Can you help me find the corret solution for this problem?

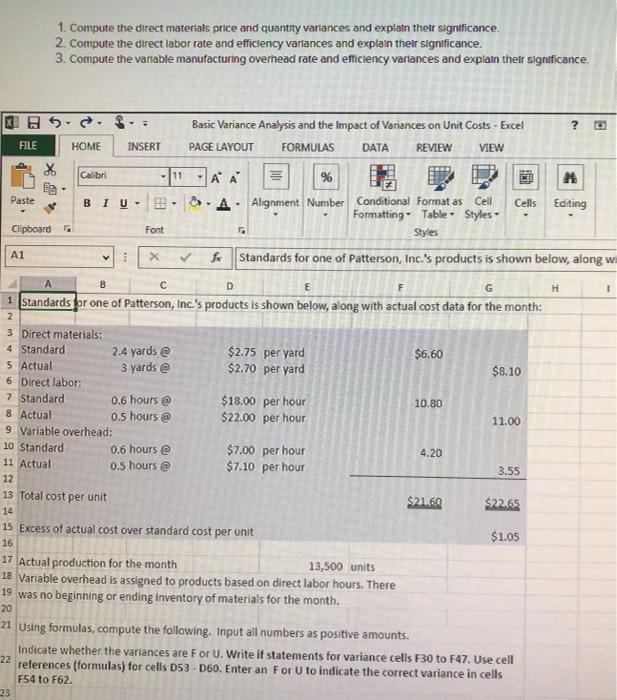

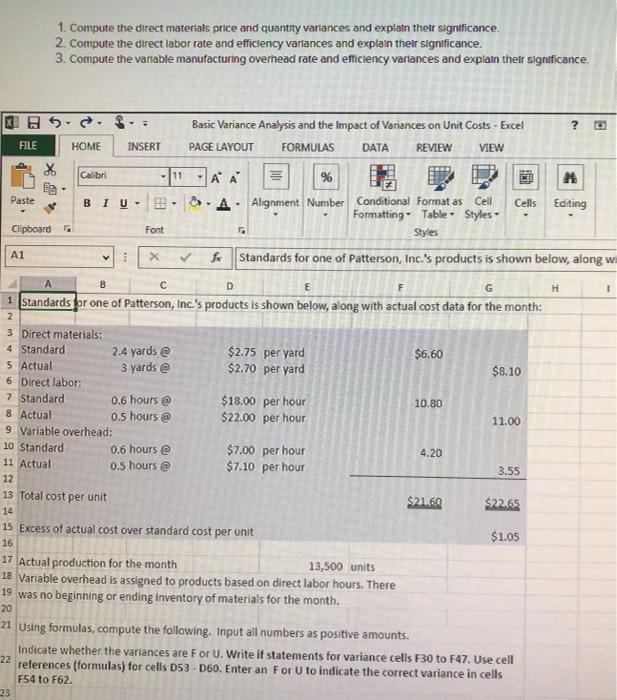

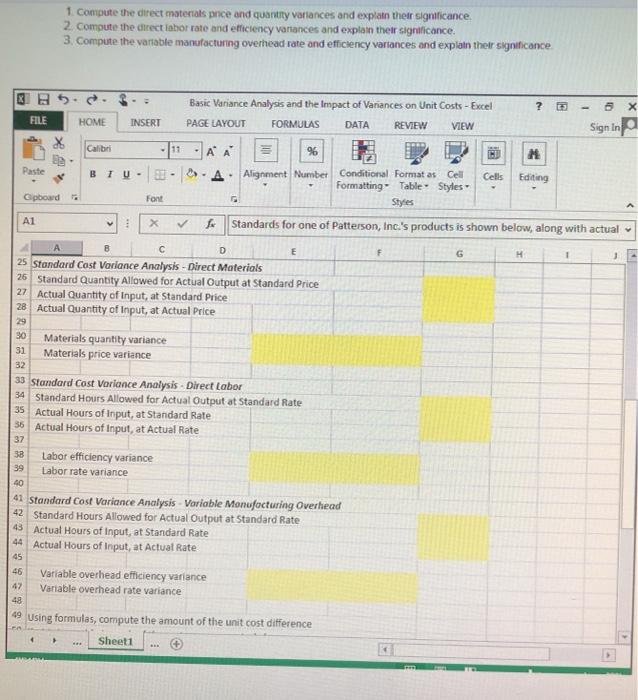

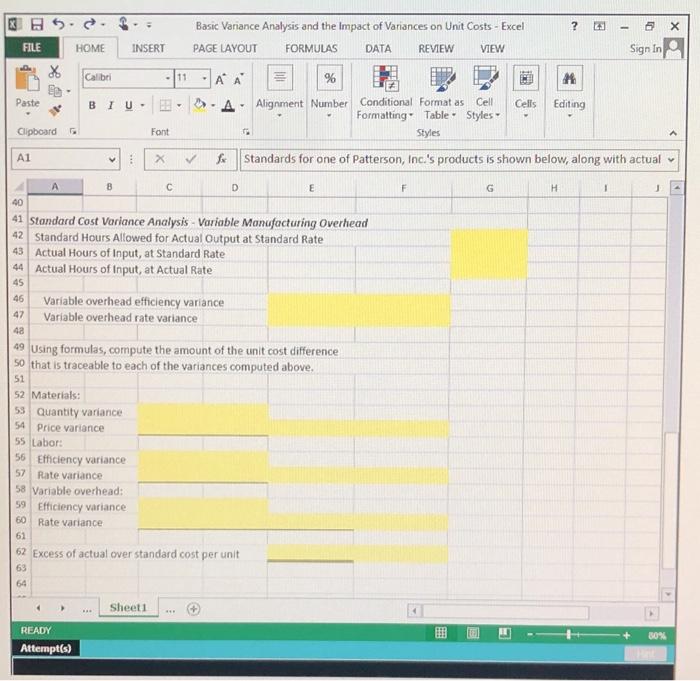

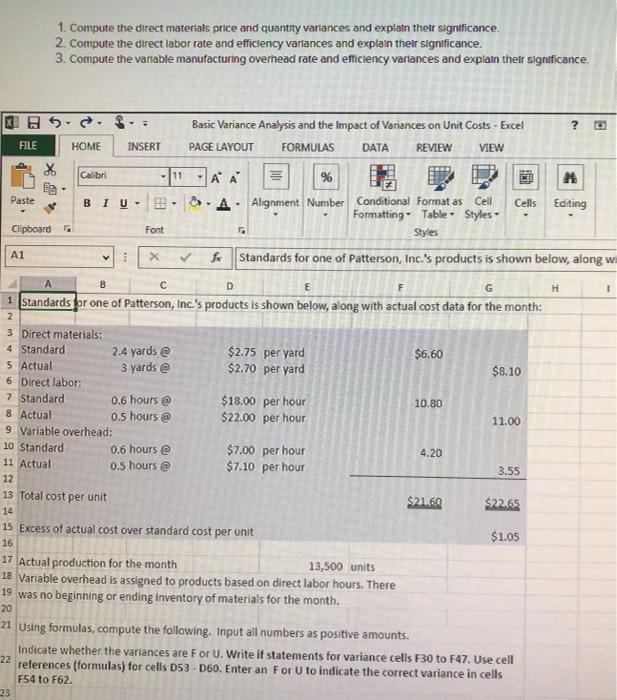

1. Compute the direct materials price and quantity variances and explain their significance. 2. Compute the direct labor rate and efficiency variances and explain their significance. 3. Compute the variable manufacturing overhead rate and efficiency variances and explain their significance. XI B ? + FILE HOME INSERT Calibri 11 Basic Variance Analysis and the impact of Variances on Unit Costs - Excel PAGE LAYOUT FORMULAS DATA REVIEW VIEW A A % Alignment Number Conditional Format as Cell Cells Editing Formatting Table Styles Styles fax Standards for one of Patterson, Inc.'s products is shown below, along w Paste BIU. Clipboard Font A1 B H 1 2 A D E G Standards for one of Patterson, Inc.'s products is shown below, along with actual cost data for the month: 3 Direct materials: 4 Standard 2.4 yards @ $2.75 per yard $6.60 5 Actual 3 yards @ $2.70 per yard $8.10 6 Direct labor: 7 Standard 0.6 hours @ $18.00 per hour 10.80 8 Actual 0.5 hours @ $22.00 per hour 11.00 9 Variable overhead: 10 Standard 0.6 hours @ $7.00 per hour 4.20 11 Actual 0.5 hours $7.10 per hour 3.55 12 13 Total cost per unit $21.60 $22.65 14 15 Excess of actual cost over standard cost per unit $1.05 16 17 Actual production for the month 13,500 units 18 Variable overhead is assigned to products based on direct labor hours. There 19 was no beginning or ending inventory of materials for the month. 