Answered step by step

Verified Expert Solution

Question

1 Approved Answer

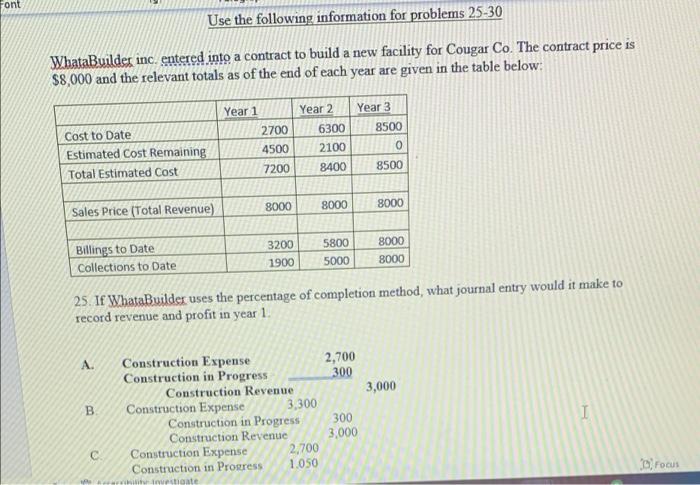

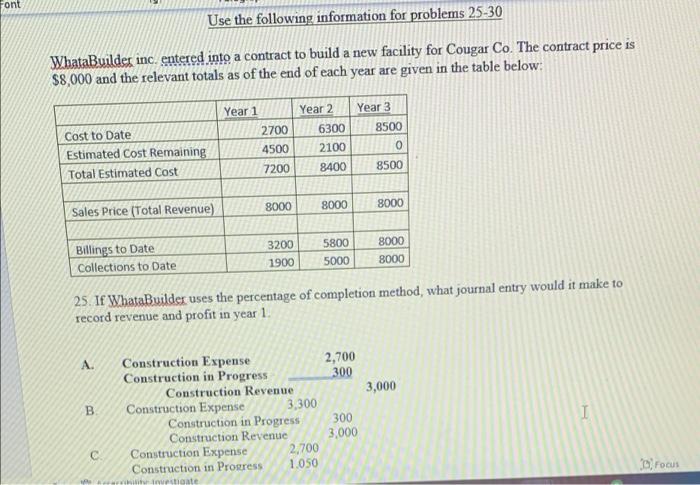

can you help me with these questions please? ASAP, I will give you thumbs up Font Use the following information for problems 25-30 a WhataBuilder

