Answered step by step

Verified Expert Solution

Question

1 Approved Answer

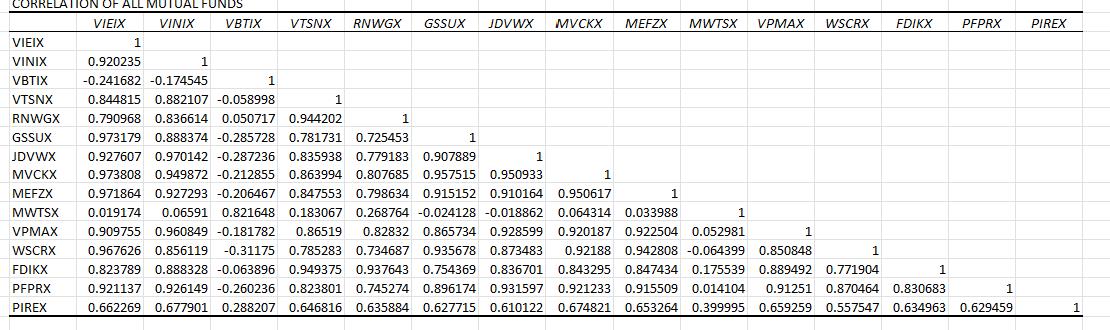

CAN YOU EXPLAIN HOW TO SELECT THE BEST CORRELATED FUNDS CORRELATION OF ALL MUTUAL FUNDS VIEIX VINIX VBTIX VTSNX RNWGX GSSUX JDVWX MVCKX MEFZX MWTSX

CAN YOU EXPLAIN HOW TO SELECT THE BEST CORRELATED FUNDS

CORRELATION OF ALL MUTUAL FUNDS VIEIX VINIX VBTIX VTSNX RNWGX GSSUX JDVWX MVCKX MEFZX MWTSX VPMAX WSCRX FDIKX PFPRX PIREX VIEIX 1 VINIX 0.920235 1 VBTIX -0.241682 -0.174545 1 VTSNX 0.844815 0.882107 -0.058998 1 RNWGX GSSUX 0.790968 0.836614 0.050717 0.944202 0.973179 0.888374 -0.285728 0.781731 0.725453 1 1 JDVWX MVCKX PIREX 0.927607 0.970142 -0.287236 0.835938 0.779183 0.907889 0.973808 0.949872 -0.212855 0.863994 0.807685 0.957515 0.950933 MEFZX 0.971864 0.927293 -0.206467 0.847553 0.798634 0.915152 0.910164 MWTSX 0.019174 0.06591 0.821648 0.183067 0.268764 -0.024128 -0.018862 VPMAX 0.909755 0.960849 -0.181782 0.86519 0.82832 0.865734 0.928599 WSCRX 0.967626 0.856119 -0.31175 0.785283 0.734687 0.935678 0.873483 FDIKX 0.823789 0.888328 -0.063896 0.949375 0.937643 0.754369 0.836701 PFPRX 0.921137 0.926149 -0.260236 0.823801 0.745274 0.896174 0.931597 0.662269 0.677901 0.288207 0.646816 0.635884 0.627715 0.610122 1 1 1 1 0.950617 0.064314 0.033988 0.920187 0.922504 0.052981 0.92188 0.942808 -0.064399 0.850848 0.843295 0.847434 0.175539 0.889492 0.771904 0.921233 0.915509 0.014104 0.91251 0.870464 0.830683 0.674821 0.653264 0.399995 0.659259 0.557547 0.634963 0.629459 1 1 1 1 1

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Selecting the Best Correlated Funds The provided data shows the correlation coefficients between various mutual funds To select the bestcorrelated fun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started