Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please answer in order and make it simple. Thank you! On December 31, 2018, Mugaboo Corporation issues 7%, 10-year convertible bonds payable with

can you please answer in order and make it simple. Thank you!

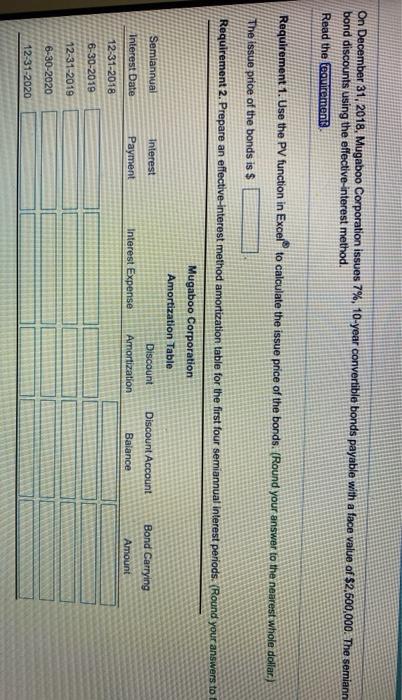

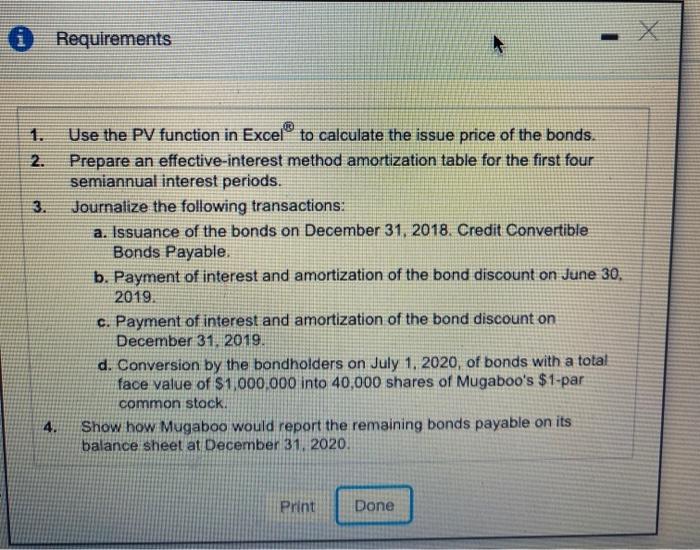

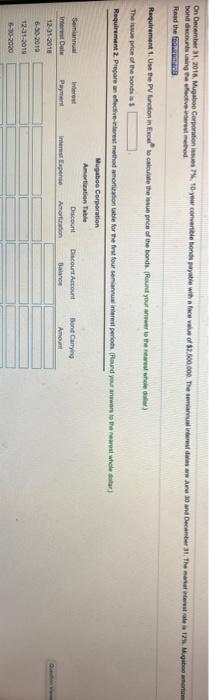

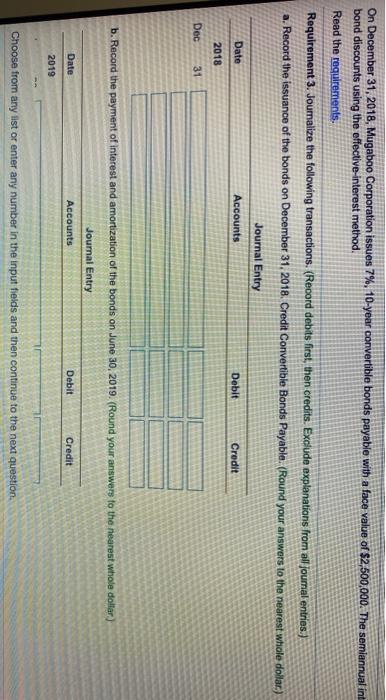

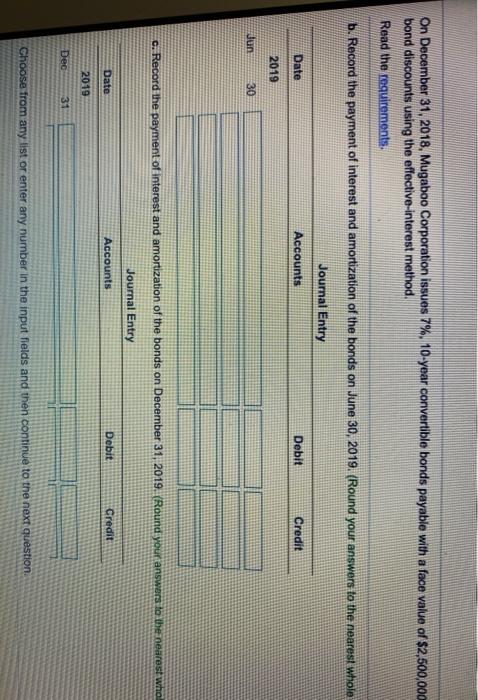

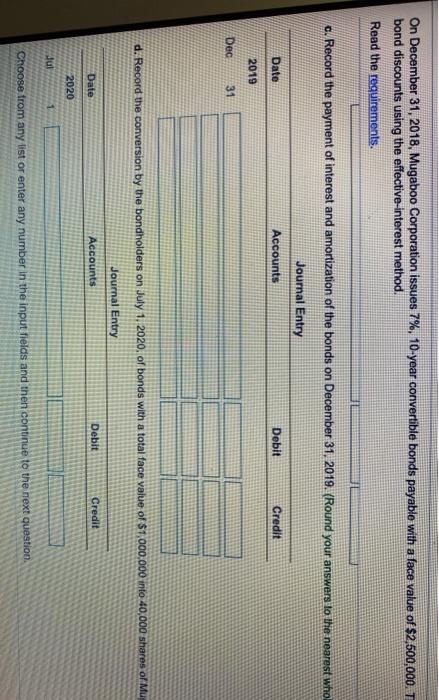

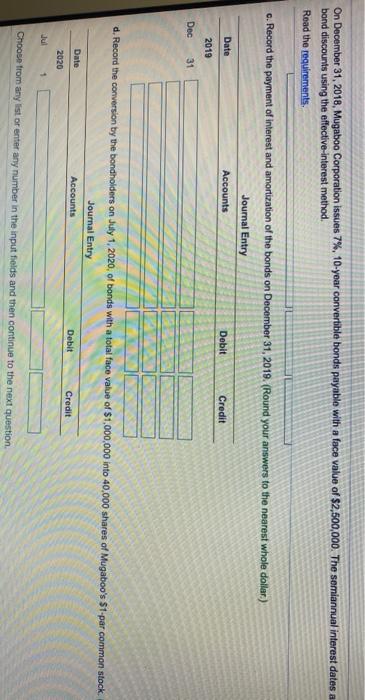

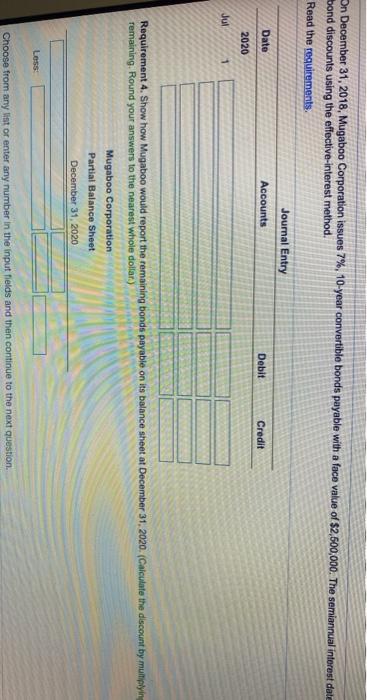

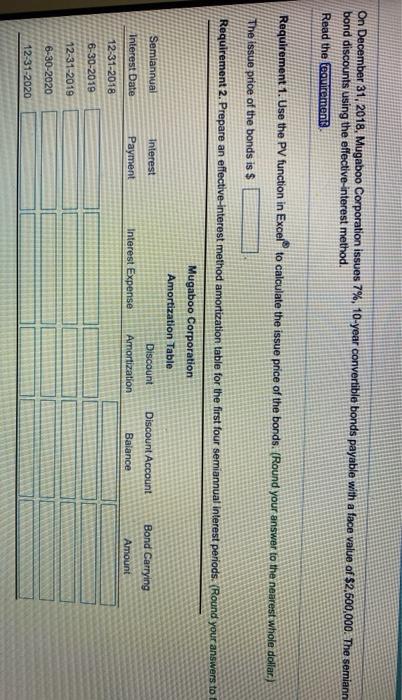

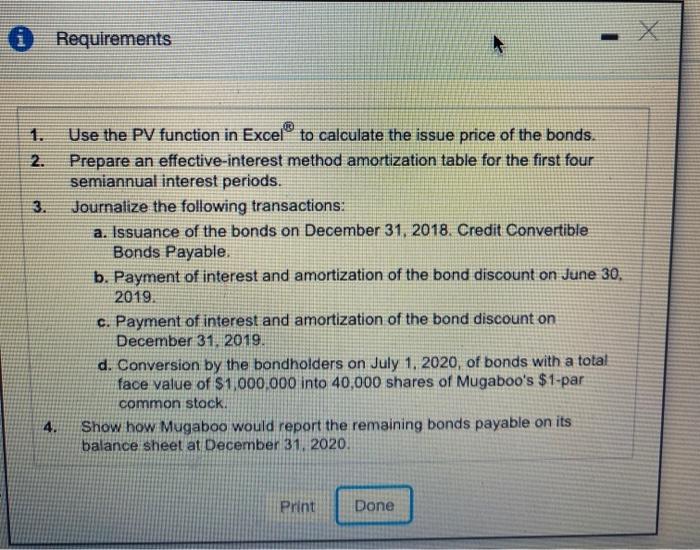

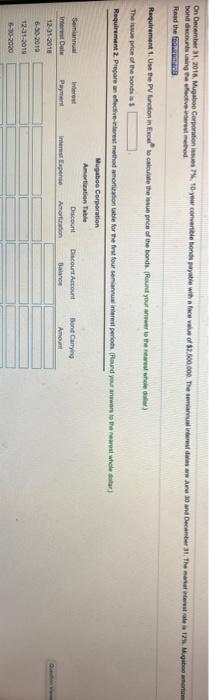

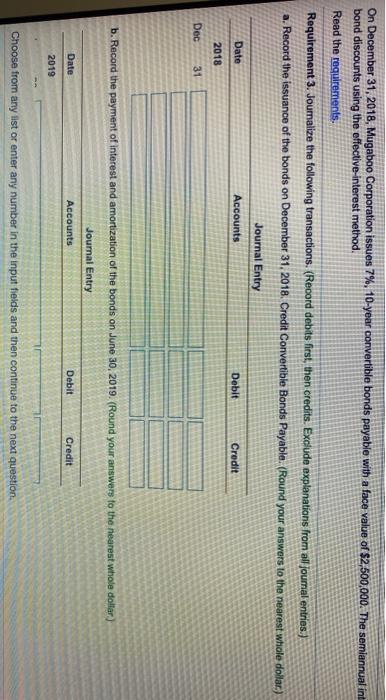

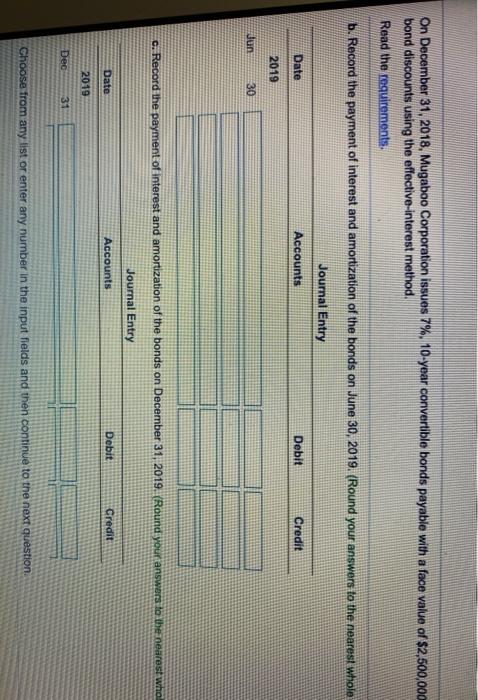

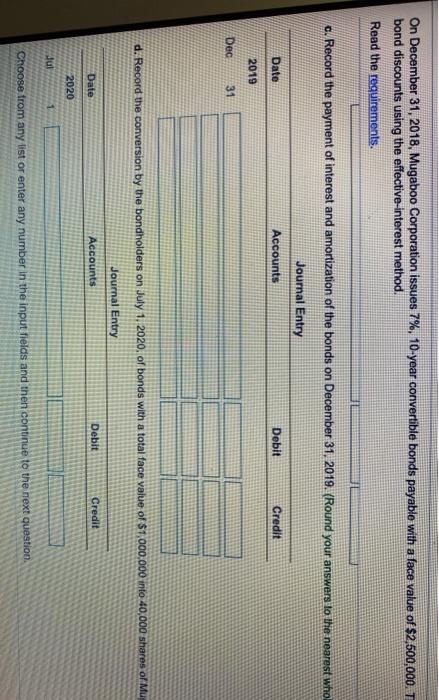

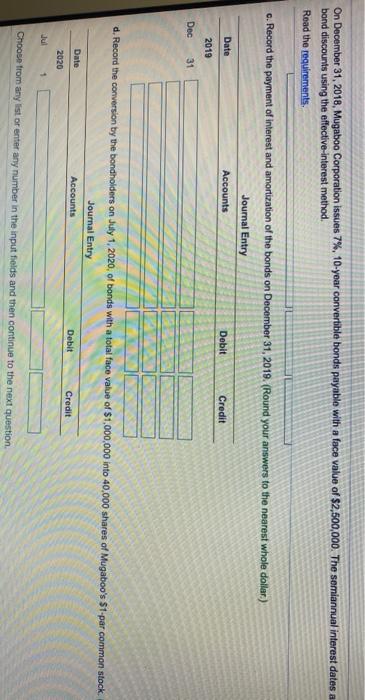

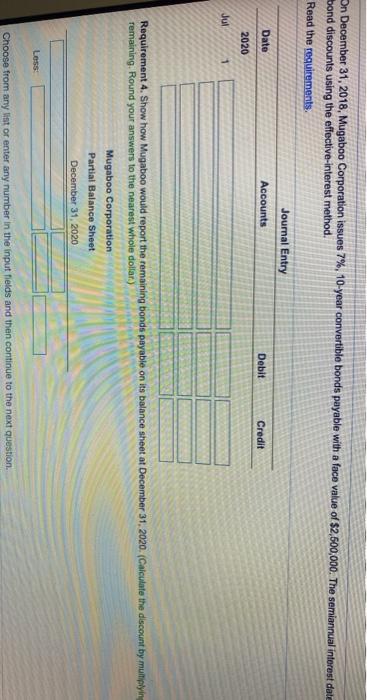

On December 31, 2018, Mugaboo Corporation issues 7%, 10-year convertible bonds payable with a face value of $2,500,000. The serniann bond discounts using the effective interest method. Read the frequement Requirement 1. Use the PV function in Excel to calculate the issue price of the bonds. (Round your answer to the nearest whole dollar.) The issue price of the bonds is $ Requirement 2. Prepare an effective interest method amortization table for the first four semiannual interest periods. (Round your answers to Mugaboo Corporation Amortization Table Semiannual Interest Discount Discount Account Interest Date Bond Carrying Amount Payment Interest Expense Amortization Balance 12-31-2018 6-30-2019 12-31-2019 6-30-2020 12-31-2020 Requirements 3. Use the PV function in Excel to calculate the issue price of the bonds. Prepare an effective-interest method amortization table for the first four semiannual interest periods. Journalize the following transactions: a. Issuance of the bonds on December 31, 2018. Credit Convertible Bonds Payable b. Payment of interest and amortization