Answered step by step

Verified Expert Solution

Question

1 Approved Answer

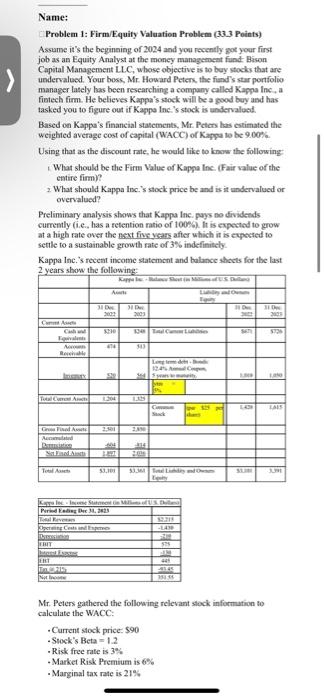

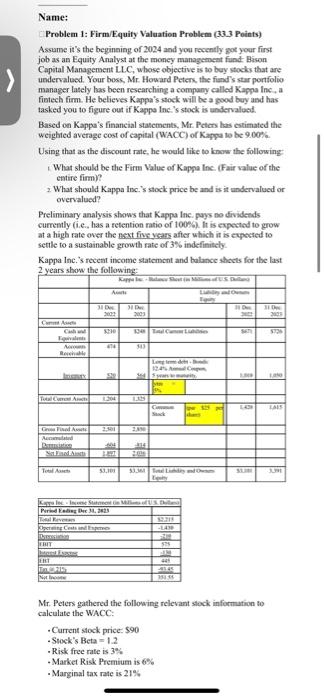

can you please do it in excel Name: Problem 1: Firm/Equity Valuation Problem (33.3 Points) Assume it's the beginaing of 2024 and you recently got

can you please do it in excel

Name: Problem 1: Firm/Equity Valuation Problem (33.3 Points) Assume it's the beginaing of 2024 and you recently got your first job as an Equity Analyst at the money management fund Bison Capital Managenent LLC, whose objective is to buy stocks that are undervalued. Your boss, Mr. Howard Peters, the find's star portfolio manager lately has been researching a company called Kappa Inc, a fintech firm. He believes Kappa's stock will be a good buy and has tasked you to figure out if Kappo lnc.'s stock is undervaloed. Based on Kappa's financial statements, Mr. Peters has estimated the weighted average cost of capital (WACC) of Kappa to be 9.00%. Using that as the discount rate, he would like to know the following: 1. What should be the Firm Value of Kappa Inc. (Fair value of the entire firm)? 2. What should Kappa Inc.'s stock price be and is it undervalued or overvalued? Preliminary analysis shows that Kappa lnc. pays no dividends currently (i.c., has a retention ratio of 1000 ). It is expected to grow at a high rate over the next five yeas after which in is expected to sente to a sustainable growth rate of 3% indefinitely. Kappa Ine.'s recent income statement and balance shects for the last Mr. Peters gathered the following relevant stock informution to calculate the WACC: - Current stock price: $90 - Stock's Beta =1.2 - Risk free rate is 3% - Market Risk Premium is 6% - Marginal tax rate is 21%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started