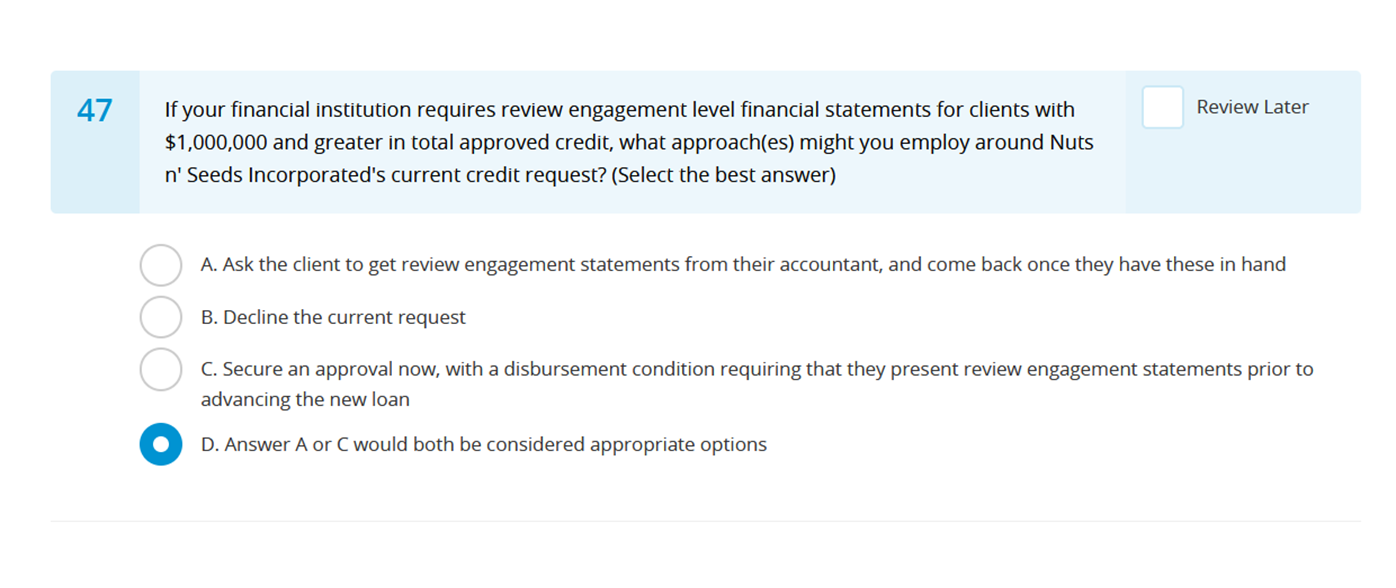

Can you check my answer is correct or no ?

Can you check my answer is correct or no ?

