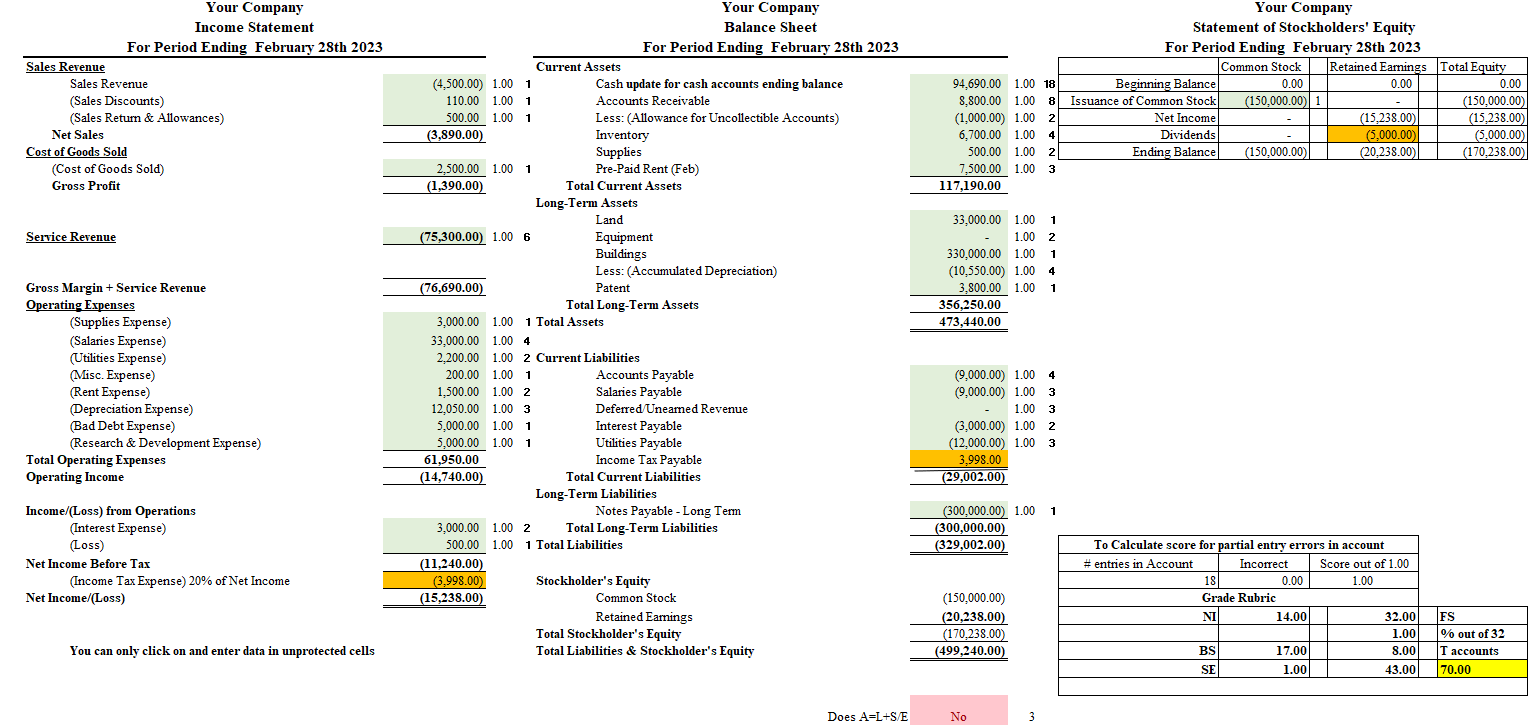

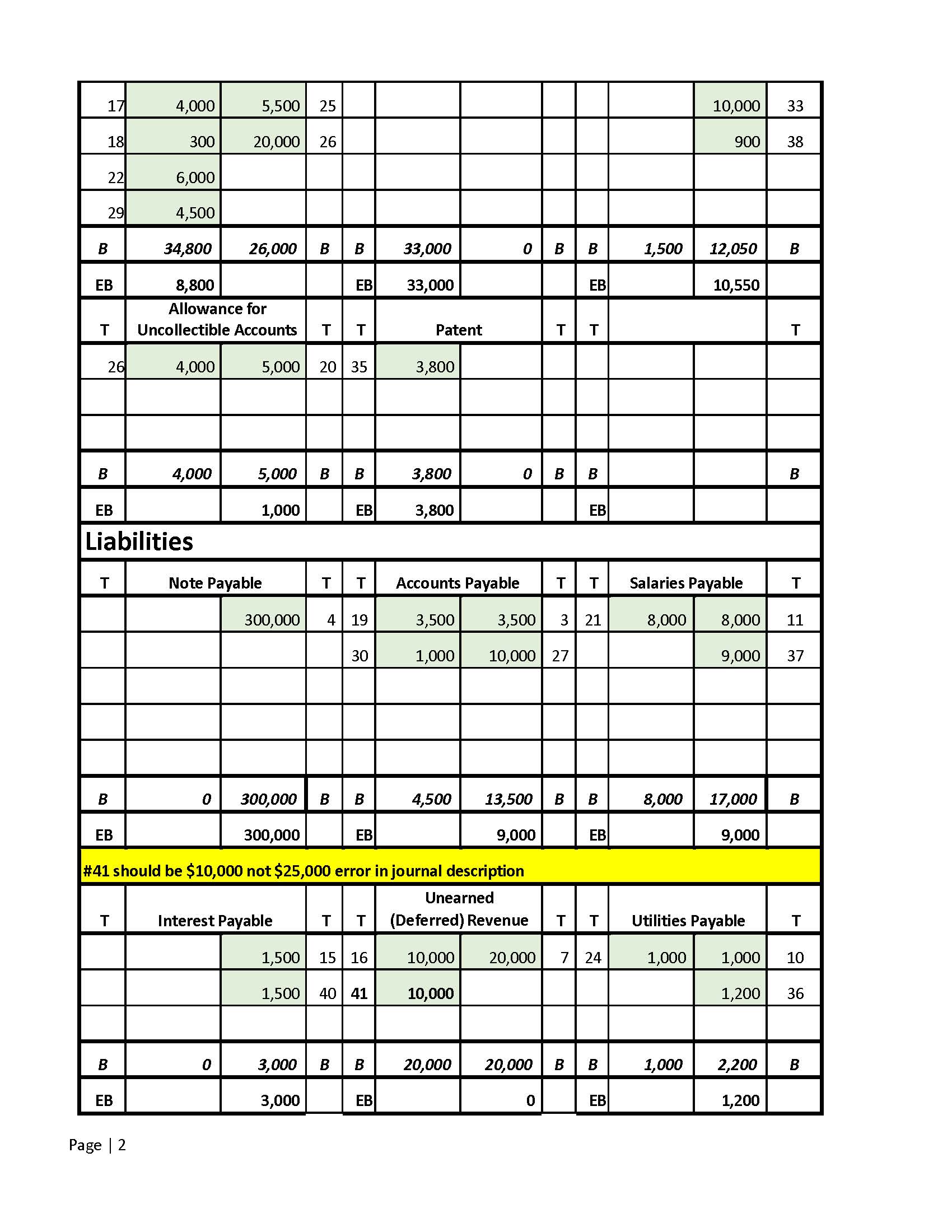

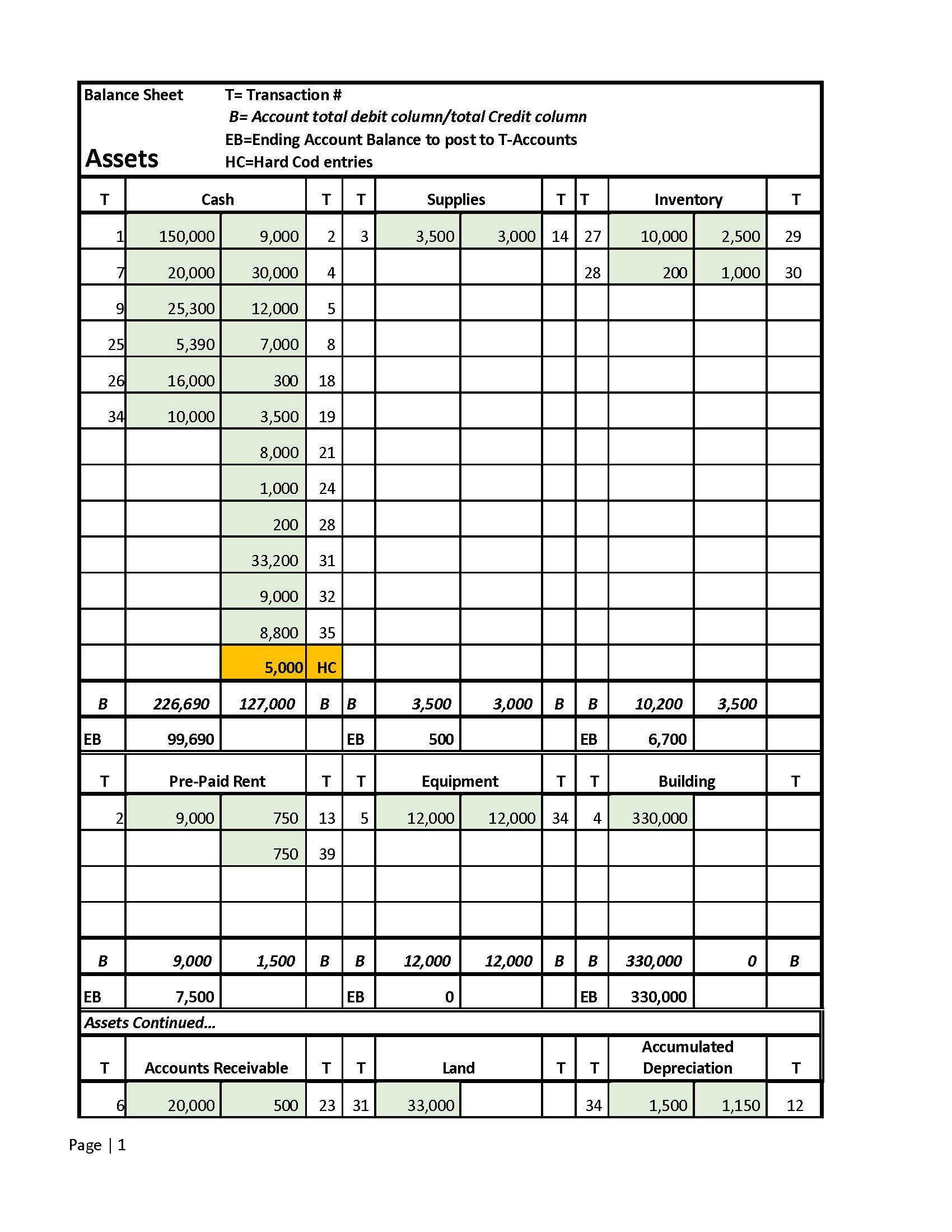

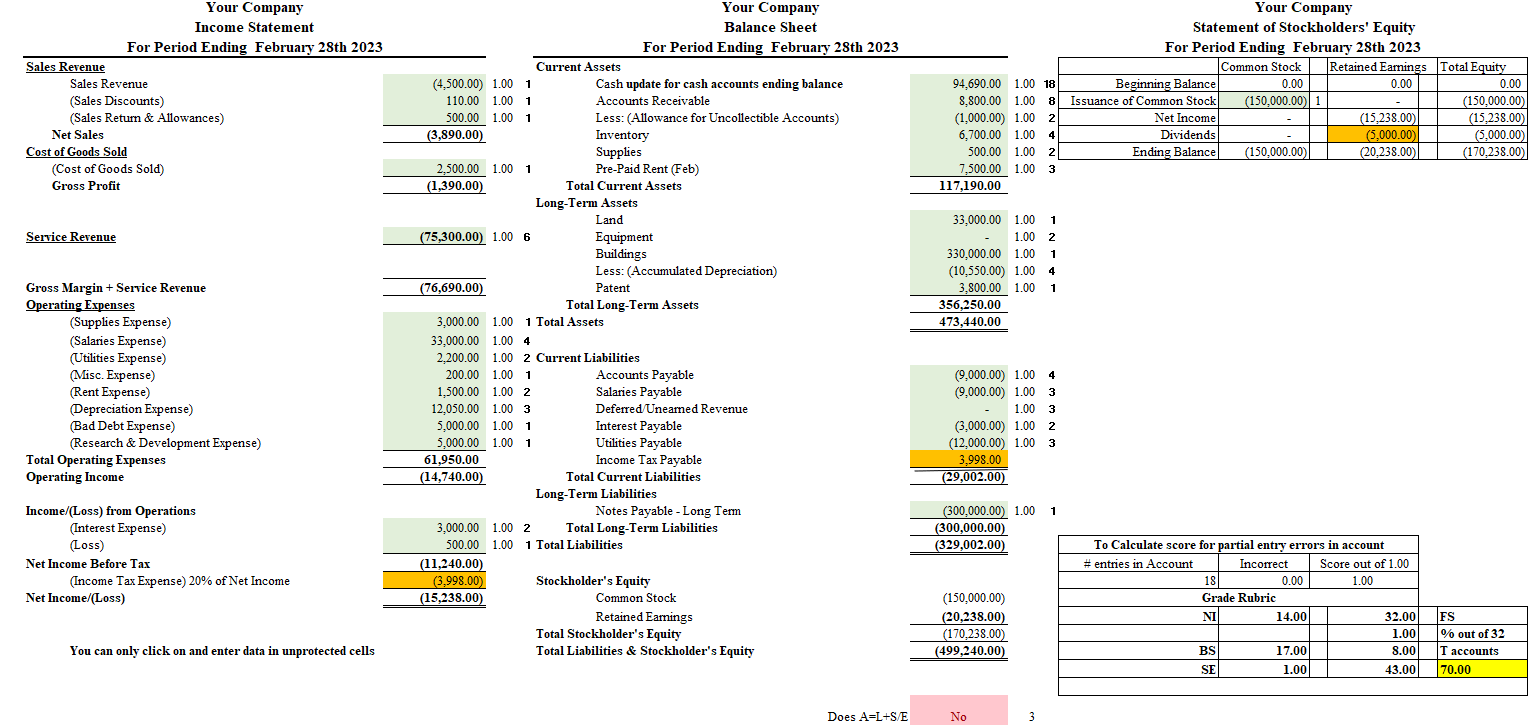

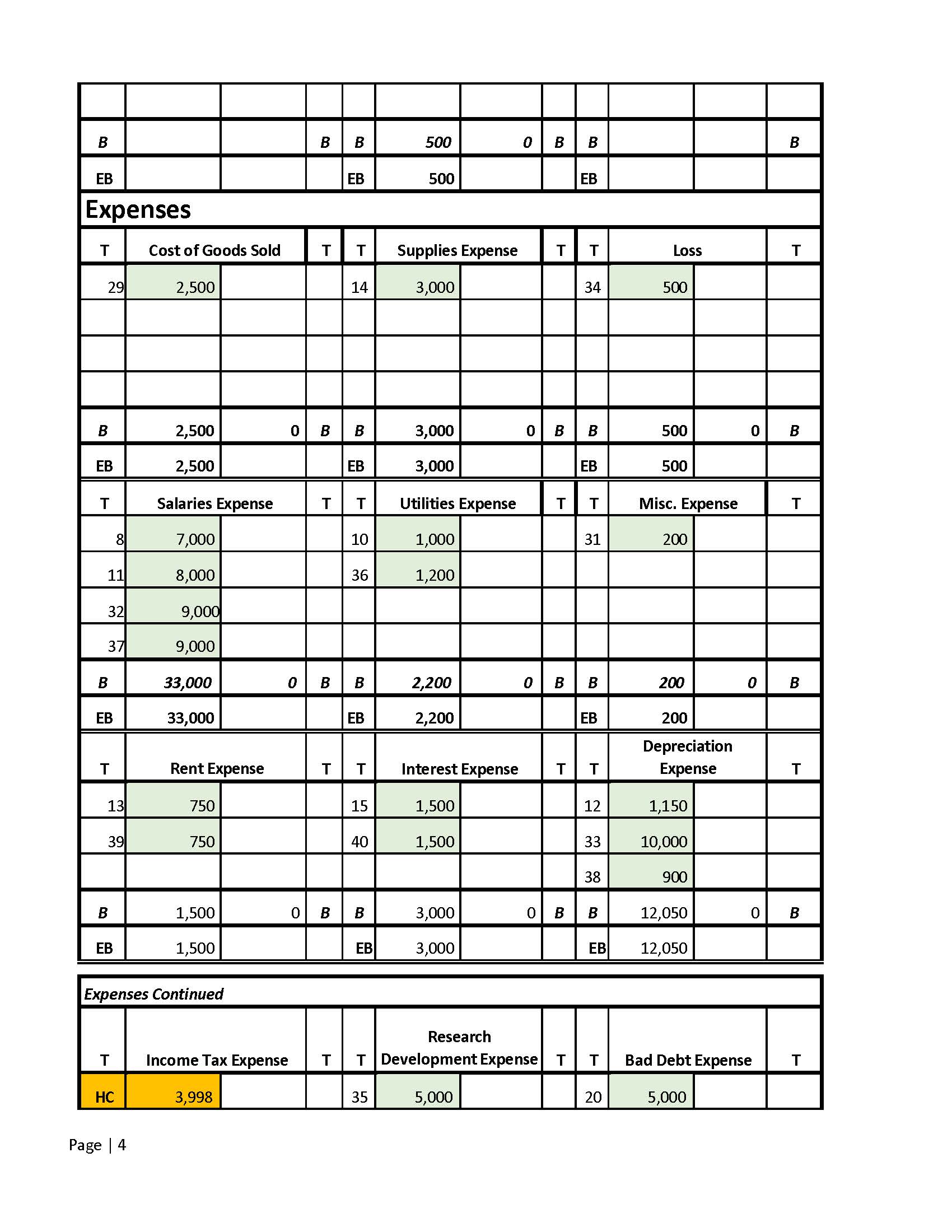

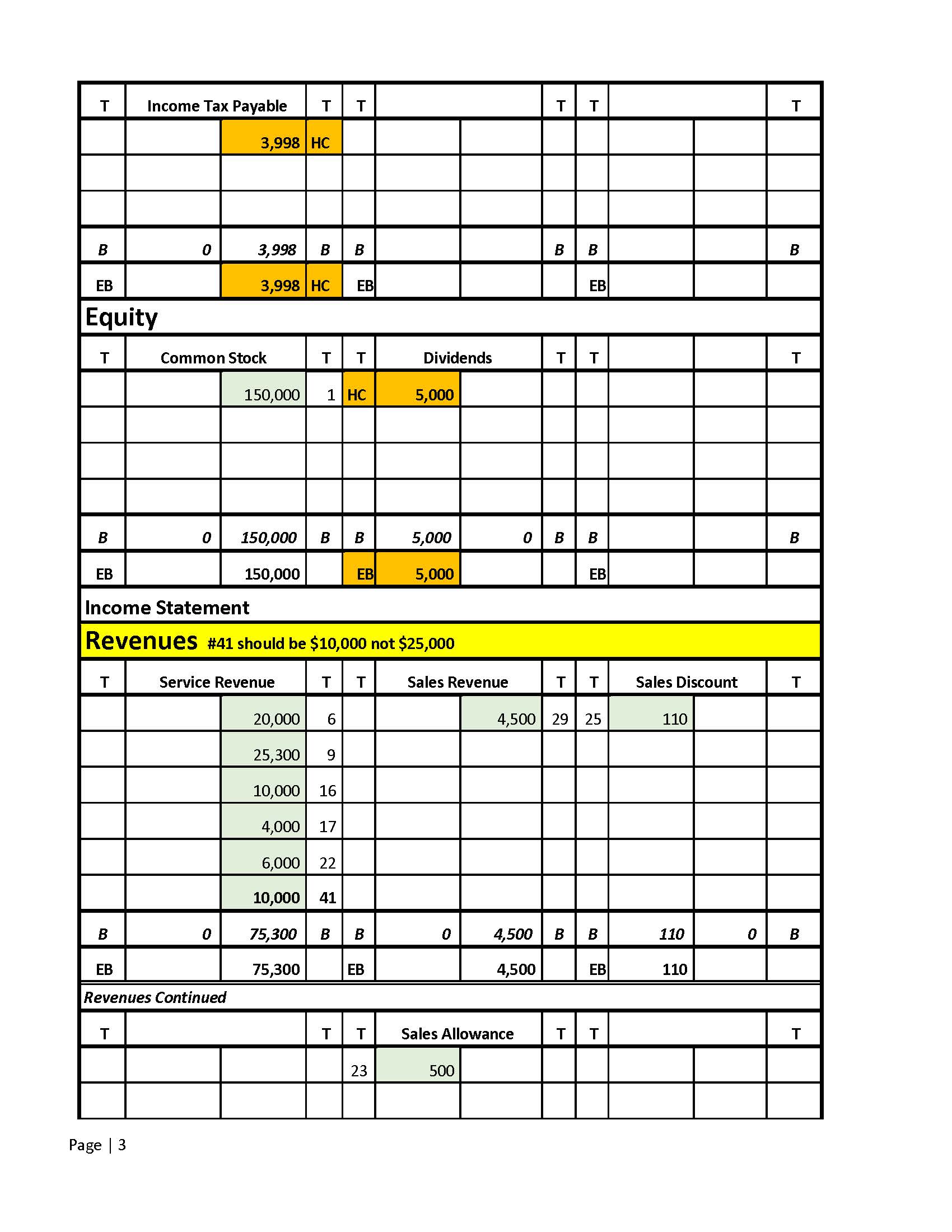

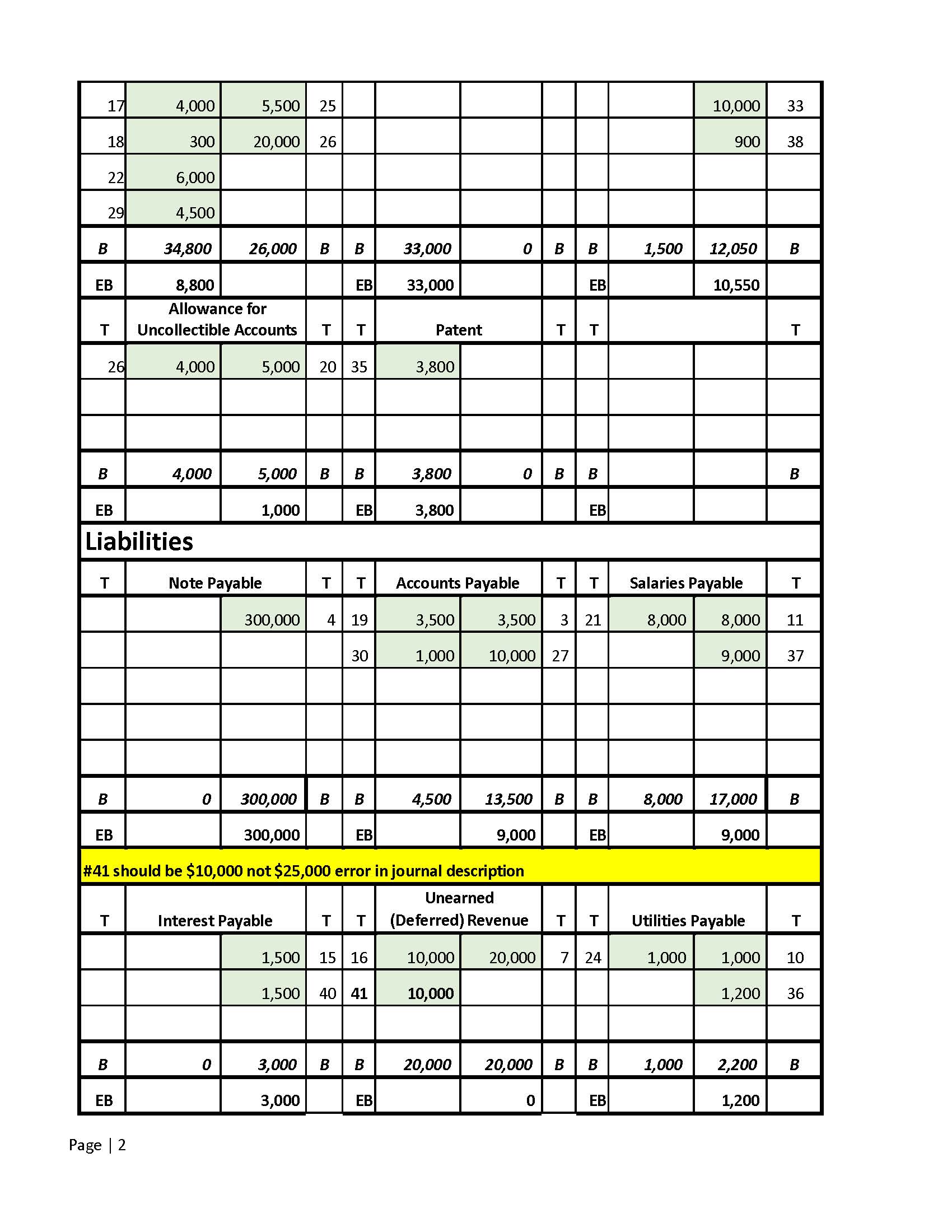

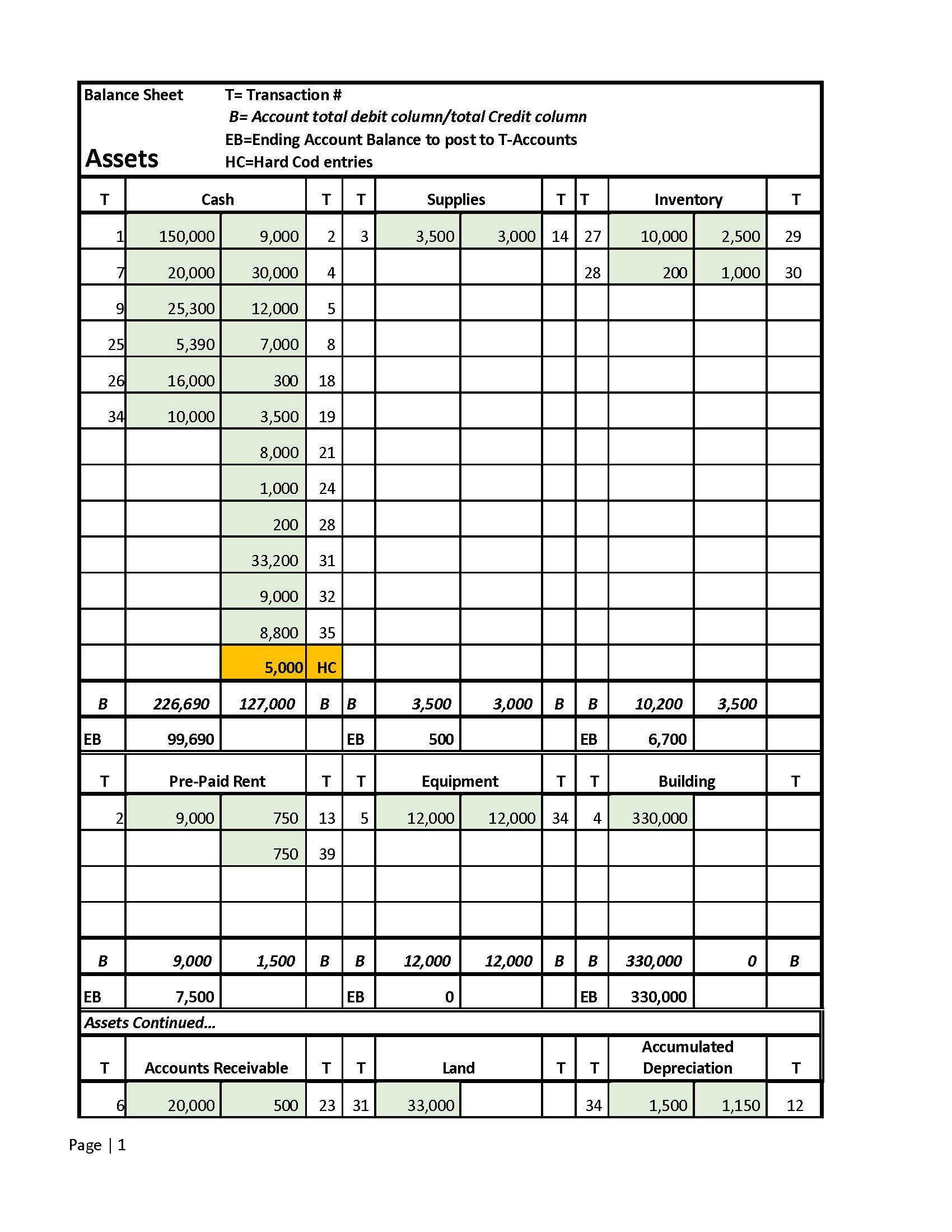

Can you help me to understand why my accounting equation isn't balancing. I am trying to fill in all the green cells using the T-accounts attached. Assets = Liablity + Stockholders Equity . I can provide the T-accounts for reference.

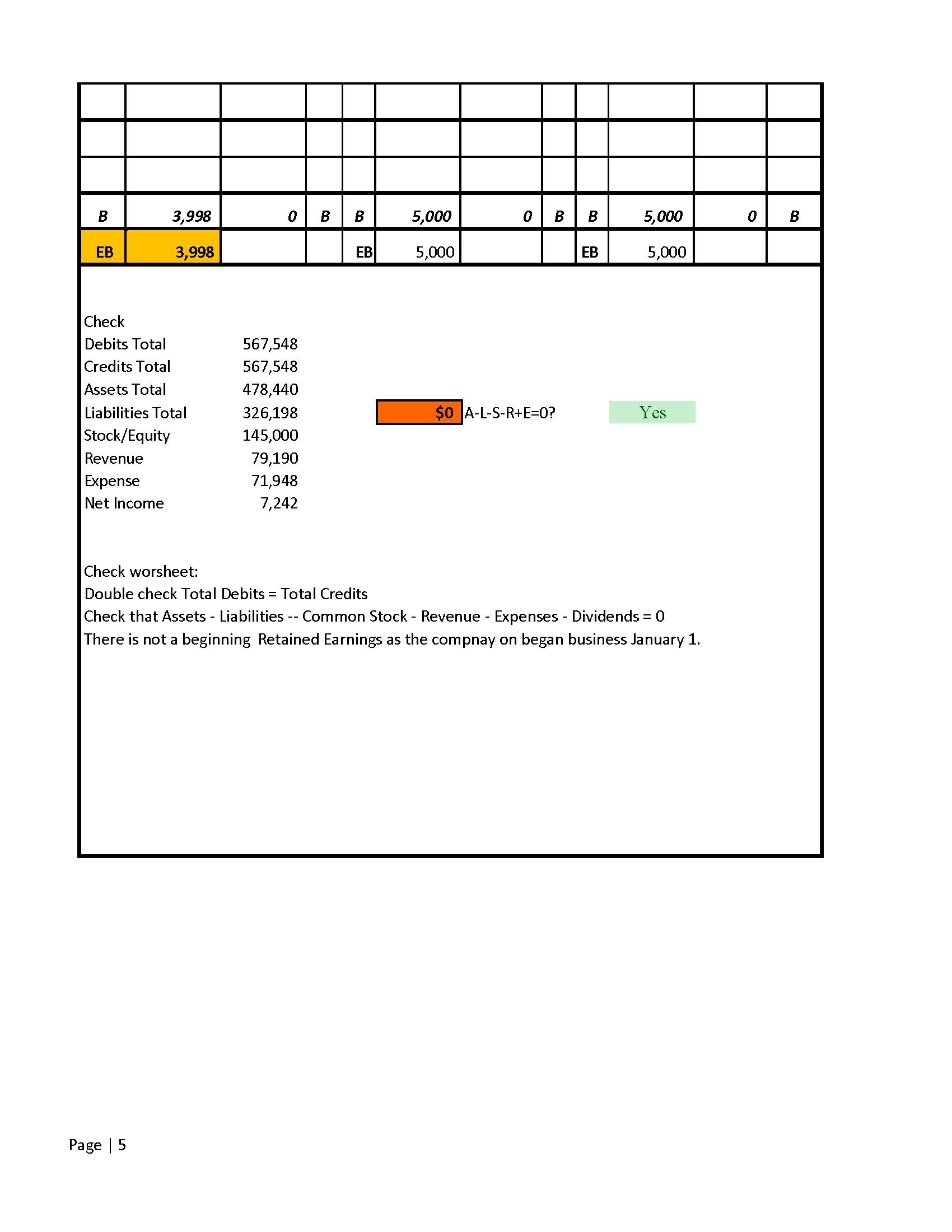

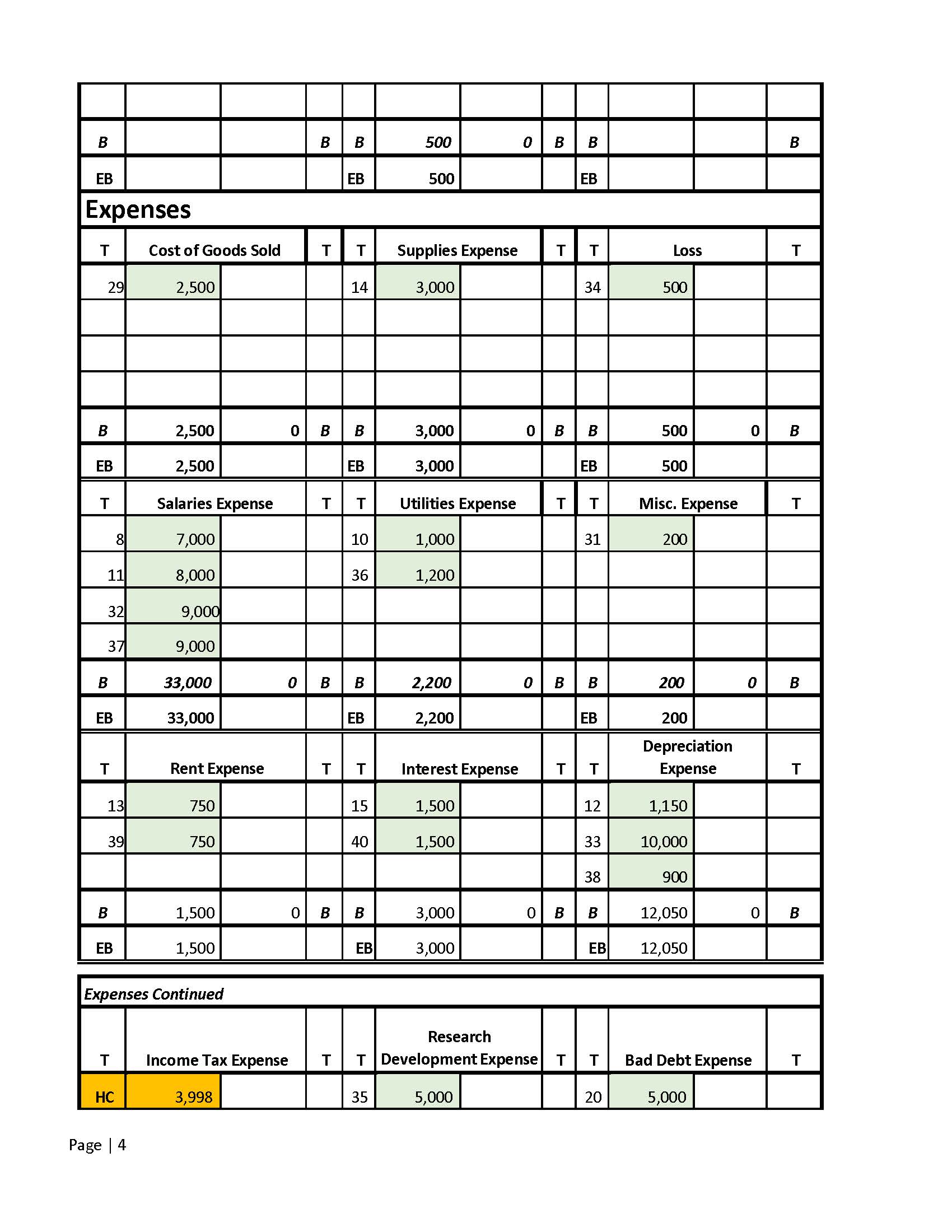

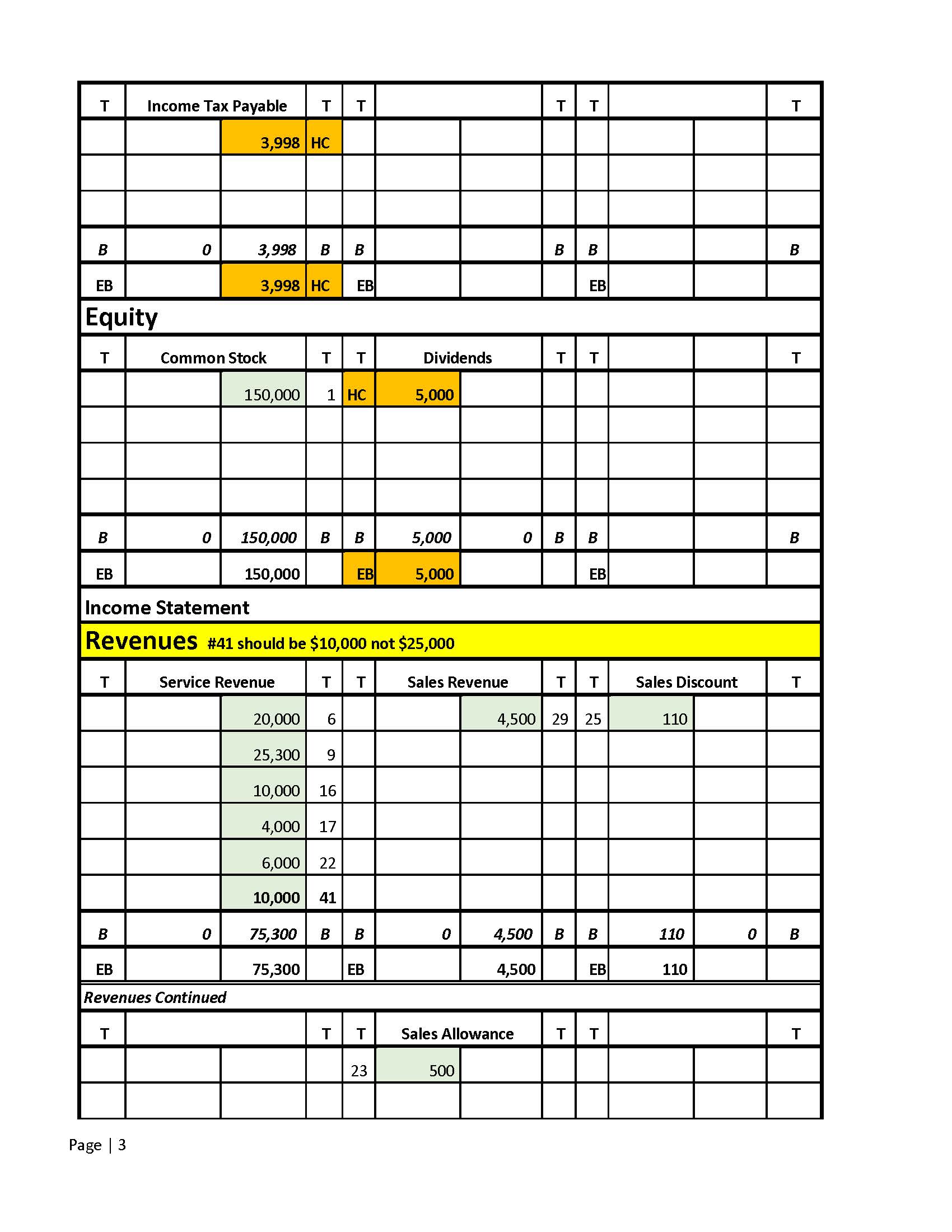

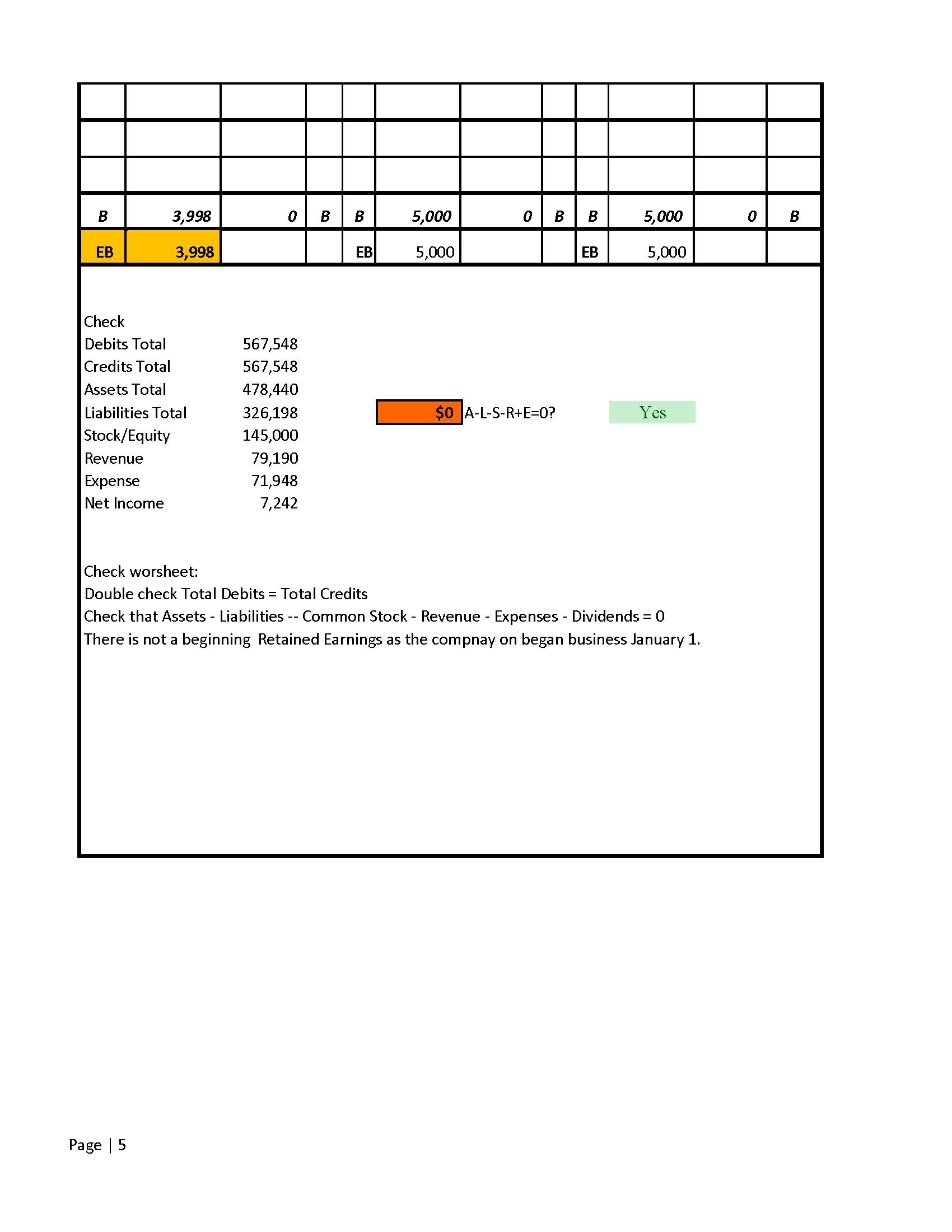

