Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please answer question number 2? Please 1. For (a), (b) and (c), assume that the reserve requirement is 12%, and banks keep no

Can you please answer question number 2? Please

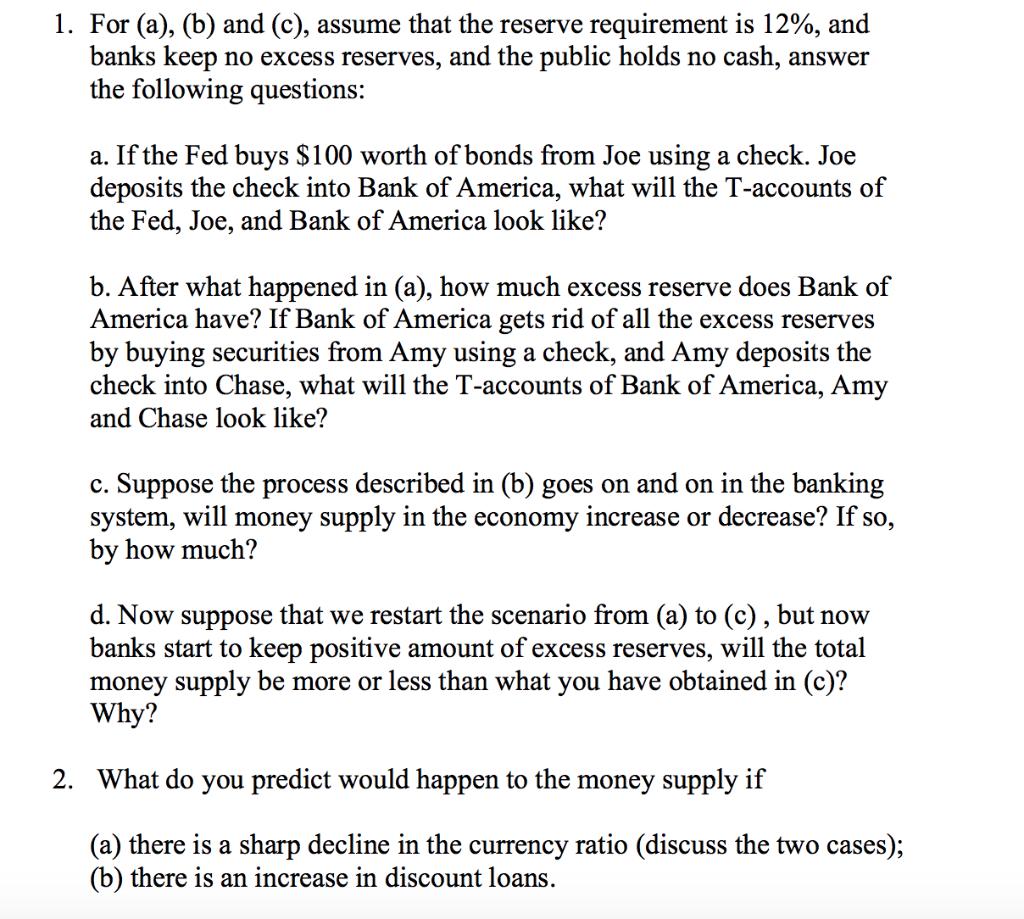

1. For (a), (b) and (c), assume that the reserve requirement is 12%, and banks keep no excess reserves, and the public holds no cash, answer the following questions: a. If the Fed buys $100 worth of bonds from Joe using a check. Joe deposits the check into Bank of America, what will the T-accounts of the Fed, Joe, and Bank of America look like? b. After what happened in (a), how much excess reserve does Bank of America have? If Bank of America gets rid of all the excess reserves by buying securities from Amy using a check, and Amy deposits the check into Chase, what will the T-accounts of Bank of America, Amy and Chase look like? c. Suppose the process described in (b) goes on and on in the banking system, will money supply in the economy increase or decrease? If so, by how much? d. Now suppose that we restart the scenario from (a) to (c), but now banks start to keep positive amount of excess reserves, will the total money supply be more or less than what you have obtained in (c)? Why? 2. What do you predict would happen to the money supply if (a) there is a sharp decline in the currency ratio (discuss the two cases); (b) there is an increase in discount loans. 1. For (a), (b) and (c), assume that the reserve requirement is 12%, and banks keep no excess reserves, and the public holds no cash, answer the following questions: a. If the Fed buys $100 worth of bonds from Joe using a check. Joe deposits the check into Bank of America, what will the T-accounts of the Fed, Joe, and Bank of America look like? b. After what happened in (a), how much excess reserve does Bank of America have? If Bank of America gets rid of all the excess reserves by buying securities from Amy using a check, and Amy deposits the check into Chase, what will the T-accounts of Bank of America, Amy and Chase look like? c. Suppose the process described in (b) goes on and on in the banking system, will money supply in the economy increase or decrease? If so, by how much? d. Now suppose that we restart the scenario from (a) to (c), but now banks start to keep positive amount of excess reserves, will the total money supply be more or less than what you have obtained in (c)? Why? 2. What do you predict would happen to the money supply if (a) there is a sharp decline in the currency ratio (discuss the two cases); (b) there is an increase in discount loans

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started