Question: Can you continue making the VRIO framework and describe its resources and capabilities in the 4 functional areas of management? Resources Valuable Rare Inimitable Well-Organized

Can you continue making the VRIO framework and describe its resources and capabilities in the 4 functional areas of management?

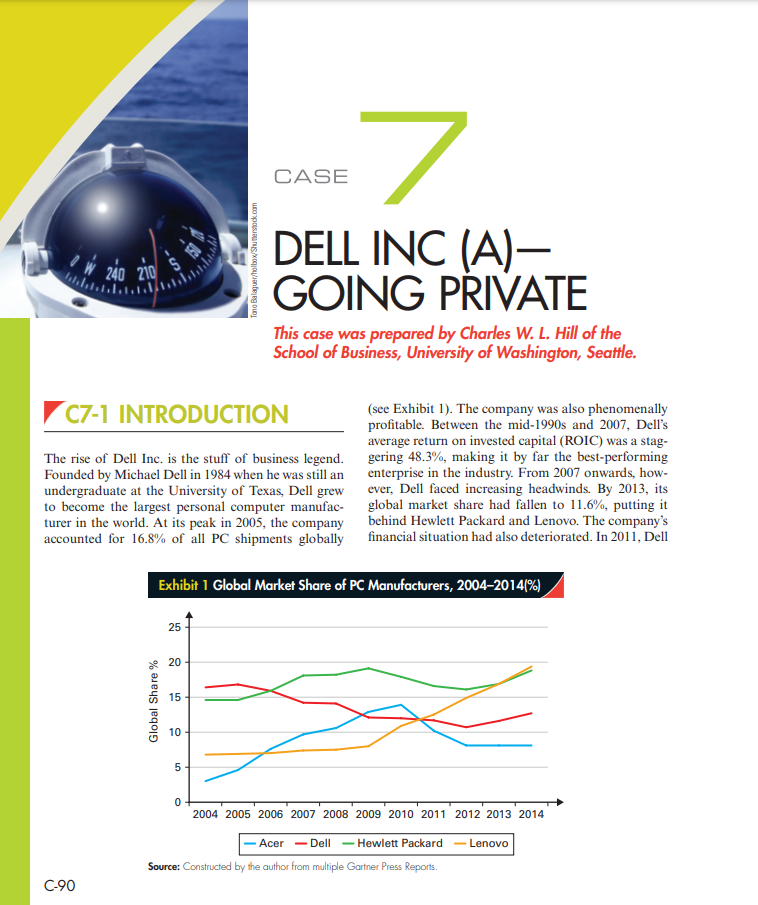

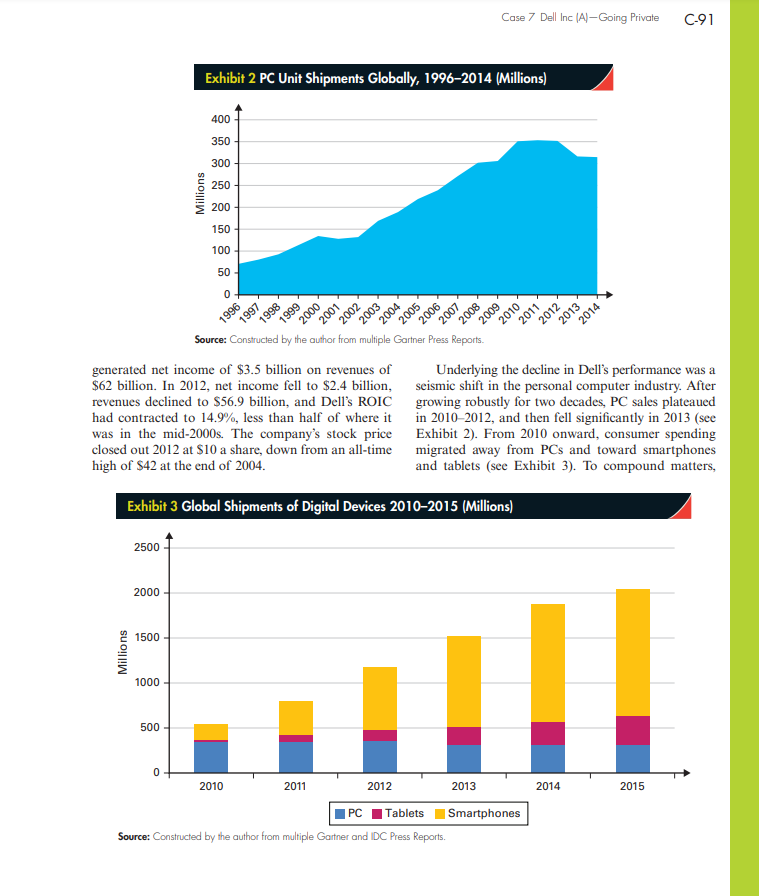

Resources Valuable Rare Inimitable Well-Organized 7-3 "By selling direct, eliminating middlemen, and using the savings to price aggressively, Dell was able to ramp up sales" 7-3 "Internet" 7-3 "Internet-based customer ordering and procurement systems allowed | 7 CASE * c 190 onio Balaguerholbox/Shutterstock.com 240210 Nu DELL INC (A) - GOING PRIVATE This case was prepared by Charles W. L. Hill of the School of Business, University of Washington, Seattle. 07-1 INTRODUCTION (see Exhibit 1). The company was also phenomenally profitable. Between the mid-1990s and 2007, Dell's average return on invested capital (ROIC) was a stag- The rise of Dell Inc. is the stuff of business legend. gering 48.3%, making it by far the best performing Founded by Michael Dell in 1984 when he was still an enterprise in the industry. From 2007 onwards, how- undergraduate at the University of Texas, Dell grew ever, Dell faced increasing headwinds. By 2013, its to become the largest personal computer manufac- global market share had fallen to 11.6%, putting it turer in the world. At its peak in 2005, the company behind Hewlett Packard and Lenovo. The company's accounted for 16.8% of all PC shipments globally financial situation had also deteriorated. In 2011, Dell Exhibit 1 Global Market Share of PC Manufacturers, 2004-2014(%) 25 20 15 Global Share% 10 5 0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Lenovo Acer - Dell - Hewlett Packard Source: Constructed by the author from multiple Gartner Press Reports. C-90 Case 7 Dell Inc (Al-Going Private C-91 Exhibit 2 PC Unit Shipments Globally, 19962014 (Millions) Millions 1996 2003 2004 2009 2014 1997 1998 1999 2000 2001 2002 2005 2006 2007 2008 2010 2011 2012 2013 Source: Constructed by the author from multiple Gartner Press Reports. generated net income of $3.5 billion on revenues of Underlying the decline in Dell's performance was a $62 billion. In 2012, net income fell to $2.4 billion, seismic shift in the personal computer industry. After revenues declined to $56.9 billion, and Dell's ROIC growing robustly for two decades, PC sales plateaued had contracted to 14.9%, less than half of where it in 2010-2012, and then fell significantly in 2013 (see was in the mid-2000s. The company's stock price Exhibit 2). From 2010 onward, consumer spending closed out 2012 at $10 a share, down from an all-time migrated away from PCs and toward smartphones high of $42 at the end of 2004. and tablets (see Exhibit 3). To compound matters, Exhibit 3 Global Shipments of Digital Devices 2010-2015 (Millions) 2500 2000 1500 Millions 1000 500 2014 2015 2010 2011 2012 2013 IPC Tablets Smartphones Source: Constructed by the author from multiple Gartner and IDC Press Reports. C-92 Case 7 Dell Inc (A)-Going Private low-cost producers such as Lenovo of China and Acer wasn't Dell's first business. Like many entrepreneurs, of Taiwan, were taking business from Dell in the mar- he started early. When he was 12, he set up a busi- ket for Windows PCs. At the high end of the market, ness selling the stamps that he and his friends had a resurgent Apple was capturing an increasing share collected. He quickly made $2,000. At 16, he got a of desktop and laptop computers with its stylishly de- summer job selling newspaper subscriptions for the signed iMac offerings. By late 2014, Apple's share of Houston Post. Not satisfied with calling people at global PC shipments had risen to over 6%, while its random, he developed a methodology for identify- share of the US market stood at a record 13.4%. ing who was most likely to pay for a new subscription Dell was also struggling in the corporate market, using publicly available data on mortgage applica- where companies like IBM and Hewlett Packard (HP) tions. He targeted those people, creating personalized were gaining business by bundling together computer letters and offering subscriptions. His income that hardware with value-added information technology year was $18,000not bad for a high school student (IT) service offerings. IBM and HP offered hardware, in 1981. When he got his driver's license, he bought including PCs and servers, at cost, and made money himself a BMW from multiyear service contracts that could encom- Computers, however, were Dell's passion. Dell's pass everything from basic maintenance to premium first was an Apple II. Much to the horror of his par- IT consulting services. In 2008, HP strengthened its ents, as soon as he