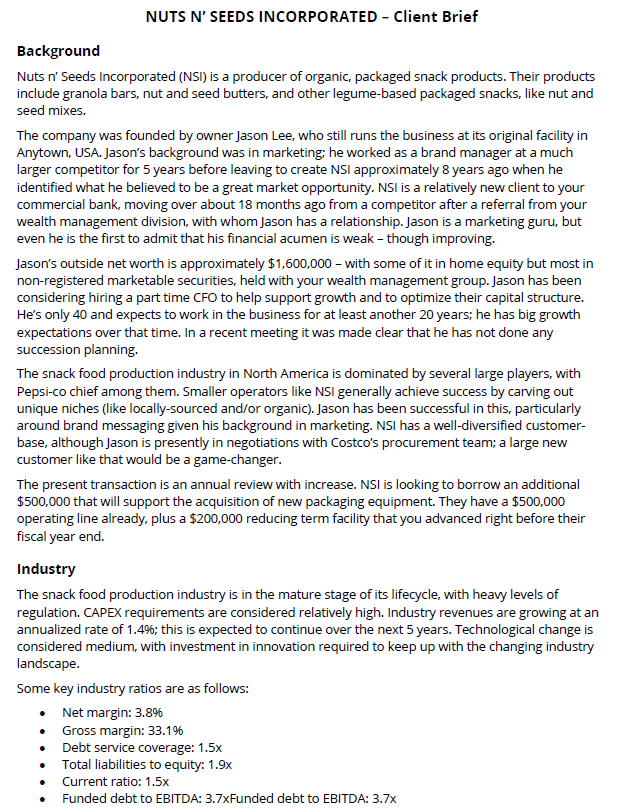

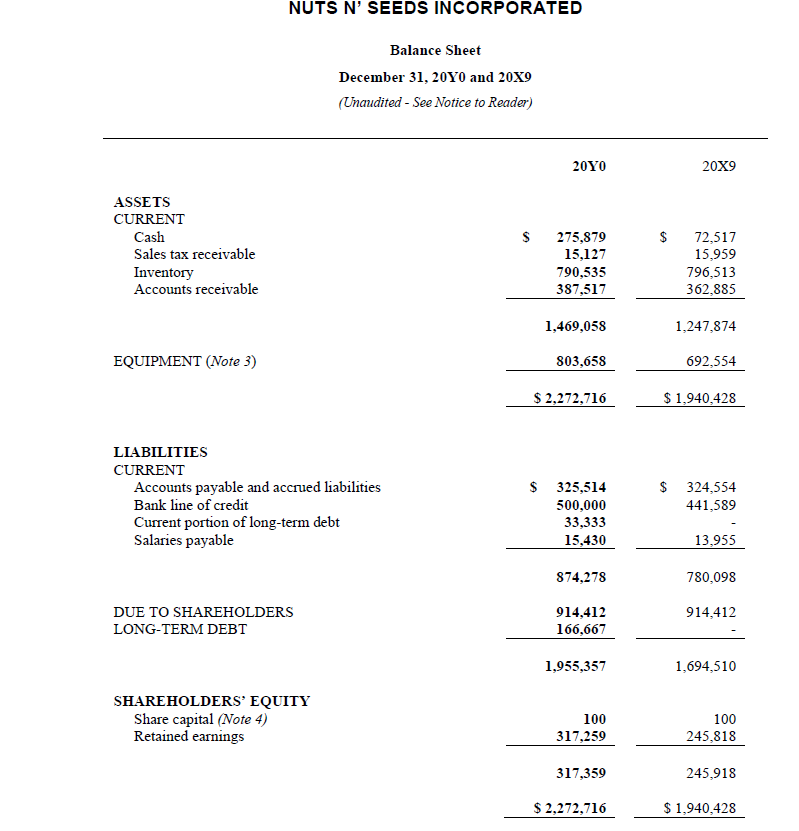

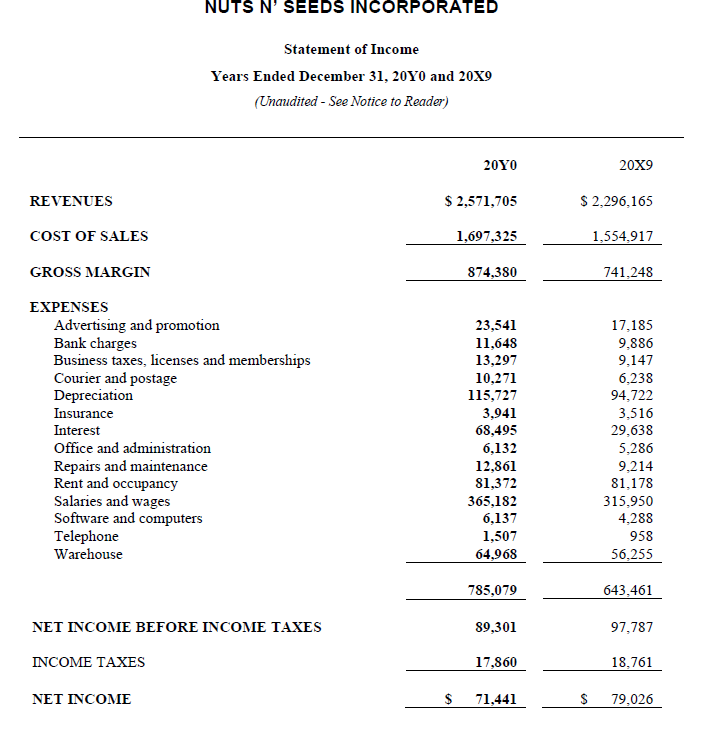

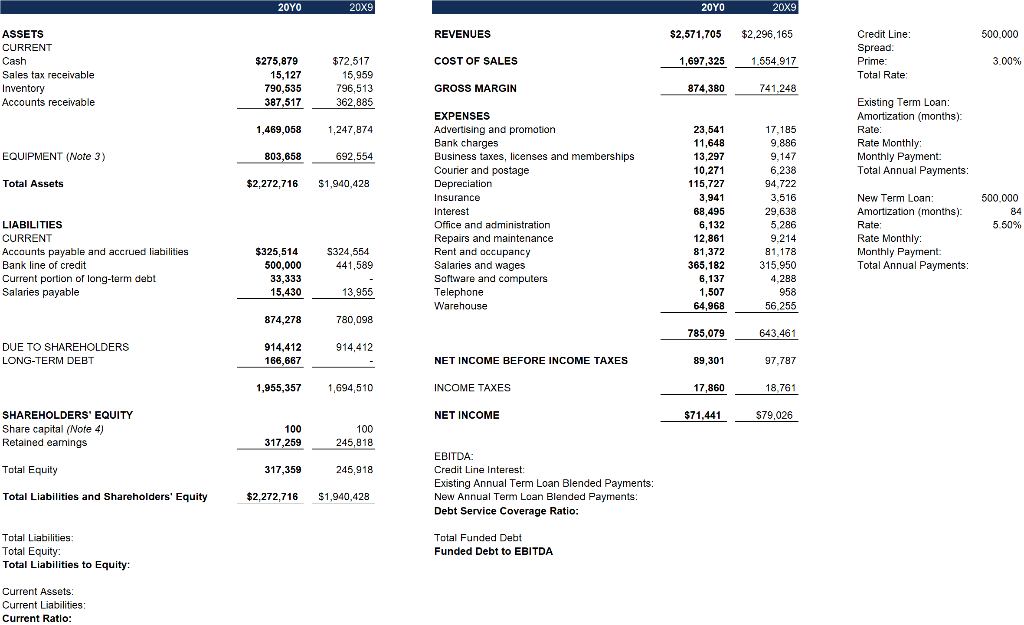

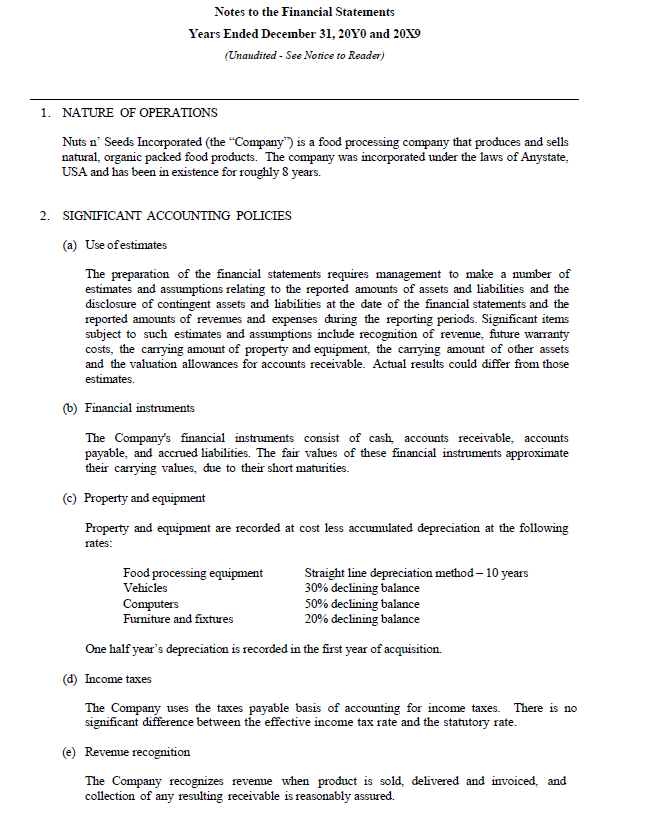

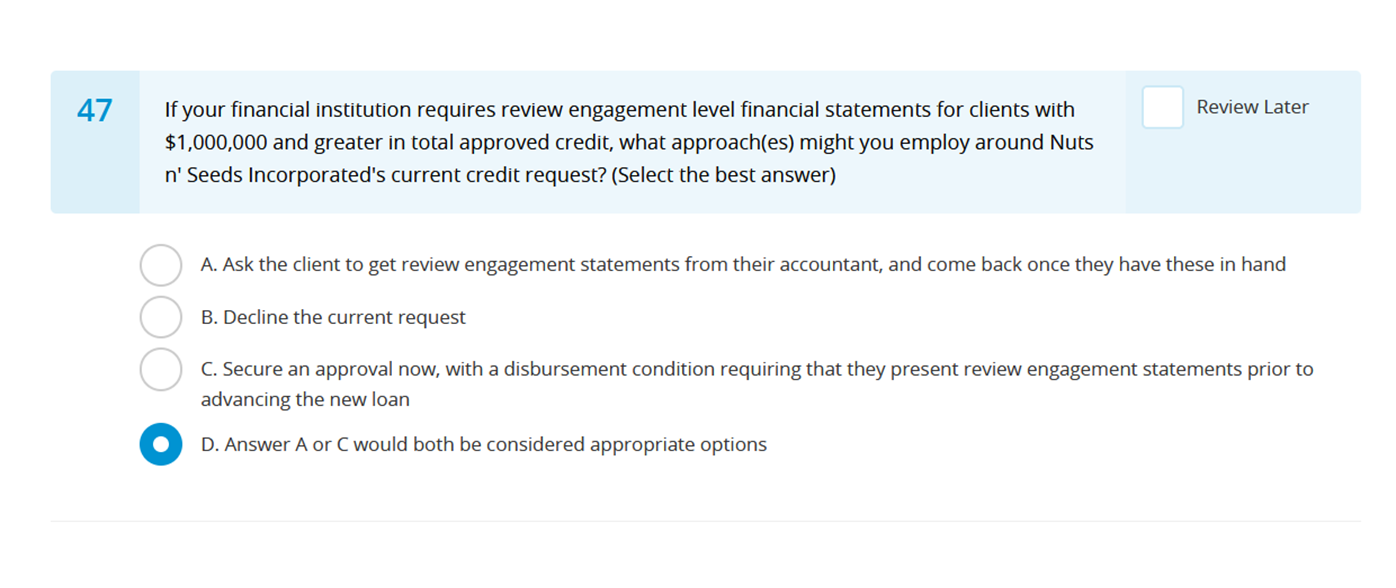

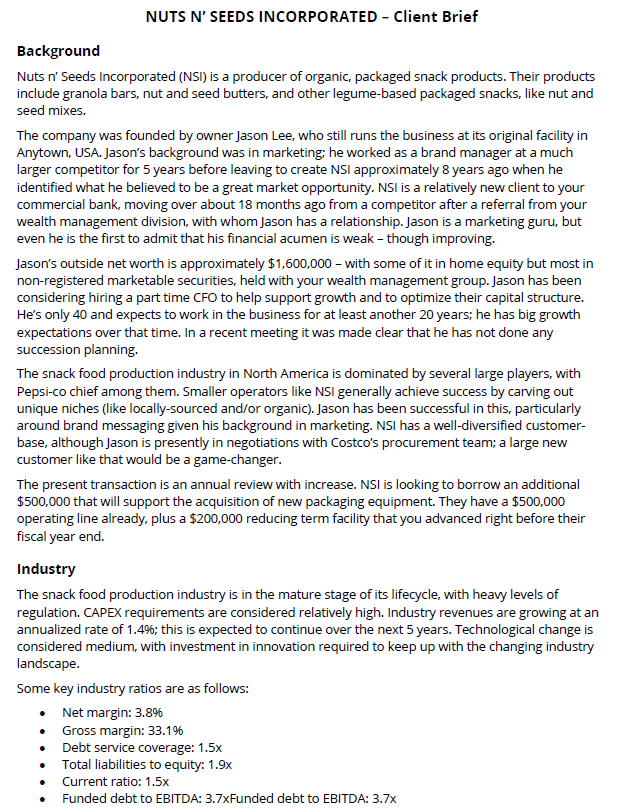

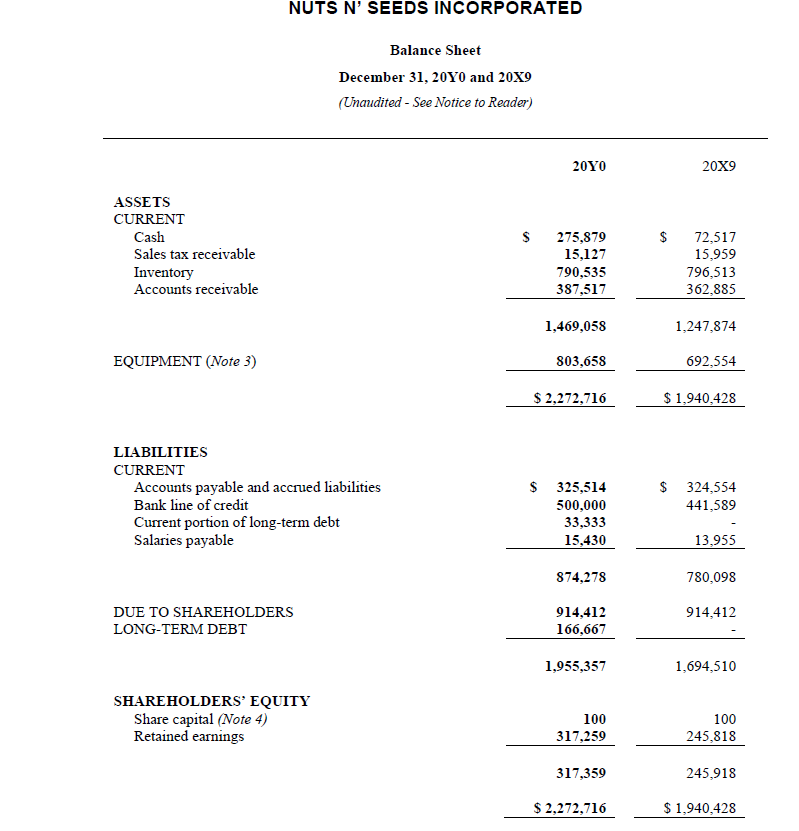

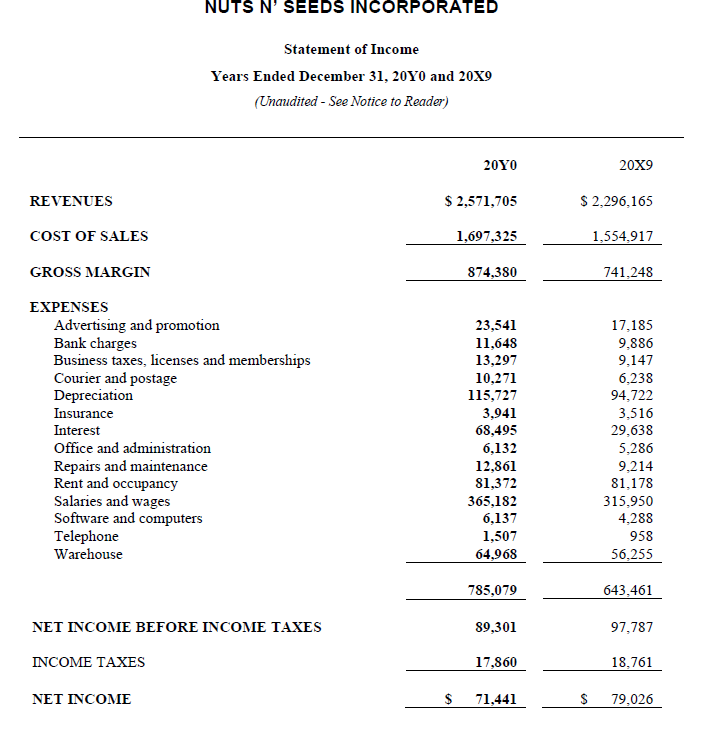

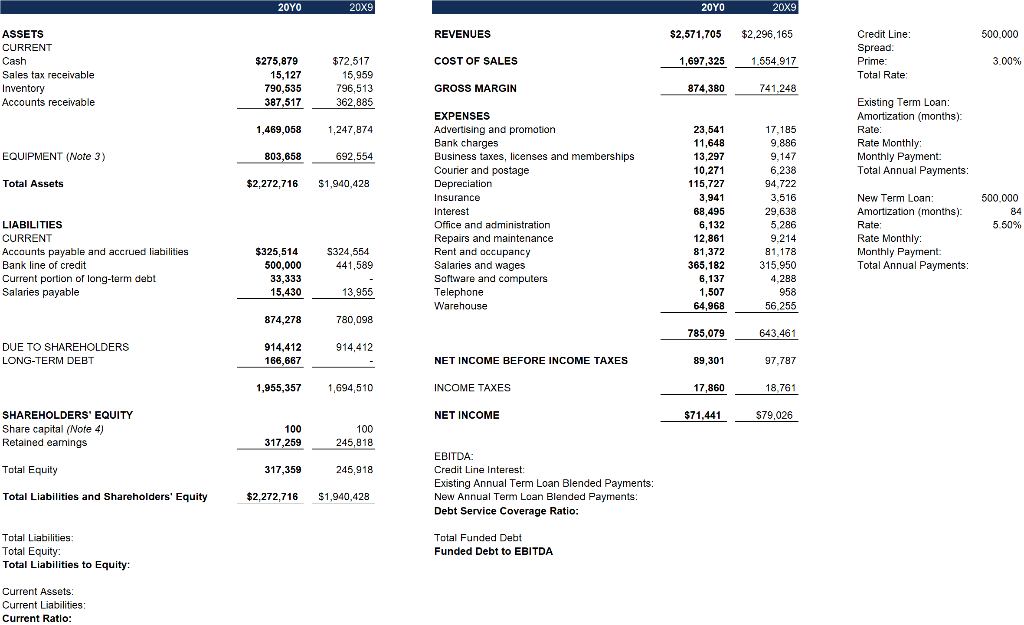

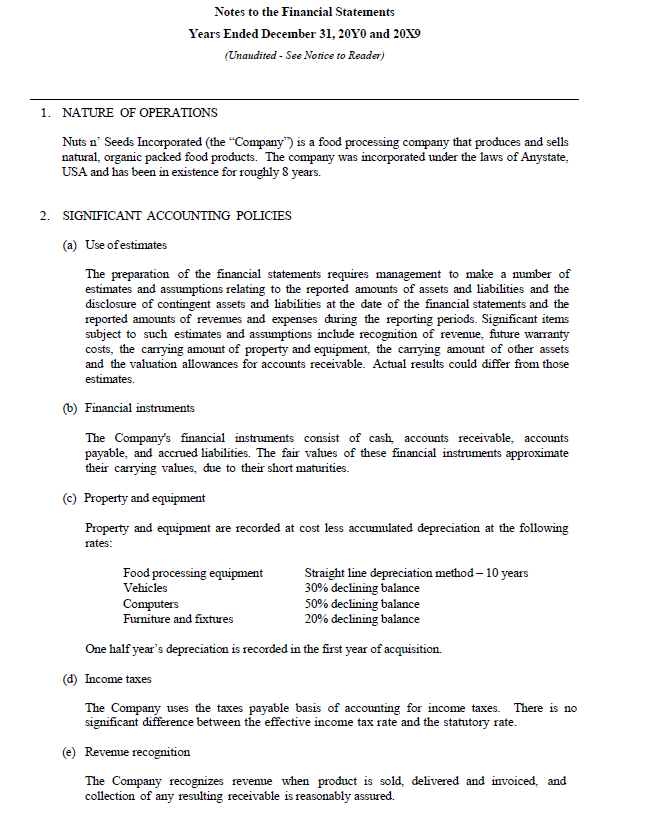

NUTS N' SEEDS INCORPORATED - Client Brief Background Nuts n' Seeds Incorporated (NSI) is a producer of organic, packaged snack products. Their products include granola bars, nut and seed butters, and other legume-based packaged snacks, like nut and seed mixes. The company was founded by owner Jason Lee, who still runs the business at its original facility in Anytown, USA. Jason's background was in marketing; he worked as a brand manager at a much larger competitor for 5 years before leaving to create NSI approximately 8 years ago when he identified what he believed to be a great market opportunity. NSI is a relatively new client to your commercial bank, moving over about 18 months ago from a competitor after a referral from your wealth management division, with whom Jason has a relationship. Jason is a marketing guru, but even he is the first to admit that his financial acumen is weak - though improving. Jason's outside net worth is approximately $1,600,000 - with some of it in home equity but most in non-registered marketable securities, held with your wealth management group. Jason has been considering hiring a part time CFO to help support growth and to optimize their capital structure. He's only 40 and expects to work in the business for at least another 20 years; he has big growth expectations over that time. In a recent meeting it was made clear that he has not done any succession planning. The snack food production industry in North America is dominated by several large players, with Pepsi-co chief among them. Smaller operators like NSi generally achieve success by carving out unique niches (like locally-sourced and/or organic). Jason has been successful in this, particularly around brand messaging given his background in marketing. NSI has a well-diversified customer- base, although Jason is presently in negotiations with Costco's procurement team; a large new customer like that would be a game-changer. The present transaction is