Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you explain me how to do this? here are the answer but i need detail explication 7. Assume a bank is in the process

Can you explain me how to do this? here are the answer but i need detail explication

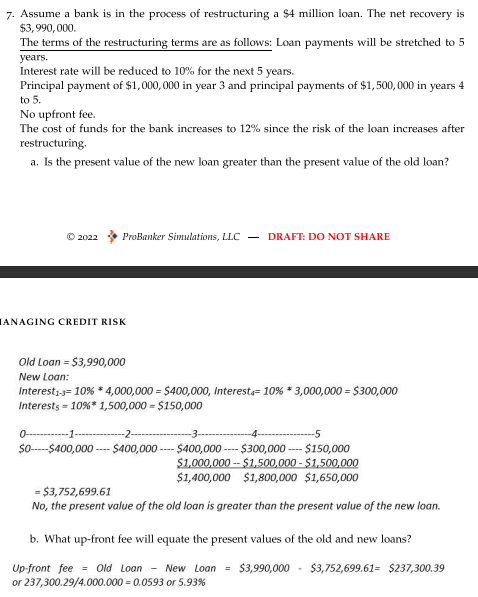

7. Assume a bank is in the process of restructuring a $4 million loan. The net recovery is $3,990,000. The terms of the restructuring terms are as follows: Loan payments will be stretched to 5 years. Interest rate will be reduced to 10% for the next 5 years. Principal payment of $1,000,000 in year 3 and principal payments of $1,500,000 in years 4 to 5 . No upfront fee. The cost of funds for the bank increases to 12% since the risk of the loan increases after restructuring. a. Is the present value of the new loan greater than the present value of the old loan? (10) 2022 ProBanker Simulations, LLC - DRAFT: DO NOT SHARE ANAGING CREDIT RISK Old Loan =$3,990,000 New Loan: Interest t1s=10%4,000,000=$400,000, Interest t4=10%3,000,000=$300,000 Interest 5=10%1,500,000=$150,000 =$3,752,699.61 No, the present value of the old loan is greater than the present value of the new loan. b. What up-front fee will equate the present values of the old and new loans? Up-front fee = Old Loan - New Loon =$3,990,000$3,752,699,61=$237,300,39 or 237,300.29/4.000.000=0.0593 or 5.93%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started