got his brand-new machine he position by acquiring for $13.9 billion the IT consult- took it apart to see how it was made. When the IBM ing company Electronic Data Systems. Dell lacked a PC was introduced in 1981, he bought one of those. big consulting arm, which put the company at a clear He opened it up, added all of the enhancements he disadvantage. To try and rectify this, after 22 years could, and sold it for a tidy profit. And so a business with no acquisitions, in 2007 Dell started to acquire was born. Dell quickly noticed an interesting fact. small IT service companies. In 2009, Dell made its While an IBM PC sold for about $3,000, the com- largest acquisition ever, purchasing Perot Systems for ponents were made by other companies and could $3.9 billion. Perot Systems was a provider of informa- be purchased off the shelf for around $700. So what tion technology services with a strong position in the accounted for the other $2,300? Sales and marketing market for electronic health-care information. Michael expenses, IBM's profit margin, and the markup taken Dell's strategy was clear: to move the company up- by retailers. To Dell, this screamed profit opportunity. stream into higher-value-added IT consulting services. He realized that by selling direct, something that he This strategy, however, could take years to execute. was already doing, he could eliminate the retailer's Investors were not impressed, focusing instead on Dell's markup, price lower, and still make a nice profit. inability to offer attractive smartphones and tablets, By early 1984, Dell was selling $50,000 to $80,000 a and the increasing commoditization of the company's month worth of upgraded PCs and add-on compo- PC business. By 2012, Dell was feeling the heat from nents to people in the Austin area. In May of that the slowdown in global PC sales. Revenues and prof- year, he incorporated the rapidly growing business as its were down, the stock price was slumping, and in- Dell Computer Corporation. He soon dropped out of vestors were grumbling about the company's inability school to concentrate full time on building the busi- to decouple itself from the commodity PC business. ness. As he described it later, the original facility was a Michael Dell's response was to take the company private. 1,000-square-foot office space in Austin. Dell's manu- facturing "consisted of three guys with screwdrivers sitting at six-foot tables upgrading machine." 07-2 ESTABLISHMENT OF DELL C7-3 THE GROWTH YEARS In 1983, a young Michael Dell was conducting a Dell was riding a wave of demand for PCs. The mar- lucrative business selling upgraded PCs out of his ket had transitioned from an embryonic one and was dormitory room at the University of Texas. This now experiencing hypergrowth. Penetration into the Case 7 Dell Inc (Al-Going Private C-93 business and consumer segments was proceeding rapidly. By selling direct, eliminating middlemen, and using the savings to price aggressively, Dell was able to ramp up sales. By late 1986, the company was doing $60 million in annualized sales. In 1988, Dell went public. Michael Dell was just 23. The 1990s, however, were the beginning of a magic decade for the company. In 1990, Dell was ranked 25th in the world among computer companies. By 1999, it was the largest PC maker in the United States, and the second largest globally. Moreover, 17 out of the top 25 computer companies in 1990 no longer existed by 1999. Dell had ridden to the top of a highly dynamic and turbulent industry, while many more venerable enterprises had failed. IBM, the dominant computer enterprise of the 1970s and 1980s, had a near death experience in the early 1990s, recording larger losses than any other company in history, while Dell went from strength to strength. One of Dell's greatest strengths was the fact that it built to order. It did not have to stuff a channel with inventory. It did not have to make educated guesses about demand. It did not have to worry that it might have built too few of a certain model and too many of another. It only built what it had already sold. The rocket fuel that propelled Dell to the top of the industry was the Internet. The development of hypertext transfer protocol by Tim Berners-Lee gave birth to the World Wide Web. The subsequent intro- duction of web browsers democratized the Internet, transforming it from a haven for computer nerds into a mainstream communications network. This enabled Dell to start direct selling over the Internet. Launched in June 1994, by 2010 more than 85% of Dell's computers were sold online. According to Michael Dell: "As I saw it, the Internet offered a logi- cal extension of the direct (selling) model, creating even stronger relationships with our customers. The Internet would augment conventional telephone, fax, and face-to-face