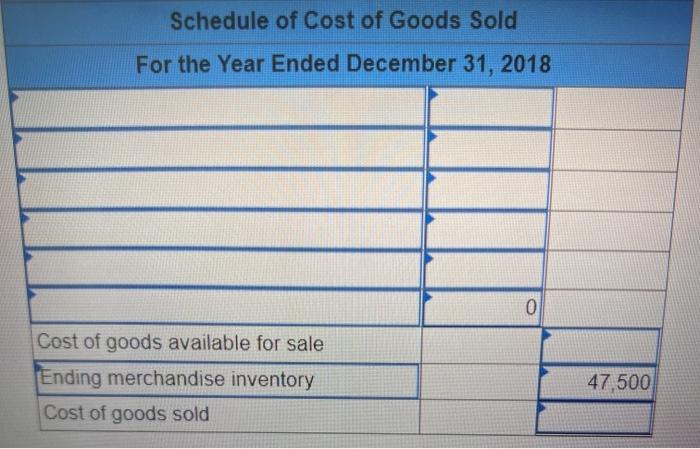

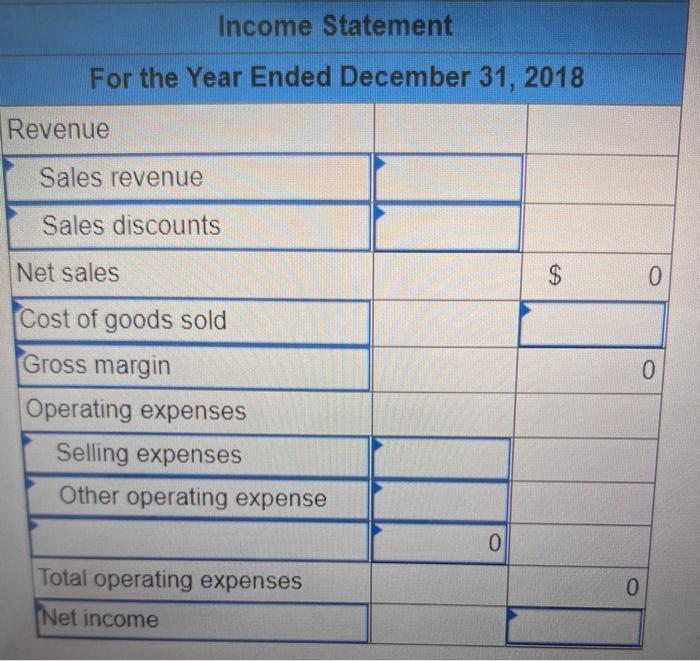

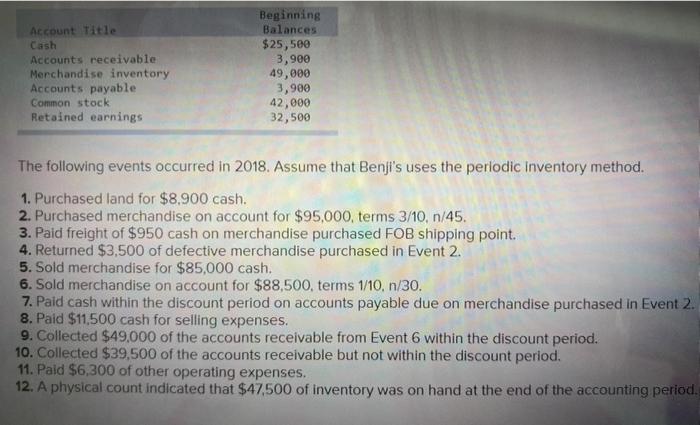

can you help me determine what the caluclations would be for event 7, 9, and 12 on a horizontal model? and how you you would do a cost of goods sold statement and income statement? thanks