an annual review with increase. NSI is looking to borrow an additional $500,000 that will support the acquisition of new packaging equipment. They have a $500,000 operating line already, plus a $200,000 reducing term facility that you advanced right before their fiscal year end. Industry The snack food production industry is in the mature stage of its lifecycle, with heavy levels of regulation. CAPEX requirements are considered relatively high. Industry revenues are growing at an annualized rate of 1.49; this is expected to continue over the next 5 years. Technological change is considered medium, with investment in innovation required to keep up with the changing industry landscape. Some key industry ratios are as follows: Net margin: 3.8% Gross margin: 33.19 Debt service coverage: 1.5x Total liabilities to equity: 1.9x Current ratio: 1.5x Funded debt to EBITDA: 3.7xFunded debt to EBITDA: 3.7x . NUTS N' SEEDS INCORPORATED Balance Sheet December 31, 2040 and 20X9 (Unaudited - See Notice to Reader) 20YO 20X9 $ $ ASSETS CURRENT Cash Sales tax receivable Inventory Accounts receivable 275,879 15,127 790,535 387,517 72,517 15,959 796,513 362,885 1,469,058 1,247,874 EQUIPMENT (Note 3) 803,658 692,554 $ 2,272,716 $ 1,940,428 $ $ LIABILITIES CURRENT Accounts payable and accrued liabilities Bank line of credit Current portion of long-term debt Salaries payable 324,554 441,589 325,514 500,000 33,333 15,430 13,955 874,278 780,098 914,412 DUE TO SHAREHOLDERS LONG-TERM DEBT 914,412 166,667 1,955,357 1,694,510 SHAREHOLDERS' EQUITY Share capital (Note 4) Retained earnings 100 317,259 100 245,818 317,359 245,918 $ 2,272,716 $ 1,940,428 NUTS N' SEEDS INCORPORATED Statement of Income Years Ended December 31, 2040 and 20X9 (Unaudited - See Notice to Reader) 20YO 20x9 REVENUES $ 2,571,705 $ 2,296,165 COST OF SALES 1,697,325 1,554,917 GROSS MARGIN 874,380 741,248 EXPENSES Advertising and promotion Bank charges Business taxes, licenses and memberships Courier and postage Depreciation Insurance Interest Office and administration Repairs and maintenance Rent and occupancy Salaries and wages Software and computers Telephone Warehouse 23,541 11,648 13,297 10,271 115,727 3,941 68,495 6,132 12,861 81,372 365,182 6,137 1,507 64,968 17,185 9.886 9,147 6,238 94,722 3,516 29,638 5,286 9.214 81,178 315.950 4,288 958 56,255 785,079 643.461 NET INCOME BEFORE INCOME TAXES 89,301 97,787 INCOME TAXES 17,860 18,761 NET INCOME $ 