Answered step by step

Verified Expert Solution

Question

1 Approved Answer

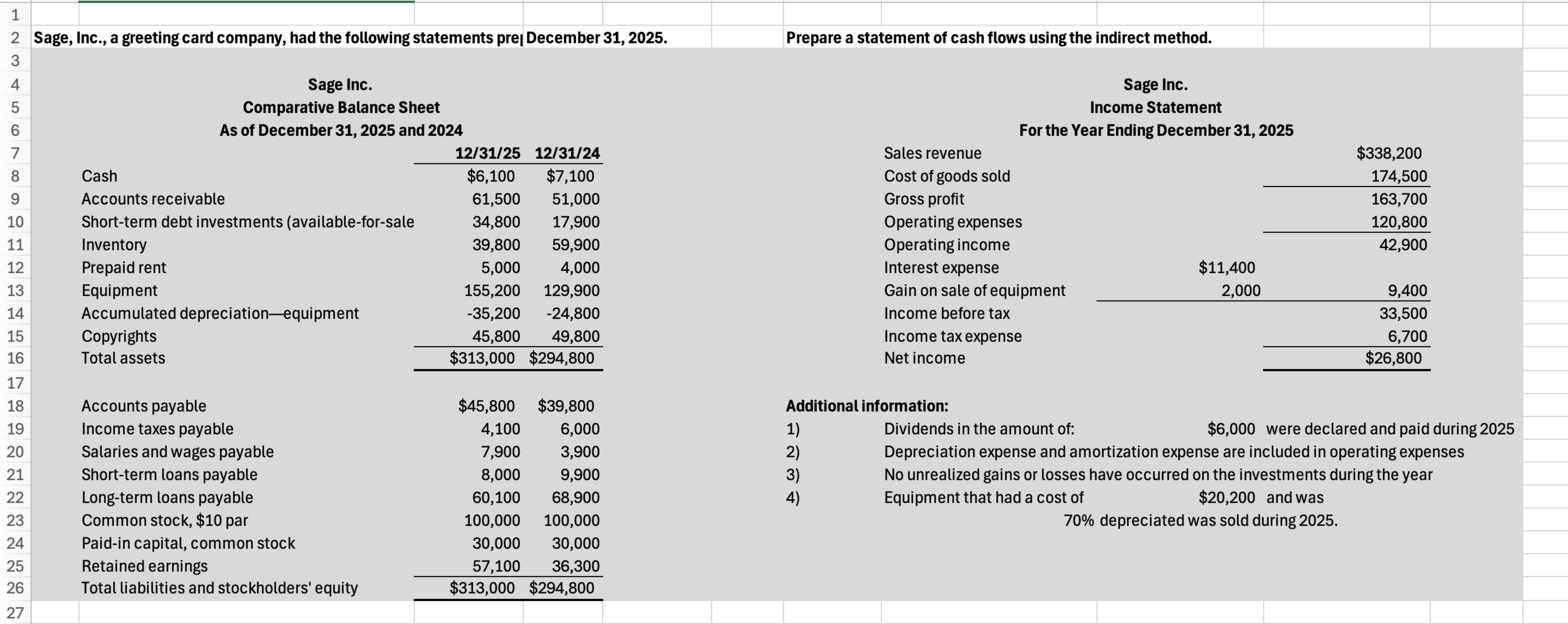

Can you please check my work and see where I went wrong? Sage, Inc., a greeting card company, had the following statements pre | December

Can you please check my work and see where I went wrong? Sage, Inc., a greeting card company, had the following statements preDecember

Prepare a statement of cash flows using the indirect method.

Sage Inc.

Sage Inc.

Comparative Balance Sheet

Income Statement

As of December and

For the Year Ending December

Additional information:

Dividends in the amount of: $ were declared and paid during

Depreciation expense and amortization expense are included in operating expenses

No unrealized gains or losses have occurred on the investments during the year

Equipment that had a cost of

$ and was

depreciated was sold during Ready

Q Cash Flows from Operating Activities Breakdown:

Operating activities include net income, adjustments for noncash expenses, and changes in working capital accounts.

Adjustments to reconcile net income to net cash provided by operating activities:

Net income:

Depreciation expense:

Accounts receivable

Inventory

Prepaid rent

Accounts payable

Income taxes payable

Salaries and wages payable

Interest Expense

Gain on sale of Equipment

Net cash provided by operating activities:

Cash Flows from Investing Activities Breakdown:

Investing activities include purchases and sales of longterm assets.

Purchase of equipment

Proceeds from sale of equipment

Purchase of shortterm debt investments:

Net cash used in investing activities:

Investing activities include purchases and sales of longterm assets.

tableShortterm loans payable,

Longterm loans payable

Cash payment of dividends

Net cash provided by investing activities:

Summary of Cash Flows Breakdown:

Net decrease in cash

Cash, January

Cash, December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started