Answered step by step

Verified Expert Solution

Question

1 Approved Answer

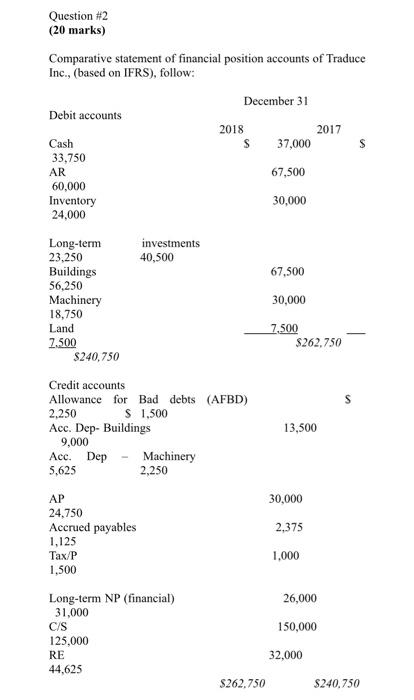

can you just solve it please? Question #2 (20 marks) Comparative statement of financial position accounts of Traduce Inc., (based on IFRS), follow: December 31

can you just solve it please?

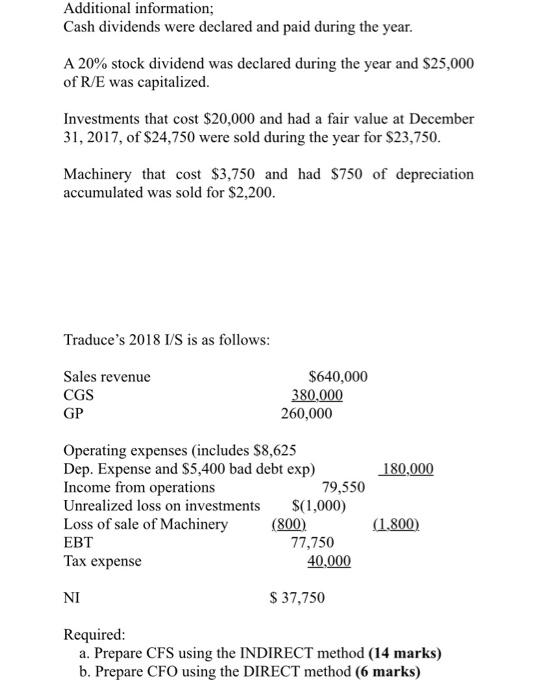

Question #2 (20 marks) Comparative statement of financial position accounts of Traduce Inc., (based on IFRS), follow: December 31 Debit accounts 2018 2017 Cash s 37,000 s 33,750 AR 67,500 60,000 Inventory 30,000 24,000 investments 40,500 67,500 Long-term 23.250 Buildings 56,250 Machinery 18,750 Land 7.500 $240,750 30,000 7.500 $262.750 Credit accounts Allowance for Bad debts (AFBD) 2.250 $ 1,500 Acc. Dep- Buildings 9,000 Acc. Dep - Machinery 5,625 2,250 13,500 30,000 2,375 AP 24,750 Accrued payables 1,125 Tax/P 1,500 1,000 26,000 Long-term NP (financial) 31,000 C/S 125,000 RE 44,625 150,000 32,000 $262.750 $240.750 Additional information; Cash dividends were declared and paid during the year. A 20% stock dividend was declared during the year and $25,000 of R/E was capitalized. Investments that cost $20,000 and had a fair value at December 31, 2017, of $24,750 were sold during the year for $23,750. Machinery that cost $3,750 and had $750 of depreciation accumulated was sold for $2,200. Traduce's 2018 I/S is as follows: Sales revenue CGS $640,000 380,000 260,000 GP 180,000 Operating expenses (includes $8,625 Dep. Expense and $5,400 bad debt exp) Income from operations 79,550 Unrealized loss on investments $(1,000) Loss of sale of Machinery (800) EBT 77,750 Tax expense 40,000 (1.800) NI $ 37,750 Required: a. Prepare CFS using the INDIRECT method (14 marks) b. Prepare CFO using the DIRECT method (6 marks) Question #2 (20 marks) Comparative statement of financial position accounts of Traduce Inc., (based on IFRS), follow: December 31 Debit accounts 2018 2017 Cash s 37,000 s 33,750 AR 67,500 60,000 Inventory 30,000 24,000 investments 40,500 67,500 Long-term 23.250 Buildings 56,250 Machinery 18,750 Land 7.500 $240,750 30,000 7.500 $262.750 Credit accounts Allowance for Bad debts (AFBD) 2.250 $ 1,500 Acc. Dep- Buildings 9,000 Acc. Dep - Machinery 5,625 2,250 13,500 30,000 2,375 AP 24,750 Accrued payables 1,125 Tax/P 1,500 1,000 26,000 Long-term NP (financial) 31,000 C/S 125,000 RE 44,625 150,000 32,000 $262.750 $240.750 Additional information; Cash dividends were declared and paid during the year. A 20% stock dividend was declared during the year and $25,000 of R/E was capitalized. Investments that cost $20,000 and had a fair value at December 31, 2017, of $24,750 were sold during the year for $23,750. Machinery that cost $3,750 and had $750 of depreciation accumulated was sold for $2,200. Traduce's 2018 I/S is as follows: Sales revenue CGS $640,000 380,000 260,000 GP 180,000 Operating expenses (includes $8,625 Dep. Expense and $5,400 bad debt exp) Income from operations 79,550 Unrealized loss on investments $(1,000) Loss of sale of Machinery (800) EBT 77,750 Tax expense 40,000 (1.800) NI $ 37,750 Required: a. Prepare CFS using the INDIRECT method (14 marks) b. Prepare CFO using the DIRECT method (6 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started