Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you do part D and E the correct is there but could provide solution how to get that answes. In all the company spent

can you do part D and E the correct is there but could provide solution how to get that answes.

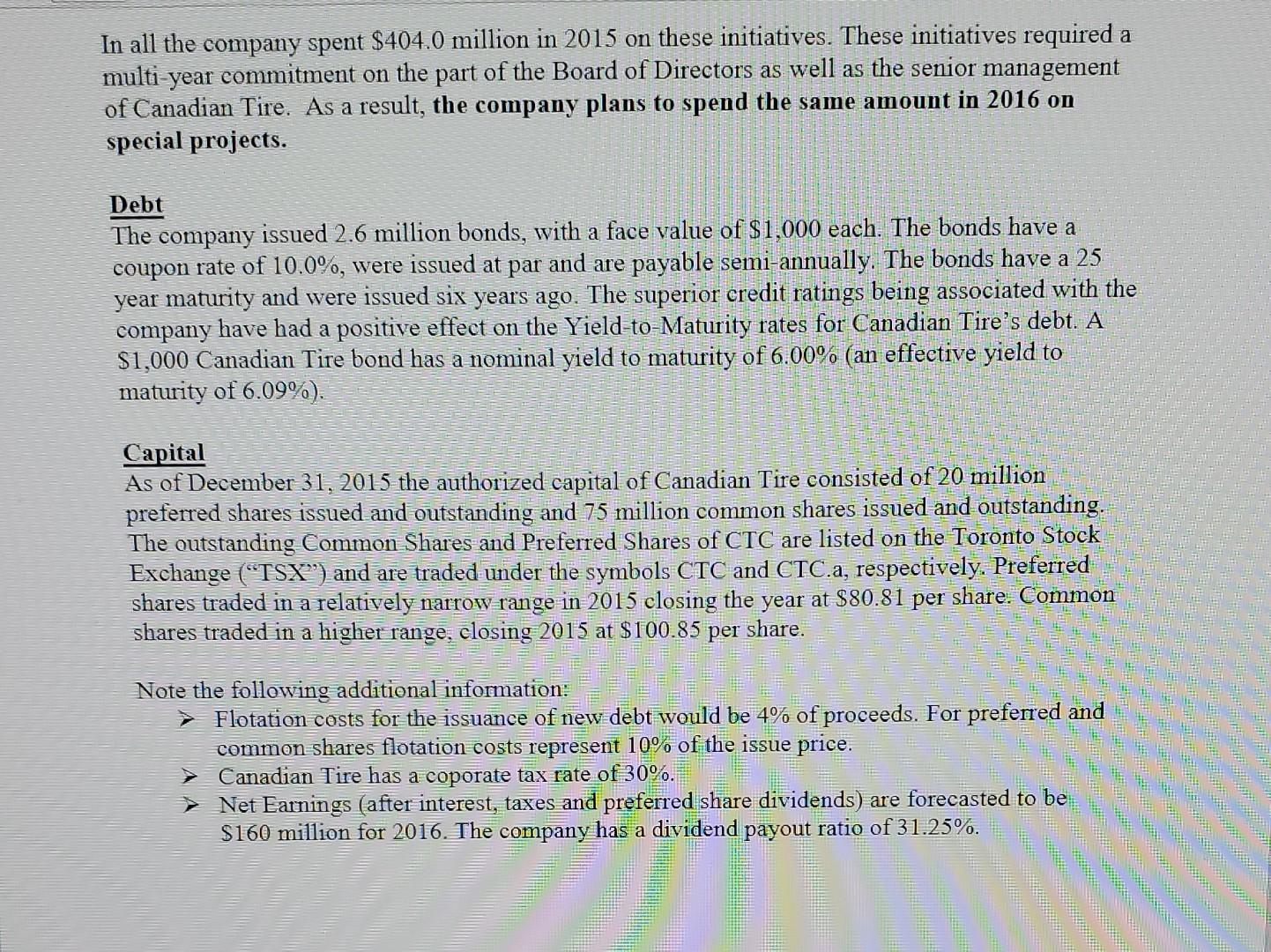

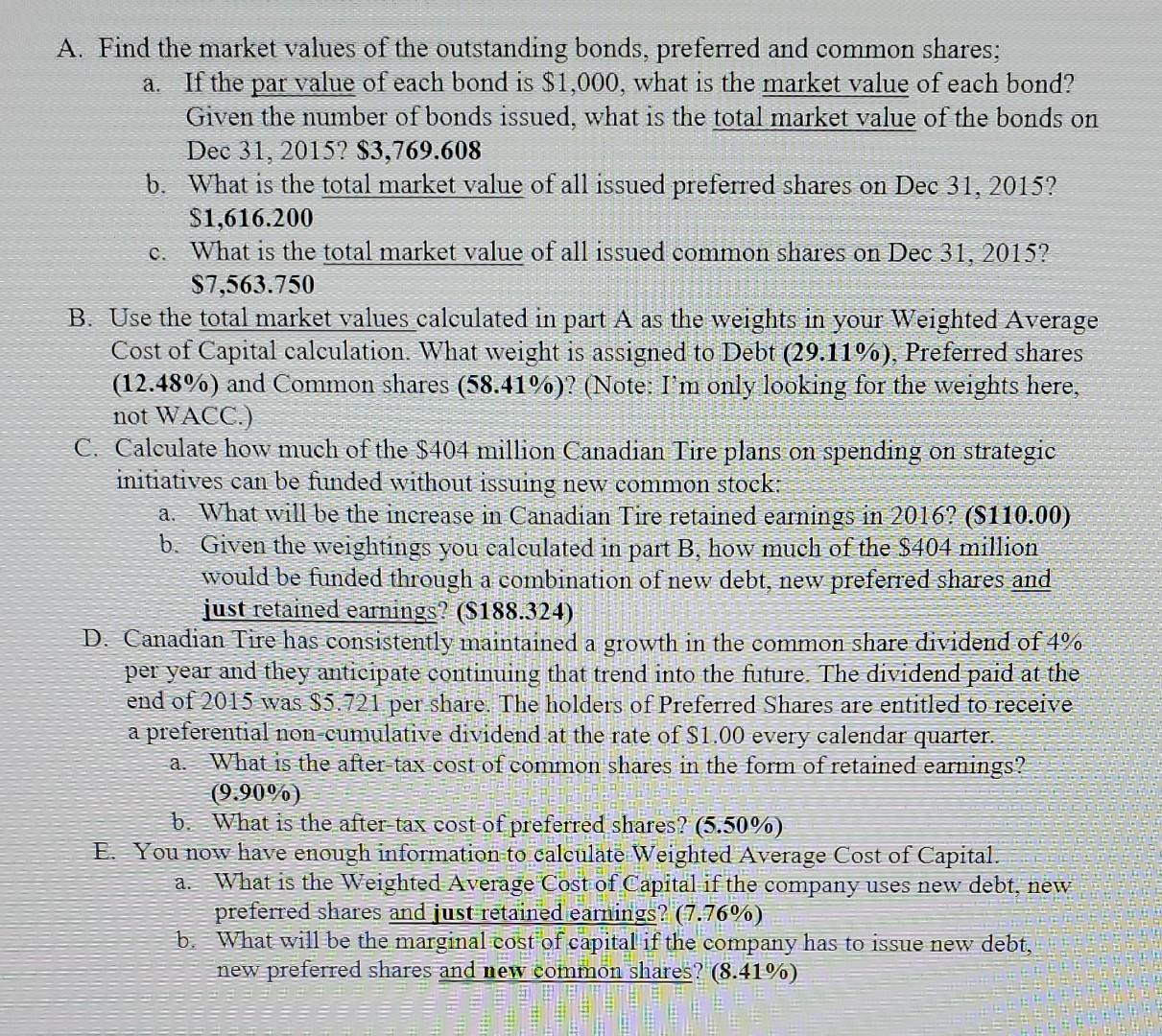

In all the company spent $404.0 million in 2015 on these initiatives. These initiatives required a multi-year commitment on the part of the Board of Directors as well as the senior management of Canadian Tire. As a result, the company plans to spend the same amount in 2016 on special projects. Debt The company issued 2.6 million bonds, with a face value of $1,000 each. The bonds have a coupon rate of 10.0%, were issued at par and are payable semi-annually. The bonds have a 25 year maturity and were issued six years ago. The superior credit ratings being associated with the company have had a positive effect on the Yield-to-Maturity rates for Canadian Tire's debt. A $1,000 Canadian Tire bond has a nominal yield to maturity of 6.00% (an effective yield to maturity of 6.09%) Capital As of December 31,2015 the authorized capital of Canadian Tire consisted of 20 million preferred shares issued and outstanding and 75 million common shares issued and outstanding. The outstanding Common Shares and Preferred Shares of CTC are listed on the Toronto Stock Exchange ("TSX") and are traded under the symbols CTC and CTC. a, respectively. Preferred shares traded in a relatively narrow range in 2015 closing the year at $80.81 per share. Common shares traded in a higher range, closing 2015 at $100.85 per share. Note the following additional information: Flotation costs for the issuance of new debt would be 4% of proceeds. For preferred and common-shares flotation costs represent 10% of the issue price. Canadian Tire has a coporate tax rate of 30%. > Net Earnings (after interest, taxes and preferred share dividends) are forecasted to be \$160 million for 2016 . The company has a dividend payout ratio of 31.25%. A. Find the market values of the outstanding bonds, preferred and common shares; a. If the par value of each bond is $1,000, what is the market value of each bond? Given the number of bonds issued, what is the total market value of the bonds on Dec31,2015?