71,441 $ 79,026 20YO 20X9 20YO 20x9 REVENUES $2,571,705 $2,296,165 500.000 COST OF SALES Credit Line: Spread: Prime Total Rate 1,697,325 1.554.917 ASSETS CURRENT Cash Sales tax receivable Inventory Accounts receivable 3.00% $275,879 15,127 790,535 387,517 $72.517 15,959 796,513 362,885 GROSS MARGIN 874,380 741,248 1,469,058 1,247,874 Existing Term Loan: Amortization (months) Rate Rate Monthly Monthly Payment: Total Annual Payments: EQUIPMENT (Note 3) 803,658 692,554 Total Assets $2 272,716 $1,940,428 EXPENSES Advertising and promotion Bank charges Business taxes, licenses and memberships Courier and postage Depreciation Insurance Interest Office and administration Repairs and maintenance Rent and accupancy Salaries and wages Software and computers Telephone Warehouse 23,541 11,648 13,297 10,271 115,727 3,941 68,495 6,132 12,861 81,372 365,182 6,137 1,507 64,968 LIABILITIES CURRENT Accounts payable and accrued liabilities Bank line of credit Current portion of long-term debt Salaries payable 17,185 9,886 9,147 6.238 94.722 3,516 29.638 5,286 9.214 81,178 315.950 4.288 958 56 255 500.000 84 5.50% New Term Loan: Amortization (months) Rate: Rate Monthly Monthly Payment Total Annual Payments: S324,554 441,589 $325,514 $ 500,000 33,333 15,430 13,955 874,278 780,098 785,079 643.461 914,412 DUE TO SHAREHOLDERS LONG-TERM DEBT 914,412 166,667 NET INCOME BEFORE INCOME TAXES 89,301 97,787 1,955,357 1,694,510 INCOME TAXES 17,860 18.761 NET INCOME $71,441 $79,026 SHAREHOLDERS' EQUITY Share capital (Note 4) Retained earings 100 317,259 100 245,818 Total Equity 317,359 245,918 EBITDA Credit Line Interest: Existing Annual Term Loan Blended Payments: New Annual Term Loan Blended Payments: Debt Service Coverage Ratio: Total Liabilities and Shareholders' Equity $2,272,716 $1,940,428 Total Liabilities: Total Equity Total Liabilities to Equity Total Funded Debt Funded Debt to EBITDA Current Assets Current Liabilities: Current Ratio: Notes to the Financial Statements Years Ended December 31, 2040 and 20X9 (Unaudited - See Notice to Reader) 1. NATURE OF OPERATIONS Nuts n' Seeds Incorporated (the "Company') is a food processing company that produces and sells natural, organic packed food products. The company was incorporated under the laws of Anystate, USA and has been in existence for roughly 8 years. 