Can you help me with this practice, there are answers but can you solve them please.

Can you help me with this practice, there are answers but can you solve them please.

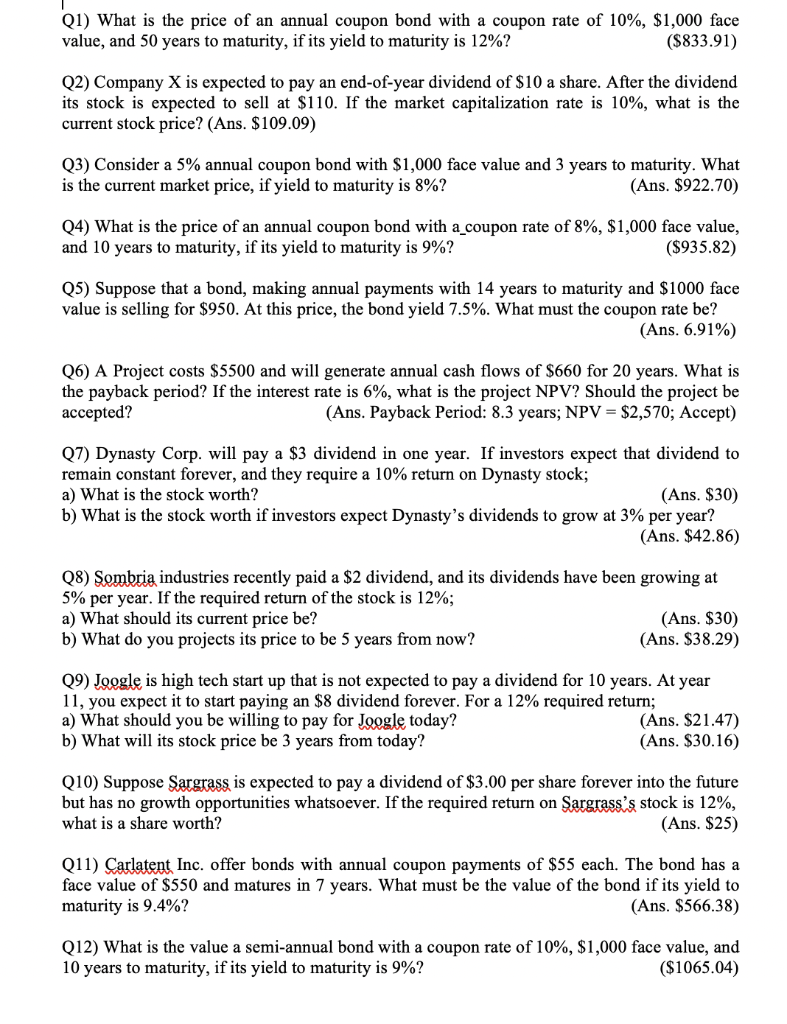

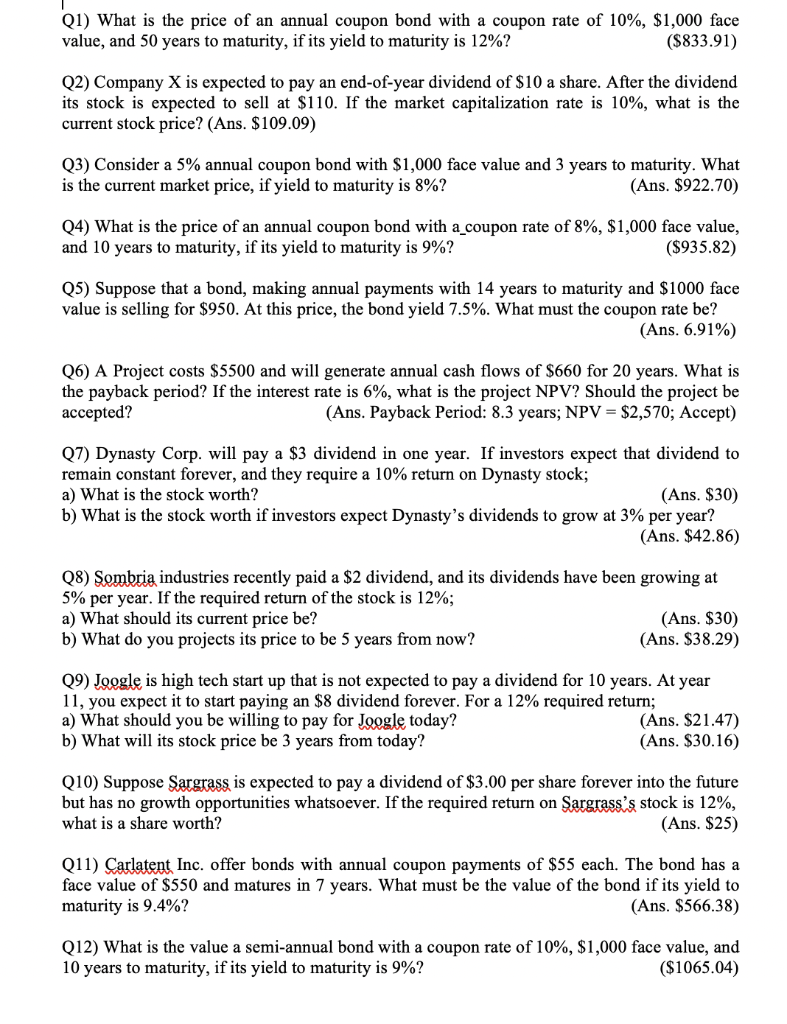

Q1) What is the price of an annual coupon bond with a coupon rate of 10%, $1,000 face value, and 50 years to maturity, if its yield to maturity is 12%? ($833.91) Q2) Company X is expected to pay an end-of-year dividend of $10 a share. After the dividend its stock is expected to sell at $110. If the market capitalization rate is 10%, what is the current stock price? (Ans. $109.09) (3) Consider a 5% annual coupon bond with $1,000 face value and 3 years to maturity. What is the current market price, if yield to maturity is 8%? (Ans. $922.70) Q4) What is the price of an annual coupon bond with a coupon rate of 8%, $1,000 face value, and 10 years to maturity, if its yield to maturity is 9%? ($935.82) Q5) Suppose that a bond, making annual payments with 14 years to maturity and $1000 face value is selling for $950. At this price, the bond yield 7.5%. What must the coupon rate be? (Ans. 6.91%) Q6) A Project costs $5500 and will generate annual cash flows of $660 for 20 years. What is the payback period? If the interest rate is 6%, what is the project NPV? Should the project be accepted? (Ans. Payback Period: 8.3 years; NPV = $2,570; Accept) Q7) Dynasty Corp. will pay a $3 dividend in one year. If investors expect that dividend to remain constant forever, and they