Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you briefly describe the product, and if you were an investor would you invest this product and your reasons! Please provide some comments for

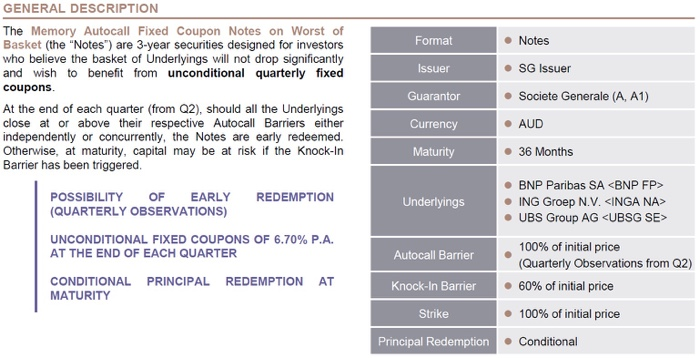

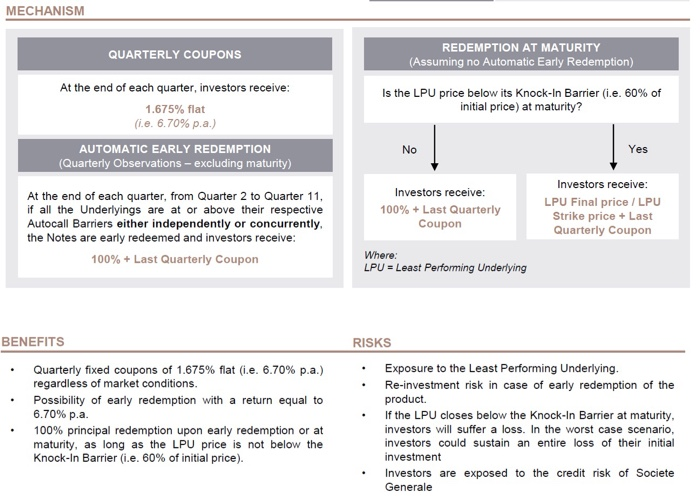

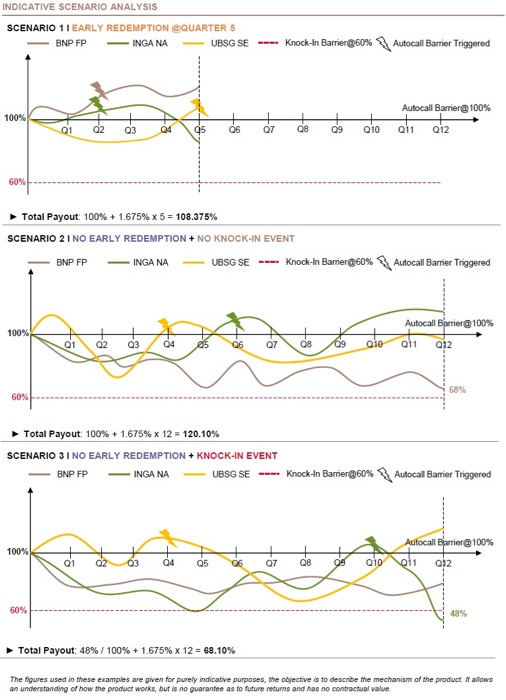

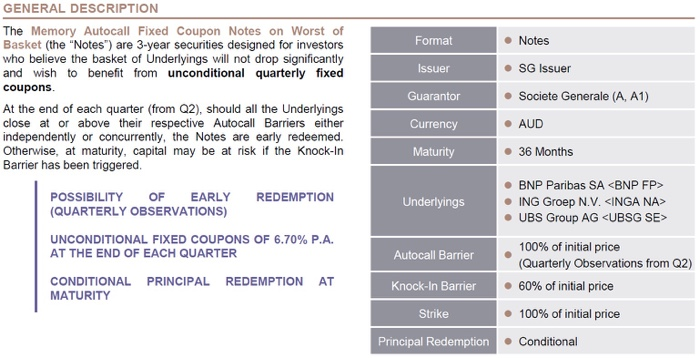

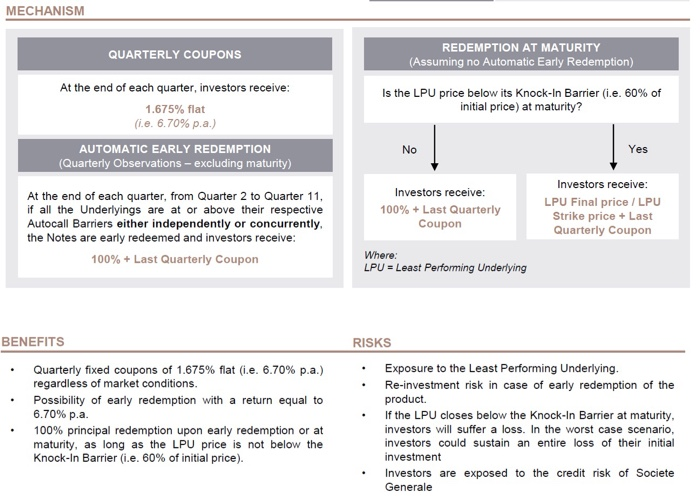

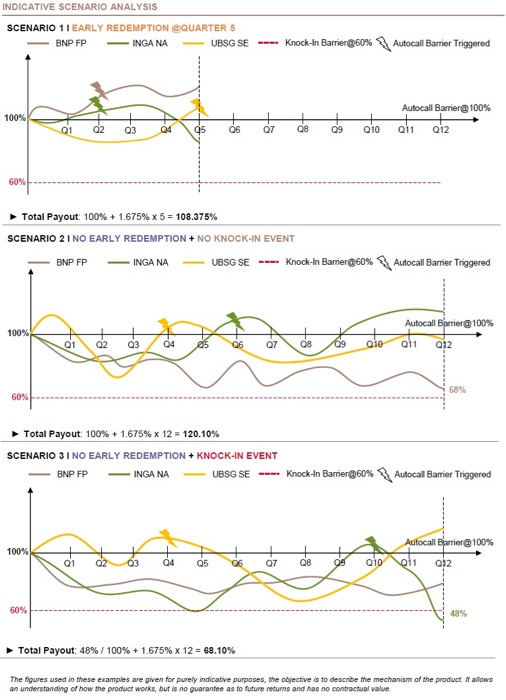

can you briefly describe the product, and if you were an investor would you invest this product and your reasons! Please provide some comments for this structured product!! Format Notes Issuer SG Issuer GENERAL DESCRIPTION The Memory Autocall Fixed Coupon Notes on Worst of Basket (the "Notes") are 3-year securities designed for investors who believe the basket of Underlyings will not drop significantly and wish to benefit from unconditional quarterly fixed coupons. At the end of each quarter (from Q2), should all the underlyings close at or above their respective Autocall Barriers either independently or concurrently, the Notes are early redeemed. Otherwise, at maturity, capital may be at risk if the Knock-in Barrier has been triggered. Guarantor Societe Generale (A, A1) Currency AUD Maturity 36 Months REDEMPTION POSSIBILITY OF EARLY (QUARTERLY OBSERVATIONS) Underlyings BNP Paribas SA

