Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you explain how to do a horizontal analysis and do one as an example? For 2018, use 2017 as the base year, and for

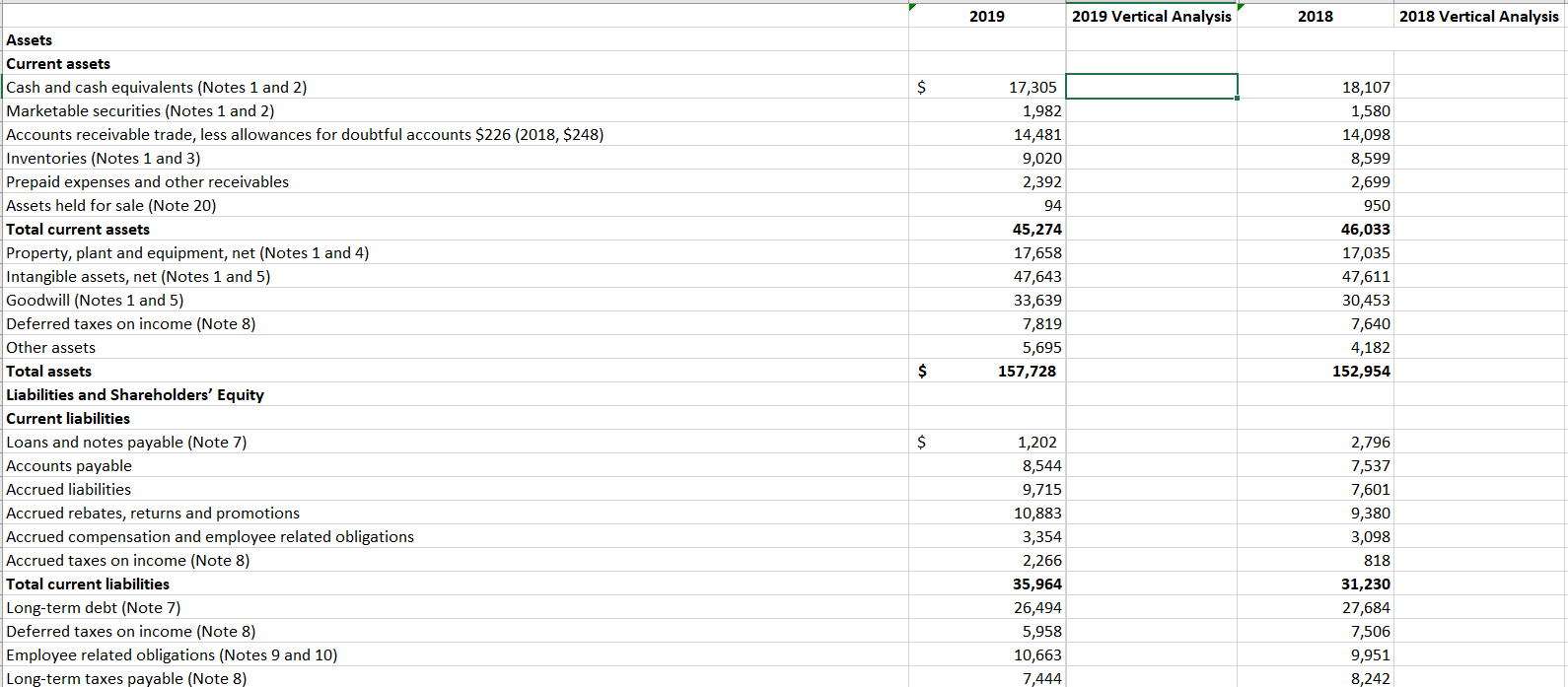

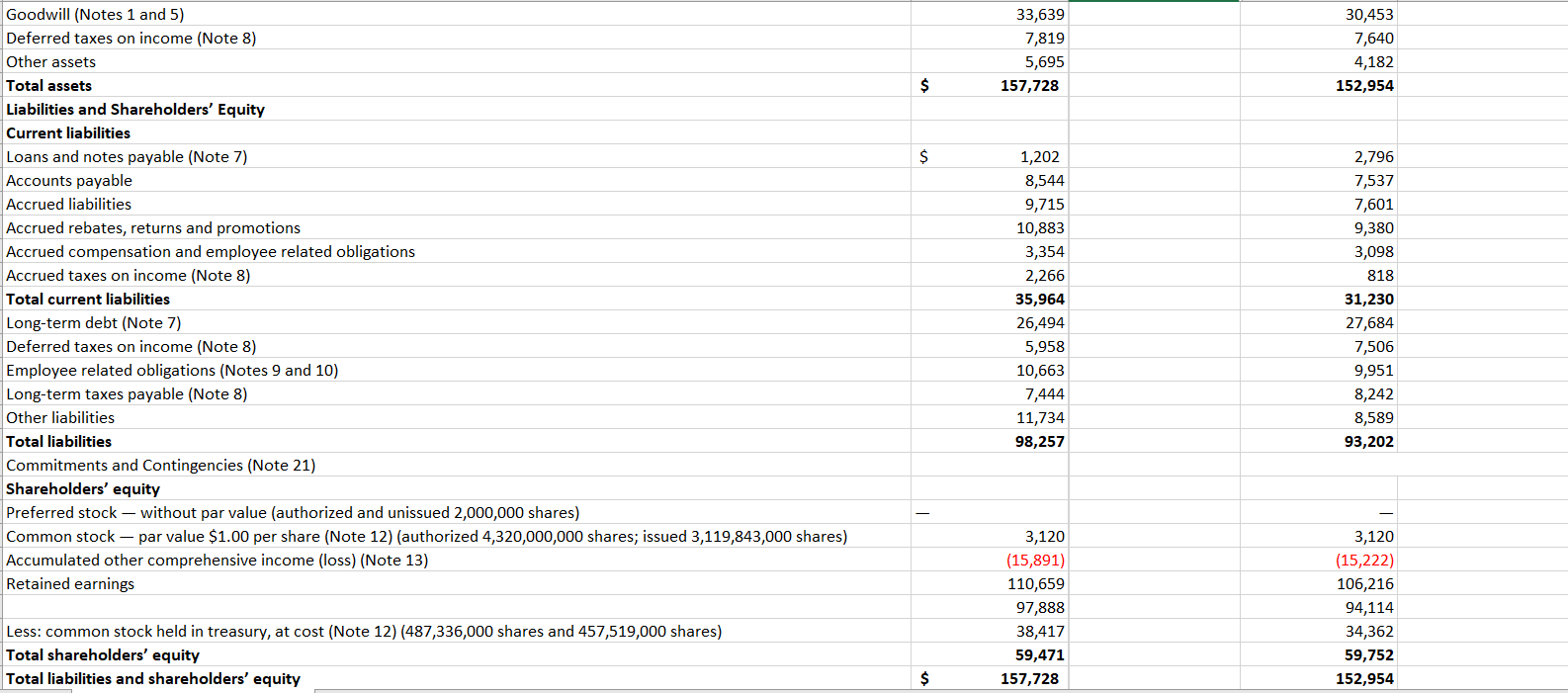

Can you explain how to do a horizontal analysis and do one as an example? For 2018, use 2017 as the base year, and for 2019, use 2018 as the base year.

2019 2019 Vertical Analysis 2018 2018 Vertical Analysis $ Assets Current assets Cash and cash equivalents (Notes 1 and 2) Marketable securities (Notes 1 and 2) Accounts receivable trade, less allowances for doubtful accounts $226 (2018, $248) Inventories (Notes 1 and 3) Prepaid expenses and other receivables Assets held for sale (Note 20) Total current assets Property, plant and equipment, net (Notes 1 and 4) Intangible assets, net (Notes 1 and 5) Goodwill (Notes 1 and 5) Deferred taxes on income (Note 8) Other assets Total assets Liabilities and Shareholders' Equity Current liabilities Loans and notes payable (Note 7) Accounts payable Accrued liabilities Accrued rebates, returns and promotions Accrued compensation and employee related obligations Accrued taxes on income (Note 8) Total current liabilities Long-term debt (Note 7) Deferred taxes on income (Note 8) Employee related obligations (Notes 9 and 10) Long-term taxes payable (Note 8) 17,305 1,982 14,481 9,020 2,392 94 45,274 17,658 47,643 33,639 7,819 5,695 157,728 18,107 1,580 14,098 8,599 2,699 950 46,033 17,035 47,611 30,453 7,640 4,182 152,954 $ $ 1,202 8,544 