Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help with these please? Jack Smith, a baker, has been working at his friend's bakery a part time basis for the past 3

can you help with these please?

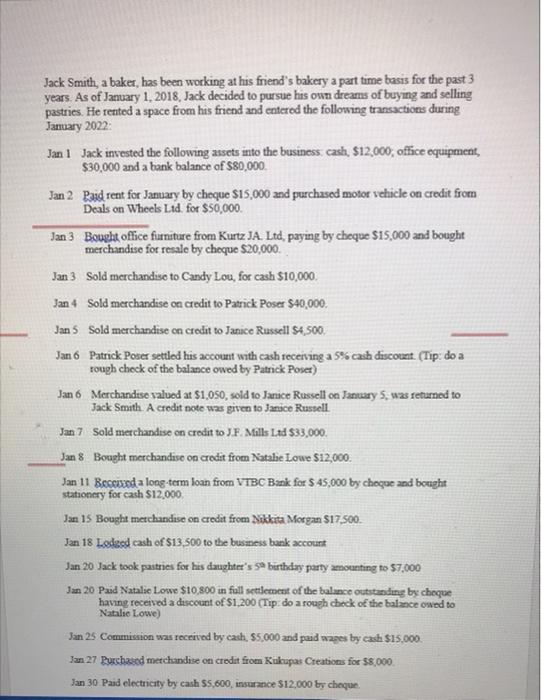

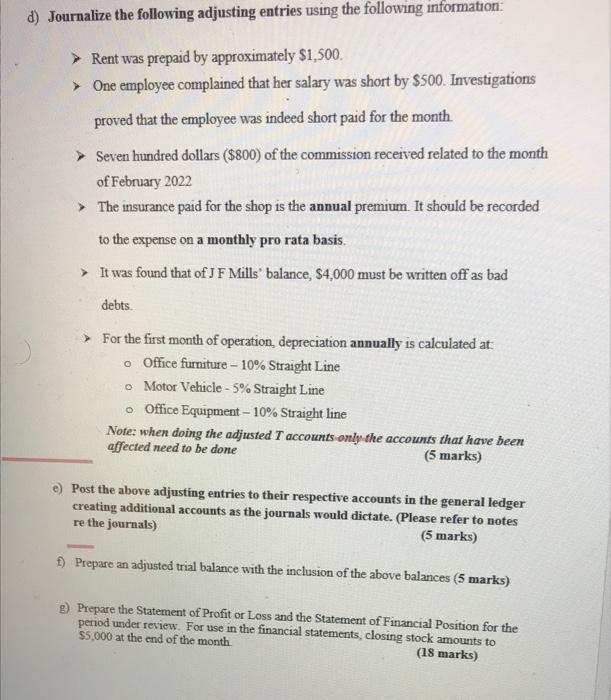

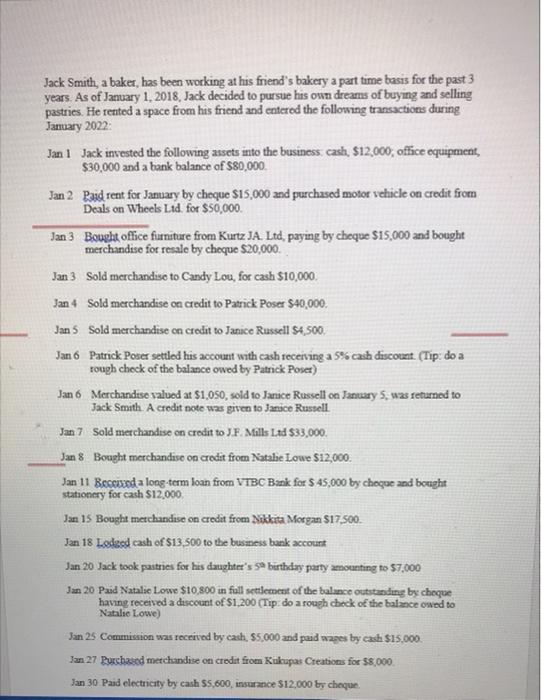

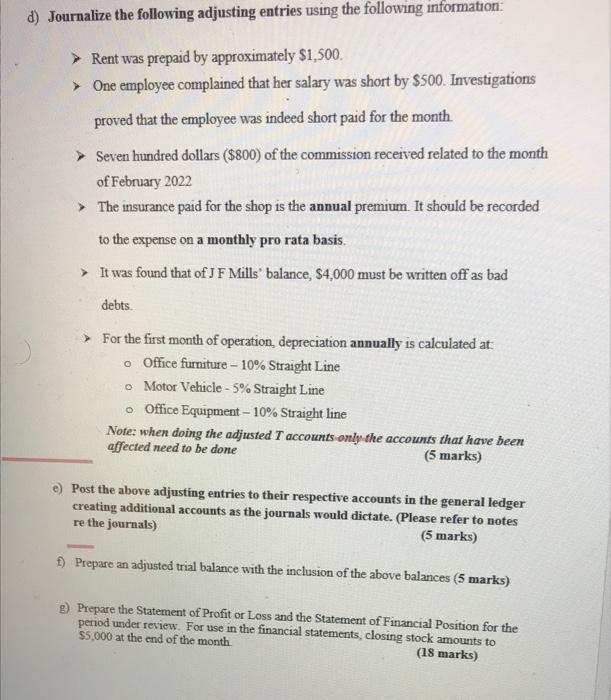

Jack Smith, a baker, has been working at his friend's bakery a part time basis for the past 3 years. As of January 1, 2018, Jack decided to pursue his own dreams of buying and selling pastries. He rented a space from his friend and entered the following transactions during January 2022 Jan 1 Jack invested the following assets into the business cash, $12,000, office equipment, $30,000 and a bank balance of $80,000 Jan 2 Paid rent for January by cheque $15,000 and purchased motor vehicle on credit from Deals on Wheels Ltd. for $50,000 Jan 3 Bought office furniture from Kurtz JA. Ltd, paying by cheque $15,000 and bought merchandise for resale by cheque $20,000 Jan 3 Sold merchandise to Candy Lou, for cash $10,000 Jan 4 Sold merchandise on credit to Patrick Poser $40,000. Jan Sold merchandise on credit to Janice Russell 54,500 Jan 6 Patrick Poser settled his account with cash recerving a 5% cash discount. (Tip: do a rough check of the balance owed by Patrick Poser) Jan 6 Merchandise valued at $1,050, sold to Janice Russell on January 5, was returned to Jack Smith A credit note was given to Janice Russell Jan 7 Sold merchandise on credit to J.F. Mills Lad $33,000 Jan 8 Bought merchandise on credit from Natalie Lowe $12,000. Jan 11 Beceived a long term loan from VTBC Bank for $ 45,000 by choque and bought stationery for cash $12,000 Jan 15 Bought met chandise on credit from Nikkita Morgan $17.500 Jan 18 Loded cash of $13,500 to the business bank account Jan 20 Jack took