Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you guys provide me the solutions for these two points? D. Juuge wiICUCI TIVI 15 Iydlucu, Idilly Vaucu, UI UVEI Valutu. 12. Sime Natural

Can you guys provide me the solutions for these two points?

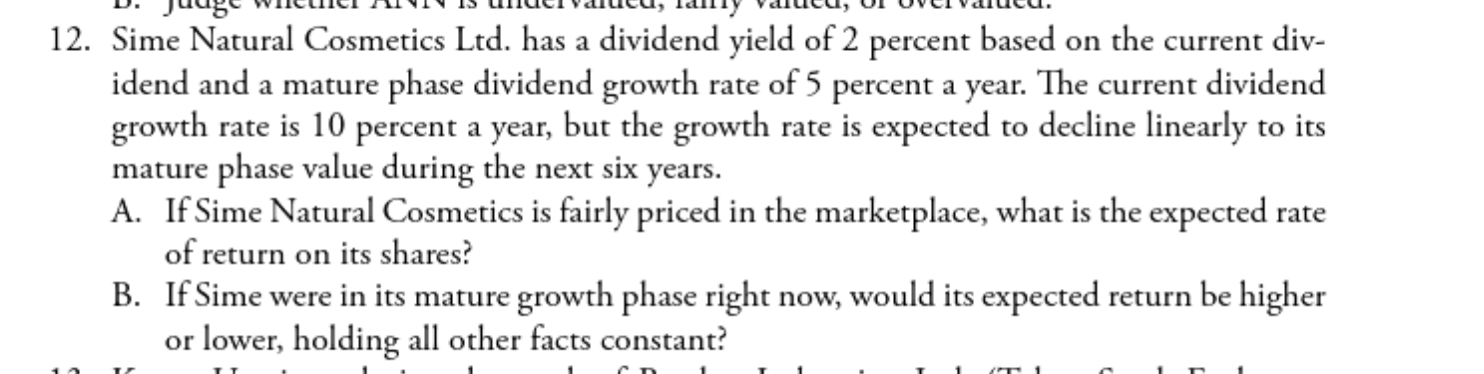

D. Juuge wiICUCI TIVI 15 Iydlucu, Idilly Vaucu, UI UVEI Valutu. 12. Sime Natural Cosmetics Ltd. has a dividend yield of 2 percent based on the current div- idend and a mature phase dividend growth rate of 5 percent a year. The current dividend growth rate is 10 percent a year, but the growth rate is expected to decline linearly to its mature phase value during the next six years. A. If Sime Natural Cosmetics is fairly priced in the marketplace, what is the expected rate of return on its shares? B. If Sime were in its mature growth phase right now, would its expected return be higher or lower, holding all other facts constantStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started