encounters, and give our customers the information they wanted faster, cheaper, and more efficiently." Customers could now build their own machine online, add the mix of components that best suited them, enter their credit card information, and then hit the purchase button. In effect, the Internet allowed Dell to almost perfectly segment the market, creating value for customers in the process. Moreover, Dell could take the real-time order flow and transfer it at the speed of light via the Internet to its suppliers. This information allowed the players in Dell's globally dispersed supply chain to optimize their production and shipping schedules so that parts arrived at one of Dell's assembly plants just in time. By the late 1990s, Dell was turning over its inventory in a matter of days, reducing its working capital re- quirements to a minimum. Internet-based customer ordering and procure- ment systems allowed Dell to synchronize demand and supply to an extent that its rivals could not. For example, if Dell found out that it was run- ning out of a particular component, say 17-inch monitors from Panasonic, it could manipulate de- mand by offering a 19-inch model at a lower price until Panasonic delivered more 17-inch monitors. By taking steps to fine-tune the balance between demand and supply, Dell could meet customers' ex- pectations and maintain its differential advantage. Moreover, balancing supply and demand allowed the company to minimize excess and obsolete in ventory. By the early 2000s, Dell was writing off be- tween 0.05 to 0.1% of total material costs as excess or obsolete inventory. Its competitors were writing off between 2 to 3%, which gave Dell a significant cost advantage By the late 1990s, Dell was starting to work some financial magic. It could take an order over the Inter- net, build the machine, and ship it to customers in a matter of days. The customer was billed when the ma- chine shipped. Its suppliers, however, were paid net 30 days. The implication; Dell could use money des- tined for its suppliers to finance its working capital requirements, including its inventory. This reduced the need for outside capital: You don't need to borrow capital from a bank, or from investors, when you can borrow at a zero interest rate from your own suppli- ers. This means that you can pair down the amount of working capital on your balance sheet, thus reducing the denominator for ROIC (defined as net profit over capital on the enterprise's balance sheet). This boosts the profitability of the enterprise. By the late 1990s, Dell was earning an ROIC in the 40% range, a remarkable level of profitability by any measure. Moreover, the high ROIC was not a short- term phenomenon. Dell continued to earn these kind of returns on its invested capital until 2007. Equally impressive, Dell grew both sales and earnings per share at double-digit rates for most of this time as it surged to the top of the industry. C-94 Case 7 Dell Inc (A)-Going Private Dell was by no means the only company that pur- computers. The long tail of small companies re- sued a direct-sales strategy-Gateway was another- flects relatively low startup costs for entering the but it was the first, and it was the best at doing business. The standard architecture of the personal it. Dell was operationally efficient. Michael Dell computer means that key components such as an avoided founder's disease, a well-known phenom- Intel compatible microprocessor, a Windows operat- enon that occurs when entrepreneurs sink the busi- ing system, memory chips, a hard drive, and other nesses they created by failing to professionalize similar hardware can be purchased on the open management and delegate responsibility. Dell hired market. Assembly is easy, requiring little capital skilled operators, and learned how to delegate to equipment and few technical skills, and economies them. The company built core skills in managing the of scale in production are moderate. Although small direct-sales model and coordinating a globally dis- entrants lack the brand-name recognition and distri- persed supply chain. bution reach of the market share leaders, they sur- Dell's main rivals during the period of rapid vive in the industry by pricing their machines a few market growth included Compaq, IBM, Hewlett hundred dollars below market leaders and capturing Packard, Packard Bell, and Toshiba. Issues arising the demand of price-sensitive consumers. This puts from channel conflict made it hard for these com- pressure on brand-name companies and the prices panies to imitate Dell's model. All of these com- they can charge panies had already committed to selling through a Most buyers view the product offerings of differ- channel, and fully embracing a direct-sales model ent branded companies as very close substitutes for might well have led to a loss