Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help me solve? Bark Co . manufactures dog toys. The costs per unit, for 2 0 , 0 0 0 fog toys, are

can you help me solve?

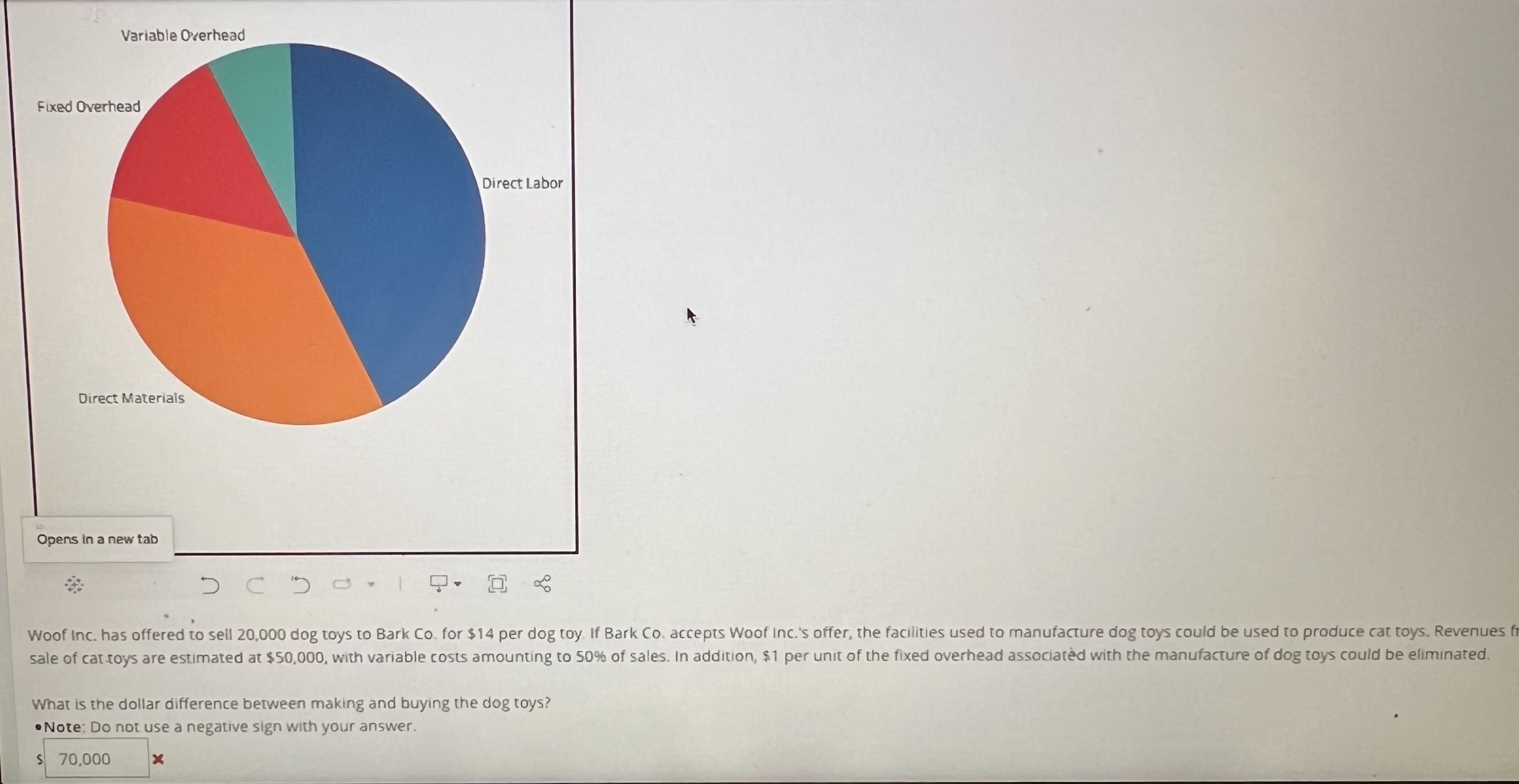

Bark Co manufactures dog toys. The costs per unit, for fog toys, are as follows:

Direct labor: $ units cost

Direct materials: $ units cost

Fixed overhead: $ units cost

Variable cost: $ units cost

Woof Inc. has offered to sell dog toys to Bark Co for $ per dog toy. If Bark Co accepts Woof Inc.s offer, she facilities used to manufacture dog toys could be used to produce cat toys. Revenues fi

sale of cat foys are estimated at $ with variable costs amounting to of sales. In addition, $ per unit of the flxed overhead associated with the manufacture of dog toys could be eliminated.

What is the dollar difference between making and buying the dog toys?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started