20 21 Using formulas, compute the following. Input all numbers as positive amounts. Indicate whether the variances are For U. Write if statements for variance cells F30 to F47. Use cell references (formulas) for cells D53 - D60. Enter an For U to indicate the correct variance in cells F54 to F62. 23 22 1. Compute the direct materials price and quantny vattances and explain their significance 2. Compute the direct labor rate and efficiency variances and explain their significance. 3. Compute the variable manufacturing overhead rate and efficiency vartances and explain their significance 1 DATA Sign in - Font A 3 Basic Variance Analysis and the Impact of Variances on Unit Costs - Excel ? 6 x FILE HOME INSERT PAGE LAYOUT FORMULAS REVIEW VIEW X Calibri %6 M Paste BTU- S- Alignment Number Conditional Format as Cell Cells Editing Formatting Table Styles powd Styles A1 X Standards for one of Patterson, Inc.'s products is shown below, along with actual D E F G 1 25 Standard Cost Variance Analysis - Direct Materials 26 Standard Quantity Allowed for Actual Output at Standard Price 27 Actual Quantity of Input, at Standard Price 28 Actual Quantity of Input, at Actual Price 29 30 Materials quantity variance 31 Materials price variance 32 33 Standard Cost Variance Analysis Direct Labor 34 Standard Hours Allowed for Actual Output at Standard Rate 35 Actual Hours of Input, at Standard Rate 36 Actual