Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you help me with this? Problem 1. An investment opportunity costing P180,000 is expected to yield net cash flows of $60,000 annually for five

Can you help me with this?

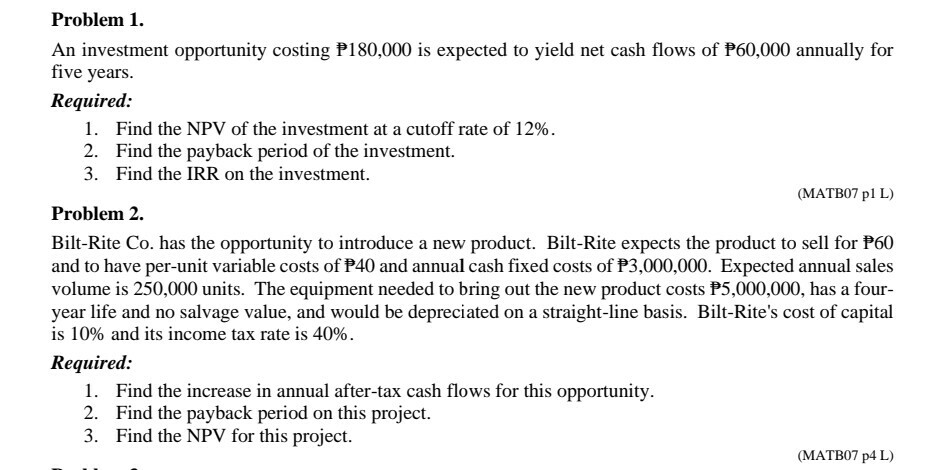

Problem 1. An investment opportunity costing P180,000 is expected to yield net cash flows of $60,000 annually for five years. Required: 1. Find the NPV of the investment at a cutoff rate of 12%. 2. Find the payback period of the investment. 3. Find the IRR on the investment. (MATB07 p1 L) Problem 2. Bilt-Rite Co. has the opportunity to introduce a new product. Bilt-Rite expects the product to sell for P60 and to have per-unit variable costs of P40 and annual cash fixed costs of P3,000,000. Expected annual sales volume is 250,000 units. The equipment needed to bring out the new product costs P5,000,000, has a four- year life and no salvage value, and would be depreciated on a straight-line basis. Bilt-Rite's cost of capital is 10% and its income tax rate is 40%. Required: 1. Find the increase in annual after-tax cash flows for this opportunity. 2. Find the payback period on this project. 3. Find the NPV for this project. (MATB07 P4 L)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started