$3,769.608 b. What is the total market value of all issued preferred shares on Dec31,2015 ? $1,616.200 c. What is the total market value of all issued common shares on Dec 31,2015 ? $7,563.750 B. Use the total market values calculated in part A as the weights in your Weighted Average Cost of Capital calculation. What weight is assigned to Debt (29.11%), Preferred shares (12.48%) and Common shares (58.41%) ? (Note: I' m only looking for the weights here, not WACC.) C. Calculate how much of the $404 million Canadian Tire plans on spending on strategic initiatives can be funded without issuing new common stock: a. What will be the increase in Canadian Tire retained earnings in 2016? (\$110.00) b. Given the weightings you calculated in part B, how much of the $404 million would be funded through a combination of new debt, new preferred shares and just retained earnings? (\$188.324) D. Canadian Tire has consistently maintained a growth in the common share dividend of 4% per year and they anticipate continuing that trend into the future. The dividend paid at the end of 2015 was $5.721 per share. The holders of Preferred Shares are entitled to receive a preferential non-cumulative dividend at the rate of S1.00 every calendar quarter. a. What is the after-tax cost of common shares in the form of retained earnings? (9.90%) b. What is the after-tax cost of preferred shares? (5.50\%) E. Younow have enough information to calculate Weighted Average Cost of Capital. a. What is the Weighted Average Cost of Capital if the company uses new debt, new preferred shares and just retained earnings? (7.76%) b. What will be the marginal cost of capital if the company has to issue new debt, new preferred shares and new common shares? (8.41%)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started