can you briefly describe the product, and if you were an investor would you invest this product and your reasons! Please provide some comments for this structured product!! Format Notes Issuer SG Issuer GENERAL DESCRIPTION The Memory Autocall Fixed Coupon Notes on Worst of Basket (the "Notes") are 3-year securities designed for investors who believe the basket of Underlyings will not drop significantly and wish to benefit from unconditional quarterly fixed coupons. At the end of each quarter (from Q2), should all the underlyings close at or above their respective Autocall Barriers either independently or concurrently, the Notes are early redeemed. Otherwise, at maturity, capital may be at risk if the Knock-in Barrier has been triggered. Guarantor Societe Generale (A, A1) Currency AUD Maturity 36 Months REDEMPTION POSSIBILITY OF EARLY (QUARTERLY OBSERVATIONS) Underlyings BNP Paribas SA ING Groep N.V. UNCONDITIONAL FIXED COUPONS OF 6.70% P.A. AT THE END OF EACH QUARTER Autocall Barrier 100% of initial price (Quarterly Observations from Q2) 60% of initial price CONDITIONAL PRINCIPAL REDEMPTION AT MATURITY Knock-In Barrier 100% of initial price Strike Principal Redemption Conditional MECHANISM QUARTERLY COUPONS REDEMPTION AT MATURITY (Assuming no Automatic Early Redemption) At the end of each quarter, investors receive: Is the LPU price below its knock-In Barrier (i.e. 60% of initial price) at maturity? 1.675% flat (i.e. 6.70% p.a.) No AUTOMATIC EARLY REDEMPTION (Quarterly Observations - excluding maturity) At the end of each quarter, from Quarter 2 to Quarter 11, if all the underlyings are at or above their respective Autocall Barriers either independently or concurrently the Notes are early redeemed and investors receive: 100% + Last Quarterly Coupon Investors receive: 100% + Last Quarterly Coupon Investors receive: LPU Final price / LPU Strike price + Last Quarterly Coupon Where: LPU = Least Performing Underlying BENEFITS RISKS Quarterly fixed coupons of 1.675% flat (.e. 6.70% p.a.) regardless of market conditions. Possibility of early redemption with a return equal to 6.70% p.a. 100% principal redemption upon early redemption or at maturity, as long as the LPU price is not below the Knock-In Barrier (i.e. 60% of initial price) Exposure to the Least Performing Underlying. Re-investment risk in case of early redemption of the product. If the LPU closes below the Knock-In Barrier at maturity, investors will suffer a loss. In the worst case scenario, investors could sustain an entire loss of their initial investment Investors are exposed to the credit risk of Societe Generale INDICATIVE SCENARIO ANALYSIS SCENARIO 11 EARLY REDEMPTION QUARTER 5 - BNP FP - INGA NA U BSG SE ---- Knock-in Barrier@60% Autocall Barrier Triggered Autocall Barrier 100% 100% 60%- Total Payout: 100% + 1.675% x 5 = 108.375% SCENARIO 2 I NO EARLY REDEMPTION + NO KNOCK-IN EVENT BNP FP INGA NA U BSG SE ---- Knock-in Barrier@60% Autocall Barrier Triggered Autocall Barrier@100% 60 Total Payout: 100% + 1.675% x 12 = 120.10% SCENARIO 3I NO EARLY REDEMPTION + KNOCK-IN EVENT BNP FP - INGA NA U BSG SE ---- Knock-In Barrier@60% Autocal Barrier Triggered Autocall Barrier 100% ooo 052 Total Payout: 48%/100% +1.675% x 12 = 68.10% allows The figures used in these examples are given for purely indicative purposes, the objective is to describe the mechanism of the product an understanding of how the product work, but is no guarantee as to future returns and has no contractual value can you briefly describe the