can you do A and b and can you write with your hand? that I can see all the numbers because sometimes the number does not show

I send many pictures now it's clear and they two parts A B

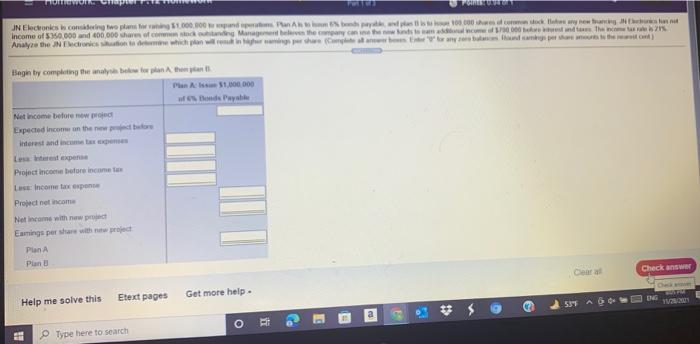

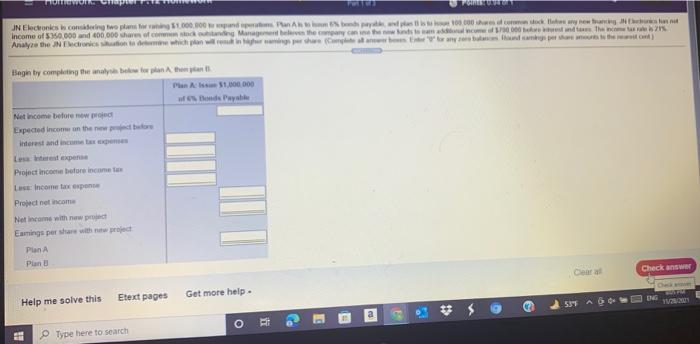

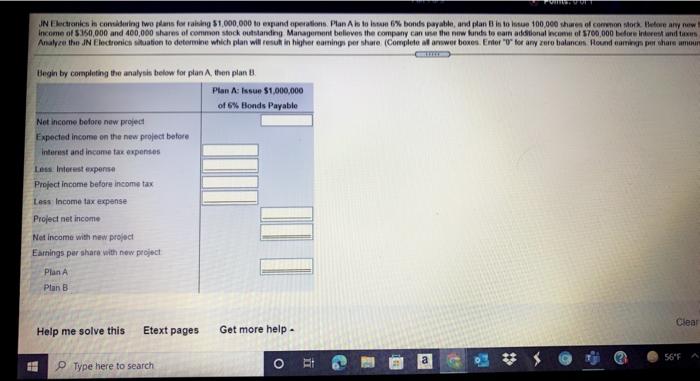

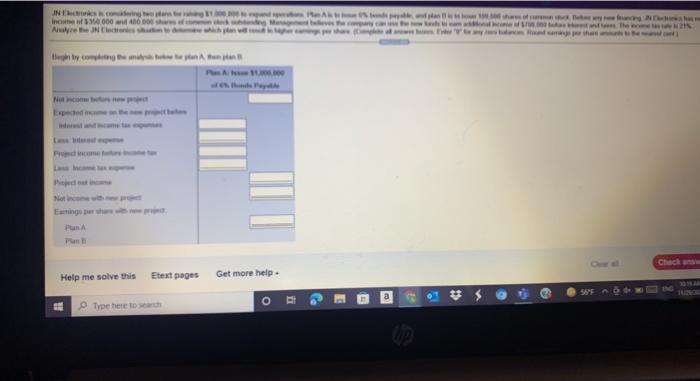

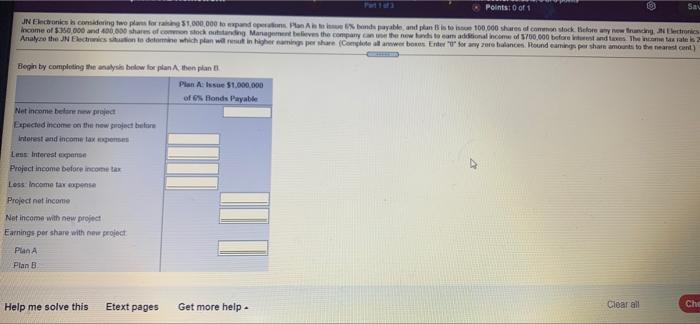

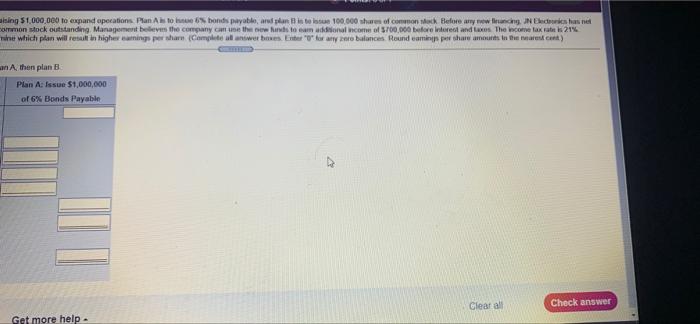

TUNG JN Electronics is considering two point000.000 dan 1000 cock you income of 5.360.000 and 400.000 shares of Manage the contrasto come out into the Analyze the JNE thin wird in her horny and at the God) Begin by completing the way for the Plan A 51.000.000 we wyse Net income before new project Expected income on the water Interest and income Lars expense Project Income before income Les Income tax expo Project net income Net income with new put Earnings per share with new project Pluna Plan Check answer Etext pages Get more help THE Help me solve this TV 53 AGO # O FH Type here to search JN Electronics he coming two plans for raining 51.000.000 to expand operation Plan A is to hab% bonds payable, and plan is to be 100.000 shares of common stork Betere any w Income of $150,000 and 400,000 shares of common stock outstanding Management believes the company can use the new funds to earn additional income of 5700,000 for interest and to Analyze the JN Electronice situation to determine which plan will rest in higher camins per shore (Complete all answer boxes. Entor for any zero balance. Round camino share amoun Begin by completing the analysis below for plan A, then plon B. Plan : Issue $1,000,000 of 6% Bonds Payable Net Income before new project Expected income on the new project before Interest and income tax expenses Less Interest expense Project income before income tax Less Income tax expense Project net income Not income with new project Earnings per share with new project Plan A Plan B Clear Help me solve this Etext pages Get more help a 56 F Type here to search O RI t eving won for thing 51.000.000 to expandera en Altersyal, and plant is to see 100 000 shares of Connon stock, Before any new