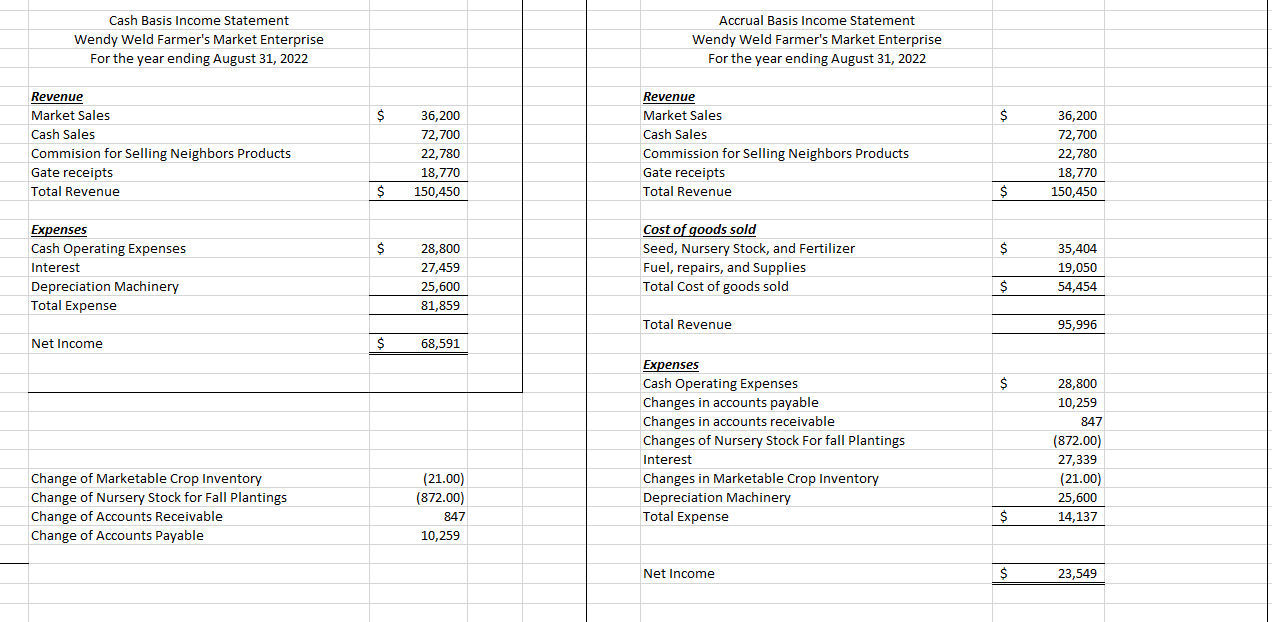

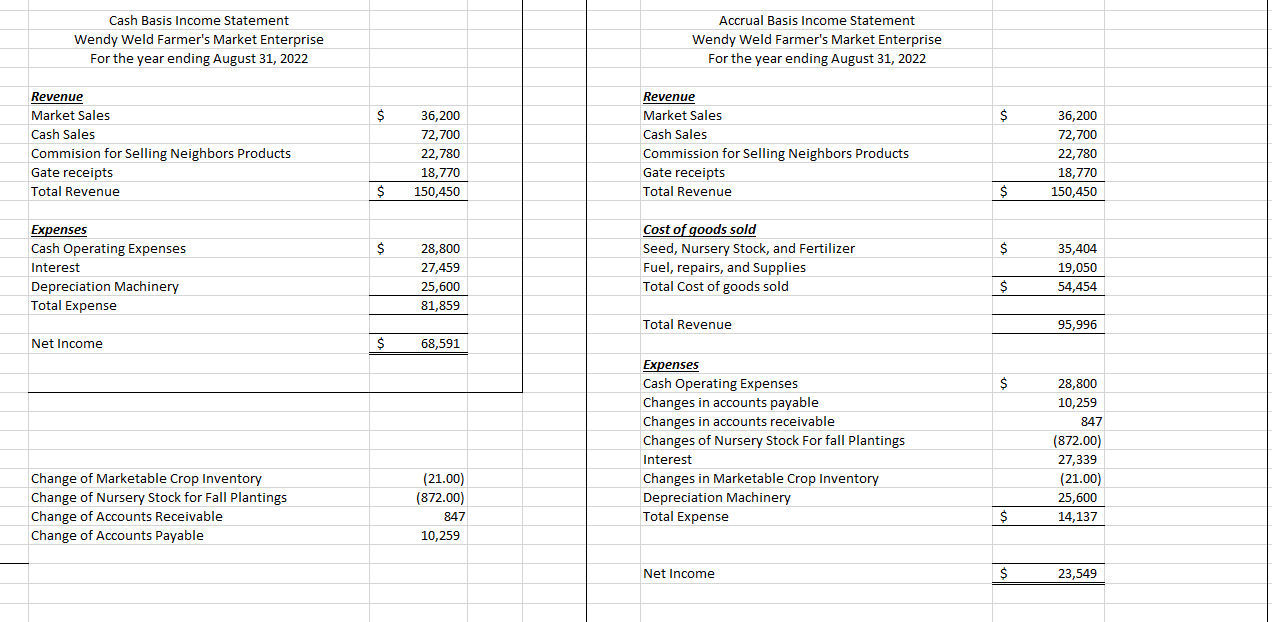

Can you help create and correct the income statement (cash and accrual basis) on the following problem?  This is what I have as of right now

