Question

Can you help with accounting problem? a ) Using the aging of AR method, compute the amount of bad debt expense for 2019 and record

Can you help with accounting problem?

a) Using the aging of AR method, compute the amount of bad debt expense for 2019 and record the proper adjusting journal entry. Show all computations, please.

BAD DEPT EXPENSE COMPUTATIONS:

ADJUSTING JOURNAL ENTRY:

b) Show how the AR section of the Balance Sheet would appear at 12-31-19 AFTER taking into account the 2019 adjusting journal entry.

c) Assume at the very beginning of 2020 AD writes off a customers account of $5,000. Show what the AR section of the Balance Sheet would look like immediately after the write-off.

AFTER WRITE-OFF

d) What is the normal balance (a DR or CR) in the Allowance for Bad Debts account? Why does it have this balance? How would it be possible for this account to temporarily have a balance that is opposite of its normal balance? Explain your answer to all 3 parts of this question clearly! (2 points)

Normal Balance: Why?:

How could it possibly have a temporary balance opposite of its normal balance?

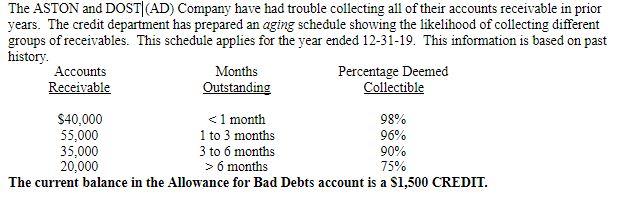

The ASTON and DOST(AD) Company have had trouble collecting all of their accounts receivable in prior years. The credit department has prepared an aging schedule showing the likelihood of collecting different groups of receivables. This schedule applies for the year ended 12-31-19. This information is based on past history Accounts Months Percentage Deemed Receivable Outstanding Collectible $40,000 6 months 75% The current balance in the Allowance for Bad Debts account is a $1,500 CREDITStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started