of the bond discount on June 30, 2019 c. Payment of interest and amortization of the bond discount on December 31, 2019 d. Conversion by the bondholders on July 1, 2020, of bonds with a total face value of $1.000.000 into 40,000 shares of Mugaboo's $1-par common stock. Show how Mugaboo would report the remaining bonds payable on its balance sheet at December 31, 2020 4. Print Done On December 21, 2016. Mugaboo Carpente. P. 16 yw convertible tende pay whateve! $2.500,000. The comand we de 30 and December 31, the manual estate Migute et bondions ingever med Read the fac Requirement 1. Use the Portion in Excel care the preso ne bonds. Round your owner to the www The price of the bonis Requirement 2. Prepare an effectivement method motion table for the first four smart period and your answers to the rear whole star Mugaboo Corporation Amortization Table Semin Bond Carrying Interessen Discount Amor Discount Account Balance Am Interest 12-01-2018 D 6-30-2012 12-01-2018 6-70-2020 On December 31, 2018, Mugaboo Corporation issues 7%, 10-year convertible bonds payable with a face value of $2,500,000. The semiannual int bond discounts using the effective-interest method. Read the requirements. Requirement 3. Joumalize the following transactions. (Record debits first, then credits. Exclude explanations from all journal entries.) a. Record the issuance of the bonds on December 31, 2018. Credit Convertible Bonds Payable. (Round your answers to the nearest whicle dollar) Journal Entry Accounts Date Debit Credit 2018 Dec 31 b. Record the payment of interest and amortization of the bonds on June 30, 2019. (Round your answers to the nearest whole dollar) Journal Entry Date Accounts Debit Credit 2019 Choose from any list or enter any number in the input fields and then continue to the next question On December 31, 2018, Mugaboo Corporation issues 7%, 10-year convertible bonds payable with a face value of $2,500,000 bond discounts using the effective-interest method. Read the requirements, b. Record