Answered step by step

Verified Expert Solution

Question

1 Approved Answer

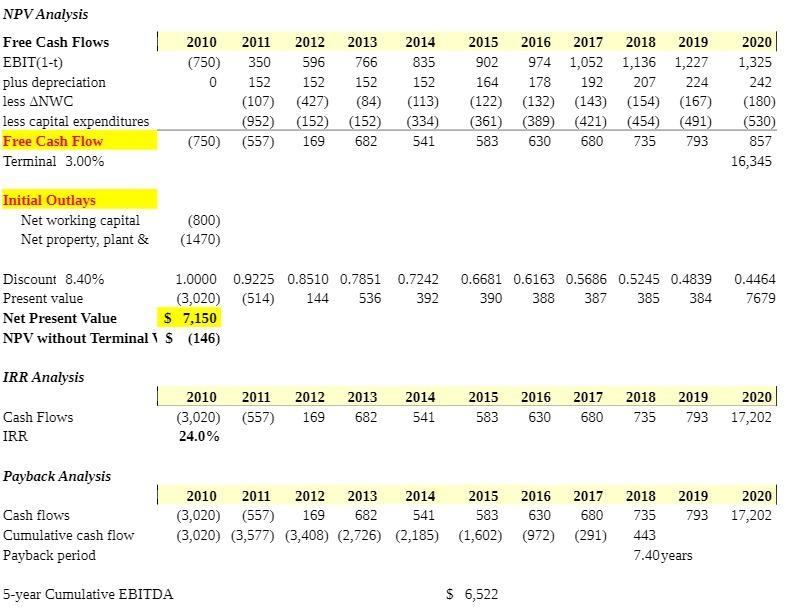

Can you explain how to get 5-year cumulative EBITDA? NPV Analysis Free Cash Flows EBIT(1-t) plus depreciation less ANWC less capital expenditures Free Cash Flow

Can you explain how to get 5-year cumulative EBITDA?

NPV Analysis Free Cash Flows EBIT(1-t) plus depreciation less ANWC less capital expenditures Free Cash Flow Terminal 3.00% Initial Outlays Net working capital Net property, plant & Discount 8.40% Present value Net Present Value $ NPV without Terminal 1 $ IRR Analysis Cash Flows IRR Payback Analysis L Cash flows Cumulative cash flow Payback period 5-year Cumulative EBITDA (750) 0 2010 2011 2012 2013 2014 350 596 766 835 152 152 152 152 (107) (427) (84) (113) (952) (152) (152) (334) (750) (557) 169 682 541 (800) (1470) 1.0000 0.9225 0.8510 0.7851 (3,020) (514) 144 536 7,150 (146) 2010 2011 2012 2013 (3,020) (557) 169 682 24.0% 0.7242 392 2014 541 2014 2010 (3,020) (557) 2011 2012 2013 169 682 (3,020) (3,577) (3,408) (2,726) (2,185) 541 2015 2016 2017 2018 2019 902 974 1,052 1,136 1,227 164 178 192 207 224 (122) (132) (143) (154) (167) (361) (389) (421) (454) (491) 583 630 680 735 793 0.6681 0.6163 0.5686 0.5245 0.4839 390 388 387 385 384 2015 2016 2017 583 630 680 2015 2016 2017 2018 583 (1,602) $ 6,522 2019 630 680 735 793 443 (972) (291) 7.40 years 2020 1,325 242 (180) (530) 857 16,345 2018 2019 2020 735 793 17,202 0.4464 7679 2020 17,202

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the 5year cumulative EBITDA Earnings Before Interes...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started