Answered step by step

Verified Expert Solution

Question

1 Approved Answer

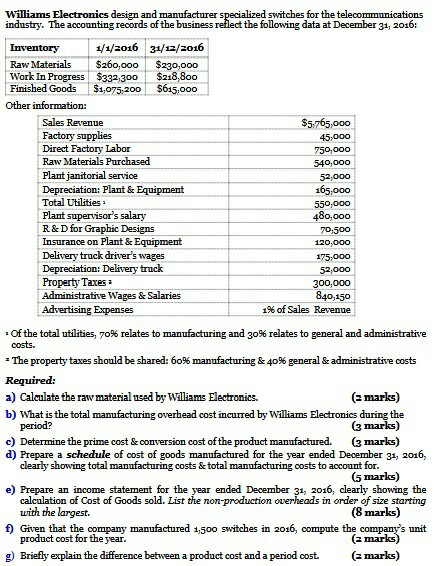

can you please assist with e, f and g? Williams Electronics design and manufacturer specialized switches for the telecommnications industry. The accounting reoords of the

can you please assist with e, f and g?

Williams Electronics design and manufacturer specialized switches for the telecommnications industry. The accounting reoords of the business reflect the following data at December 31, 2016: 1/1/z016 31//z016 Raw Materials $a6o,ooo$230,000 Work In Progress $332 300 $218,800 Finished Goods $1,075200 $615,000 Other information: $5-765,000 Sales Revenue Factory supplies Direct Factory Labor Raw Materials Purchased Plant janitorial service Depreciation: Plant& Equipment Total Utilities Plant supervisor's salary R & D for Graphic Designs Insurance on Plant & Equipmenit Delivery truck driver's wages Depreciation: Delivery truck Property Taxes Administrative Wages &Salaries Advertising Expenses 45,000 750,000 540,000o 52,000 165,000 550,000 480,000 70,500 120,000 175:000 52,000 300,000 840,150 1%ofSales Revenue Of the total utilities, 70% relates to manufacturing and 30% relates to general and administrative costs The property taxes should be shared: 60% manufacturing & 40% general & administrative costs Required: (emarks) b) What is the total manufacturing overhead cost incurred by Williams Electronics during the a) Calculate the raw material used by Williams Electronics. (3 marks) (3marks) c) Determine the prime cost &conversion cost of the product manufactured. d) Prepare a schedule of cost of goods manufactured for the year ended December 31, 2016, clearly showing total manufacturing costs & total manufacturing costs to account for. (5 marks) e) Prepare an income statement for the year ended December 31, 2016, clearly showing the calculation of Cost of Goods sold. List the non-production overheads in order of sze starting with the largest. (8 marks) (a marks) (2 marks) f Given that the company manufactured 1,500 switches in 2016, compute the company's unit product cost for the year. g) Briefly explain the difference between a product cost and a period costStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started