the payment of interest and amortization of the bonds on June 30, 2019. (Round your answers to the nearest whole Journal Entry Date Accounts Debit Credit 2019 dun 30 C. Record the payment of interest and amortization of the bonds on December 31, 2019. (Round your answers to the nearest who Journal Entry Date Accounts Debit Credit 2019 Dec 31 Choose from any list or enter any number in the input fields and then continue to the next question. On December 31, 2018, Mugaboo Corporation issues 7%, 10-year convertible bonds payable with a face value of $2,500,000. T bond discounts using the effective-interest method. Read the requirements. c. Record the payment of interest and amortization of the bonds on December 31, 2019. (Round your answers to the nearest who Journal Entry Date Accounts Debit Credit 2019 Dec 31 d. Record the conversion by the bondholders on July 1, 2020. of bonds with a total face value of $1,000,000 into 40,000 shares of Mu Journal Entry Date Accounts Debit Credit 2020 Jul 1 Choose from any list or enter any number in the input fields and then continue to the next question. On December 31, 2018, Mugaboo Corporation issues 7%, 10-year convertible bonds payable with a face value of $2,500,000. The semiannual interest dates a bond discounts using the effective interest method. Read the requirements, c. Record the payment of interest and amortization of the bonds on December 31, 2019. (Round your answers to the nearest whole dollar) Journal Entry Date Accounts Debit Credit 2019 Dec 31 d. Record the conversion by the bondholders on July 1, 2020, of bonds with a total face value of $1,000,000 into 40,000 shares of Mugaboo's $1-par common stock Journal Entry Accounts Date Debit Credit 2020 1 Choose from any list or enter any number in the input fields and then continue to the next question On December 31, 2018, Mugaboo Corporation issues 7%, 10-year convertible bonds payable with a face value of $2,500,000. The semiannual interest date bond discounts using the