of sales through their each other, so competition between them often de- existing channel. faults to price. Due to a combination of competition and technological improvements, the average selling price of a PC fell from around $1,700 in 1999 to un- 07-4 THE GLOBAL PC der $750 by 2010. The downward pressure on prices makes it hard for personal computer companies to INDUSTRY bring in big gross margins, and results in lower profit- ability. The exception is Apple, which has successfully differentiated its iMac offerings by design, operating The global personal computer industry is very system software, and brand. competitive. At the end of 2014, Lenovo was mar- Slowing demand growth in many developed ket leader with a global share of 19.4%, followed nations, including the world's largest market the by Hewlett Packard with 18.8% and Dell Inc. with United States, where the market is now mature and 12.7%. Apple had 6% of the market, although in the demand is limited to replacement demand, has ex- United States its share was 13.4% (among U.S. con- acerbated the downward pressure on prices. There sumers, Apple's market share is thought to be much is also a pronounced cyclical aspect to demand higher, coming in at over 30%). from businesses. Demand growth was just 4% in There was consolidation in the industry during the 2009, for example, due to a global recession, but it 2000s. Hewlett Packard acquired the large PC vendor jumped to 14% in 2010 as the economy recovered. Compaq in 2002. Lenovo, the fast-growing Chinese The rise of powerful substitutes in the form of tab- firm, acquired IBM's ThinkPad consumer PC busi- lets and smartphones has depressed demand since ness in 2005. In 2014, Lenovo entered into a deal to 2010 (see Exhibits 2 and 3). buy part of IBM's server business. Meanwhile, in late Personal computer companies have long had to 2014 HP announced plans to split into two compa- deal with two very powerful suppliers-Microsoft, nies, HP Inc. and HP Enterprise. HP Inc would sell which supplies the industry standard operating sys- PCs and printers, while HP Enterprise would focus tem, Windows, and Intel, the supplier of the industry on providing software and services to corporations. standard microprocessor. Microsoft and Intel have A long tail of small companies accounts for some been able to charge relatively high prices for their 35% of the global market. Some of these companies fo- products, which has raised input costs for per- cus on local markets and make unbranded white box sonal computer manufacturers, and reduced their Case 7 Dell Inc (Al-Going Private C-95 profitability. In late 2012 Microsoft introduced a new Each plant uses exactly the same supply chain version of its Windows operating system, Windows 8. management processes that have made Dell famously Windows 8 featured a different user interface that the efficient. Taking advantage of its supply chain man- one consumers had grown used to. It was not well agement software, Dell schedules production of every received by many consumers and businesses. Some line in every factory around the world every 2 hours. industry observers believe that the poor reception Every factory is run with no more than a few hours for Windows 8 hurt demand for PCs, as many people of inventory on hand, including work in progress. decided not to upgrade, instead sticking with their To serve Dell's global factories, many of Dell's larg- Windows 7 machines. est suppliers have also located their facilities close From the early 1990s onwards, servers became an to Dell's manufacturing plants so that they can bet- increasingly important part of the PC business. Servers ter meet the company's demands for just-in-time are specialized PCs that sit at the heart of corporate inventory. networks, and can be used to store data and serve Dell has set up customer service centers in each re- up applications such as email to a network of con- gion to handle phone and online orders and to provide nected PCs. Client server architecture was the domi- technical assistance. In general, each center serves an nant computing paradigm in enterprises both large entire region, which Dell has found to be more effi- and small for most of the 1990s through to the pres- cient than locating a customer service center in each ent day. By 2014, severs were accounting for about country where the company does business. Dell has $50 billion in annual sales industry wide. The three experimented with outsourcing some of its customer largest server vendors were HP, IBM and Dell, which service functions for English language customers to had 27%, 18.5% and 17.7% of this market respectively call centers in India. Although the move helped the in the third quarter of 2014. Cisco was fourth in the company to lower costs, it also led to dissatisfaction market with a 6.2% share.? from customers, particularly in the United States, who could not always follow the directions given over the phone from someone with a thick regional accent. 