Can you explain this question to me? It's so hard to grasp....

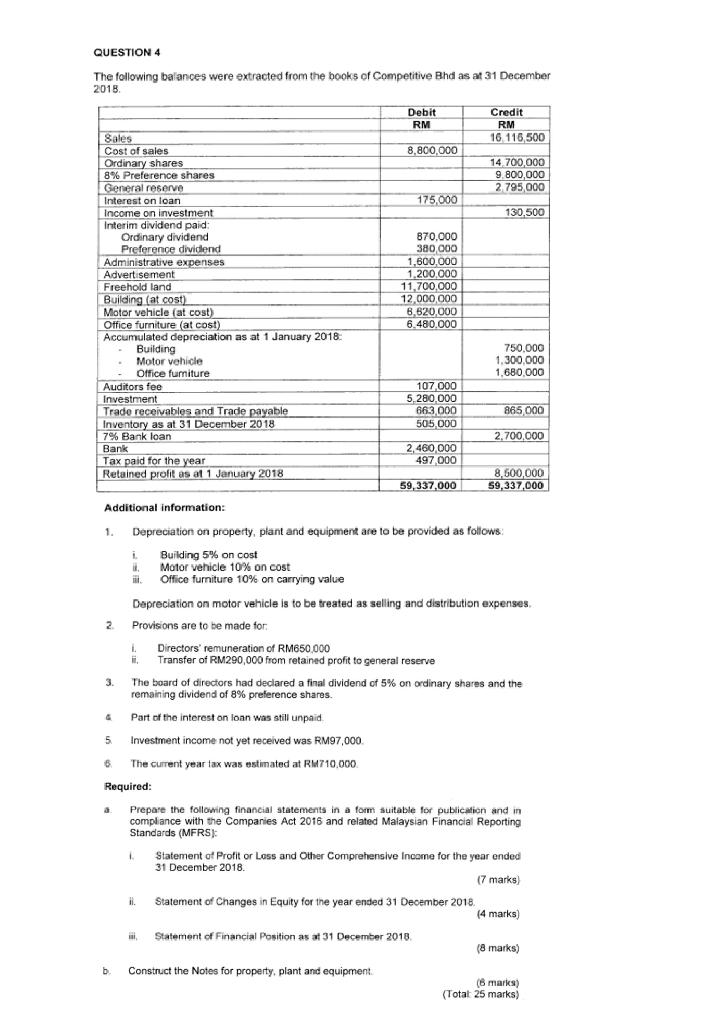

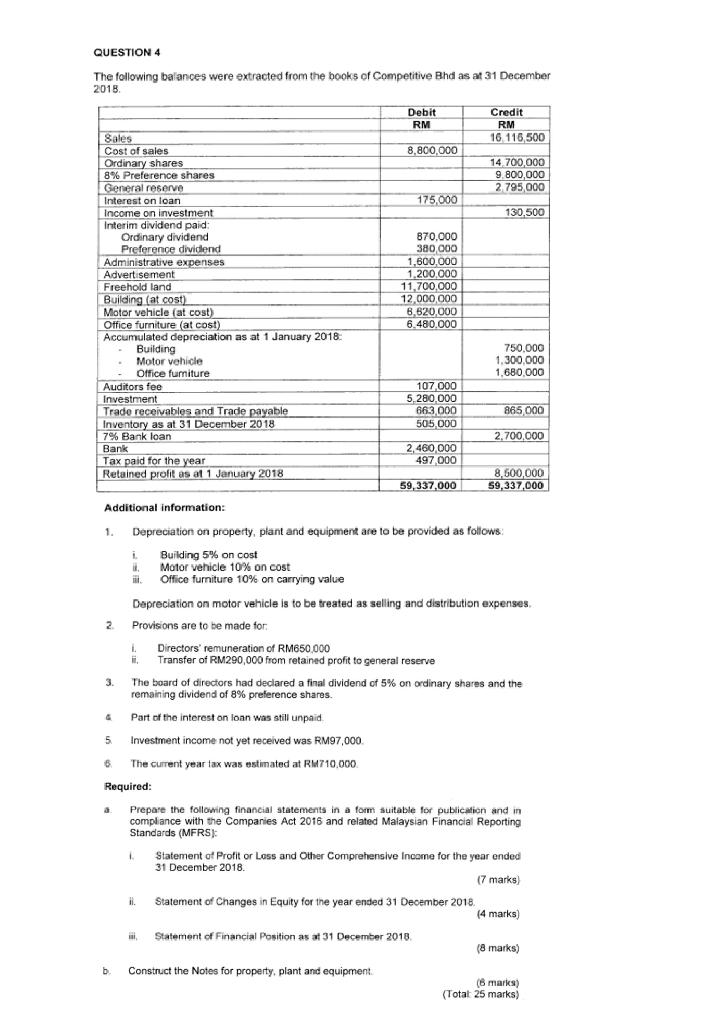

QUESTION 4 The following balances were extracted from the books of Competitive Bhd as at 31 December 2018 Debit Credit RM RM Sales 16 116,500 Cost of sales 8,800,000 Ordinary shares 14,700,000 8% Preference shares 9.800,000 General reserve 2 795,000 Interest on loan 175,000 Income on investment 130,500 Interim dividend paid Ordinary dividend 870.000 Preference dividend 380,000 Administrative expenses 1,600,000 Advertisement 1.200.000 Freehold land 11,700,000 Building (at cost) 12.000.000 Motor vehicle (at cost) 6,820,000 Office furniture (at cost) 6.480.000 Accumulated depreciation as at 1 January 2018 Building 750.000 Motor vehicle 1.300.000 Office furniture 1,680,000 Auditors fee 107 000 Investment 5,280 000 Trade receivables and Trade payable 663.000 865 000 Inventory as at 31 December 2018 505,000 7% Bank loan 2.700,000 Bank 2,460 000 Tax paid for the year 497 000 Retained profit as af 1 January 2018 8,600,000 59,337,000 59,337,000 Additional information: 1. Depreciation on property, plant and equipment are to be provided as follows: i Building 5% on cost ik Motor vehicle 10% on cost Office furniture 10% on carrying value Depreciation on motor vehicle is to be treated as selling and distribution expenses 2 Provisions are to be made for Directors' remuneration of RM650.000 Transfer of RM290,000 from retained profit to general reserve 3. The board of directors had declared a final dividend of 5% on ordinary shares and the remaining dividend of 8% preference shares. Part of the interest on loan was still unpaid . 5 Investment income not yet received was RM97,000 6 The current year tax was estimated at RM710.000 G Required: . Prepare the following financial statements in a form suitable for publication and in compliance with the Companies Act 2016 and related Malaysian Financial Reporting Standards (MFRSE Statement of Profit or Lass and Other Comprehensive Income for the year ended 31 December 2018, (7 marks) ii. Statement of Changes in Equity for the year ended 31 December 2018, (4 marks) Statement of Financial Position as at 31 December 2018 (8 marks) b Construct the Notes for property, plant and equipment (6 marks) (Total 25 marks)