Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help me answer these? 5 points Question 17. (Homework Chapter 3) A $1000 zero-coupon pond with five years to maturity if the yield

can you help me answer these?

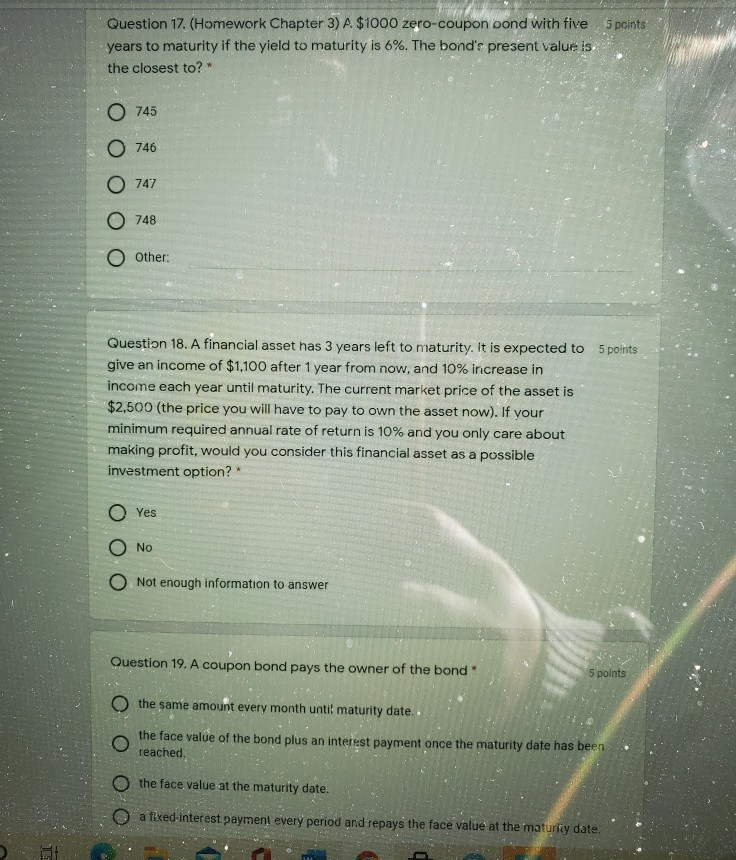

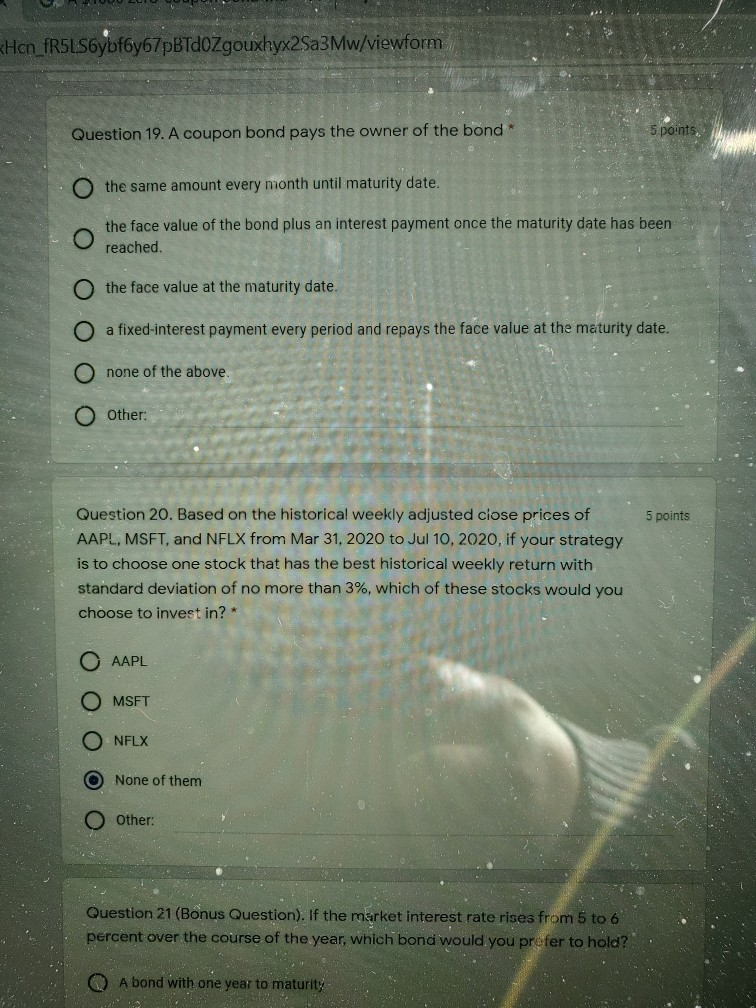

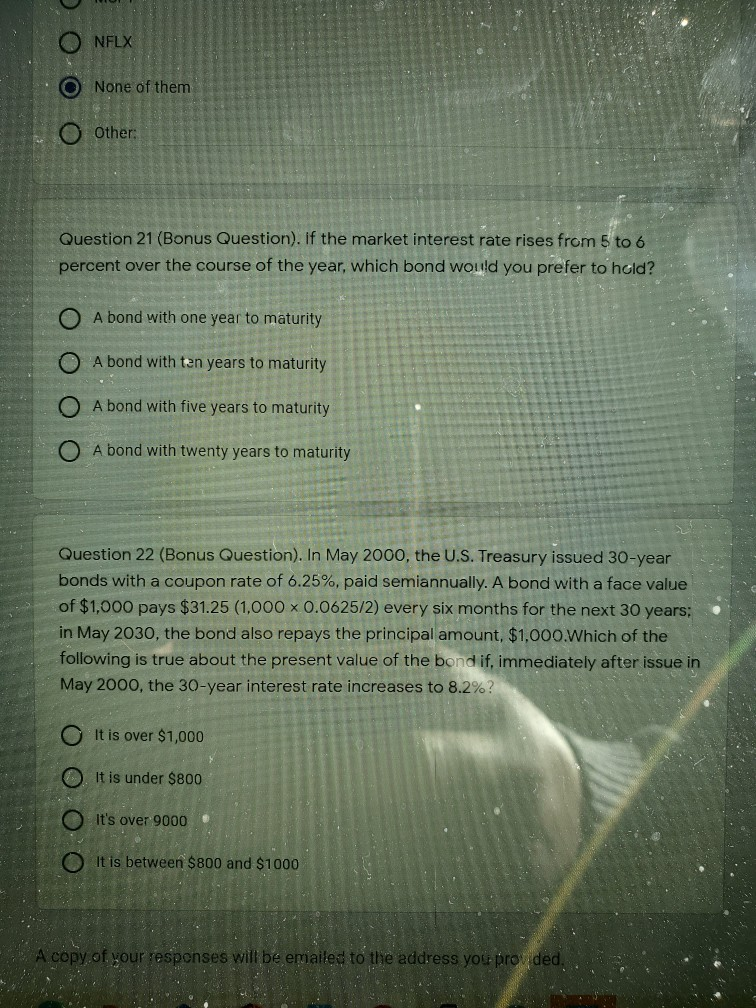

5 points Question 17. (Homework Chapter 3) A $1000 zero-coupon pond with five years to maturity if the yield to maturity is 6%. The bond's present value is the closest to? 745 746 747 748 O Other: Question 18. A financial asset has 3 years left to maturity. It is expected to 5 points give an income of $1,100 after 1 year from now, and 10% increase in income each year until maturity. The current market price of the asset is $2,500 (the price you will have to pay to own the asset now). If your minimum required annual rate of return is 10% and you only care about making profit, would you consider this financial asset as a possible investment option? Yes No O Not enough information to answer Question 19. A coupon bond pays the owner of the bond 5 points the same amount every month until maturity date.. the face value of the bond plus an interest payment once the maturity date has been reached O the face value at the maturity date. a fixed-interest payment every period and repays the face value at the maturliy date. KHcn_fR5LS6ybf6y67pBTdOZgouxhyx2Sa3Mw/viewform Question 19. A coupon bond pays the owner of the bond 5 points O the same amount every month until maturity date. the face value of the bond plus an interest payment once the maturity date has been reached. the face value at the maturity