07-5 DELL'S GLOBAL Subsequently, Dell moved its call centers for English language businesses back to the United States and the OPERATIONS United Kingdom. Dell continues to invest in Indian call centers for its retail customers. The PC market is a global one. Dell has been expand- ing its presence outside of the United States since the 07-6 GOING PRIVATE early-1990s. By 2010, over 40% of Dell's revenue was generated outside of the United States. Dell does not alter its business model from country to country-it Michael Dell had stepped down as CEO in March uses the same direct selling and supply chain model 2004 to devote more time to his family's charitable that worked so well in the United States. foundation and personal investments. He passed the Dell's basic approach to global expansion has been reins to Kevin Rollins, who had been chief operating to serve foreign markets from a handful of regional officer, and whom Michael Dell credited with trans- manufacturing facilities, each established as a wholly forming Dell into an efficient manufacturer. Dell owned subsidiary. To support its global business, it op- remained on as chairman. In January 2007, Rollins erates 3 final assembly facilities in the United States, resigned and Michael Dell came back as CEO. 1 in Brazil (serving South America), Poland (serving The catalyst for Rollins resignation was Dell's de- Europe), Malaysia (serving Southeast Asia), China clining market share in the PC industry (see Exhibit 1). (serving China), and India. Each of these plants is large After 10 years of strong performance, in 2006 Dell enough to attain significant economies of scale. When lost its leadership position to HP, and the com- demand in a region gets large enough, Dell considers pany's growth rate fell below that of the industry. A opening a second plant-thus it has 3 plants in the compounding factor was that in 2006 the Securities United States to serve North America and 3 in Asia. and Exchange Commission (SEC) announced that it C-96 Case 7 Dell Inc (A)-Going Private was investigating Dell for possible accounting regu- offerings, including installing and maintaining IT larities. Rollins's resignation was seen my many as an hardware, installing and customizing software appli- attempt to deflect attention away from Michael Dell. cations such as ERP and database offerings, applica- According to the SEC, Dell received some $6 billion tion development, business process outsourcing, and in "exclusivity payments from Intel to use only Intel business process analysis. Steve Shuckenbrock was microprocessors. The SEC asserted that these hired from the IT consulting services company EDS payments, which were not disclosed to investors, had a to lead the initiative. His task was to establish Dell as material impact on Dell's performance between 2001 a viable competitor to IBM and HP. Both of these and 2005, allowing the company to meet or exceed companies were pursuing a razor and blade strategy, analysts' earnings expectations. When the payments pricing commoditized hardware at close to cost, and from Intel were cut, this negatively impacted Dell's then making money from multiyear service contracts. profitability, but again the company did not disclose Dell aimed to do the same. the reason for falling profits to investors. In 2010, Dell To build up its services business, Dell made some Inc. agreed to pay a $100-million penalty to settle the 20 acquisitions for a total of $13 billion. These in- charges. Dell and Rollins both paid a $4-million fine. cluded the 2009 acquisition of Perot Systems for As he stepped back into the CEO position, $3.9 billion, the largest in the company's history. The Michael Dell was confronted with a number of prob- price that Dell paid for Perot Systems represented a lems, which only intensified over the next 6 years. 68% premium over the company's prior market value. Dell's rivals had become more efficient, eroding the Commenting on the acquisition binge, Dell noted: cost advantage that Dell once enjoyed. Moreover, "At the scale of Dell, the only way you are going to the growth rate in the PC market was slowing. The move the needle quicker was acquisitions."