Hours of Input, at Actual Rate 37 38 Labor efficiency variance 39 Labor rate variance 40 41 Standard Cost Variance Analysis Variable Manufacturing Overhead 42 Standard Hours Allowed for Actual Output at Standard Rate 43 Actual Hours of Input, at Standard Rate 44 Actual Hours of Input, at Actuat Rate 45 46 Variable overhead efficiency variance Variable overhead rate variance 48 49 Using formulas, compute the amount of the unit cost difference Sheet1 47 X 5 ? 5 FILE HOME INSERT Sign in X 1 Calibri - 11 Basic Variance Analysis and the Impact of Variances on Unit Costs - Excel PAGE LAYOUT FORMULAS DATA REVIEW VIEW AA % A. Alignment Number Conditional Format as Cell Cells Formatting Table - Styles Styles M Paste BIU- Editing Clipboard Font A1 : X Standards for one of Patterson, Inc.'s products is shown below, along with actual A 8 D E F G H 1 47 40 41 Standard Cost Variance Analysis - Variable Manufacturing Overhead 42 Standard Hours Allowed for Actual Output at Standard Rate 43 Actual Hours of Input, at Standard Rate 44 Actual Hours of Input, at Actual Rate 45 46 Variable overhead efficiency variance Variable overhead rate variance 4a 49 Using formulas, compute the amount of the unit cost difference 50 that is traceable to each of the variances computed above. 52 52 Materials: 53 Quantity variance 54 Price variance 55 Labor: 56 Efficiency variance 57 Rate variance 58 Variable overhead: 59 Efficiency variance 60 Rate variance 61 62 Excess of actual over standard cost per unit 63 64 Sheet1 * 80% READY Attempt(s)