Can you help me wit the part 2 please

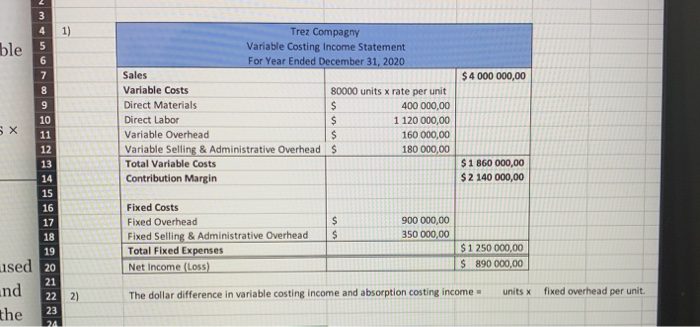

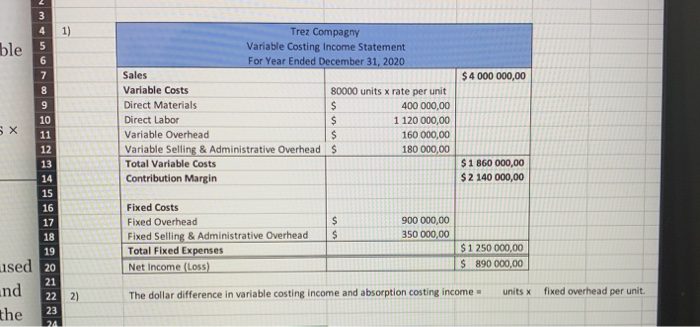

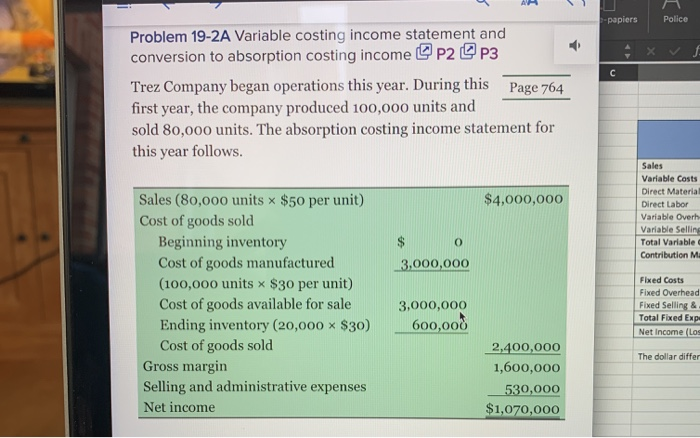

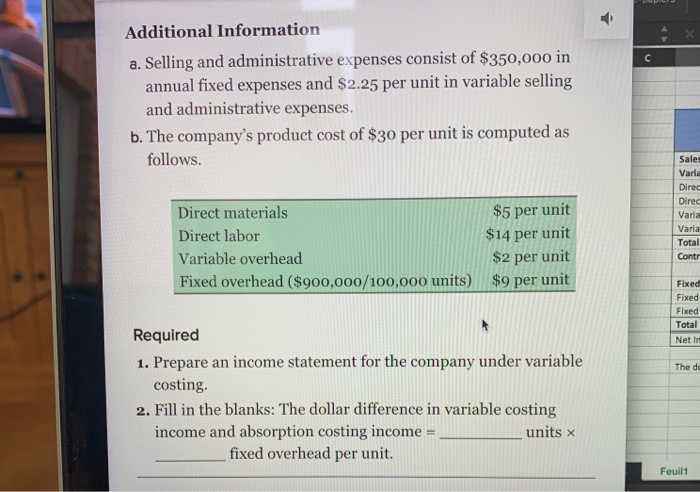

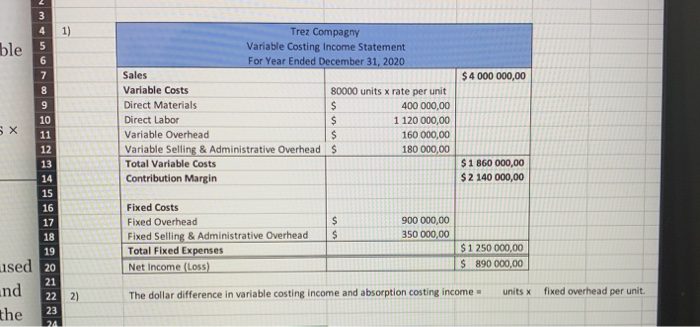

ble $ 4 000 000,00 Trez Compagny Variable Costing Income Statement For Year Ended December 31, 2020 Sales Variable Costs 80000 units x rate per unit Direct Materials 400 000,00 Direct Labor 1 120 000,00 Variable Overhead 160 000,00 Variable Selling & Administrative Overhead $ 180 000,00 Total Variable Costs Contribution Margin $ 1 860 000,00 $ 2 140 000,00 Fixed Costs Fixed Overhead Fixed Selling & Administrative Overhead Total Fixed Expenses Net Income (Loss) 900 000,00 350 000,00 $1 250 000,00 $ 890 000,00 used and 22 2) The dollar difference in variable costing income and absorption costing income units X fixed overhead per unit. the -papiers Police Problem 19-2A Variable costing income statement and conversion to absorption costing income P2 P3 Trez Company began operations this year. During this Page 764 first year, the company produced 100,000 units and sold 80,000 units. The absorption costing income statement for this year follows. $4,000,000 Sales Variable costs Direct Material Direct Labor Variable Overh Variable Selling Total Variable Contribution M $ 0 3,000,000 Sales (80,000 units $50 per unit) Cost of goods sold Beginning inventory Cost of goods manufactured (100,000 units x $30 per unit) Cost of goods available for sale Ending inventory (20,000 x $30) Cost of goods sold Gross margin Selling and administrative expenses Net income 3,000,000 600,000 Fixed Costs Fixed Overhead Fixed Selling & Total Fixed Exp Net Income (Los The dollar differ 2,400,000 1,600,000 530,000 $1,070,000 Additional Information a. Selling and administrative expenses consist of $350,000 in annual fixed expenses and $2.25 per unit in variable selling and administrative expenses. b. The company's product cost of $30 per unit is computed as follows. Direct materials Direct labor Variable overhead Fixed overhead ($900,000/100,000 units) $5 per unit $14 per unit $2 per unit $9 per unit Sales Varia Direc Direc Varia Varia Total Contr Fixed Fixed Fixed Total Net in The do Required 1. Prepare an income statement for the company under variable costing. 2. Fill in the blanks: The dollar difference in variable costing income and absorption costing income = units x fixed overhead per unit. Feuil