can you help me with these questions please? ASAP, I will give you thumbs up

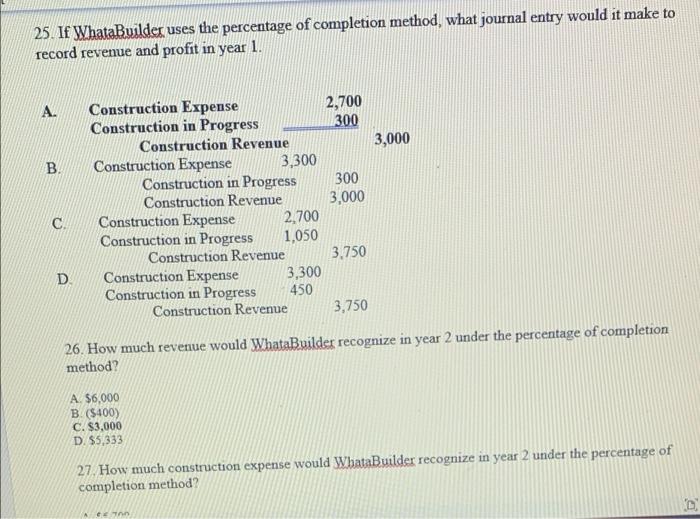

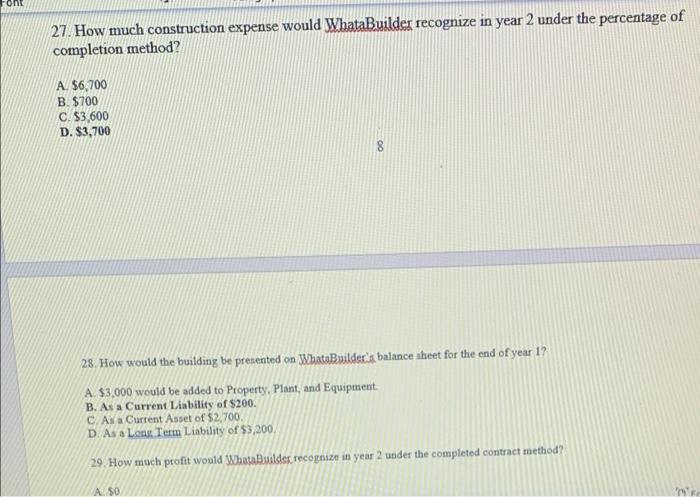

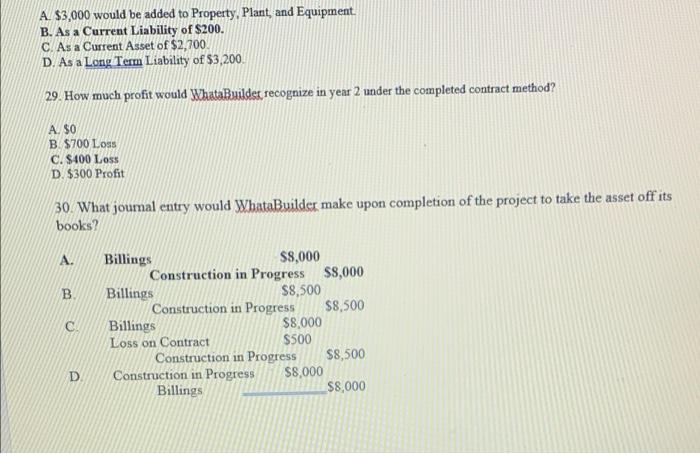

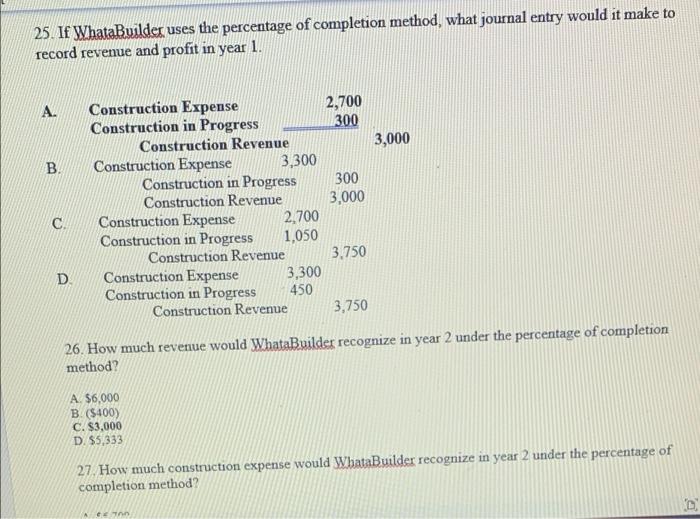

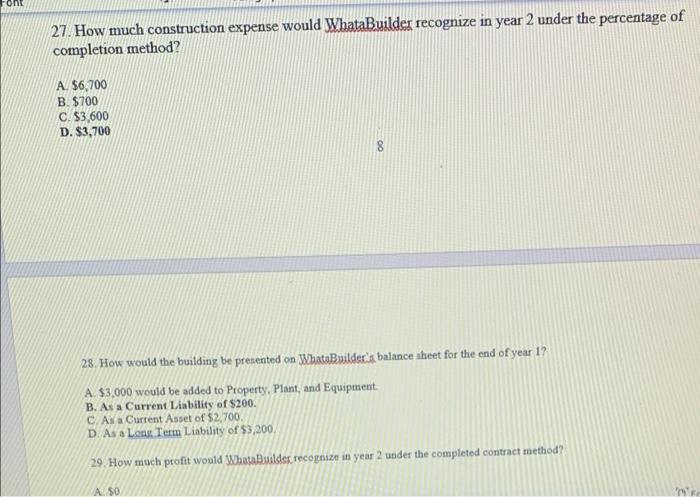

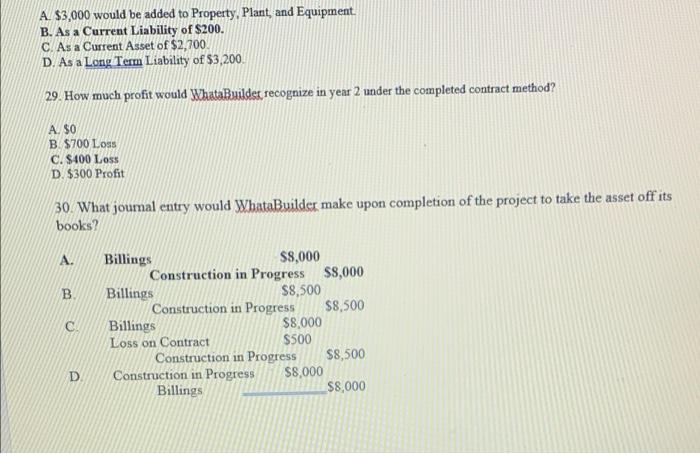

Font Use the following information for problems 25-30 a WhataBuilder inc. entered into a contract to build a new facility for Cougar Co. The contract price is $8,000 and the relevant totals as of the end of each year are given in the table below: Year 3 8500 Year 1 2700 4500 7200 Cost to Date Estimated Cost Remaining Total Estimated cost Year 2 6300 2100 8400 0 8500 8000 8000 Sales Price (Total Revenue) 8000 5800 5000 8000 8000 Billings to Date 3200 Collections to Date 1900 25. If WhataBuilder uses the percentage of completion method, what journal entry would it make to record revenue and profit in year 1. A. 2,700 300 3,000 B Construction Expense Construction in Progress Construction Revenue Construction Expense 3,300 Construction in Progress Construction Revenue Construction Expense 2,700 Construction in Progress 1.050 I 300 3,000 C Focus investigate 25. If WhataBuilder uses the percentage of completion method, what journal entry would it make to record revenue and profit in year 1. 3,000 A. Construction Expense 2,700 Construction in Progress 300 Construction Revenue 3,000 B. Construction Expense 3,300 Construction in Progress 300 Construction Revenue C! Construction Expense 2,700 Construction in Progress 1,050 Construction Revenue 3.750 D Construction Expense 3,300 Construction in Progress Construction Revenue 3,750 26. How much revenue would WhataBuilder recognize in year 2 under the percentage of completion method? 