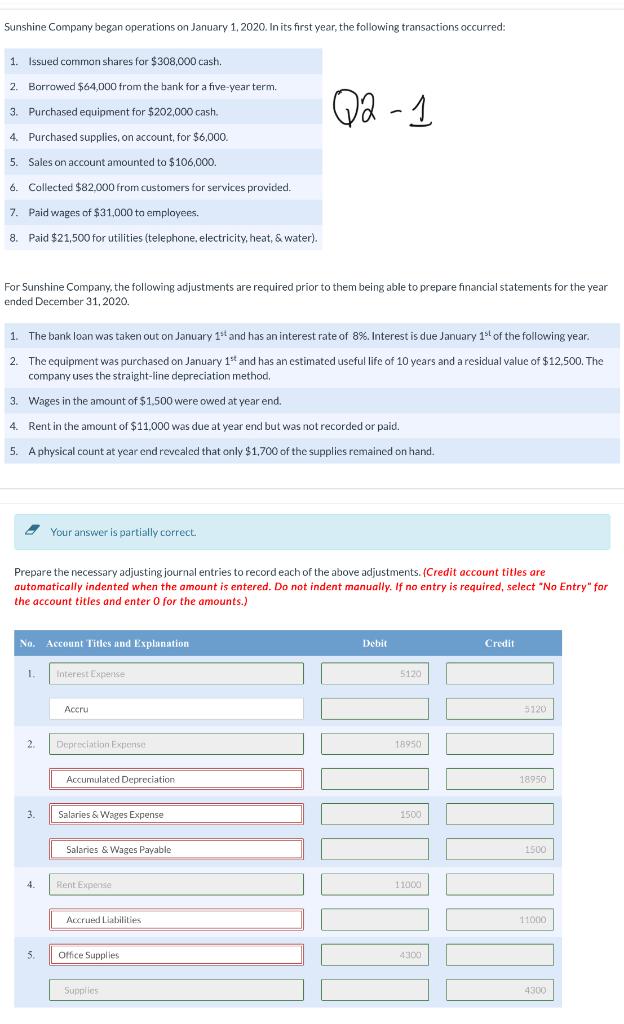

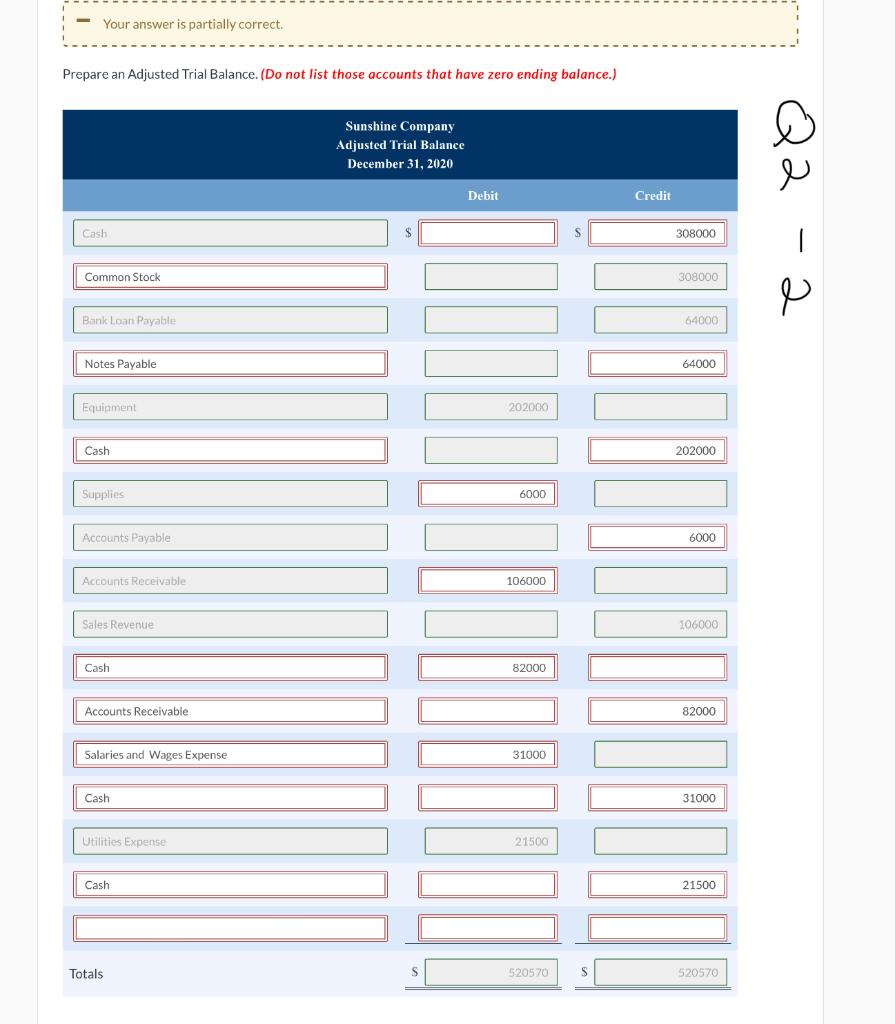

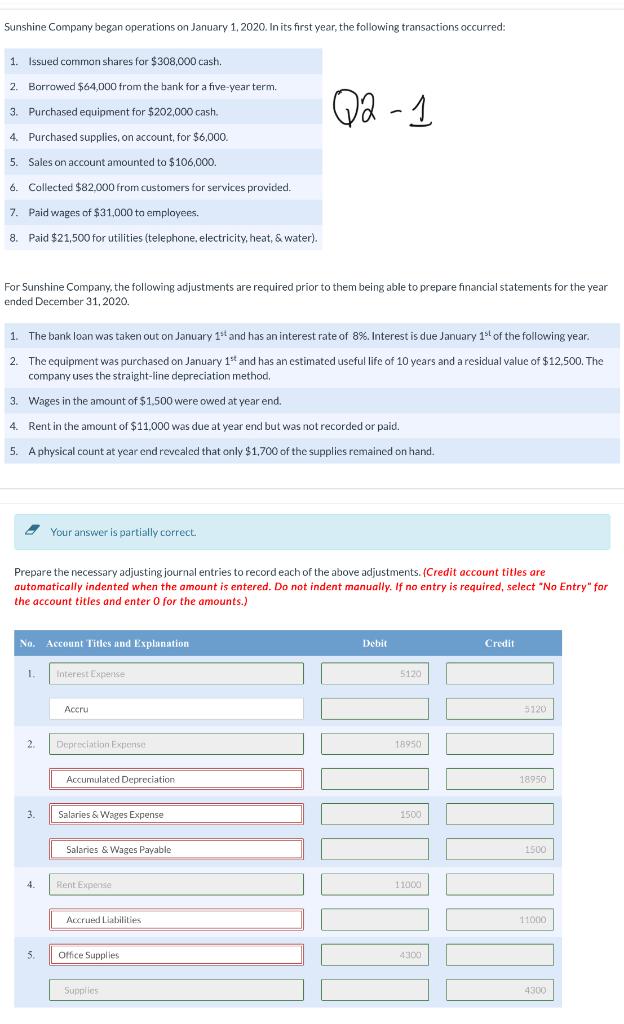

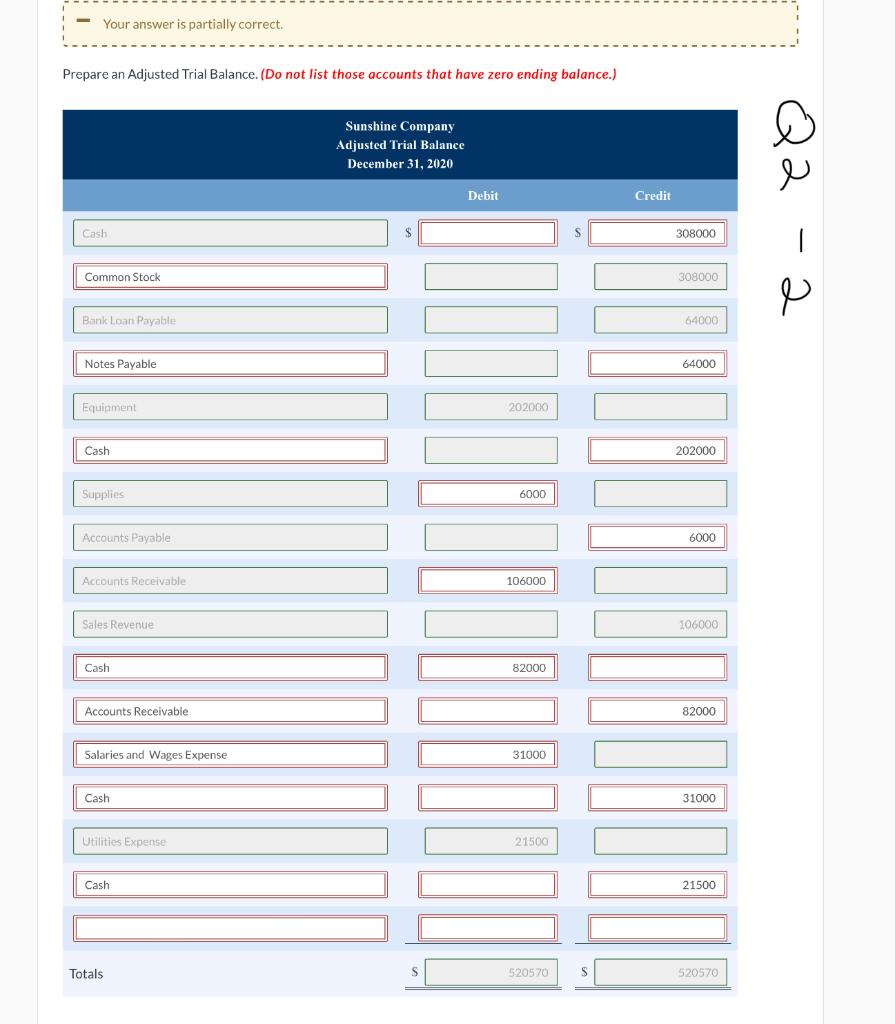

Can you help me to correct the one with RED MARKS? Thank you.

Sunshine Company began operations on January 1, 2020. In its first year, the following transactions occurred: 1. Issued common shares for $308,000 cash. 2. Borrowed $64,000 from the bank for a five-year term. 3. Purchased equipment for $202,000 cash. 4. Purchased supplies, on account, for $6,000. 5. Sales on account amounted to $106,000. Q2 - 1 6. Collected $82.000 from customers for services provided. 7. Paid wages of $31,000 to employees. 8. Paid $21,500 for utilities (telephone, electricity, heat, & water). , . For Sunshine Company, the following adjustments are required prior to them being able to prepare financial statements for the year ended December 31, 2020. 