Answered step by step

Verified Expert Solution

Question

1 Approved Answer

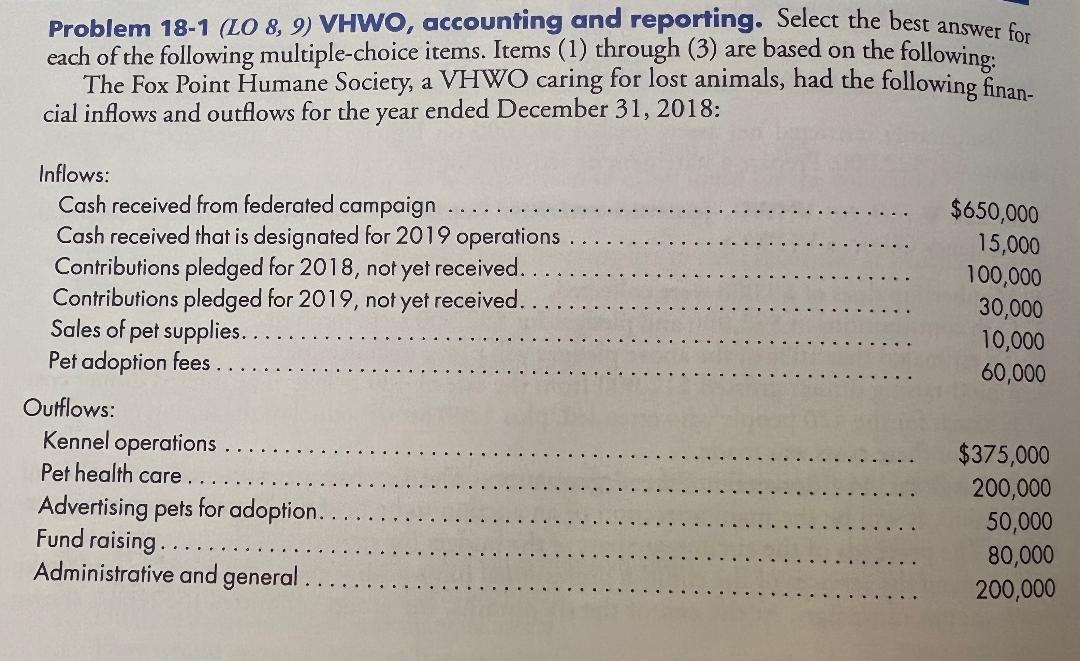

Problem 18-1 (LO 8, 9) VHWO, accounting and reporting. Select the best answer for each of the following multiple-choice items. Items (1) through (3)

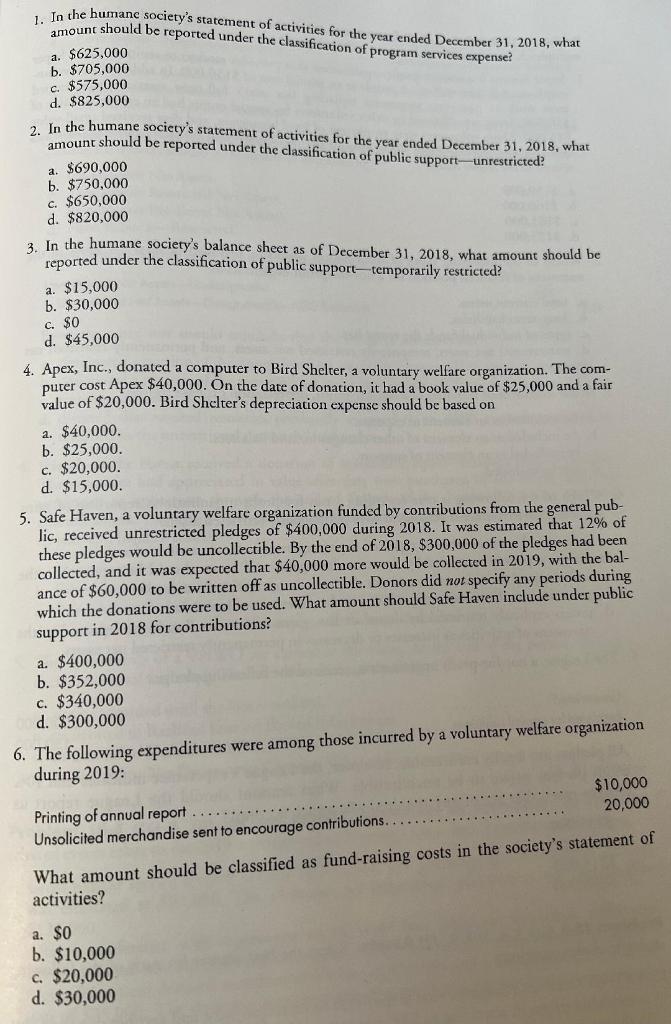

Problem 18-1 (LO 8, 9) VHWO, accounting and reporting. Select the best answer for each of the following multiple-choice items. Items (1) through (3) are based on the following: The Fox Point Humane Society, a VHWO caring for lost animals, had the following finan- cial inflows and outflows for the year ended December 31, 2018: Inflows: Cash received from federated campaign Cash received that is designated for 2019 operations Contributions pledged for 2018, not yet received.. Contributions pledged for 2019, not yet received. Sales of pet supplies.. Pet adoption fees.. Outflows: Kennel operations Pet health care.. Advertising pets for adoption. Fund raising.. Administrative and general. $650,000 15,000 100,000 30,000 10,000 60,000 $375,000 200,000 50,000 80,000 200,000 1. In the humane society's statement of activities for the year ended December 31, 2018, what amount should be reported under the classification of program services expense? a. $625,000 b. $705,000 c. $575,000 d. $825,000 2. In the humane society's statement of activities for the year ended December 31, 2018, what amount should be reported under the classification of public support-unrestricted? a. $690,000 b. $750,000 c. $650,000 d. $820,000 3. In the humane society's balance sheet as of December 31, 2018, what amount should be reported under the classification of public support-temporarily restricted? a. $15,000 b. $30,000 c. $0 d. $45,000 4. Apex, Inc., donated a computer to Bird Shelter, a voluntary welfare organization. The com- puter cost Apex $40,000. On the date of donation, it had a book value of $25,000 and a fair value of $20,000. Bird Shelter's depreciation expense should be based on a. $40,000. b. $25,000. c. $20,000. d. $15,000. 5. Safe Haven, a voluntary welfare organization funded by contributions from the general pub- lic, received unrestricted pledges of $400,000 during 2018. It was estimated that 12% of these pledges would be uncollectible. By the end of 2018, $300,000 of the pledges had been collected, and it was expected that $40,000 more would be collected in 2019, with the bal- ance of $60,000 to be written off as uncollectible. Donors did not specify any periods during which the donations were to be used. What amount should Safe Haven include under public support in 2018 for contributions? a. $400,000 b. $352,000 c. $340,000 d. $300,000 6. The following expenditures were among those incurred by a voluntary welfare organization during 2019: Printing of annual report Unsolicited merchandise sent to encourage contributions.. $10,000 20,000 What amount should be classified as fund-raising costs in the society's statement of activities? a. $0 b. $10,000 c. $20,000 d. $30,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve each question we need to analyze the information provided and apply the relevant accounting ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started