pastries for his daughter's S birthday party amounting to 57,000 Jan 20 Paid Natalie Lowe $10,800 in full settlement of the balance outstanding by choque having received a discount of $1.200 (Tip: do a rough check of the balance owed to Natalie Lowe) Jan 25 Commission was received by cash, 5,000 and paid wapes by cash $15.000 Jan 27 Purchased merchandise on credit from Kukupas Creations for $8,000 Jan 30 Paid electricity by cash 55,600, insurance $12,000 by cheque d) Journalize the following adjusting entries using the following information: Rent was prepaid by approximately $1,500. One employee complained that her salary was short by $500. Investigations proved that the employee was indeed short paid for the month. Seven hundred dollars ($800) of the commission received related to the month of February 2022 The insurance paid for the shop is the annual premium It should be recorded to the expense on a monthly pro rata basis. It was found that of J F Mills balance, $4,000 must be written off as bad debts. For the first month of operation, depreciation annually is calculated at Office furniture - 10% Straight Line Motor Vehicle - 5% Straight Line Office Equipment - 10% Straight line Note: when doing the adjusted T accounts only the accounts that have been affected need to be done (5 marks) e) Post the above adjusting entries to their respective accounts in the general ledger creating additional accounts as the journals would dictate. (Please refer to notes re the journals) (5 marks) f) Prepare an adjusted trial balance with the inclusion of the above balances (5 marks) ) Prepare the Statement of Profit or Loss and the Statement of Financial Position for the period under review. For use in the financial statements, closing stock amounts to $5,000 at the end of the month (18 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started