product, and if you were an investor would you invest this product and your reasons! Please provide some comments for this structured product!! Format Notes Issuer SG Issuer GENERAL DESCRIPTION The Memory Autocall Fixed Coupon Notes on Worst of Basket (the "Notes") are 3-year securities designed for investors who believe the basket of Underlyings will not drop significantly and wish to benefit from unconditional quarterly fixed coupons. At the end of each quarter (from Q2), should all the underlyings close at or above their respective Autocall Barriers either independently or concurrently, the Notes are early redeemed. Otherwise, at maturity, capital may be at risk if the Knock-in Barrier has been triggered. Guarantor Societe Generale (A, A1) Currency AUD Maturity 36 Months REDEMPTION POSSIBILITY OF EARLY (QUARTERLY OBSERVATIONS) Underlyings BNP Paribas SA ING Groep N.V. UNCONDITIONAL FIXED COUPONS OF 6.70% P.A. AT THE END OF EACH QUARTER Autocall Barrier 100% of initial price (Quarterly Observations from Q2) 60% of initial price CONDITIONAL PRINCIPAL REDEMPTION AT MATURITY Knock-In Barrier 100% of initial price Strike Principal Redemption Conditional MECHANISM QUARTERLY COUPONS REDEMPTION AT MATURITY (Assuming no Automatic Early Redemption) At the end of each quarter, investors receive: Is the LPU price below its knock-In Barrier (i.e. 60% of initial price) at maturity? 1.675% flat (i.e. 6.70% p.a.) No AUTOMATIC EARLY REDEMPTION (Quarterly Observations - excluding maturity) At the end of each quarter, from Quarter 2 to Quarter 11, if all the underlyings are at or above their respective Autocall Barriers either independently or concurrently the Notes are early redeemed and investors receive: 100% + Last Quarterly Coupon Investors receive: 100% + Last Quarterly Coupon Investors receive: LPU Final price / LPU Strike price + Last Quarterly Coupon Where: LPU = Least Performing Underlying BENEFITS RISKS Quarterly fixed coupons of 1.675% flat (.e. 6.70% p.a.) regardless of market conditions. Possibility of early redemption with a return equal to 6.70% p.a. 100% principal redemption upon early redemption or at maturity, as long as the LPU price is not below the Knock-In Barrier (i.e. 60% of initial price) Exposure to the Least Performing Underlying. Re-investment risk in case of early redemption of the product. If the LPU closes below the Knock-In Barrier at maturity, investors will suffer a loss. In the worst case scenario, investors could sustain an entire loss of their initial investment Investors are exposed to the credit risk of Societe Generale INDICATIVE SCENARIO ANALYSIS SCENARIO 11 EARLY REDEMPTION QUARTER 5 - BNP FP - INGA NA U BSG SE ---- Knock-in Barrier@60% Autocall Barrier Triggered Autocall Barrier 100% 100% 60%- Total Payout: 100% + 1.675% x 5 = 108.375% SCENARIO 2 I NO EARLY REDEMPTION + NO KNOCK-IN EVENT BNP FP INGA NA U BSG SE ---- Knock-in Barrier@60% Autocall Barrier Triggered Autocall Barrier@100% 60 Total Payout: 100% + 1.675% x 12 = 120.10% SCENARIO 3I NO EARLY REDEMPTION + KNOCK-IN EVENT BNP FP - INGA NA U BSG SE ---- Knock-In Barrier@60% Autocal Barrier Triggered Autocall Barrier 100% ooo 052 Total Payout: 48%/100% +1.675% x 12 = 68.10% allows The figures used in these examples are given for purely indicative purposes, the objective is to describe the mechanism of the product an understanding of how the product work, but is no guarantee as to future returns and has no contractual value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started