Question

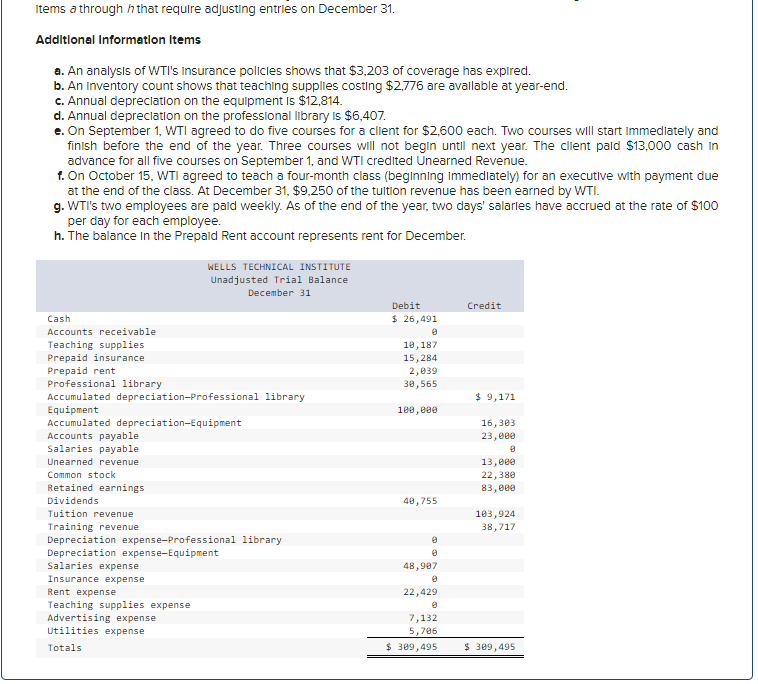

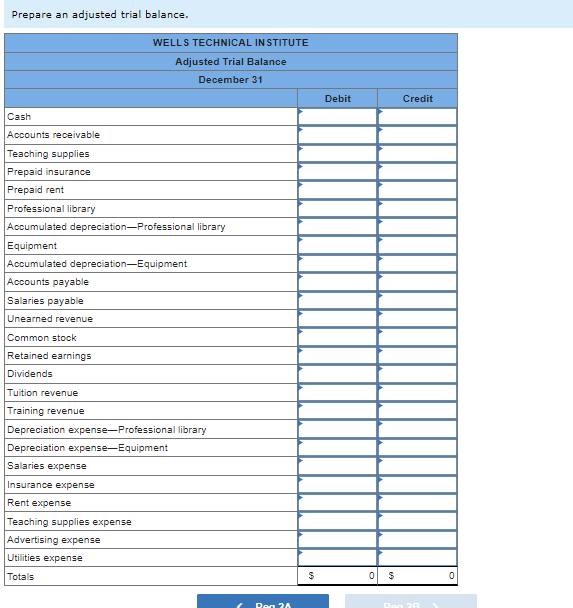

Can you input the information given into a Trial Balance? Adjusting Entries Transaction Accounts Title and Explanation Debit Credit a Insurance Expense $3,203 Prepaid Insurance

Can you input the information given into a Trial Balance?

| Adjusting Entries |

| ||

| Transaction | Accounts Title and Explanation | Debit | Credit |

| a | Insurance Expense | $3,203 |

|

|

| Prepaid Insurance |

| $3,203 |

|

| (To record expired insurance) |

|

|

|

|

|

|

|

| b | Teaching Supplies Expense($10,187 -$2,776) | $7,411 |

|

|

| Teaching Supplies |

| $7,411 |

|

| (To record supplies expense) |

|

|

|

|

|

|

|

| c | Depreciation Expense - Equipment | $12,814 |

|

|

| Accumulated Depreciation- Equipment |

| $12,814 |

|

| (To record annual depreciation expense) |

|

|

|

|

|

|

|

| d | Depreciation Expense - Professional library | $6,407 |

|

|

| Accumulated Depreciation- Professional library |

| $6,407 |

|

| (To record annual depreciation expense) |

|

|

|

|

|

|

|

| e | Unearned Revenue ($2,600*2) | $5,200 |

|

|

| Training Revenue |

| $5,200 |

|

| (To record earned revenue) |

|

|

|

|

|

|

|

| f | Accounts Receivable | $9,250 |

|

|

| Tuition Revenue |

| $9,250 |

|

| (To record accured revenue) |

|

|

|

|

|

|

|

| g | Salaries Expense($100*2*2) | $400 |

|

|

| Salaries Payable |

| $400 |

|

| (To record Accured Salaries) |

|

|

|

|

|

|

|

| h | Rent Expense | $2,039 |

|

|

| Prepaid Expense |

| $2,039 |

|

| (To record expired rent) | ||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started