Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help me these too?Thank you Shanken Corp. issued a 30-year, 5.9 percent semiannual bond three years ago. The bond currently sells for 106

can you help me these too?Thank you

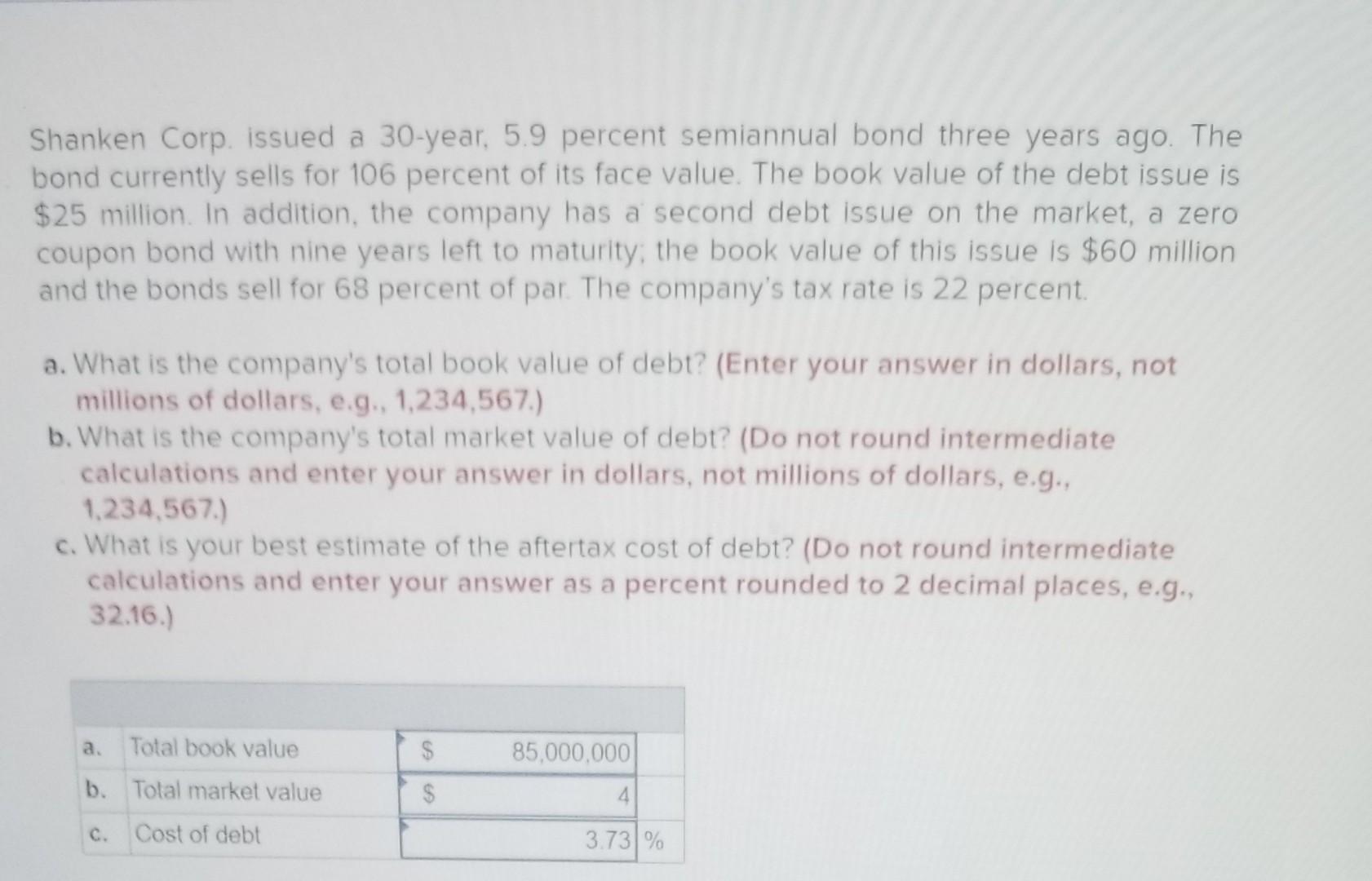

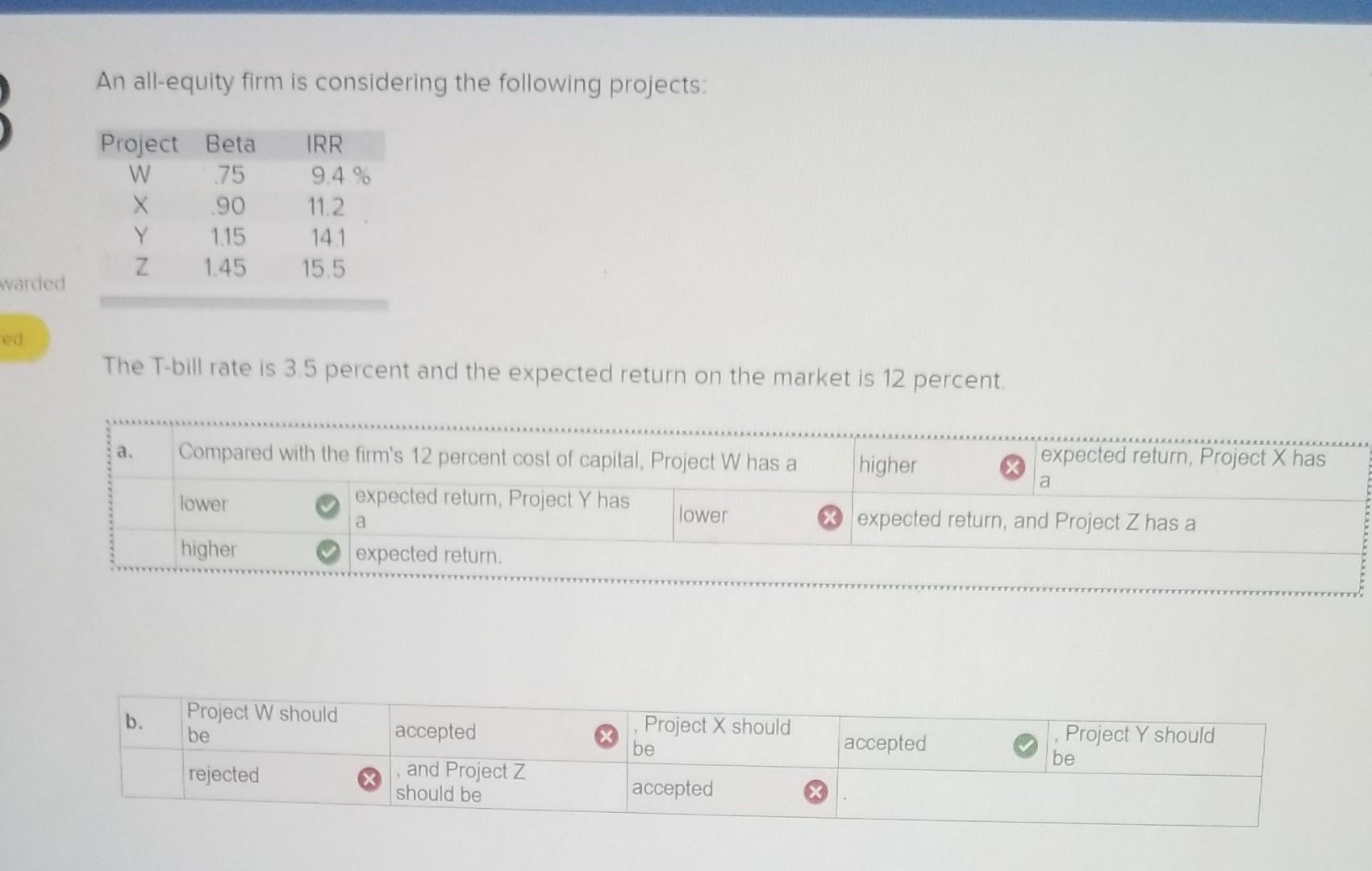

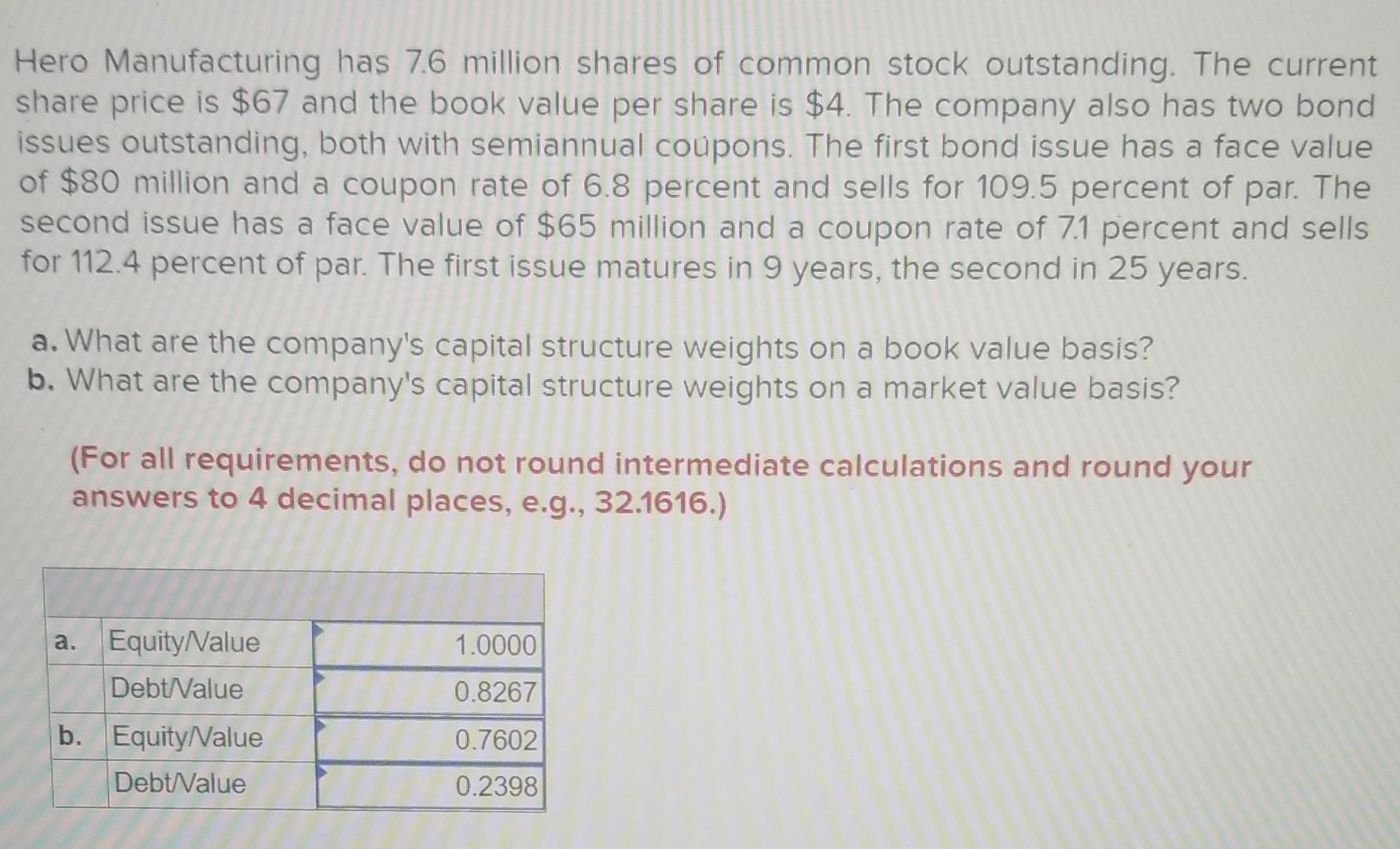

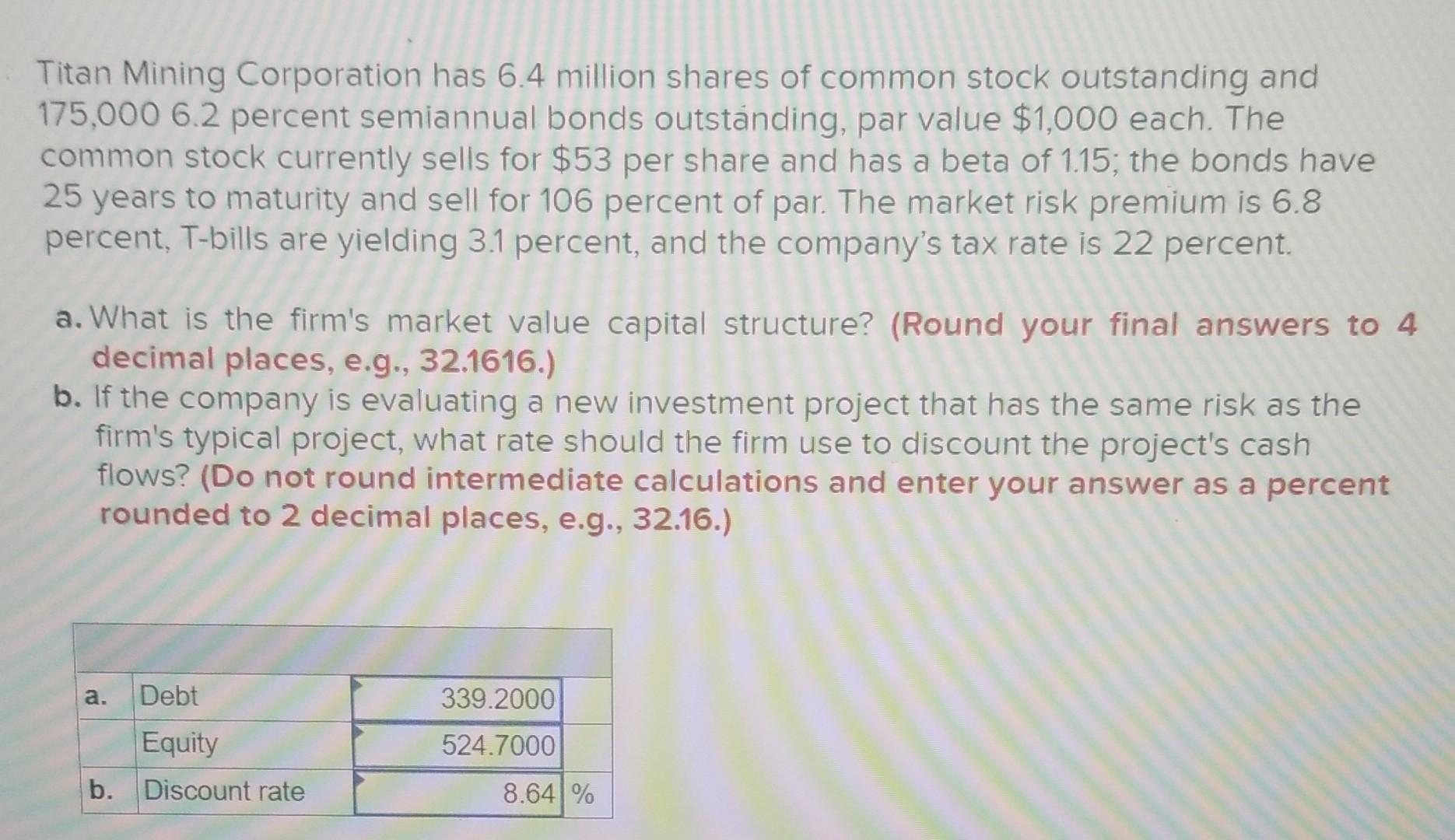

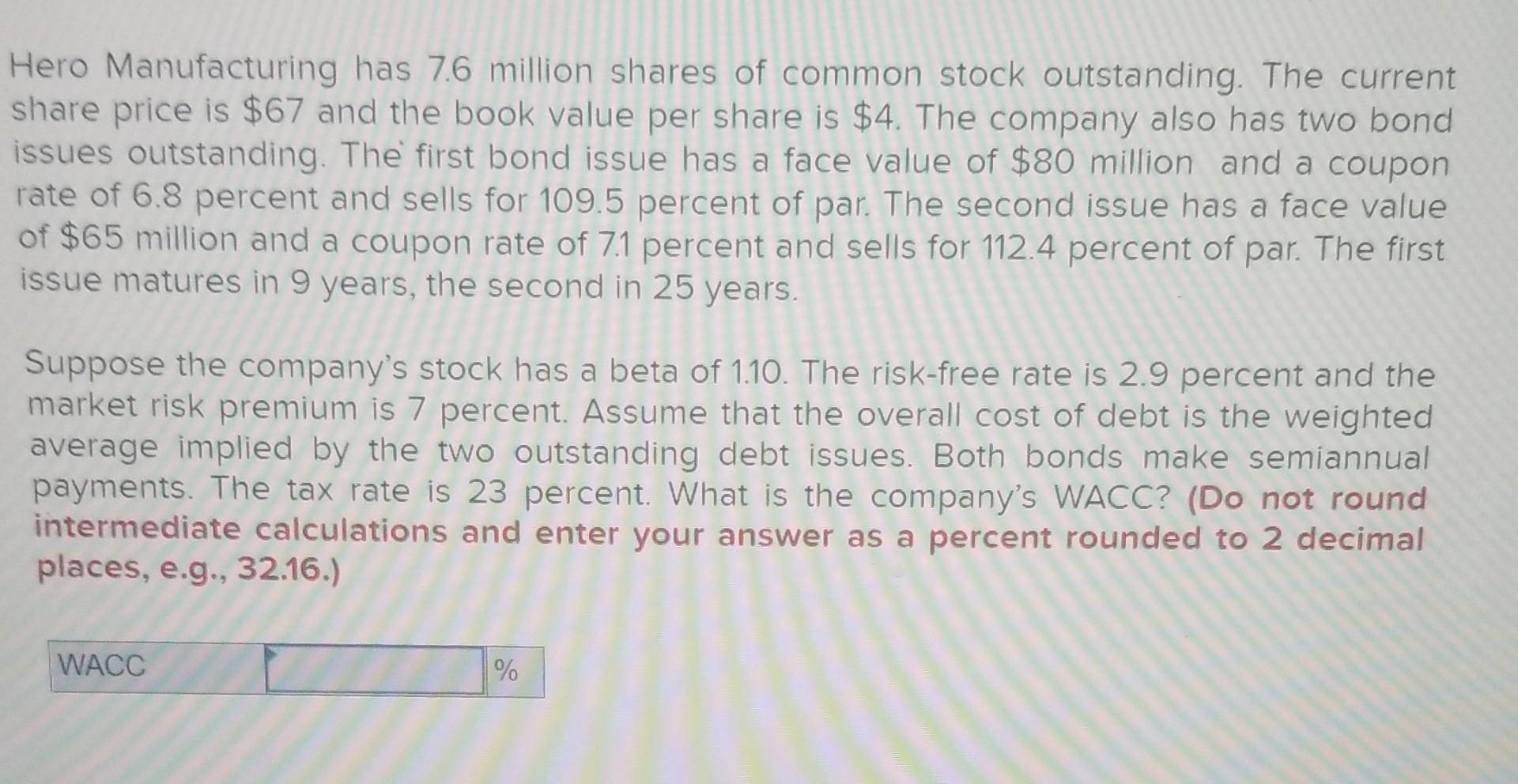

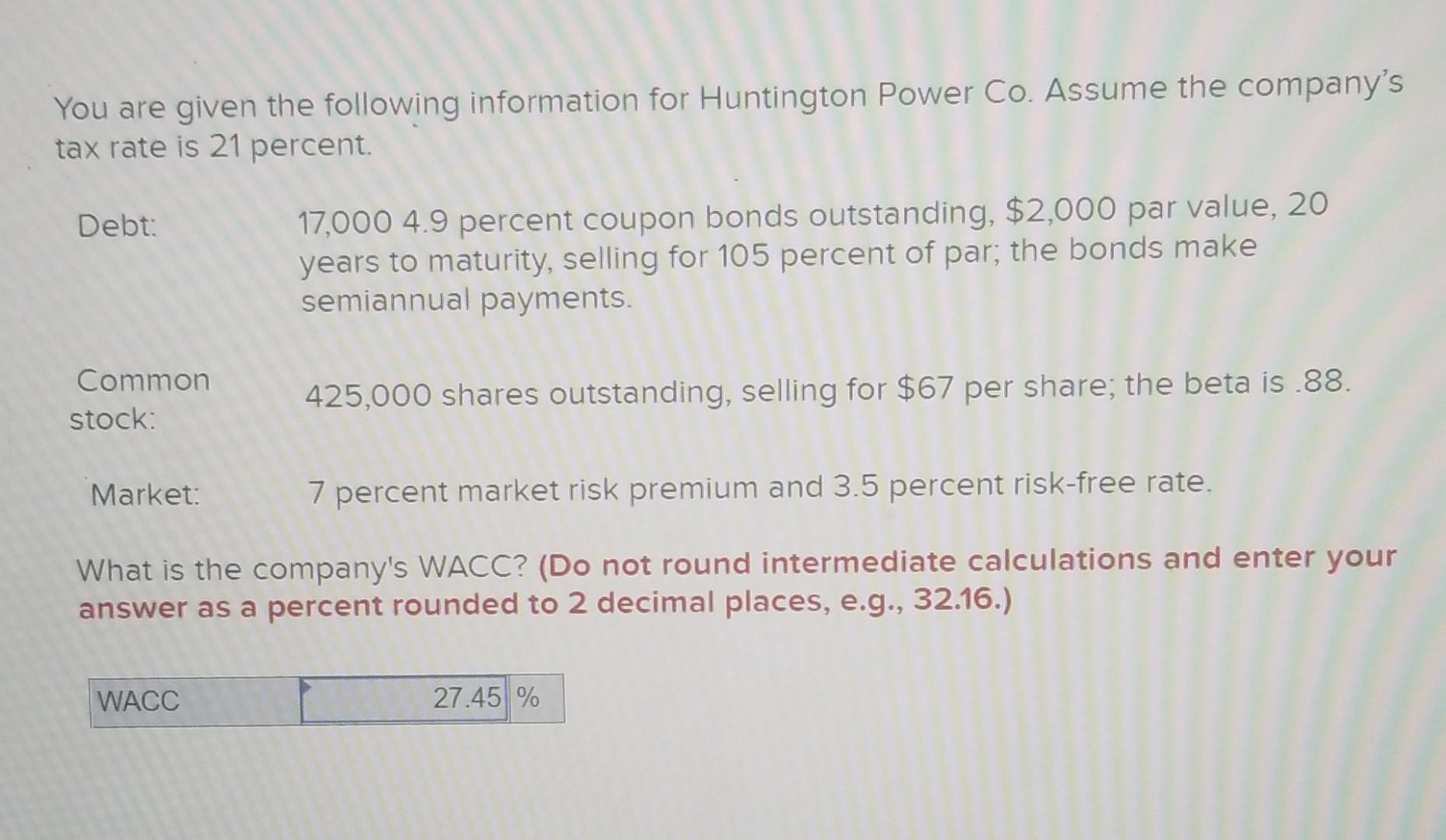

Shanken Corp. issued a 30-year, 5.9 percent semiannual bond three years ago. The bond currently sells for 106 percent of its face value. The book value of the debt issue is $25 million. In addition, the company has a second debt