*0 market plateaued in 2010-2012, and in 2013 it shrank By the financial year ending February 1, 2013, (Exhibit 2). This triggered intense price competition. "services was a $12-billion revenue business at Dell. To compound matters, the rise of smartphones and In the same year, Dell made $45 billion in revenues tablets left traditional PC companies like Dell out in from hardware products (mostly PCs and servers). the cold (see Exhibit 3). Dell's net income 2013 was $2.37 billion, down Dell did enter both the smartphone and the tab- from $3.49 billion a year earlier. While services were let markets. A mobility group was established within growing the top line, this was not yet translating Dell, and Ron Garriques, who joined Dell from into bottom line growth. Investors were clearly not Motorola, was appointed to lead the unit. The division satisfied with the lack of progress at Dell. The com- released a number of products, but they were not well pany's stock price, which had been trading around received. A pocket tablet running Android with a $25 when Michael Dell reassumed the CEO role 5-inch screen, known as The Streak," was released in in early 2007, was trading below $10 a share in August 2010. It was a year behind schedule and ran on mid-2012. It was against this background that, in an old version of Android. Streak it did not. It really February 2013, Dell announced that he had part- had no chance against the runaway success of Apple's nered with private equity fund Silver Lake to take iPad, which had been released in January of that year. Dell private in a $25-billion deal. The mobile division also released a smartphone that Michael Dell first contemplated taking Dell private used the Windows Phone 7 operating system. The in mid-2012, after a conversation with Southeastern phone had battery and Wi-Fi problems. It did not sell Asset Management, the company's second biggest well. In November 2010, Garriques resigned from the shareholder. Southern Asset Management was under- company, and Dell shut its mobile division down, roll- water on its investment in Dell and saw little upside. ing its mobile products into the broader business. The However, the investment company said that it would company continued to make Android smartphones be willing to back an effort to take the company pri- until 2012, when it pulled out of the business, citing vate if the price were right. This started a chain of low sales and large investment requirements. events that culminated with Dell and partners from Michael Dell also pushed the company into the Silver Lake, and another investment firm, Kohlberg information technology services business. The service Kravis and Roberts (KKR), talking about a possible business encompassed a number of different product private buyout of Dell. Case 7 Dell Inc (Al-Going Private C-97 At this point, Dell informed the board of direc- now have to vote on the deal. Under the terms of the tors about his conversations. The board formed a agreement, Dell stockholders were to receive $13.65 special committee from which Dell was excluded to in cash for every share of Dell they held a transac- consider the idea along with other options. Report- tion that valued the company at $24.4 billion." The edly these other options included (1) splitting Dell up offer price represented a premium of 25% over the into a PC business and a services business; (2) making closing share price of $10.88 on January 11, the last more "transformative acquisitions; (3) increasing day before rumors of a possible private equity buy- the dividend payout and stock buybacks to boost out started to appear in the media, and a premium of the share price; and (4) selling Dell to a "strategic 37% over the average closing share price during the buyer. The board then told Michael Dell that it was previous 90 calendar days ending on January 11, open to considering a transaction that would take 2013. The buyers would acquire all of the outstand- Dell private. ing shares of Dell not held by Michael Dell and By October 2012, KKR had submitted bids for certain other members of management. The buyout Dell at around $12 a share. Michael Dell had pledged deal included a 45-day "go-shop" provision during that he would participate with whichever sponsor was which the special committee would actively solicit, willing to pay the highest price. At the time the stock receive, evaluate, and potentially enter in to negotia- price was around $10 a share. Then the November tions with parties offering alternative proposals. earnings report came out. Earnings came in below To finance the deal, Silver Lake put up $1.4 bil- management forecasts, and the stock price fell below lion in cash, and Michael Dell committed another $9 a share. At this point KKR, citing structural weak- $750 million in cash, along with his existing 14% stake ness in the PC business, withdrew from the bidding in the company. A consortium of banks, including process. Bank of America, Credit Suisse, and RBC provided On December 6, 2012, the CFO provided updates loans totaling $13.75 billion. Microsoft added an- on Dell's business and gave the board of directors other $2 billion in loans. Dell was to remain CEO of projections through until 2016. He told the board the company after privatization. Without the need to that fully