effective-interest method. Read the requirements Journal Entry Date Accounts Debit Credit 2020 Jul 1 Requirement 4. Show how Mugaboo would report the remaining bonds payable on its balance sheet at December 31, 2020. (Calculate the discount by multiplying remaining. Round your answers to the nearest whole dollar) Mugaboo Corporation Partial Balance Sheet December 31, 2020 Loss Choose from any list or enter any number in the input fields and then continue to the next question On December 31, 2018, Mugaboo Corporation issues 7%, 10-year convertible bonds payable with a face value of $2,500,000. The serniann bond discounts using the effective interest method. Read the frequement Requirement 1. Use the PV function in Excel to calculate the issue price of the bonds. (Round your answer to the nearest whole dollar.) The issue price of the bonds is $ Requirement 2. Prepare an effective interest method amortization table for the first four semiannual interest periods. (Round your answers to Mugaboo Corporation Amortization Table Semiannual Interest Discount Discount Account Interest Date Bond Carrying Amount Payment Interest Expense Amortization Balance 12-31-2018 6-30-2019 12-31-2019 6-30-2020 12-31-2020 Requirements 3. Use the PV function in Excel to calculate the issue price of the bonds. Prepare an effective-interest method amortization table for the first four semiannual interest periods. Journalize the following transactions: a. Issuance of the bonds on December 31, 2018. Credit Convertible Bonds Payable b. Payment of interest and amortization of the bond discount on June 30, 2019 c. Payment of interest and amortization of the bond discount on December 31, 2019 d. Conversion by the bondholders on July 1, 2020, of bonds with a total face value of $1.000.000 into 40,000 shares of Mugaboo's $1-par common stock. Show how Mugaboo would report the remaining bonds payable on its balance sheet at December 31, 2020 4. Print Done On December 21, 2016. Mugaboo Carpente. P. 16 yw convertible tende pay