Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help me with this questions please Q1: A 4-year real return bond (par value =$1,000 ) has a coupon rate of 3%; inflation

can you help me with this questions please

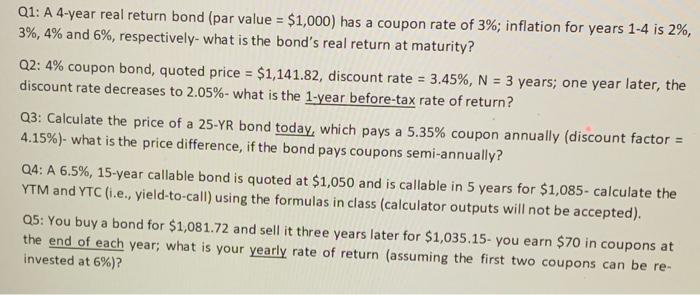

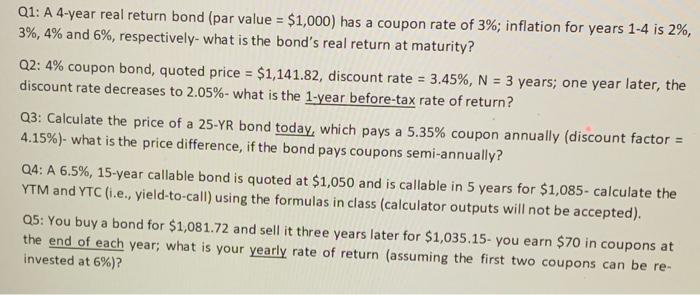

Q1: A 4-year real return bond (par value =$1,000 ) has a coupon rate of 3%; inflation for years 14 is 2%, 3%,4% and 6%, respectively-what is the bond's real return at maturity? Q2: 4% coupon bond, quoted price =$1,141.82, discount rate =3.45%,N=3 years; one year later, the discount rate decreases to 2.05% - what is the 1 -year before-tax rate of return? Q3: Calculate the price of a 25YR bond today, which pays a 5.35% coupon annually (discount factor = 4.15\%)- what is the price difference, if the bond pays coupons semi-annually? Q4: A 6.5\%, 15-year callable bond is quoted at \$1,050 and is callable in 5 years for $1,085 - calculate the YTM and YTC (i.e., yield-to-call) using the formulas in class (calculator outputs will not be accepted). Q5: You buy a bond for $1,081.72 and sell it three years later for $1,035.15-you earn $70 in coupons at the end of each year; what is your yearly rate of return (assuming the first two coupons can be reinvested at 6% )? Q1: A 4-year real return bond (par value =$1,000 ) has a coupon rate of 3%; inflation for years 14 is 2%, 3%,4% and 6%, respectively-what is the bond's real return at maturity? Q2: 4% coupon bond, quoted price =$1,141.82, discount rate =3.45%,N=3 years; one year later, the discount rate decreases to 2.05% - what is the 1 -year before-tax rate of return? Q3: Calculate the price of a 25YR bond today, which pays a 5.35% coupon annually (discount factor = 4.15\%)- what is the price difference, if the bond pays coupons semi-annually? Q4: A 6.5\%, 15-year callable bond is quoted at \$1,050 and is callable in 5 years for $1,085 - calculate the YTM and YTC (i.e., yield-to-call) using the formulas in class (calculator outputs will not be accepted). Q5: You buy a bond for $1,081.72 and sell it three years later for $1,035.15-you earn $70 in coupons at the end of each year; what is your yearly rate of return (assuming the first two coupons can be reinvested at 6% )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started