Answered step by step

Verified Expert Solution

Question

1 Approved Answer

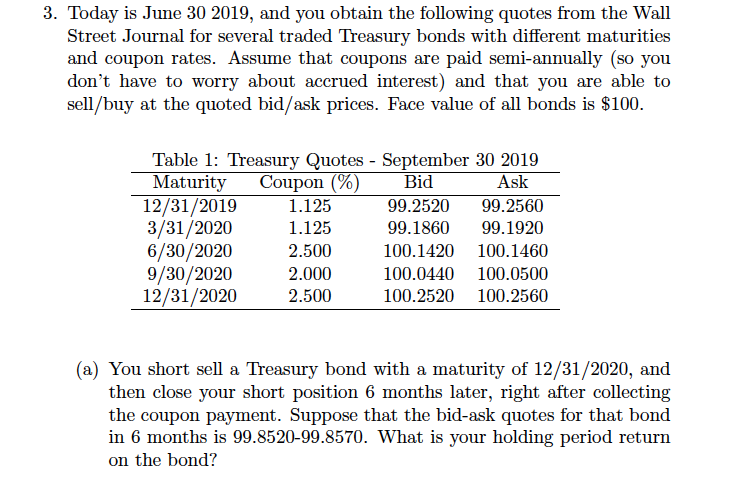

Can you help me with parts 3 b-c, I don't understand how to compare a zero-coupon bond without given a price/discount rate. 3. Today is

Can you help me with parts 3 b-c, I don't understand how to compare a zero-coupon bond without given a price/discount rate.

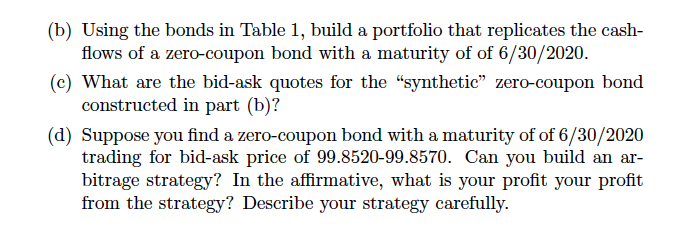

3. Today is Jume 30 2019, and you obtain the following quotes from the Wall Street Journal for several traded Treasury bonds with different maturities and coupon rates. Assume that coupons are paid semi-annually (so you don't have to worry about accrued interest) and that you are able to sell/buy at the quoted bid/ask prices. Face value of all bonds is $100 Table 1: Treasury Quotes September 30 2019 Maturity 12/31/2019 3/31/2020 6/30/2020 9/30/2020 12/31/2020 Coupon (% Bid Ask 1.125 99.2520 99.2560 1.125 99.1860 99.1920 2.500 100.1420 100.1460 2.000 100.0440 100.0500 2.500 100.2520 100.2560 (a) You short sell a Treasury bond with a maturity of 12/31/2020, and then close your short position 6 months later, right after collecting the coupon payment. Suppose that the bid-ask quotes for that bond in 6 months is 99.8520-99.8570. What is your holding period return on the bond? (b) Using the bonds in Table 1, build a portfolio that replicates the cash- flows of a zero-coupon bond with a maturity of of 6/30/2020. (c) What are the bid-ask quotes for the "synthetic" zero-coupon bond constructed in part (b)? (d) Suppose you find a zero-coupon bond with a maturity of of 6/30/2020 trading for bid-ask price of 99.8520-99.8570. Can you build an ar- bitrage strategy? In the affirmative, what is your profit your profit from the strategy? Describe your strategy carefully 3. Today is Jume 30 2019, and you obtain the following quotes from the Wall Street Journal for several traded Treasury bonds with different maturities and coupon rates. Assume that coupons are paid semi-annually (so you don't have to worry about accrued interest) and that you are able to sell/buy at the quoted bid/ask prices. Face value of all bonds is $100 Table 1: Treasury Quotes September 30 2019 Maturity 12/31/2019 3/31/2020 6/30/2020 9/30/2020 12/31/2020 Coupon (% Bid Ask 1.125 99.2520 99.2560 1.125 99.1860 99.1920 2.500 100.1420 100.1460 2.000 100.0440 100.0500 2.500 100.2520 100.2560 (a) You short sell a Treasury bond with a maturity of 12/31/2020, and then close your short position 6 months later, right after collecting the coupon payment. Suppose that the bid-ask quotes for that bond in 6 months is 99.8520-99.8570. What is your holding period return on the bond? (b) Using the bonds in Table 1, build a portfolio that replicates the cash- flows of a zero-coupon bond with a maturity of of 6/30/2020. (c) What are the bid-ask quotes for the "synthetic" zero-coupon bond constructed in part (b)? (d) Suppose you find a zero-coupon bond with a maturity of of 6/30/2020 trading for bid-ask price of 99.8520-99.8570. Can you build an ar- bitrage strategy? In the affirmative, what is your profit your profit from the strategy? Describe your strategy carefullyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started