Page \\( \\mid 4 \\) Page | 1 Check worsheet: Double check Total Debits \\( = \\) Total Credits Check that Assets - Liabilities -- Common Stock - Revenue - Expenses - Dividends \\( =0 \\) There is not a beginning Retained Earnings as the compnay on began business January 1 . Page | 3 Your Company Income Statement For Period Ending February 28th 2023 \\begin{tabular}{l} \\hline Sales Rerenue \\\\ \\hline \\( \\begin{array}{l}\\text { Sales Revenue } \\\\ \\text { (Sales Discounts) } \\\\ \\text { (Sales Return \\& Allowances) }\\end{array} \\) \\\\ Net Sales \\\\ Cost of Goods Sold \\\\ \\hline (Cost of Goods Sold) \\\\ Gross Profit \\end{tabular} Service Rerenue Gross Margin + Service Revenue Operating Expenses (Supplies Expense) (Salaries Expense) (Utilities Expense) (Misc. Expense) (Rent Expense) (Depreciation Expense) (Bad Debt Expense) (Research \\& Development Expense) Total Operating Expenses Operating Income Income/(Loss) from Operations (Interest Expense) (Loss) Net Income Before Tax (Income Tax Expense) 20\\% of Net Income Net Income/(Loss) Your Company Balance Sheet For Period Ending February 28th 2023 \\begin{tabular}{rrr} & & \\\\ \\( (4,500.00) \\) & 1.00 & 1 \\\\ 110.00 & 1.00 & 1 \\\\ 500.00 & 1.00 & 1 \\\\ \\hline\\( (3,890.00) \\) & & \\\\ \\hline & & \\\\ \\hline\\( (1,500.00 \\) & 1.00 & 1 \\\\ \\hline \\end{tabular} \\( \\begin{array}{r}\\mathbf{( 7 5 , 3 0 0 . 0 0 )} \\\\ \\hline \\mathbf{( 7 6 , 6 9 0 . 0 0 )} \\\\ \\hline 3,000.00 \\\\ 33,000.00 \\\\ 2,200.00 \\\\ 200.00 \\\\ 1,500.00 \\\\ 12,050.00 \\\\ 5,000.00 \\\\ 5,000.00 \\\\ \\hline \\mathbf{6 1 , 9 5 0 . 