Can you figure out what the total capital gain or loss is? These parts are six reciepts from the same tax return customer. They also used specific identification when selling stock. Thank you!!

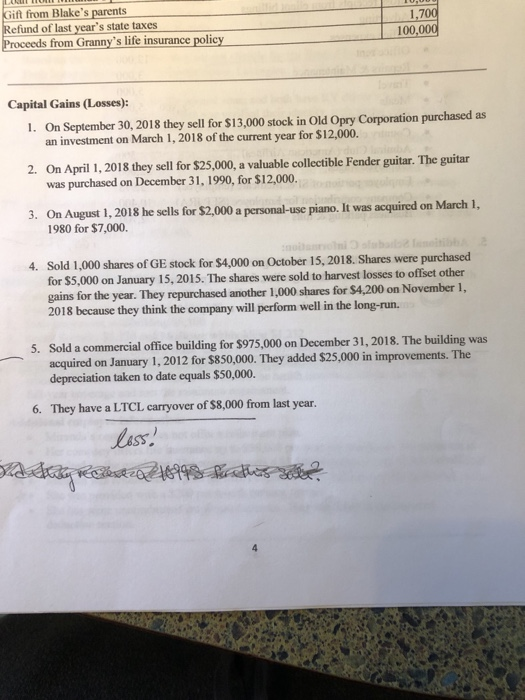

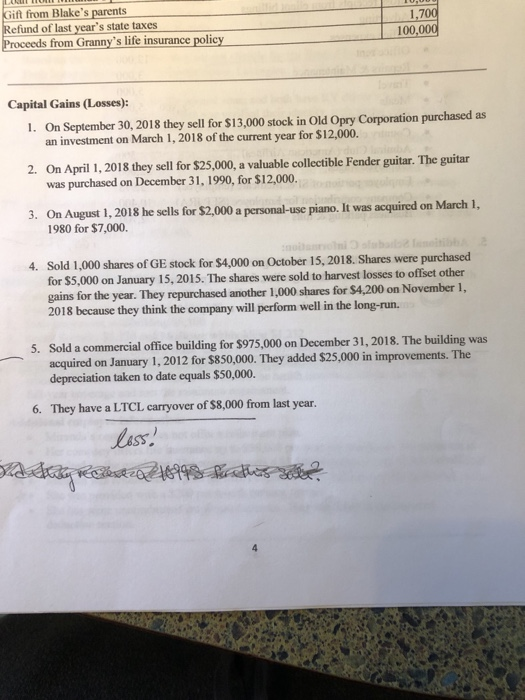

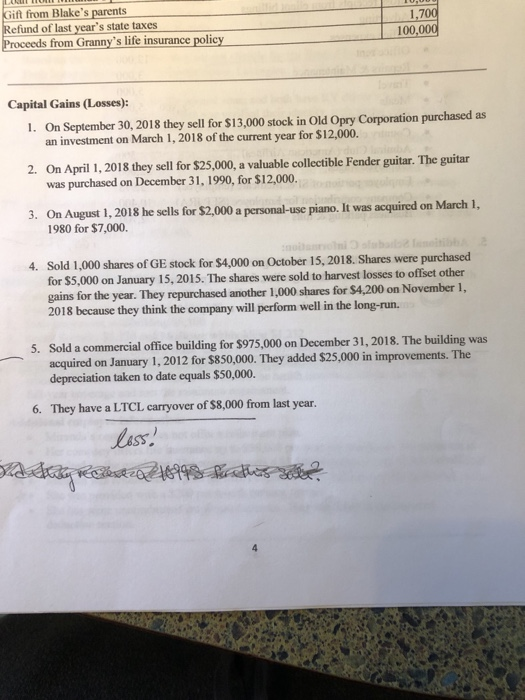

ift from Blake's parents Refund of last year's state taxes Proceeds from Granny's life insurance policy 100,000 Capital Gains (Losses): On September 30, 2018 they sell for $13,000 stock in Old Opry Corporation purchased as an investment on March 1, 2018 of the current year for $12,000. 1. 2. On April 1, 2018 they sell for $25,000, a valuable collectible Fender guitar. The guitar was purchased on December 31, 1990, for $12,000. 3. On August 1, 2018 he sells for $2,000 a personal-use piano. It was acquired on March 1, 1980 for $7,000. Sold 1,000 shares of GE stock for $4,000 on October 15, 2018. Shares were purchased for $5,000 on January 15, 2015. The shares were sold to harvest losses to offset other gains for the year. They repurchased another 1,000 shares for $4,200 on November 1, 2018 because they think the company will perform well in the long-run. 4. Sold a commercial office building for $975,000 on December 31, 2018. The building was acquired on January 1, 2012 for $850,000. They added $25,000 in improvements. The depreciation taken to date equals $50,000. S. They have a LTCL carryover of $8,000 from last year. 6. lass ift from Blake's parents Refund of last year's state taxes Proceeds from Granny's life insurance policy 100,000 Capital Gains (Losses): On September 30, 2018 they sell for $13,000 stock in Old Opry Corporation purchased as an investment on March 1, 2018 of the current year for $12,000. 1. 2. On April 1, 2018 they sell for $25,000, a valuable collectible Fender guitar. The guitar was purchased on December 31, 1990, for $12,000. 3. On August 1, 2018 he sells for $2,000 a personal-use piano. It was acquired on March 1, 1980 for $7,000. Sold 1,000 shares of GE stock for $4,000 on October 15, 2018. Shares were purchased for $5,000 on January 15, 2015. The shares were sold to harvest losses to offset other gains for the year. They repurchased another 1,000 shares for $4,200 on November 1, 2018 because they think the company will perform well in the long-run. 4. Sold a commercial office building for $975,000 on December 31, 2018. The building was acquired on January 1, 2012 for $850,000. They added $25,000 in improvements. The depreciation taken to date equals $50,000. S. They have a LTCL carryover of $8,000 from last year. 6. lass