This is what I have as of right now

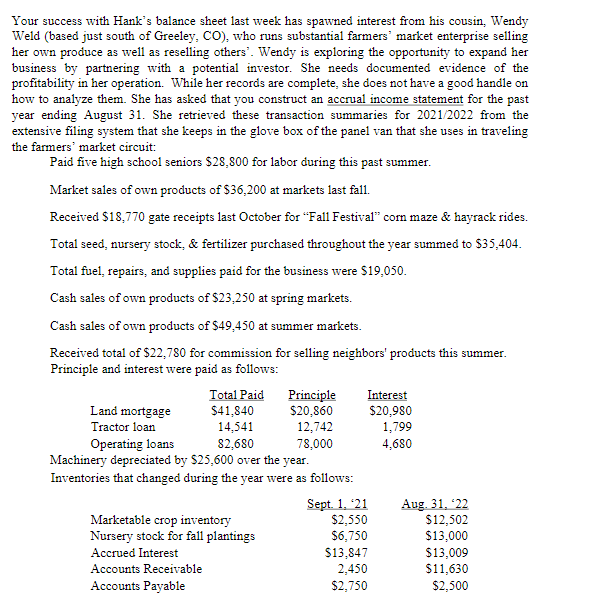

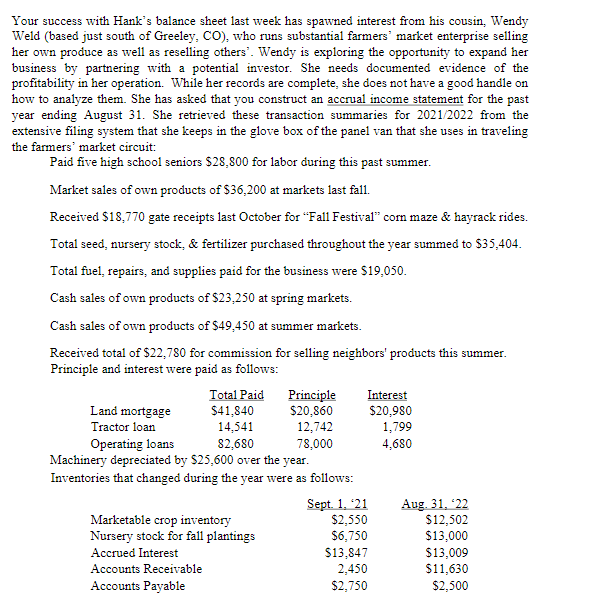

Your success with Hank's balance sheet last week has spawned interest from his cousin, Wendy Weld (based just south of Greeley, CO), who runs substantial farmers' market enterprise selling her own produce as well as reselling others'. Wendy is exploring the opportunity to expand her business by partnering with a potential investor. She needs documented evidence of the profitability in her operation. While her records are complete, she does not have a good handle on how to analyze them. She has asked that you construct an accrual income statement for the past year ending August 31. She retrieved these transaction summaries for 2021/2022 from the extensive filing system that she keeps in the glove box of the panel van that she uses in traveling the farmers' market circuit: Paid five high school seniors $28,800 for labor during this past summer. Market sales of own products of $36,200 at markets last fall. Received $18,770 gate receipts last October for "Fall Festival" corn maze \& hayrack rides. Total seed, nursery stock, \& fertilizer purchased throughout the year summed to $35,404. Total fuel, repairs, and supplies paid for the business were $19,050. Cash sales of own products of $23,250 at spring markets. Cash sales of own products of $49,450 at summer markets. Received total of $22,780 for commission for selling neighbors' products this summer. Principle and interest were paid as follows: Machinery depreciated by $25,600 over the year. Inventories that changed during the year were as follows: Your success with Hank's balance sheet last week has spawned interest from his cousin, Wendy Weld (based just south of Greeley, CO), who runs substantial farmers' market enterprise selling her own produce as well as reselling others'. Wendy is exploring the opportunity to expand her business by partnering with a potential investor. She needs documented evidence of the profitability in her operation. While her records are complete, she does not have a good handle on how to analyze them. She has asked that you construct an accrual income statement for the past year ending August 31. She retrieved these transaction summaries for 2021/2022 from the extensive filing system that she keeps in the glove box of the panel van that she uses in traveling the farmers' market circuit: Paid five high school seniors $28,800 for labor during this past summer. Market sales of own products of $36,200 at markets last fall. Received $18,770 gate receipts last October for "Fall Festival" corn maze \& hayrack rides. Total seed, nursery stock, \& fertilizer purchased throughout the year summed to $35,404. Total fuel, repairs, and supplies paid for the business were $19,050. Cash sales of own products of $23,250 at spring markets. Cash sales of own products of $49,450 at summer markets. Received total of $22,780 for commission for selling neighbors' products this summer. Principle and interest were paid as follows: Machinery depreciated by $25,600 over the year. Inventories that changed during the year were as follows

This is what I have as of right now

This is what I have as of right now