Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CAN YOU PLEASE CLEARLY WRITTEN SOLVE THESE PROBLEMS USING THE MOST EFFICIENT WAY POSSIBLE CLEARLY EXPLAINING THE STEPS THANK YOU. Declining growth stock The Textbook

CAN YOU PLEASE CLEARLY WRITTEN SOLVE THESE PROBLEMS USING THE MOST EFFICIENT WAY POSSIBLE CLEARLY EXPLAINING THE STEPS THANK YOU.

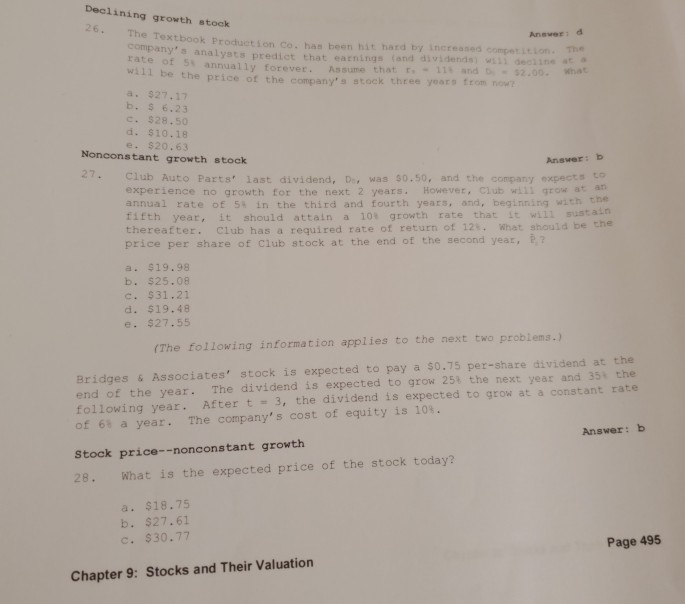

Declining growth stock The Textbook Product ion co, has been hit hard by increases comperition Ansver: d company' s analysts predict that earnings (and di vidends) wis deciine The rate of 5% annually forever. Assume that r,-11, and . will be the price of the company's stock three years from now , $27,17 b. $ 6.23 .$28.50 d. $10.18 e. $20.63 what 00. Nonconstant growth stock Answer: b 27. Club Auto Parts' last dividend, Do, was s0.50, and the company expects to experience no growth for the next 2 years. However, Club wiil grow at ar annual rate of 5% in the third and fourth years, and, beginning with the fifth year, it should attain a 10s growth rate that it will sustaln thereatter. Club has a required rate of return of 12 What should be the price per share of Club stock at the end of the second year, E, a. $19.98 b. $25.08 c. $31 21 d. $19.48 e. $27.55 (The following information applies to the next two problems.) Bridges & Associates' stock is expected to pay a $0.75 per-share dividend at the end of the year. The dividend is expected to grow 25% the next year and 35, the following year. After t # 3, the dividend is expected to grow at a constant rate of 65 a year. The company's cost of equity is 10%. Answer: b Stock price--nonconstant growth 28. What is the expected price of the stock today? $18.75 b. $27.61 . $30.77 Page 495 Chapter 9: Stocks and Their ValuationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started