implementing the plan to shift from PCs to pay out dividends and make stock buybacks, Michael a service business would take another 3 to 5 years. It Dell and Silver Lake felt that they could adequately would also require more capital investment. This was cover the interest payments on the debt from cash a big concern, given that cash flows from the PC busi- flow. Moreover, privatization would give management ness were declining. The board asked another private the flexibility to pursue longer-term investments. equity firm, Texas Pacific Group, if it was interested in bidding for Dell, but the company declined. C7-6a Enter Carl Icahn By early February 2013, the board had come to the conclusion that a private buyout of Dell was prob- At this point, Carl Icahn entered the field. Icahn had ably the best option. With rumors of a buyout start- first made his name during the 1980s as an activist ing to appear in the media, the board needed to make investor. He had specialized in taking a substantial a statement. They had come to the conclusion that a or controlling position in companies that he claimed buyout would inject needed capital into the company. were poorly managed, and pushing for changes in It would also take the company out of the glare of the management and strategy. He would make money public markets, enabling management to make long- from selling out after the stock price had made sub- term investments that could in the short run depress stantial gains. earnings. Convinced that there would be no other bid- One of the high points of Icahn's career was the ders, the board gave Michael Dell and Silver Lake the takeover of the venerable airline, TWA. TWA was go ahead to make a formal offer to take Dell Inc. pri- in financial trouble. Icahn raised debt capital from a vate. Dell recused himself from all board discussions group of investors to finance the takeover. To sway and board voting on any transaction. TWAS board, management, and employees, he told On February 5, the board announced that it had them he wanted to make TWA profitable again. He reached an agreement with Silver Lake and Michael ended up with a 20% stake in the company and the Dell to take the company private. Shareholders would chairman's position. After the takeover, he sold off C-98 Case 7 Dell Inc (A)-Going Private some of the company's assets in order to pay down originally offered in February. It was not a big con- the debt. In 1988, Icahn took TWA private in a lever- cession. Dell's board backed the revised offer. Icahn aged buyout, which gave him a profit of $469 million pushed for shareholders to seek "appraisal rights," from selling his personal 20% stake. The buyout left which is a process by which a judge determines the TWA with $540 million in debt. Icahn paid down the value of the shares. Appraisal rights are available to debt by selling off TWA's prized London routes to companies like Dell that are incorporated in Delaware, American Airlines for $445 million in 1991. but it is a process that can take months. There are also Stripped of its most valuable routes, a year later risks involved because while judge might rule that the airline went into Chapter 11 bankruptcy proceed- Dell was worth more than $13.65 a share, the judge ings. Icahn resigned as chairman but remained in- could also rule that it was worth less. volved in TWA, this time as a creditor. TWA emerged Dell's board scheduled a vote to approve the buy- from bankruptcy in 1993. As part of the restructur- out offer to be held on September 12, 2013. Within ing, TWA owed Carl Icahn $180 million. Desperate to 15 minutes the meeting was over. With roughly 65% get rid of Icahn, TWA's new management cut a deal of the votes cast for the transaction, Icahn lacked that allowed him to buy any ticket that connected sufficient support to derail the buyout. Initially Icahn through TWA's St. Louis hub for 55 cents, and then continued to push for his own Dell shares to be ap- resell it at a discounted price. The deal blocked Icahn praised by a Delaware judge, but on October 4, he an- from selling through travel agents, but it didn't men- nounced that he was withdrawing his request.' Icahn tion a rapidly emerging new distribution channel, the was left with a small (for him) 870-million profit on his Internet. Icahn set up Lowestfare.com to resell TWA Dell investments, but he wasn't beyond taking one last tickets. Icahn put downward pressure on the amount swipe at the company. Icahn stated that his attempt to TWA could sell tickets for, because the company was block the buyout was "too difficult" given the lack of essentially competing with itself. Estimates suggest progress with the board, which he likened to a "dicta- that the deal cost TWA $100 million a year. In 1995, torship." Icahn complained that the board would just TWA went bankrupt. 