whateve! $2.500,000. The comand we de 30 and December 31, the manual estate Migute et bondions ingever med Read the fac Requirement 1. Use the Portion in Excel care the preso ne bonds. Round your owner to the www The price of the bonis Requirement 2. Prepare an effectivement method motion table for the first four smart period and your answers to the rear whole star Mugaboo Corporation Amortization Table Semin Bond Carrying Interessen Discount Amor Discount Account Balance Am Interest 12-01-2018 D 6-30-2012 12-01-2018 6-70-2020 On December 31, 2018, Mugaboo Corporation issues 7%, 10-year convertible bonds payable with a face value of $2,500,000. The semiannual int bond discounts using the effective-interest method. Read the requirements. Requirement 3. Joumalize the following transactions. (Record debits first, then credits. Exclude explanations from all journal entries.) a. Record the issuance of the bonds on December 31, 2018. Credit Convertible Bonds Payable. (Round your answers to the nearest whicle dollar) Journal Entry Accounts Date Debit Credit 2018 Dec 31 b. Record the payment of interest and amortization of the bonds on June 30, 2019. (Round your answers to the nearest whole dollar) Journal Entry Date Accounts Debit Credit 2019 Choose from any list or enter any number in the input fields and then continue to the next question On December 31, 2018, Mugaboo Corporation issues 7%, 10-year convertible bonds payable with a face value of $2,500,000 bond discounts using the effective-interest method. Read the requirements, b. Record the payment of interest and amortization of the bonds on June 30, 2019. (Round your answers to the nearest whole Journal Entry Date Accounts Debit Credit 2019 dun 30 C. Record the payment of interest and amortization of the bonds on December 31, 2019. (Round your answers to the nearest who Journal Entry Date Accounts Debit Credit 2019 Dec 31 Choose from any list or enter any number in the input fields and then continue to the next question. On December 