0 0} \\\\ \\hline \\mathbf{( 1 4 , 7 4 0 . 0 0 )} \\\\ \\hline\\end{array} \\) You can only click on and enter data in unprotected cells Current Assets Cash update for cash accounts ending balance Accounts Receivable Less: (Allowance for Uncollectible Accounts) Inventory Supplies Pre-Paid Rent (Feb) Total Current Assets Long-Term Assets Land Equipment Buildings Less: (Accumulated Depreciation) Patent Total Long-Term Assets 1.001 Total Assets 1.004 1.002 Current Liabilities 1.001 Accounts Payable Salaries Payable Deferred/Uneamed Revenue Interest Payable Utilities Payable Income Tax Payable Total Current Liabilities Long-Term Liabilities Notes Payable - Long Term \\( \\begin{array}{llll}3,000.00 & 1.00 & 2 & \\text { Total Long-Term Liabilities }\\end{array} \\) \\( 500.00 \\quad 1.00 \\quad 1 \\) Total Liabilities \\( (11,240.00) \\) Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities \\& Stockholder's Equity Statement of Stockholders' Equity For Period Ending February 28th 2023 Does \\( A=L+S / E \\quad \\) No 3 Page \\( \\mid 2 \\) Page \\( \\mid 4 \\) Page | 1 Check worsheet: Double check Total Debits \\( = \\) Total Credits Check that Assets - Liabilities -- Common Stock - Revenue - Expenses - Dividends \\( =0 \\) There is not a beginning Retained Earnings as the compnay on began business January 1 . Page | 3 Your Company Income Statement For Period Ending February 28th 2023 \\begin{tabular}{l} \\hline Sales