9,715 10,883 3,354 2,266 35,964 26,494 5,958 10,663 7,444 2,796 7,537 7,601 9,380 3,098 818 31,230 27,684 7,506 9,951 8,242 33,639 7,819 5,695 157,728 30,453 7,640 4,182 152,954 $ $ 2,796 7,537 7,601 9,380 3,098 818 Goodwill (Notes 1 and 5) Deferred taxes on income (Note 8) Other assets Total assets Liabilities and Shareholders' Equity Current liabilities Loans and notes payable (Note 7) Accounts payable Accrued liabilities Accrued rebates, returns and promotions Accrued compensation and employee related obligations Accrued taxes on income (Note 8) Total current liabilities Long-term debt (Note 7) Deferred taxes on income (Note 8) Employee related obligations (Notes 9 and 10) Long-term taxes payable (Note 8) Other liabilities Total liabilities Commitments and Contingencies (Note 21) Shareholders' equity Preferred stock without par value (authorized and unissued 2,000,000 shares) Common stock par value $1.00 per share (Note 12) (authorized 4,320,000,000 shares; issued 3,119,843,000 shares) Accumulated other comprehensive income (loss) (Note 13) Retained earnings 1,202 8,544 9,715 10,883 3,354 2,266 35,964 26,494 5,958 10,663 7,444 11,734 98,257 31,230 27,684 7,506 9,951 8,242 8,589 93,202 | 3,120 (15,891) 110,659 97,888 38,417 59,471 157,728 3,120 (15,222) 106,216 94,114 34,362 59,752 152,954 Less: common stock held in treasury, at cost (Note 12) (487,336,000 shares and 457,519,000 shares) Total shareholders' equity Total liabilities and shareholders' equity $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started