31, 2018, Mugaboo Corporation issues 7%, 10-year convertible bonds payable with a face value of $2,500,000. T bond discounts using the effective-interest method. Read the requirements. c. Record the payment of interest and amortization of the bonds on December 31, 2019. (Round your answers to the nearest who Journal Entry Date Accounts Debit Credit 2019 Dec 31 d. Record the conversion by the bondholders on July 1, 2020. of bonds with a total face value of $1,000,000 into 40,000 shares of Mu Journal Entry Date Accounts Debit Credit 2020 Jul 1 Choose from any list or enter any number in the input fields and then continue to the next question. On December 31, 2018, Mugaboo Corporation issues 7%, 10-year convertible bonds payable with a face value of $2,500,000. The semiannual interest dates a bond discounts using the effective interest method. Read the requirements, c. Record the payment of interest and amortization of the bonds on December 31, 2019. (Round your answers to the nearest whole dollar) Journal Entry Date Accounts Debit Credit 2019 Dec 31 d. Record the conversion by the bondholders on July 1, 2020, of bonds with a total face value of $1,000,000 into 40,000 shares of Mugaboo's $1-par common stock Journal Entry Accounts Date Debit Credit 2020 1 Choose from any list or enter any number in the input fields and then continue to the next question On December 31, 2018, Mugaboo Corporation issues 7%, 10-year convertible bonds payable with a face value of $2,500,000. The semiannual interest date bond discounts using the effective-interest method. Read the requirements Journal Entry Date Accounts Debit Credit 2020 Jul 1 Requirement 4. Show how Mugaboo would report the remaining bonds payable on its balance sheet at December 31, 2020. (Calculate the discount by multiplying remaining. Round your answers to the nearest whole dollar) Mugaboo Corporation Partial Balance Sheet December 31, 2020 Loss Choose from any list or enter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started