issue on the market, a zero coupon bond with nine years left to maturity, the book value of this issue is $60 million and the bonds sell for 68 percent of par The company's tax rate is 22 percent. a. What is the company's total book value of debt? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) b. What is the company's total market value of debt? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) c. What is your best estimate of the aftertax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Total book value $ 85,000,000 b. Total market value $ Cost of debt 3.73% An all-equity firm is considering the following projects: Project Beta W 75 X 90 Y 1.15 Z 1.45 IRR 9.4% 11.2 14.1 15.5 warded The T-bill rate is 3.5 percent and the expected return on the market is 12 percent. a. higher expected return, Project X has Compared with the firm's 12 percent cost of capital, Project W has a lower expected return, Project Y has lower a a X expected return, and Project Z has a higher expected return b. Project W should be Project X should be accepted accepted and Project Z should be Project Y should be rejected accepted Hero Manufacturing has 7.6 million shares of common stock outstanding. The current share price is $67 and the book value per share is $4. The company also has two bond issues outstanding, both with semiannual coupons. The first bond issue has a face value of $80 million and a coupon rate of 6.8 percent and sells for 109.5 percent of par. The second issue has a face value of $65 million and a coupon rate of 71 percent and sells for 112.4 percent of par. The first issue matures in 9 years, the second in 25 years. a. What are the company's capital structure weights on a book value basis? b. What are the company's capital structure weights on a market value basis? (For all requirements, do not round intermediate calculations and round your answers to 4 decimal places, e.g., 32.1616.) a 1.0000 0.8267 a. EquityNalue Debt/Value b. EquityNalue Debt/Value 0.7602 0.2398 Titan Mining Corporation has 6.4 million shares of common stock outstanding and 175,000 6.2 percent semiannual bonds outstanding, par