require a 10% return on Dynasty stock; a) What is the stock worth? (Ans. $30) b) What is the stock worth if investors expect Dynasty's dividends to grow at 3% per year? (Ans. $42.86) (8) Sombria industries recently paid a $2 dividend, and its dividends have been growing at 5% per year. If the required return of the stock is 12%; a) What should its current price be? (Ans. $30) b) What do you projects its price to be 5 years from now? (Ans. $38.29) Q9) Joogle is high tech start up that is not expected to pay a dividend for 10 years. At year 11, you expect it to start paying an $8 dividend forever. For a 12% required return; a) What should you be willing to pay for Joogle today? (Ans. $21.47) b) What will its stock price be 3 years from today? (Ans. $30.16) Q10) Suppose Sargrass is expected to pay a dividend of $3.00 per share forever into the future but has no growth opportunities whatsoever. If the required return on Sargrass's stock is 12%, what is a share worth? (Ans. $25) Q11) Carlatent Inc. offer bonds with annual coupon payments of $55 each. The bond has a face value of $550 and matures in 7 years. What must be the value of the bond if its yield to maturity is 9.4%? (Ans. $566.38) Q12) What is the value a semi-annual bond with a coupon rate of 10%, $1,000 face value, and 10 years to maturity, if its yield to maturity is 9%? ($1065.04)

Can you help me with this practice, there are answers but can you solve them please.

Can you help me with this practice, there are answers but can you solve them please.