of return, (3) payback, and (4) growth in earnings per share. Your task is to examine Vincents analysis and make adjustments where necessary.

1. Provide a quantitative analysis of the AntiCov Flow project by completing the AntiCov Flow spreadsheet provided.

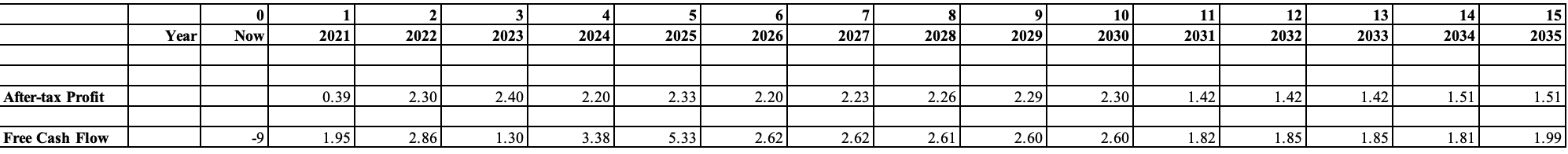

2. Provide your estimates of each of the following project selection methods: (1) Net Present Value (NPV), (2) Internal Rate of Return (IRR), (3) payback, and (4) growth in earnings per share (EPS). Pick two methods that you think most appropriate to evaluate the project? Justify your choices. See References for a summary of the first three methods. The growth in EPS in method (4) is based on the average annual EPS contribution of a project over its entire economic life, using the number of outstanding shares at the most recent fiscal year-end (FYE) as the basis for the calculation. The project is deemed feasible if the contribution to the net income from the contemplated project is positive.

3. An executive vice president of AllVax recently proposed that the company should consider a project in Alt Zeneca (based on the Alt Zeneca spreadsheet provided). There is no need to adjust this worksheet. AllVax only has resources to invest in either the AntiCov Flow project or the Alt Zeneca project. Hilary has asked you to evaluate the Alt Zeneca project as she does not trust Vincent. You need to evaluate the Alt Zeneca project based on four criteria: (1) net present value, (2) internal rate of return, (3) payback, and (4) growth in earnings per share. Provide your estimates of each of these project selection methods.

4. What should you do when NPV and another valuation method (out of those presented in question 2) disagree in ranking mutually exclusive projects? Did this occur for our comparison between the AntiCov Flow and Alt Zeneca projects? You then need to advise Hilary on which project to invest and provide reasons for your decision.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started