2. SIGNIFICANT ACCOUNTING POLICIES (a) Use of estimates The preparation of the financial statements requires management to make a number of estimates and assumptions relating to the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Significant items subject to such estimates and assumptions include recognition of revenue, future warranty costs, the carrying amount of property and equipment, the carrying amount of other assets and the valuation allowances for accounts receivable. Actual results could differ from those estimates. (6) Financial instruments The Company's financial instruments consist of cash accounts receivable, accounts payable, and accrued liabilities. The fair values of these financial instruments approximate their carrying values, due to their short maturities. Property and equipment Property and equipment are recorded at cost less accumulated depreciation at the following rates: Food processing equipment Straight line depreciation method 10 years Vehicles 30% declining balance Computers 50% declining balance Furniture and fixtures 20% declining balance One half year's depreciation is recorded in the first year of acquisition. (d) Income taxes The Company uses the taxes payable basis of accounting for income taxes. There is no significant difference between the effective income tax rate and the statutory rate. (e) Revenue recognition The Company recognizes revenue when product is sold, delivered and invoiced, and collection of any resulting receivable is reasonably assured. NUTS N' SEEDS INCORPORATED - Client Brief Background Nuts n' Seeds Incorporated (NSI) is a producer of organic, packaged snack products. Their products include granola bars, nut and seed butters, and other legume-based packaged snacks, like nut and seed mixes. The company was founded by owner Jason Lee, who still runs the business at its original facility in Anytown, USA. Jason's background was in marketing; he worked as a brand manager at a much larger competitor for 5 years before leaving to create NSI approximately 8 years ago when he identified what he believed to be a great market opportunity. NSI is a relatively new client to your commercial bank, moving over about 18 months ago from a competitor after a referral from your wealth management division, with whom Jason has a relationship. Jason is a marketing guru, but even he is the first to admit that his financial acumen is weak - though improving. Jason's outside net worth is approximately $1,600,000 - with some of it in home equity but most in non-registered