Rerenue \\\\ \\hline \\( \\begin{array}{l}\\text { Sales Revenue } \\\\ \\text { (Sales Discounts) } \\\\ \\text { (Sales Return \\& Allowances) }\\end{array} \\) \\\\ Net Sales \\\\ Cost of Goods Sold \\\\ \\hline (Cost of Goods Sold) \\\\ Gross Profit \\end{tabular} Service Rerenue Gross Margin + Service Revenue Operating Expenses (Supplies Expense) (Salaries Expense) (Utilities Expense) (Misc. Expense) (Rent Expense) (Depreciation Expense) (Bad Debt Expense) (Research \\& Development Expense) Total Operating Expenses Operating Income Income/(Loss) from Operations (Interest Expense) (Loss) Net Income Before Tax (Income Tax Expense) 20\\% of Net Income Net Income/(Loss) Your Company Balance Sheet For Period Ending February 28th 2023 \\begin{tabular}{rrr} & & \\\\ \\( (4,500.00) \\) & 1.00 & 1 \\\\ 110.00 & 1.00 & 1 \\\\ 500.00 & 1.00 & 1 \\\\ \\hline\\( (3,890.00) \\) & & \\\\ \\hline & & \\\\ \\hline\\( (1,500.00 \\) & 1.00 & 1 \\\\ \\hline \\end{tabular} \\( \\begin{array}{r}\\mathbf{( 7 5 , 3 0 0 . 0 0 )} \\\\ \\hline \\mathbf{( 7 6 , 6 9 0 . 0 0 )} \\\\ \\hline 3,000.00 \\\\ 33,000.00 \\\\ 2,200.00 \\\\ 200.00 \\\\ 1,500.00 \\\\ 12,050.00 \\\\ 5,000.00 \\\\ 5,000.00 \\\\ \\hline \\mathbf{6 1 , 9 5 0 . 0 0} \\\\ \\hline \\mathbf{( 1 4 , 7 4 0 . 0 0 )} \\\\ \\hline\\end{array} \\) You can only click on and enter data in unprotected cells Current Assets Cash update for cash accounts ending balance Accounts Receivable Less: (Allowance for Uncollectible Accounts) Inventory Supplies Pre-Paid Rent (Feb) Total Current Assets Long-Term Assets Land Equipment Buildings Less: (Accumulated Depreciation) Patent Total Long-Term Assets 1.001 Total Assets 1.004 1.002 Current Liabilities 1.001 Accounts Payable Salaries Payable Deferred/Uneamed Revenue Interest Payable Utilities Payable Income Tax Payable Total Current Liabilities Long-Term Liabilities Notes Payable - Long Term \\( \\begin{array}{llll}3,000.00 & 1.00 & 2 & \\text { Total Long-Term Liabilities }\\end{array} \\) \\( 500.00 \\quad 1.00 \\quad 1 \\) Total Liabilities \\( (11,240.00) \\) Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities \\& Stockholder's Equity Statement of Stockholders' Equity For Period Ending February 28th 2023 Does \\( A=L+S / E \\quad \\) No 3 Page \\( \\mid 2 \\)