racingJN Electronics has and 400,000 shares of common stock and Manages the company can in the new kinds to cam ada income of 5700,000 before interest and taxes. The income tax rates 21% ronics Motion to determine which plan willingering pershare (Complete and hones Endere for any rere balance. Round per share amounts to the nearest cent) the analysiew for plan A then plan Plan A $1,000,000 es Bonds Payable joc the new project before broject the new project his Etext pages Get more help Clear all Check an 10:19 to search O ti C a 56F AD ENG JNE inone 00046 Ane Nene . The they come 11. Plan Check Help me solve this Etext pages Get more help. no Type here to search O a G Points of 1 Sau JN Electronics is considering two plans for a 1.000.000 to and person. Pan Al Banda payable and plan is the 100.000 shares of come stock for any way to Income of $350.000 and 400.000 shares of common stock banding Management telleves the company and the new onesto cam aditional income of $700.000 before and The come tax rates Analyze the JN Electries she te demine which plan wiring per share (Comete all arwe bors Ende nyare balance. Round caring pa share amours to the nearest cant) Begin by completing the analysis below for plan then plan Plan Issue 51.000.000 of Bonds Payable Net income benew project Expected income on the new project before Interest and income tax expenses Less Interest pense Project Income before income tax Loss Income tax expense Project net income Net income with new project Earnings per share with new project Plan A Plan B Help me solve this Etext pages Get more help Clear all Chi sing $1,000,000 to expand operations Pan Abs to be bonds payable, and plan is to laue 100.000 shares of common stock Before any w racing, JN kederies has ne ommon stock outstanding, Management believes the company can be the hands to eam aditional income of 5700.000 before interest and The come tax rate 21% he which plan will result in higher earnings per shar(Complete all answer bows Enter for any rere balonces Round camins per share amounts in the nearest cant) in Athen plan B Plan A: Issue $1,000,000 of 6% Bonds Payable Clear al Check answer Get more help