marketable securities, held with your wealth management group. Jason has been considering hiring a part time CFO to help support growth and to optimize their capital structure. He's only 40 and expects to work in the business for at least another 20 years; he has big growth expectations over that time. In a recent meeting it was made clear that he has not done any succession planning. The snack food production industry in North America is dominated by several large players, with Pepsi-co chief among them. Smaller operators like NSi generally achieve success by carving out unique niches (like locally-sourced and/or organic). Jason has been successful in this, particularly around brand messaging given his background in marketing. NSI has a well-diversified customer- base, although Jason is presently in negotiations with Costco's procurement team; a large new customer like that would be a game-changer. The present transaction is an annual review with increase. NSI is looking to borrow an additional $500,000 that will support the acquisition of new packaging equipment. They have a $500,000 operating line already, plus a $200,000 reducing term facility that you advanced right before their fiscal year end. Industry The snack food production industry is in the mature stage of its lifecycle, with heavy levels of regulation. CAPEX requirements are considered relatively high. Industry revenues are growing at an annualized rate of 1.49; this is expected to continue over the next 5 years. Technological change is considered medium, with investment in innovation required to keep up with the changing industry landscape. Some key industry ratios are as follows: Net margin: 3.8% Gross margin: 33.19 Debt service coverage: 1.5x Total liabilities to equity: 1.9x Current ratio: 1.5x Funded debt to EBITDA: 3.7xFunded debt to EBITDA: 3.7x . NUTS N' SEEDS INCORPORATED Balance Sheet December 31, 2040 and 20X9 (Unaudited - See Notice to Reader) 20YO 20X9 $ $ ASSETS CURRENT Cash Sales tax receivable Inventory Accounts receivable 275,879 15,127 790,535 387,517 72,517 15,959 796,513 362,885 1,469,058 1,247,874 EQUIPMENT (Note 3) 803,658 692,554 $ 2,272,716 $ 1,940,428 $ $ LIABILITIES CURRENT Accounts payable and accrued liabilities Bank line of credit Current portion of long-term debt Salaries payable 324,554 441,589 325,514 500,000 33,333 15,430 13,955 874,278 780,098 914,412 DUE TO SHAREHOLDERS LONG-TERM DEBT 914,412 