Answered step by step

Verified Expert Solution

Question

1 Approved Answer

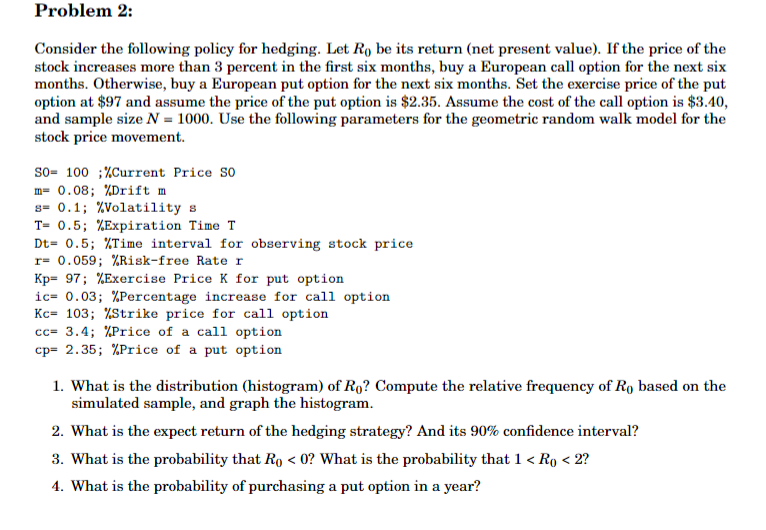

can you d o this problem i n excel with formulas and can you show i t t o m e Problem 2 : Consider

can you this problem excel with formulas and can you show

Problem :

Consider the following policy for hedging. Let be its return net present value If the price of the

stock increases more than percent in the first six months, buy a European call option for the next six

months. Otherwise, buy a European put option for the next six months. Set the exercise price of the put

option at $ and assume the price of the put option is $ Assume the cost of the call option is $

and sample size Use the following parameters for the geometric random walk model for the

stock price movement.

S;Current Price S

m; Drift m

s; Volatility s

T; Expiration Time T

Dt; Time interval for observing stock price

Kp; Exercise Price K for put option

ic; Percentage increase for call option

Kc; Strike price for call option

cc; Price of a call option

cp; Price of a put option

What is the distribution histogram of Compute the relative frequency of based on the

simulated sample, and graph the histogram.

What is the expect return of the hedging strategy? And its confidence interval?

What is the probability that What is the probability that

What the probability purchasing a put option a year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started