Answered step by step

Verified Expert Solution

Question

1 Approved Answer

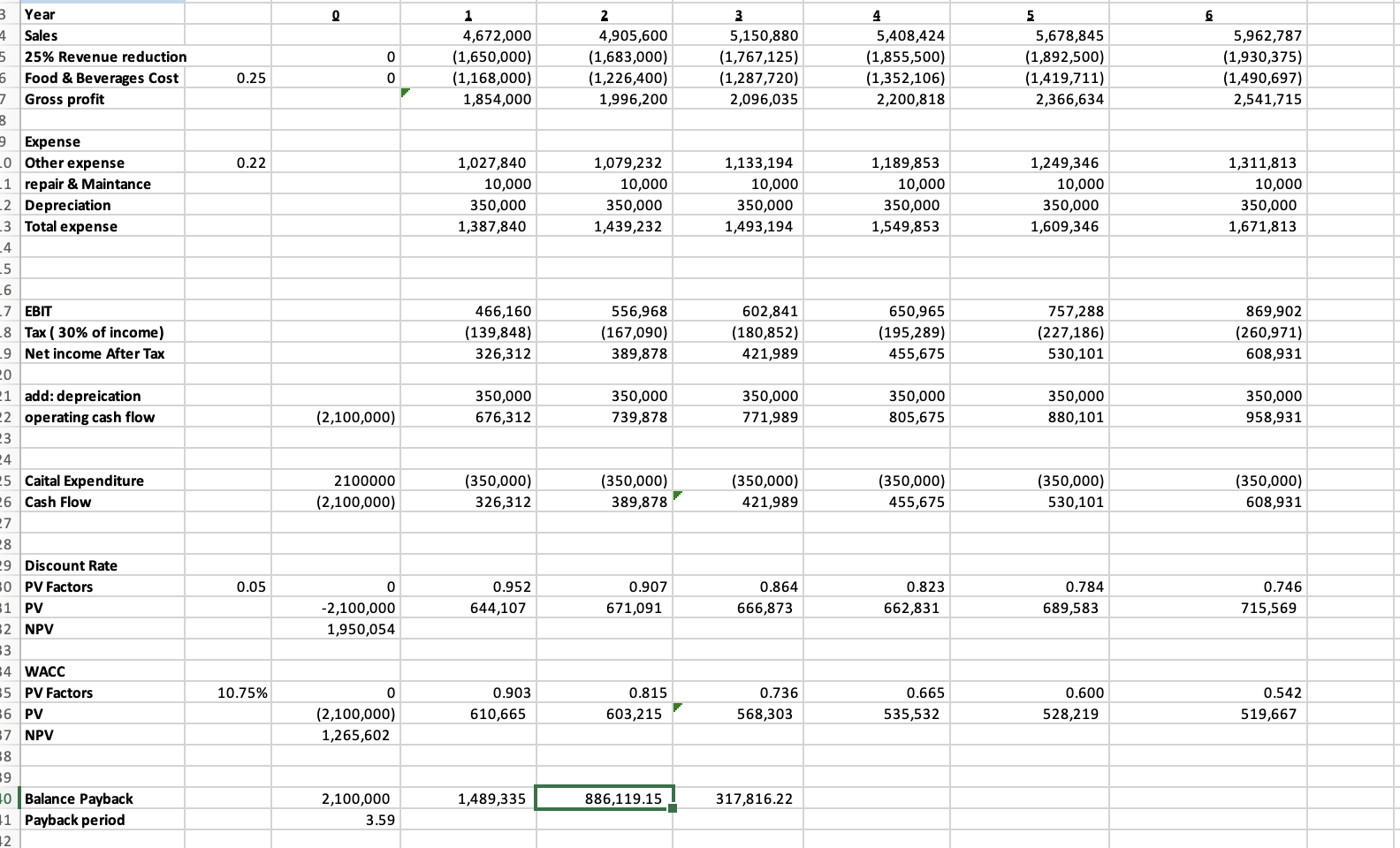

can you help figure out if this pro forma or cash flow statement thank you! .1 .2 .3 .4 .5 .6 .8 .9 '5 '6

can you help figure out if this pro forma or cash flow statement thank you!

.1 .2 .3 .4 .5 .6 .8 .9 '5 '6 11 12 Year Sales 25% Revenue reduction Food & Beverages Cost Gross profit Expense Other expense repair & Maintance Depreciation Total expense EBIT Tax ( 30% of income) Net income After Tax add: depreication operating cash flow Caital Expenditure Cash Flow Discount Rate PV Factors NPV WACC PV Factors NPV Balance Payback Payback period 0.25 0.22 0.05 10.75% (2,100,000) 2100000 (2,100,000) -2,100,000 1,950,054 (2,100,000) 1,265,602 2,100,000 3.59 1 4,672,000 (1,650,000) 1,854,000 1,027,840 10,000 350,000 1,387,840 466,160 (139,848) 326,312 350,000 676,312 (350,000) 326,312 0.952 644,107 0.903 610,665 1,489,335 2 4,905,600 (1,683,000) (1,226,400) 1,996,200 1,079,232 10,000 350,000 1,439,232 556,968 (167,090) 389,878 350,000 739,878 (350,000) 389,878 0.907 671,091 0.815 603,215 886,119.15 3 5,150,880 (1,767,125) (1,287,720) 2,096,035 1,133,194 10,000 350,000 1,493,194 602,841 (180,852) 421,989 350,000 771,989 (350,000) 421,989 0.864 66673 0.736 568,303 317,816.22 4 5,408,424 (155,500) (1,352,106) 2,200,818 1,189,853 10,000 350,000 1,549,853 650,965 (195,289) 455,675 350,000 805,675 (350,000) 455,675 0.823 662,831 0.665 535,532 5 5,67845 (1,892,500) (1,419,711) 2,366,634 1,249,346 10,000 350,000 1,609,346 757,288 (227,186) 530,101 350,000 880,101 (350,000) 530,101 0.784 689,583 0.600 528,219 5,962,787 (1,930,375) (1,490,697) 2,541,715 1,311,813 10,000 350,000 1,671,813 869,902 (260,971) 608,931 350,000 958,931 (350,000) 608,931 0.746 715,569 0.542 519,667

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started