166,667 1,955,357 1,694,510 SHAREHOLDERS' EQUITY Share capital (Note 4) Retained earnings 100 317,259 100 245,818 317,359 245,918 $ 2,272,716 $ 1,940,428 NUTS N' SEEDS INCORPORATED Statement of Income Years Ended December 31, 2040 and 20X9 (Unaudited - See Notice to Reader) 20YO 20x9 REVENUES $ 2,571,705 $ 2,296,165 COST OF SALES 1,697,325 1,554,917 GROSS MARGIN 874,380 741,248 EXPENSES Advertising and promotion Bank charges Business taxes, licenses and memberships Courier and postage Depreciation Insurance Interest Office and administration Repairs and maintenance Rent and occupancy Salaries and wages Software and computers Telephone Warehouse 23,541 11,648 13,297 10,271 115,727 3,941 68,495 6,132 12,861 81,372 365,182 6,137 1,507 64,968 17,185 9.886 9,147 6,238 94,722 3,516 29,638 5,286 9.214 81,178 315.950 4,288 958 56,255 785,079 643.461 NET INCOME BEFORE INCOME TAXES 89,301 97,787 INCOME TAXES 17,860 18,761 NET INCOME $ 71,441 $ 79,026 20YO 20X9 20YO 20x9 REVENUES $2,571,705 $2,296,165 500.000 COST OF SALES Credit Line: Spread: Prime Total Rate 1,697,325 1.554.917 ASSETS CURRENT Cash Sales tax receivable Inventory Accounts receivable 3.00% $275,879 15,127 790,535 387,517 $72.517 15,959 796,513 362,885 GROSS MARGIN 874,380 741,248 1,469,058 1,247,874 Existing Term Loan: Amortization (months) Rate Rate Monthly Monthly Payment: Total Annual Payments: EQUIPMENT (Note 3) 803,658 692,554 Total Assets $2 272,716 $1,940,428 EXPENSES Advertising and promotion Bank charges Business taxes, licenses and memberships Courier and postage Depreciation Insurance Interest Office and administration Repairs and maintenance Rent and accupancy Salaries and wages Software and computers Telephone Warehouse 23,541 11,648 13,297 10,271 115,727 3,941 68,495 6,132 12,861 81,372 365,182 6,137 1,507 64,968 LIABILITIES CURRENT Accounts payable and accrued liabilities Bank line of credit Current portion of long-term debt Salaries payable 17,185 9,886 9,147 6.238 94.722 3,516 29.638 5,286 9.214 81,178 315.950 4.288 958 56 255 500.000 84 5.50% New Term Loan: Amortization (months) Rate: Rate Monthly Monthly Payment Total Annual Payments: S324,554 441,589 $325,514 $ 500,000 33,333 15,430 13,955 874,278 780,098 785,079 643.461 914,412 DUE TO SHAREHOLDERS LONG-TERM DEBT 914,412 166,667 NET INCOME BEFORE INCOME TAXES 89,301 97,787 1,955,357 1,694,510 INCOME TAXES 17,860 18.761 NET INCOME $71,441 $79,026 SHAREHOLDERS' EQUITY