450 A $6,000 B. ($400) C. $3.000 D. $5,333 27. How much construction expense would WhataBuilder recognize in year 2 under the percentage of completion method? D one 27. How much construction expense would WhataBuilder recognize in year 2 under the percentage of completion method? A $6,700 B. $700 C. $3,600 D. $3,700 8 28. How would the building be presented on WhataBuilder'a balance sheet for the end of year 1? A $3,000 would be added to Property, Plant, and Equipment B. As a Current Liability of $200. C. As a Current Asset of $2,700 D. As a Long Term Liability of $3,200. 29. How much profit would WhataBuilder recognize in year 2 under the completed contract method? ASO A. $3,000 would be added to Property, Plant, and Equipment B. As a Current Liability of $200. C. As a Current Asset of $2,700 D. As a Long Term Liability of $3,200 29. How much profit would WhataBuildes recognize in year 2 under the completed contract method? A. $0 B $700 Loss C. $400 Loss D. $300 Profit 30. What journal entry would WhataBuilder make upon completion of the project to take the asset off its books? A. . Billings $8,000 Construction in Progress $8,000 Billings $8,500 Construction in Progress $8,500 Billings $8,000 Loss on Contract Construction in Progress $8,500 Construction in Progress $8,000 Billings $8,000 $500 D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started