1. The bank loan was taken out on January 19 and has an interest rate of 8%. Interest is due January 11 of the following year. 2. The equipment was purchased on January 19 and has an estimated useful life of 10 years and a residual value of $12,500. The company uses the straight-line depreciation method, 3. Wages in the amount of $1,500 were owed at year end. 4. Rent in the amount of $11,000 was due at year end but was not recorded or paid. 5. A physical count at year end revealed that only $1,700 of the supplies remained on hand, Your answer is partially correct. Prepare the necessary adjusting journal entries to record each of the above adjustments. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) No. Account Titles and Explanation Debit Credit 1. Interest Expense 5120 Accru 5120 2 Depreciation Expense 18950 Accumulated Depreciation 18950 3. Salaries & Wages Expense 1500 Salaries & Wages Payable & 1500 4 Rent Expense 11000 Accrued Liabilities 11000 5. Office Supplies 4300 Supplies 4300 Your answer is partially correct. Prepare an Adjusted Trial Balance. (Do not list those accounts that have zero ending balance.) Sunshine Company Adjusted Trial Balance December 31, 2020 Debit Credit Cash 308000 Common Stock 308000 e Bank Loan Payable 64000 Notes Payable 64000 Equipment 202000 Cash 202000 Supplies 6000 Accounts Payable 6000 Accounts Receivable 106000 Sales Revenue 106000 Cash 82000 Accounts Receivable 82000 Salaries and Wages Expense 31000 Cash 31000 Utilities Expense 21500 Cash 21500 10000 Totals 520570 S 520570