date. O a fixed-interest payment every period and repays the face value at the maturity date. none of the above. Other: 5 points Question 20. Based on the historical weekly adjusted close prices of AAPL, MSFT, and NFLX from Mar 31, 2020 to Jul 10, 2020, if your strategy is to choose one stock that has the best historical weekly return with standard deviation of no more than 3%, which of these stocks would you choose to invest in? * AAPL MSFT O NFLX O None of them Other: Question 21 (Bonus Question). If the market interest rate rises from 5 to 6 percent over the course of the year, which bond would you prefer to hold? A bond with one year to maturity O NFLX O O O C None of them Other: Question 21 (Bonus Question). if the market interest rate rises from 5 to 6 percent over the course of the year, which bond would you prefer to hold? A bond with one year to maturity O A bond with ten years to maturity O O O A bond with five years to maturity A bond with twenty years to maturity Question 22 (Bonus Question). In May 2000, the U.S. Treasury issued 30-year bonds with a coupon rate of 6.25%, paid semiannually. A bond with a face value of $1,000 pays $31.25 (1,000 x 0.0625/2) every six months for the next 30 years: in May 2030, the bond also repays the principal amount. $1,000.Which of the following is true about the present value of the bond if, immediately after issue in May 2000, the 30-year interest rate increases to 8.2%? It is over $1,000 O. It is under $800 O It's over 9000 O It is between $800 and $1000 A copy of your responses will be emailed to the address you providedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started