2 not listen to his arguments. He needed better corporate Icahn reportedly got interested in Dell after some governance in U.S. companies, he stated. 15 large investors contacted him. In a March 5 letter to Dell's board, Icahn let it be known that he had qui- etly purchased $1 billion in Dell shares, and that he 707-7 AFTERMATH thought the Dell-Silver lake bid was too low. Privately, Icahn reportedly believed that Dell was worth $20 a share. In June 2013, Icahn purchased another $1 bil- The transaction to take Dell private closed on lion in shares from Southeastern Asset Management October 28, 2013. The final value of the transaction was at $13.52 a share, giving him a 9% stake in Dell Inc. $24.8 billion. A year later, Michael Dell told attend- Icahn did not pull any punches; he barraged investors ees at an Inc. 5000 conference that his company was with messages that the deal undervalued Dell, often "quite a bit more profitable than it had been a year using Twitter to communicate. He stated emphatically ago, without offering any specifics, and 60% of its that Michael Dell's strategy was a failure, and that he business came from PCs. Despite some media reports should be fired and the board should be replaced. He at the time of the Dell buyout speculating that the painted a picture of Dell's board as being beholden company might get into mobile, Dell didn't sound to Michael Dell and lacking independence. Icahn interested in that. Asked to respond to the criticism urged shareholders to vote against the buyout. Icahn that Dellmissed the boat" on mobile, Dell shrugged. and Southeastern Asset Management proposed to re- "Enormous sums are being lost" in that sector, he said. place Dell's board with their own slate of directors, "Every three years, the leader of the mobile space has who would then push the company into buying back changed. I guess all those guys missed it, too."!6 1.1 billion shares at $14 each.13 In an open letter published in the Wall Street Michael Dell and Silver Lake responded to Icahn Journal on November 25, 2014, Michael Dell again by boosting their bid to $13.75 a share, plus a 13-cent asserted that the buyout was the right move. He special dividend up from the $13.65 a share they had noted that: "Shareholders increasingly demanded Case 7 Dell Inc (Al-Going Private C-99 short-term results to drive returns; innovation and No more having a small group of vocal investors investment too often suffered as a result. Share- hijack the public perception of our strategy while holder and customer interests decoupled ... As a we're fully focused on building for the future. No private company, Dell now has the freedom to take more trade-offs between what's best for a short- long-term view ... No more pulling R&D and term return and what's best for the long-term growth investments to make in-quarter numbers. success of our customers. "1? NOTES K. Hodgkins, "Apple grabs 7"Gartner says worldwide server Airline," Business Insider, March 18, record US market share on strong shipments grew 1% in the third 2014. Mac sales in Q3 2014," MacRumors, quarter of 2014," Gartner press re- 13J. de La Merced, "Icahn's November 7, 2014 lease, December 3, 2014. Latest Gamble at Dell: Appraisal A. Vance, Dell Trails Its Security and Exchange Com- Rights," New York Times, July 10, Rivals in the Worst of Times," New mission, "SEC charges Dell and 2013. York Times, December 15, 2008. senior executives with disclosure 14M. J. de La Merced, "Icahn S, Hansell and A. Vance, Dell and accounting fraud," SEC press Gives Up Fight Over Dell to Spend $3.9 Billion to Acquire release, July 22, 2010. Appraisal Rights," New York Perot Systems," New York Times, "E. Sherman, "Dell Mobile Is Times, October 4, 2013. September 21, 2009. Gone, a Victim of Incompetence," 15D. Sandholm, "Carl Icahn The historical material in this CBS Money Watch, November 18, Slams Dell Board After Drop- section is drawn from Michael 2010. ping Fight," CNBC, September 9, Dell's autobiography. M. Dell 1C. Guglielmo, Dell Officially 2013. and C. Fredman (1999) Direct Goes Private: Inside the Nasti- 16. Fine, "Michael Dell on Carl from Dell. New York, NY. Harper est Tech Buyout Ever," Forbes, Icahn, Hewlett Packard, and the Business. October 30, 2013 Entrepreneurs He Most Admires," Dell.M and Fredman, C. (1999) "Dell Inc Press release, Dell Inc, October 17, 2014. Direct from Dell. New York, NY. Enters into an Agreement to Be 1'D. H. Kass, "Michael Dell Harper Business. Acquired by Michael Dell and on Privatization One Year Later: Source: T. W. Smith, Standard & Silver Lake," February 5, 2013. "We Got It Right," The Var Guy, Poor's Industry Surveys, Computers: 12J. D'Onfro. "Mare Andressen: November 25, 2014. Hardware, April 21, 2011. Carl Icahn Killed an Entire

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts