Can you check again whether my answer is correct?

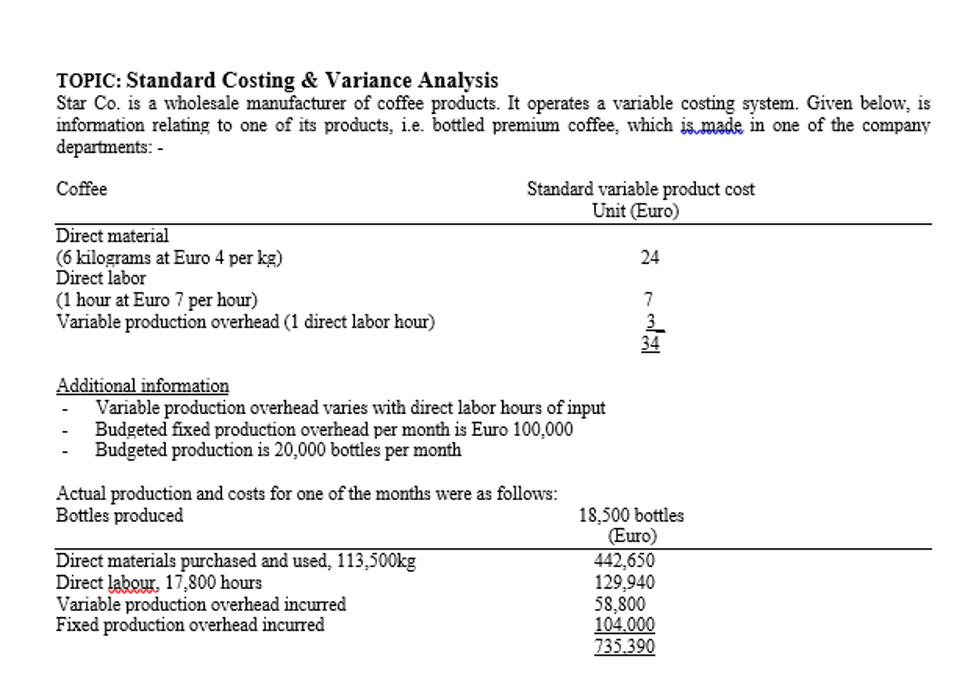

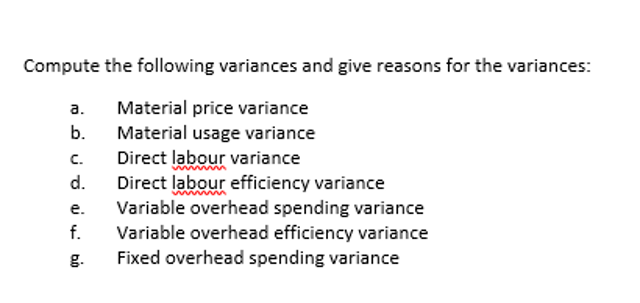

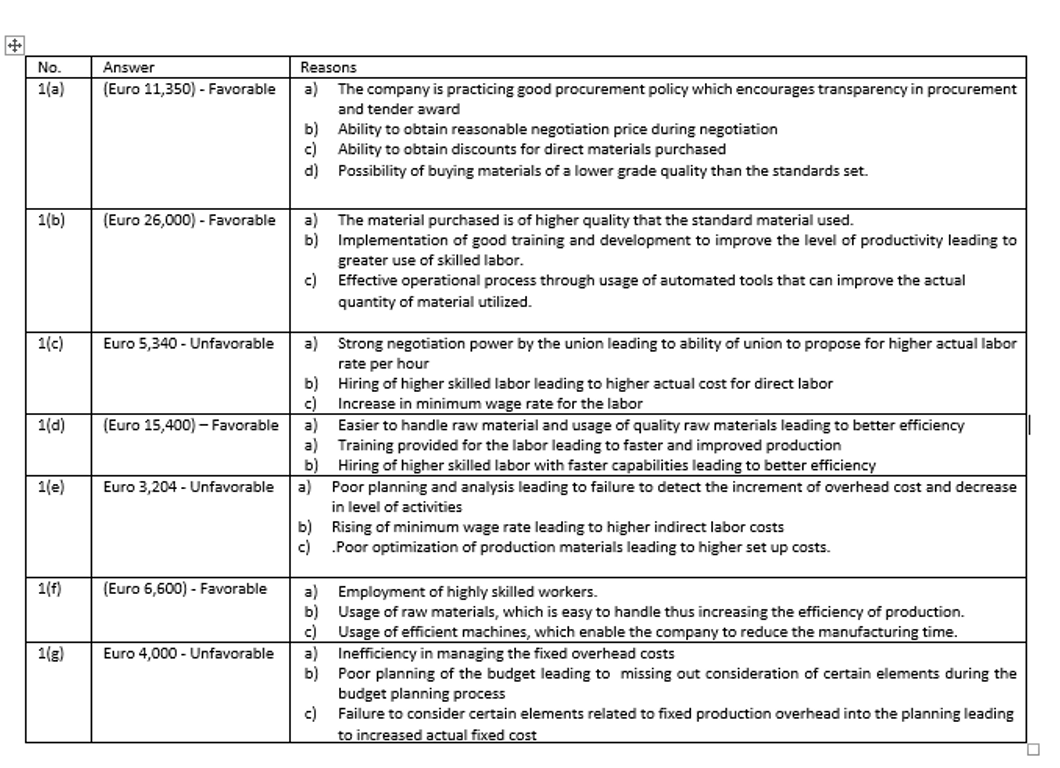

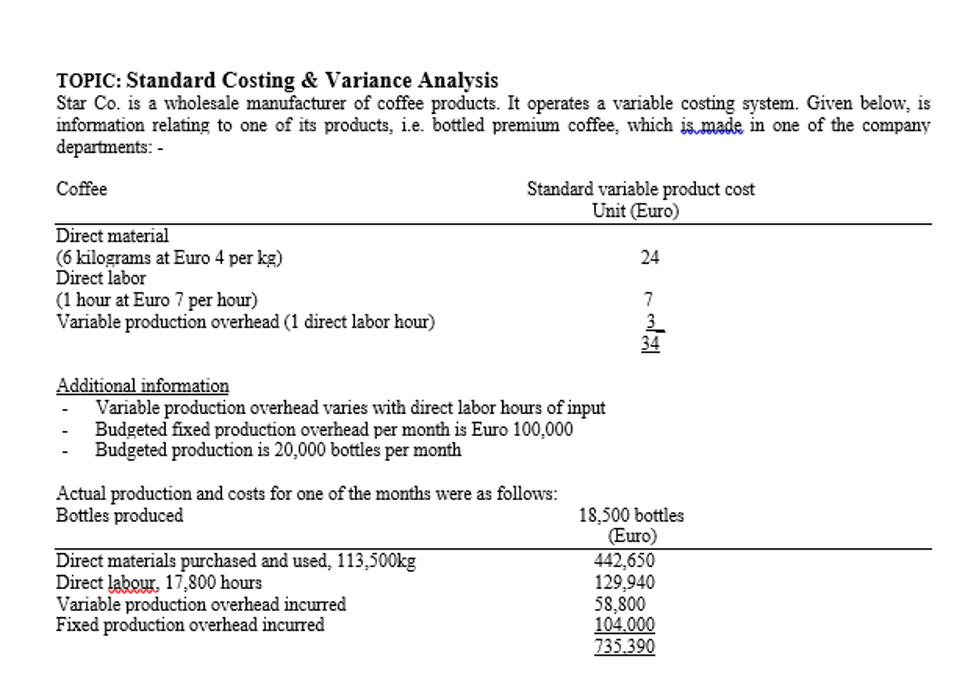

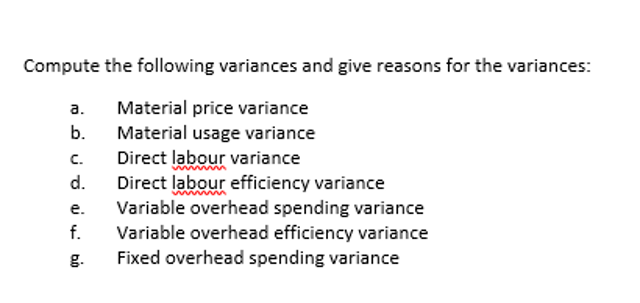

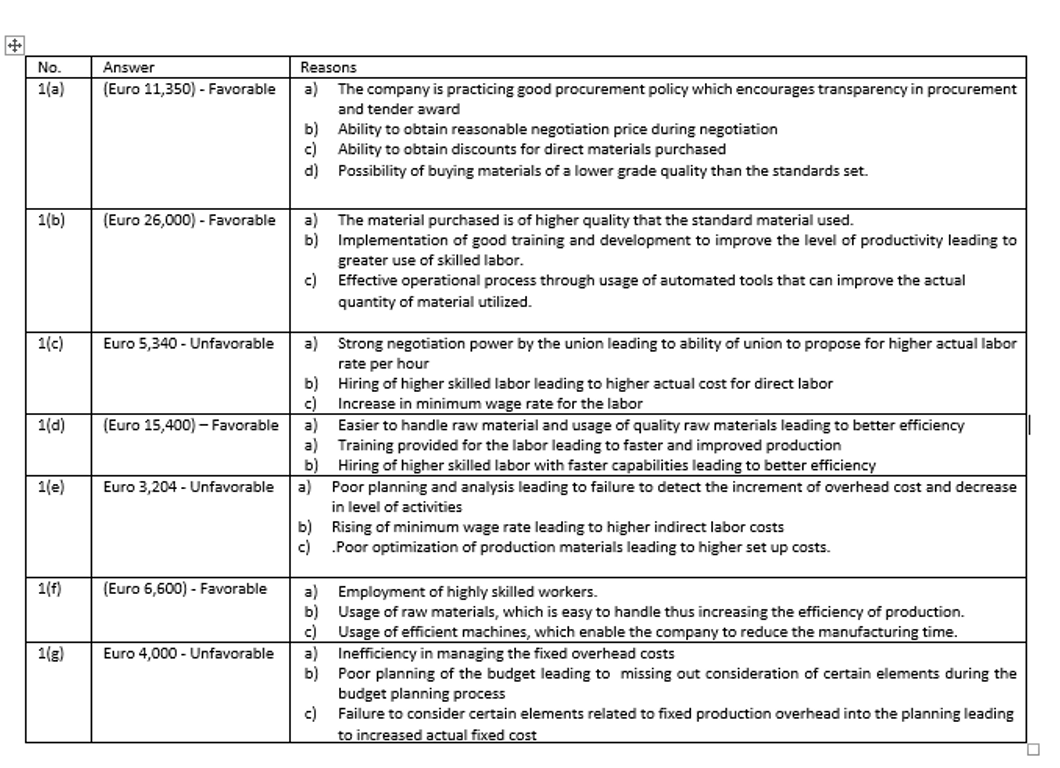

TOPIC: Standard Costing & Variance Analysis Star Co. is a wholesale manufacturer of coffee products. It operates a variable costing system. Given below, is information relating to one of its products, i.e. bottled premium coffee, which is made in one of the company departments:- Coffee Standard variable product cost Unit (Euro) Direct material (6 kilograms at Euro 4 per kg) Direct labor (1 hour at Euro 7 per hour) Variable production overhead (1 direct labor hour) a nolatan Additional information Variable production overhead varies with direct labor hours of input - Budgeted fixed production overhead per month is Euro 100.000 - Budgeted production is 20,000 bottles per month Actual production and costs for one of the months were as follows: Bottles produced Direct materials purchased and used, 113,500kg Direct labour, 17,800 hours Variable production overhead incurred Fixed production overhead incurred 18,500 bottles (Euro) 442,650 129.940 58,800 104.000 735.390 Compute the following variances and give reasons for the variances: a. Suoww Material price variance Material usage variance Direct labour variance Direct labour efficiency variance Variable overhead spending variance Variable overhead efficiency variance Fixed overhead spending variance No. 1(a) Answer (Euro 11,350) - Favorable Reasons a) The company is practicing good procurement policy which encourages transparency in procurement and tender award b) Ability to obtain reasonable negotiation price during negotiation c) Ability to obtain discounts for direct materials purchased d) Possibility of buying materials of a lower grade quality than the standards set. 1(b) (Euro 26,000) - Favorable a) b) The material purchased is of higher quality that the standard material used. Implementation of good training and development to improve the level of productivity leading to greater use of skilled labor. Effective operational process through usage of automated tools that can improve the actual quantity of material utilized. c) | 1(c) 11d) Euro 5,340 - Unfavorable | a) Strong negotiation power by the union leading to ability of union to propose for higher actual labor rate per hour b) Hiring of higher skilled labor leading to higher actual cost for direct labor c) Increase in minimum wage rate for the labor (Euro 15,400) - Favorable a) Easier to handle raw material and usage of quality raw materials leading to better efficiency a) Training provided for the labor leading to faster and improved production b) Hiring of higher skilled labor with faster capabilities leading to better efficiency Euro 3,204 - Unfavorable a) Poor planning and analysis leading to failure to detect the increment of overhead cost and decrease in level of activities b) Rising of minimum wage rate leading to higher indirect labor costs c) Poor optimization of production materials leading to higher set up costs. 1(e) 1(f) (Euro 6,600) - Favorable | a) 118) Euro 4,000 - Unfavorable c) a) b) Employment of highly skilled workers. Usage of raw materials, which is easy to handle thus increasing the efficiency of production. Usage of efficient machines, which enable the company to reduce the manufacturing time. Inefficiency in managing the fixed overhead costs Poor planning of the budget leading to missing out consideration of certain elements during the budget planning process Failure to consider certain elements related to fixed production overhead into the planning leading to increased actual fixed cost c)