Share capital (Note 4) Retained earings 100 317,259 100 245,818 Total Equity 317,359 245,918 EBITDA Credit Line Interest: Existing Annual Term Loan Blended Payments: New Annual Term Loan Blended Payments: Debt Service Coverage Ratio: Total Liabilities and Shareholders' Equity $2,272,716 $1,940,428 Total Liabilities: Total Equity Total Liabilities to Equity Total Funded Debt Funded Debt to EBITDA Current Assets Current Liabilities: Current Ratio: Notes to the Financial Statements Years Ended December 31, 2040 and 20X9 (Unaudited - See Notice to Reader) 1. NATURE OF OPERATIONS Nuts n' Seeds Incorporated (the "Company') is a food processing company that produces and sells natural, organic packed food products. The company was incorporated under the laws of Anystate, USA and has been in existence for roughly 8 years. 2. SIGNIFICANT ACCOUNTING POLICIES (a) Use of estimates The preparation of the financial statements requires management to make a number of estimates and assumptions relating to the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Significant items subject to such estimates and assumptions include recognition of revenue, future warranty costs, the carrying amount of property and equipment, the carrying amount of other assets and the valuation allowances for accounts receivable. Actual results could differ from those estimates. (6) Financial instruments The Company's financial instruments consist of cash accounts receivable, accounts payable, and accrued liabilities. The fair values of these financial instruments approximate their carrying values, due to their short maturities. Property and equipment Property and equipment are recorded at cost less accumulated depreciation at the following rates: Food processing equipment Straight line depreciation method 10 years Vehicles 30% declining balance Computers 50% declining balance Furniture and fixtures 20% declining balance One half year's depreciation is recorded in the first year of acquisition. (d) Income taxes The Company uses the taxes payable basis of accounting for income taxes. There is no significant difference between the effective income tax rate and the statutory rate. (e) Revenue recognition The Company recognizes revenue when product is sold, delivered and invoiced, and collection of any resulting receivable is reasonably assured

Can you check my answer is correct or no ?

Can you check my answer is correct or no ?