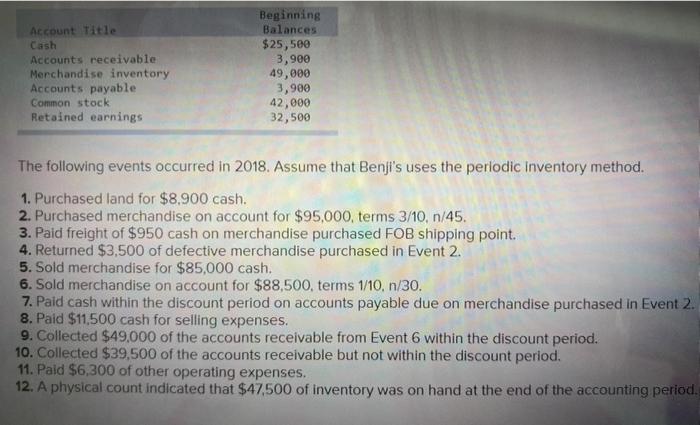

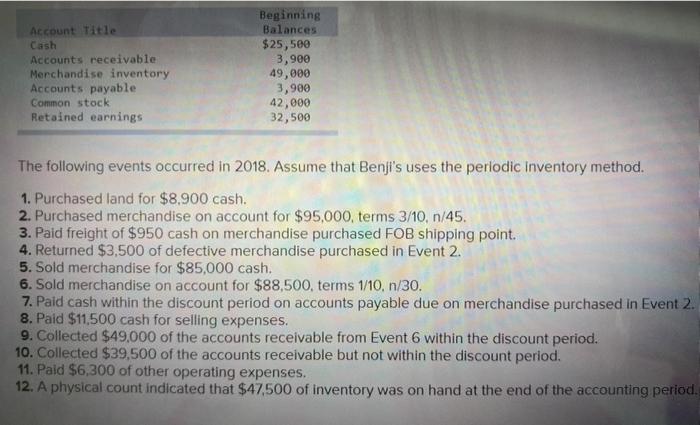

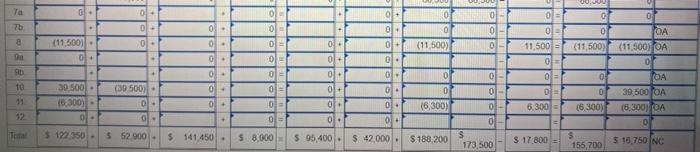

Account Title Cash Accounts receivable Merchandise inventory Accounts payable Common stock Retained earnings Beginning Balances $25,500 3,900 49,000 3,900 42,000 32,500 The following events occurred in 2018. Assume that Benji's uses the periodic Inventory method. 1. Purchased land for $8.900 cash. 2. Purchased merchandise on account for $95,000, terms 3/10,n/45. 3. Paid freight of $950 cash on merchandise purchased FOB shipping point 4. Returned $3,500 of defective merchandise purchased in Event 2. 5. Sold merchandise for $85,000 cash. 6. Sold merchandise on account for $88,500, terms 1/10, n/30. 7. Paid cash within the discount period on accounts payable due on merchandise purchased in Event 2. 8. Paid $11,500 cash for selling expenses. 9. Collected $49,000 of the accounts receivable from Event 6 within the discount period. 10. Collected $39.500 of the accounts receivable but not within the discount period. 11. Paid $6,300 of other operating expenses. 12. A physical count indicated that $47,500 of inventory was on hand at the end of the accounting period. 00,00 Ta 0 0. 0 +10 0 0 10 Tb 0 0 . 0 10 0 0 01 0 @ 01 - +10 (11 500 04 (11 500) 0 (11,500) 0. 0 - 0 10 11,500 0 ol 75 01 (11,500) OA 0 ( 39,500 OA (5,300) OA +10 10 10 10 =0 0 DI O - +10 RO =10 -10 10 39 500 - 15300) 0 (30.500) ol- 0 0 - 0- 0 10 +10 0 6,300 (6,300) (6.300) 12 0 O. . O 0. 0 0 S 173,500 0 122.350 - $ 52.900 $ 141.450 5 8.000 $ 95,400 $ 42,000 $ 188 200 $ 17.800 $ 155,700 $18.750 NC Schedule of Cost of Goods Sold For the Year Ended December 31, 2018 0 Cost of goods available for sale Ending merchandise inventory Cost of goods sold 47,500 Income Statement For the Year Ended December 31, 2018 Revenue Sales revenue Sales discounts Net sales $ 0 0 Cost of goods sold Gross margin Operating expenses Selling expenses Other operating expense 0 Total operating expenses Net income 0 Account Title Cash Accounts receivable Merchandise inventory Accounts payable Common stock Retained earnings Beginning Balances $25,500 3,900 49,000 3,900 42,000 32,500 The following events occurred in 2018. Assume that Benji's uses the periodic Inventory method. 1. Purchased land for $8.900 cash. 2. Purchased merchandise on account for $95,000, terms 3/10,n/45. 3. Paid freight of $950 cash on merchandise purchased FOB shipping point 4. Returned $3,500 of defective merchandise purchased in Event 2. 5. Sold merchandise for $85,000 cash. 6. Sold merchandise on account for $88,500, terms 1/10, n/30. 7. Paid cash within the discount period on accounts payable due on merchandise purchased in Event 2. 8. Paid $11,500 cash for selling expenses. 9. Collected $49,000 of the accounts receivable from Event 6 within the discount period. 10. Collected $39.500 of the accounts receivable but not within the discount period. 11. Paid $6,300 of other operating expenses. 12. A physical count indicated that $47,500 of inventory was on hand at the end of the accounting period. 00,00 Ta 0 0. 0 +10 0 0 10 Tb 0 0 . 0 10 0 0 01 0 @ 01 - +10 (11 500 04 (11 500) 0 (11,500) 0. 0 - 0 10 11,500 0 ol 75 01 (11,500) OA 0 ( 39,500 OA (5,300) OA +10 10 10 10 =0 0 DI O - +10 RO =10 -10 10 39 500 - 15300) 0 (30.500) ol- 0 0 - 0- 0 10 +10 0 6,300 (6,300) (6.300) 12 0 O. . O 0. 0 0 S 173,500 0 122.350 - $ 52.900 $ 141.450 5 8.000 $ 95,400 $ 42,000 $ 188 200 $ 17.800 $ 155,700 $18.750 NC Schedule of Cost of Goods Sold For the Year Ended December 31, 2018 0 Cost of goods available for sale Ending merchandise inventory Cost of goods sold 47,500 Income Statement For the Year Ended December 31, 2018 Revenue Sales revenue Sales discounts Net sales $ 0 0 Cost of goods sold Gross margin Operating expenses Selling expenses Other operating expense 0 Total operating expenses Net income 0