value $1,000 each. The common stock currently sells for $53 per share and has a beta of 1.15; the bonds have 25 years to maturity and sell for 106 percent of par. The market risk premium is 6.8 percent, T-bills are yielding 3.1 percent, and the company's tax rate is 22 percent. a. What is the firm's market value capital structure? (Round your final answers to 4 decimal places, e.g., 32.1616.) b. If the company is evaluating a new investment project that has the same risk as the firm's typical project, what rate should the firm use to discount the project's cash flows? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. . Debt 339.2000 524.7000 Equity Discount rate b. 8.64% Hero Manufacturing has 7.6 million shares of common stock outstanding. The current share price is $67 and the book value per share is $4. The company also has two bond issues outstanding. The first bond issue has a face value of $80 million and a coupon rate of 6.8 percent and sells for 109.5 percent of par. The second issue has a face value of $65 million and a coupon rate of 7.1 percent and sells for 112.4 percent of par. The first issue matures in 9 years, the second in 25 years. Suppose the company's stock has a beta of 1.10. The risk-free rate is 2.9 percent and the market risk premium is 7 percent. Assume that the overall cost of debt is the weighted average implied by the two outstanding debt issues. Both bonds make semiannual payments. The tax rate is 23 percent. What is the company's WACC? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) WACC % You are given the following information for Huntington Power Co. Assume the company's tax rate is 21 percent. Debt: 17,000 4.9 percent coupon bonds outstanding, $2,000 par value, 20 years to maturity, selling for 105 percent of par; the bonds make semiannual payments. Common stock: 425,000 shares outstanding, selling for $67 per share; the beta is.88 Market: 7 percent market risk premium and 3.5 percent risk-free rate. What is the company's WACC? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) WACC 27.45 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started