Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you explain every single options and choose right answers. tell me why you choose that answers. 97. The IRA deduction that is an adjustment

Can you explain every single options and choose right answers. tell me why you choose that answers.

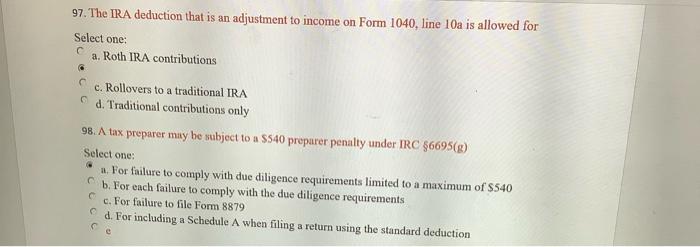

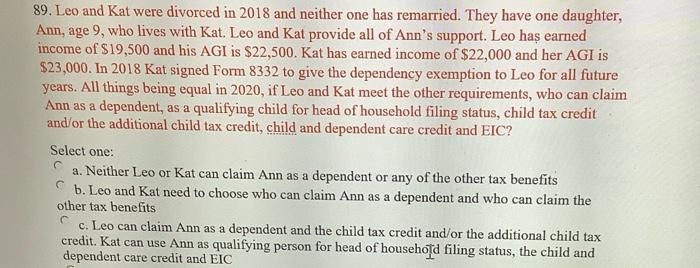

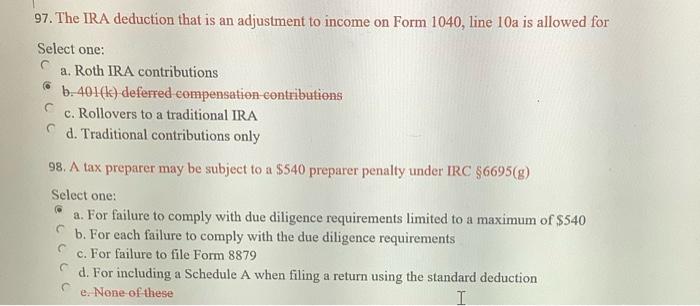

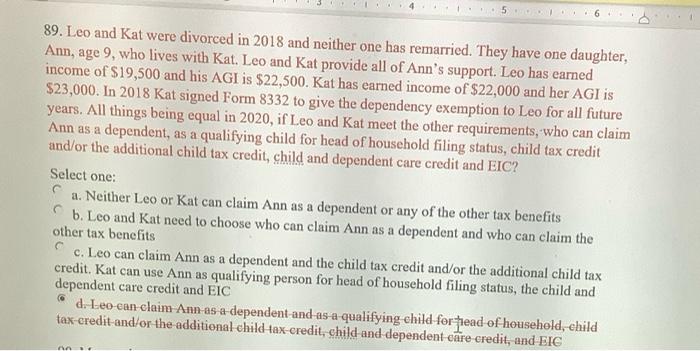

97. The IRA deduction that is an adjustment to income on Form 1040, line 10a is allowed for Select one: a. Roth IRA contributions c. Rollovers to a traditional IRA d. Traditional contributions only 98. A tax preparer may be subject to a $540 preparer penalty under IRC $6695(8) Select one: a. For failure to comply with due diligence requirements limited to a maximum of $540 b. For each failure to comply with the due diligence requirements c. For failure to file Form 8879 d. For including a Schedule A when filing a return using the standard deduction C 89. Leo and Kat were divorced in 2018 and neither one has remarried. They have one daughter, Ann, age 9, who lives with Kat. Leo and Kat provide all of Ann's support. Leo has earned income of $19,500 and his AGI is $22,500. Kat has earned income of $22,000 and her AGI is $23,000. In 2018 Kat signed Form 8332 to give the dependency exemption to Leo for all future years. All things being equal in 2020, if Leo and Kat meet the other requirements, who can claim Ann as a dependent, as a qualifying child for head of household filing status, child tax credit and/or the additional child tax credit, child and dependent care credit and EIC? Select one: a. Neither Leo or Kat can claim Ann as a dependent or any of the other tax benefits b. Leo and Kat need to choose who can claim Ann as a dependent and who can claim the other tax benefits c. Leo can claim Ann as a dependent and the child tax credit and/or the additional child tax credit. Kat can use Ann as qualifying person for head of household filing status, the child and dependent care credit and EIC 97. The IRA deduction that is an adjustment to income on Form 1040, line 10a is allowed for Select one: a. Roth IRA contributions b. 401(k) deferred compensation contributions c. Rollovers to a traditional IRA d. Traditional contributions only 98. A tax preparer may be subject to a $540 preparer penalty under IRC 96695(g) Select one: a. For failure to comply with due diligence requirements limited to a maximum of $540 b. For each failure to comply with the due diligence requirements c. For failure to file Form 8879 d. For including a Schedule A when filing a return using the standard deduction e. None of these 1:6 89. Leo and Kat were divorced in 2018 and neither one has remarried. They have one daughter, Ann, age 9, who lives with Kat. Leo and Kat provide all of Ann's support. Leo has earned income of $19,500 and his AGI is $22,500. Kat has earned income of $22,000 and her AGI is $23,000. In 2018 Kat signed Form 8332 to give the dependency exemption to Leo for all future years. All things being equal in 2020, if Leo and Kat meet the other requirements, who can claim Ann as a dependent, as a qualifying child for head of household filing status, child tax credit and/or the additional child tax credit, child and dependent care credit and EIC? Select one: a. Neither Leo or Kat can claim Ann as a dependent or any of the other tax benefits b. Leo and Kat need to choose who can claim Ann as a dependent and who can claim the other tax benefits c. Leo can claim Ann as a dependent and the child tax credit and/or the additional child tax credit. Kat can use Ann as qualifying person for head of household filing status, the child and dependent care credit and EIC d. Leo-can claim Annas a dependent and as a qualifying child for pead of household, child tax-credit-and/or the additional child-tax-credit, child and dependent care credit, and EIC Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started